The HDB resale market in 2024 closed on a high note, registering a 9.8% year-on-year increase in the price index by December. This growth represents the 19th consecutive quarter of rising prices since the second quarter of 2020, driven by strong demand and limited supply. Key towns like Kallang/Whampoa, Toa Payoh, and Bukit Merah saw significant growth in high-value transactions, contributing the most to million-dollar flats recorded throughout the year.

Table of contents

- HDB resale price index: 9.8% increase year-on-year

- Resale activity surged in December

- Notable HDB resale transactions in December

- #1 in Mature Estates: S$1,539,000 for a 5-room flat along Bishan Street 24

- #1 in Non-Mature Estates: S$1,100,000 for an Executive flat along Jelebu Road

- Overall HDB resale market trends in 2024

- Million-dollar flats have doubled over the year

- What to expect in 2025 HDB resale market?

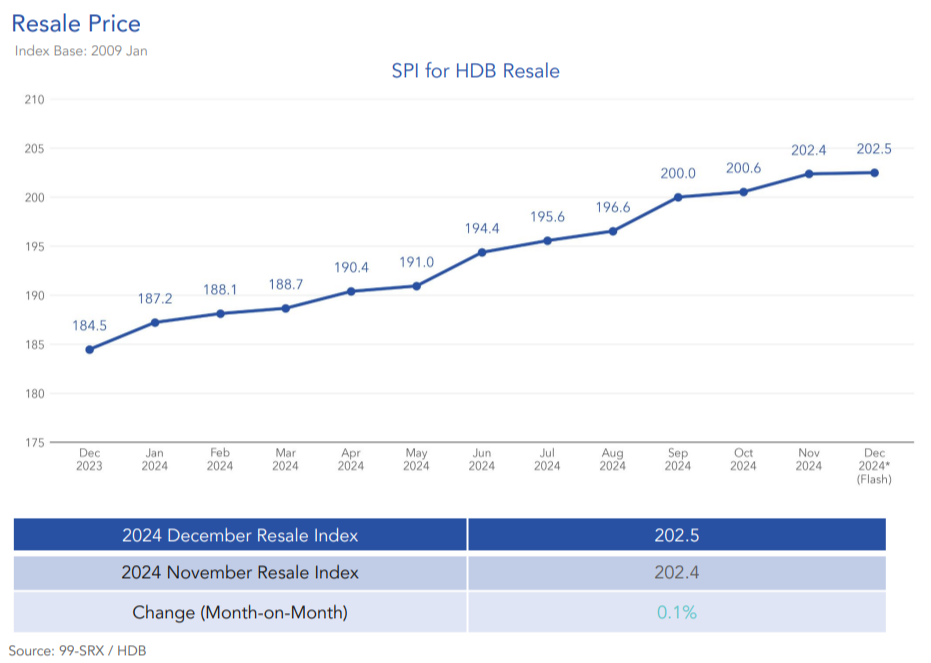

