The Singapore rental market in November 2024 navigated its usual year-end dip in activity with surprising price resilience. While rental volumes for both condos and HDB flats declined due to the festive season, both rental prices defied the trend by inching upward. Growth in condo rental prices signs a continued recovery following a downtrend in the first half of the year. Meanwhile, the surge in HDB rental prices has resulted in a total increase of 4% year-to-date.

This article provides an in-depth analysis of November’s rental market activities and price trends, offering a forward-looking perspective on 2025.

Table of contents

- Condo rental market: Prices continue to stabilise

- HDB rental market: 4.2% price increase year-on-year

- Rental market outlook for 2025: Price growth expected to continue

Condo rental market: Prices continue to stabilise

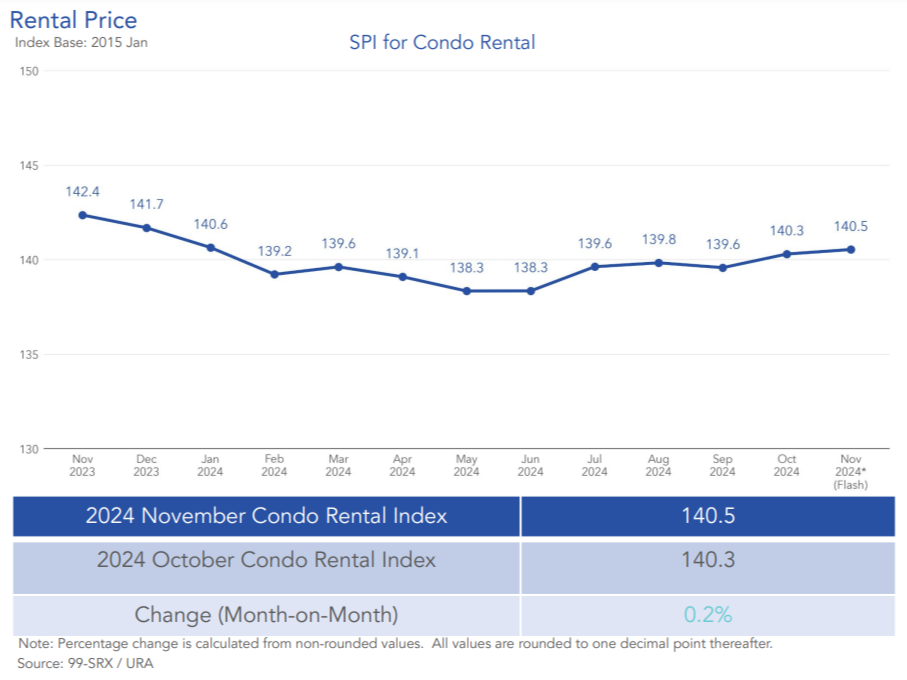

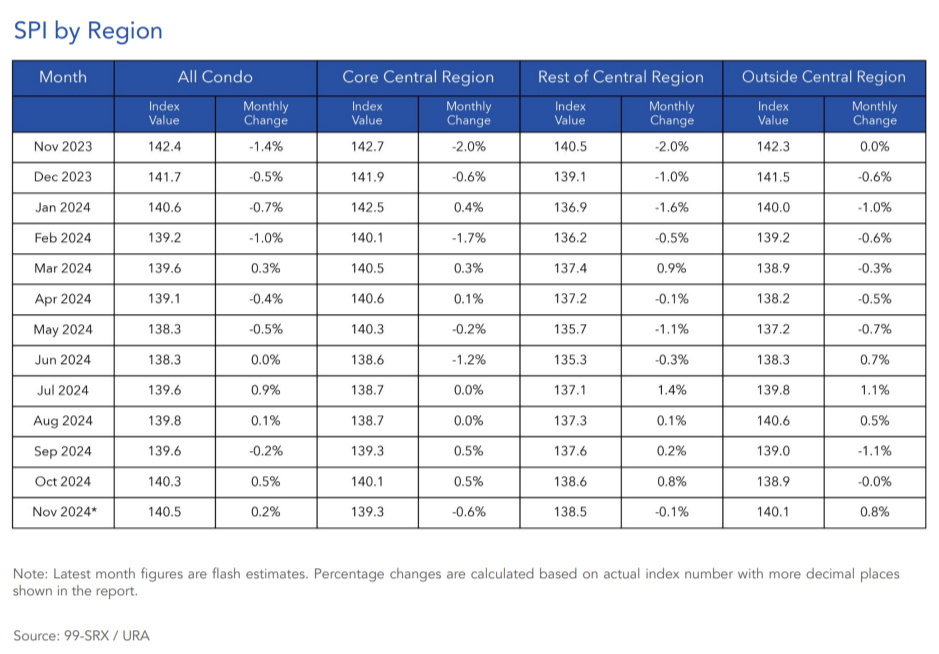

In November 2024, condo rental prices edged up by 0.2% month-on-month, signalling a recovery following a softening trend earlier in the year. This increase was largely driven by the Outside Central Region (OCR), where rental prices climbed by 0.8%, offsetting declines of 0.6% and 0.1% in the Core Central Region (CCR) and Rest of Central Region (RCR), respectively.

Year-on-year, however, condo rental prices remained subdued, registering a 1.3% decline compared to November 2023. Rental prices in CCR, RCR, and OCR all fell year-on-year, reflecting decreases of 2.4%, 1.4%, and 1.5%, respectively.