HDB resale price index: 9.8% increase year-on-year

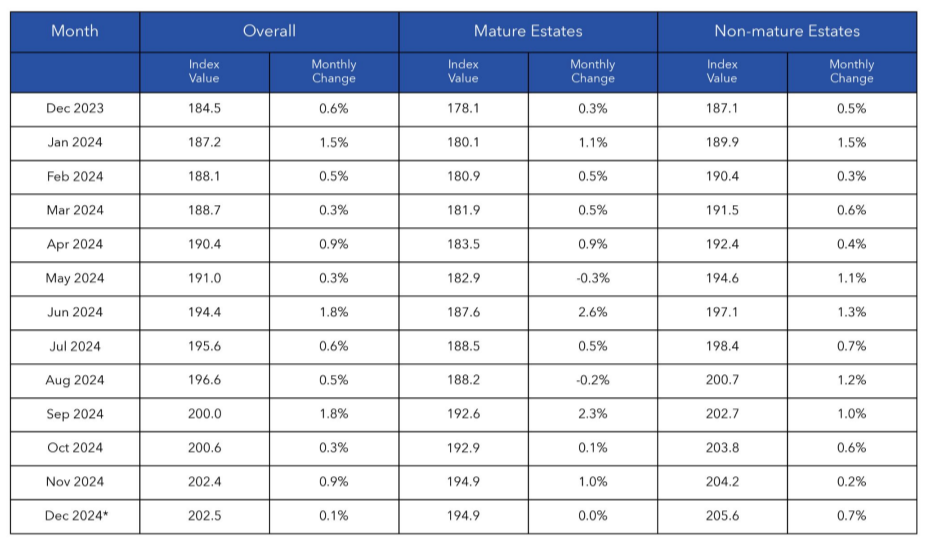

Despite the overall growth in 2024, December witnessed a slight deceleration in HDB resale price growth, increasing by just 0.1% from November. This slowdown may signal possible resistance from buyers facing increasingly high prices.

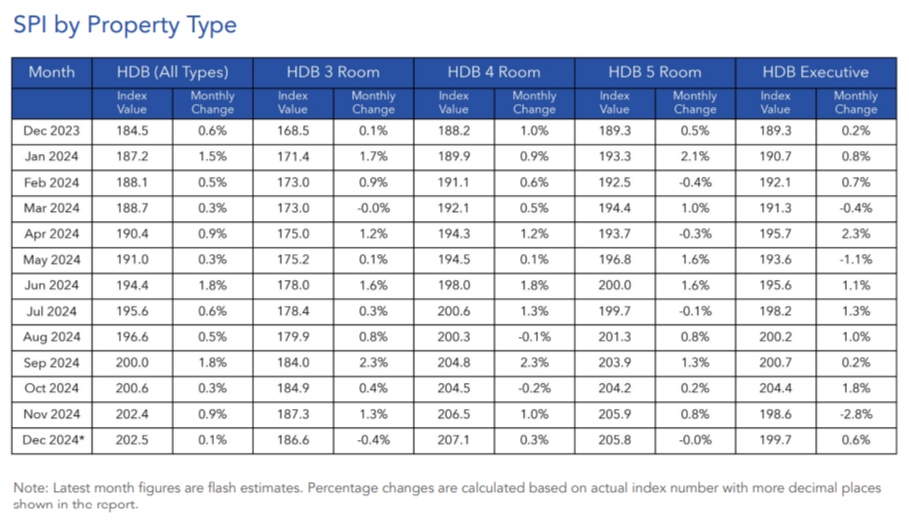

Prices in Mature Estates remained steady, while Non-Mature Estates recorded a 0.7% increase. Among room types, 3-room flats experienced a slight price dip of 0.4%, whereas 4-room and Executive flats saw increases of 0.3% and 0.6%, respectively. Prices for 5-room flats remained unchanged.

Year-on-year, the overall price growth of 9.8% was felt across all flat types and estate categories. Prices for 3-room flats surged by 10.7%, 4-room flats by 10%, 5-room flats by 8.7%, and Executive flats by 5.5%. Similarly, Mature Estate prices rose by 9.4%, while Non-Mature Estates outpaced them with a 9.9% increase.

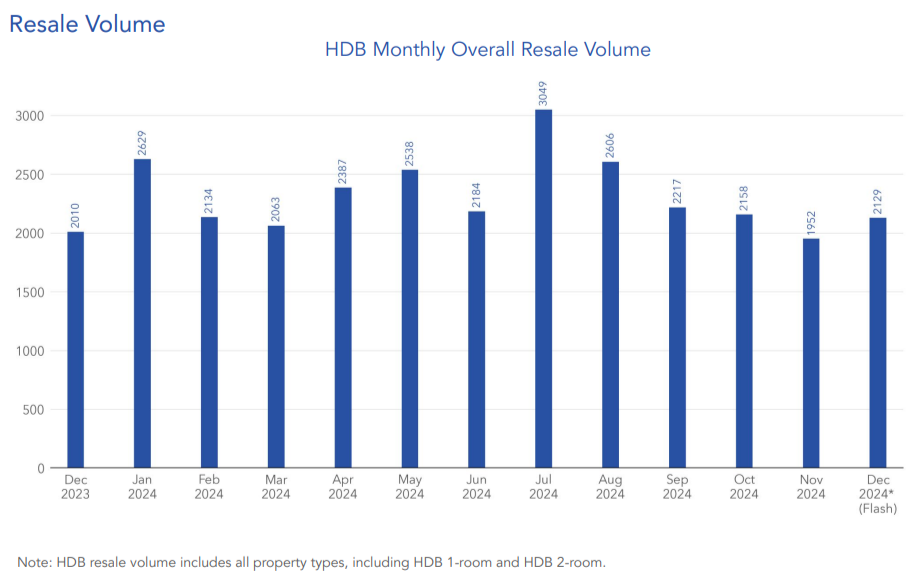

Resale activity surged in December

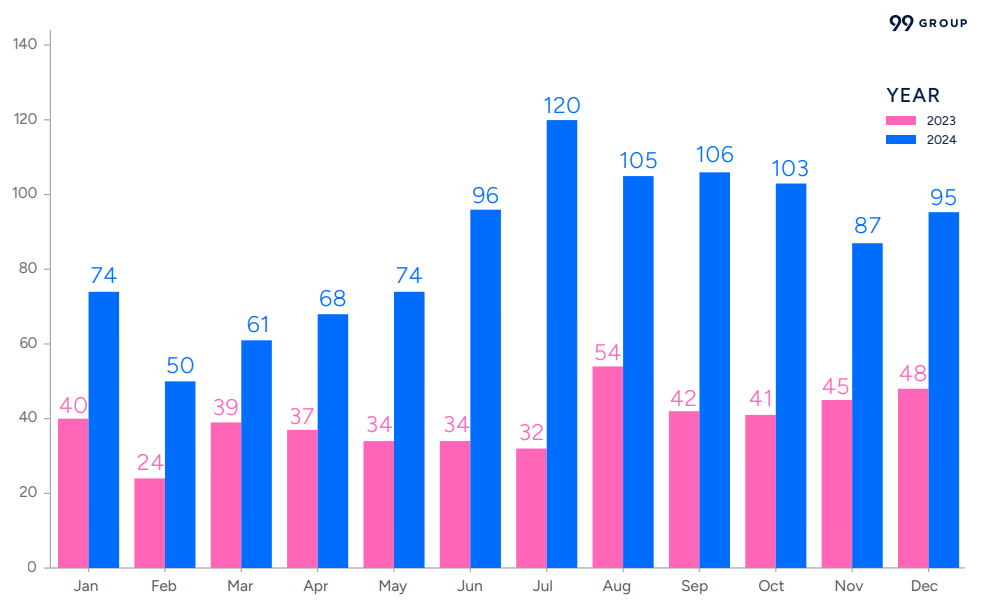

While price growth slowed towards the end of the year, resale transaction volumes in December 2024 reversed a four-month decline. With 2,129 transactions, the month recorded a 9.1% increase in activity compared to November. This also represented a 5.9% year-on-year increase from December 2023.

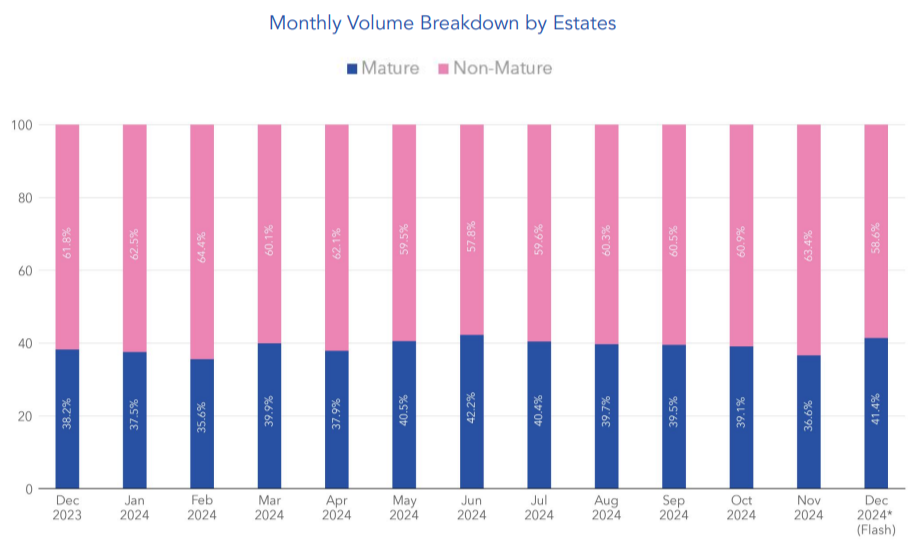

Of these transactions, Non-Mature Estates contributed 58.6%, reflecting their appeal among buyers seeking affordability in less central locations. The remaining 41.4% originated from Mature Estates, where limited supply continues to drive prices upward.

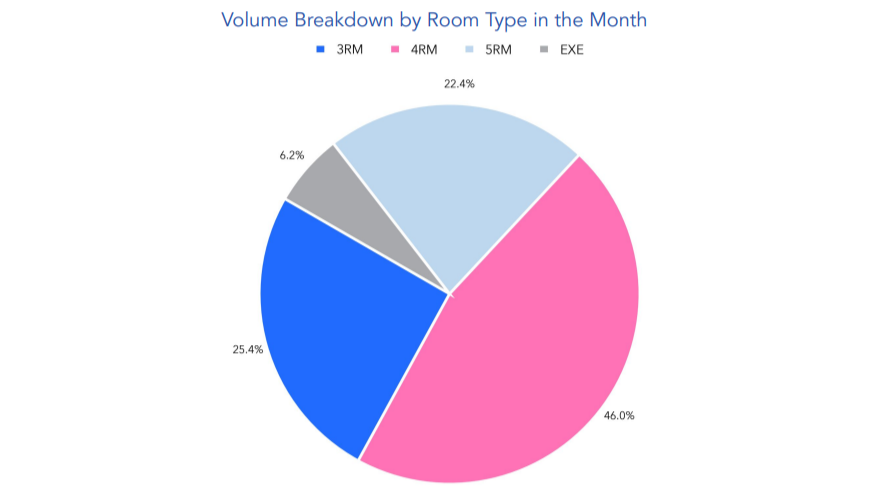

Room type analysis showed that 4-room flats dominated resale volumes in December, accounting for 46% of the total. This shows buyers’ preference for bigger units which typically offer higher value for money.

Looking to upgrade to a larger flat? Use 99.co’s affordability calculator to see if it fits your budget!

Notable HDB resale transactions in December

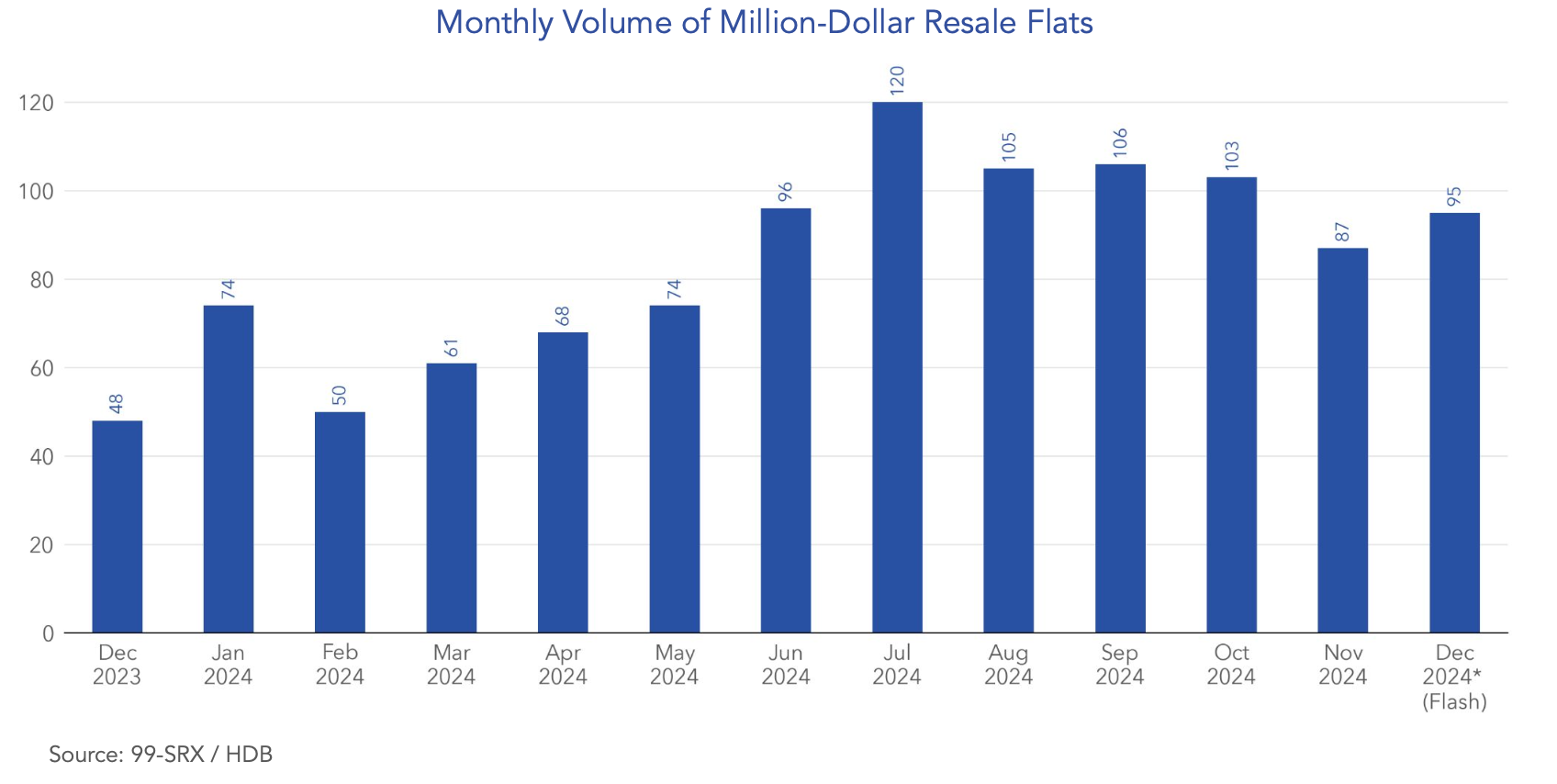

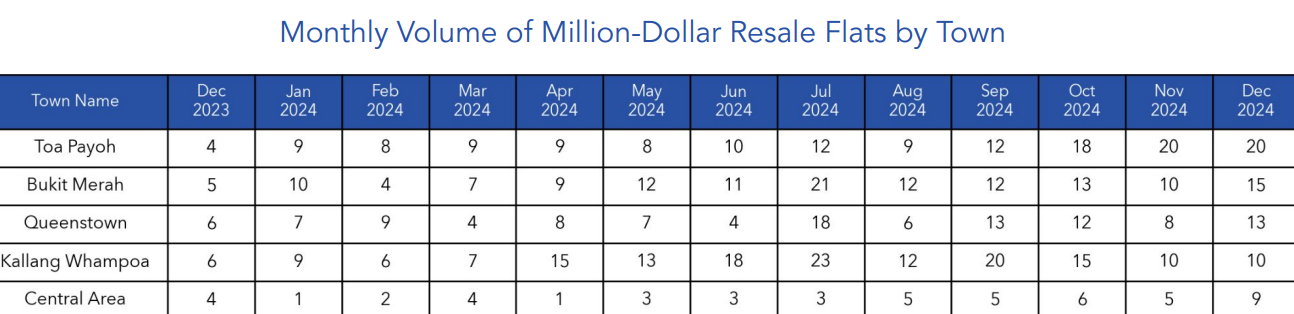

In December 2024, there were 95 million-dollar HDB resale transactions, up from 87 in November. These high-value units made up 4.5% of the total resale volume. Toa Payoh emerged as a hotspot with 20 transactions, followed by Bukit Merah with 15 and Queenstown with 13. Other towns such as Kallang/Whampoa, Bishan, and Ang Mo Kio also contributed significantly to the million-dollar flat category, highlighting a citywide demand for premium resale units.

#1 in Mature Estates: S$1,539,000 for a 5-room flat along Bishan Street 24

The highest transaction price in December 2024 was an impressive S$1,539,000 for a 5-room flat on Bishan Street 24. This transaction highlights the ongoing demand for prime units in central locations. Bishan, a highly sought-after mature estate, offers excellent connectivity via the Circle and North-South MRT lines, as well as proximity to reputable schools and amenities. Buyers are drawn to Bishan’s balance of accessibility and quality of life, making it a consistent performer in the resale market.

#1 in Non-Mature Estates: S$1,100,000 for an Executive flat along Jelebu Road

In the Non-Mature Estates category, the highest transaction was S$1,100,000 for an Executive flat along Jelebu Road in Bukit Panjang. This notable sale reflects increasing interest in spacious units outside the central region. Jelebu Road’s appeal stems from its proximity to Bukit Panjang MRT station, an integrated transport hub, and nearby amenities such as Hillion Mall and Bukit Panjang Plaza. The transaction underscores the growing willingness of buyers to invest in Non-Mature Estates that offer modern conveniences and connectivity.

Looking for a property close to an MRT station of your choice? Check out your options here!

Overall HDB resale market trends in 2024

The HDB resale market in Singapore achieved grand milestones in 2024, marking a year of robust growth and heightened activity. While there was a slowdown in the last quarter, this feat made 2024 one of the rare years without a single month of negative price movement.

Despite government cooling measures and high prices, demand for HDB resale flats remained robust throughout the year. Resale transactions for the year reached approximately 28,876 units in December, an 8% increase from 26,735 in 2023. Despite a 21.4% decline in Q4 volumes compared to Q3, the annual figures underscore the resilience of the HDB resale market.

The HDB resale market continues to offer value within Singapore’s competitive housing landscape. In 2024, the average resale prices for 5-room flats hovered around S$700,000, while 4-room flats averaged at S$600,000. This price range reinforces their appeal as affordable alternatives to private properties.

However, HDB buyers seem to have demonstrated a shift in priorities, influenced by recently introduced regulations that, while not yet stringent, encouraged greater financial prudence. These measures included reducing the loan-to-value (LTV) limit for HDB loans from 80% to 75%, implemented in August 2024.

Million-dollar flats have doubled over the year

The number of million-dollar HDB flats sold in 2024 doubled compared to 2023. A total of 1,039 such units are transacted throughout 2024, more than twice the 436 units recorded in 2023. Kallang/Whampoa, Toa Payoh, and Bukit Merah are among the towns that saw the most significant growth in high-value transactions.

According to 99.co’s Property Market Year-End Review 2024, Kallang/Whampoa led with 158 million-dollar flats sold in 2024, up from 54 units in 2023. Changing buyer preferences drove this trend. Condominium downgraders and dual-income families prioritised convenience and unique property features over private property prestige.

Additional reading: Why are more buyers willing to spend million-dollars on HDB flats instead of condos?

What to expect in 2025 HDB resale market?

The outlook for 2025 suggests a moderating pace of growth in the HDB resale market, influenced by an influx of new housing supply. In February, about 5,000 Build-To-Order (BTO) flats will be launched in estates such as Kallang/Whampoa, Queenstown, Woodlands, and Yishun.

Additionally, the largest-ever Sale of Balance Flats (SBF) exercise will introduce more than 5,500 units across various estates. Together, these initiatives will add over 10,000 new flats to the market, potentially tempering demand for resale flats and leading to slower price growth in the first quarter.

Moving forward in 2025, all eyes will be on how the balance between demand and supply shapes the future of this vital housing sector. Buyers are advised to weigh their financial capacities carefully, given the sustained high prices and evolving regulations in the HDB resale market.

What do you think about the price increase in HDB resale? Let us know in the comments section below or on our Facebook page.

The post 2024 Recap: HDB resale prices increased 9.8% with million-dollar flats doubled over the year appeared first on .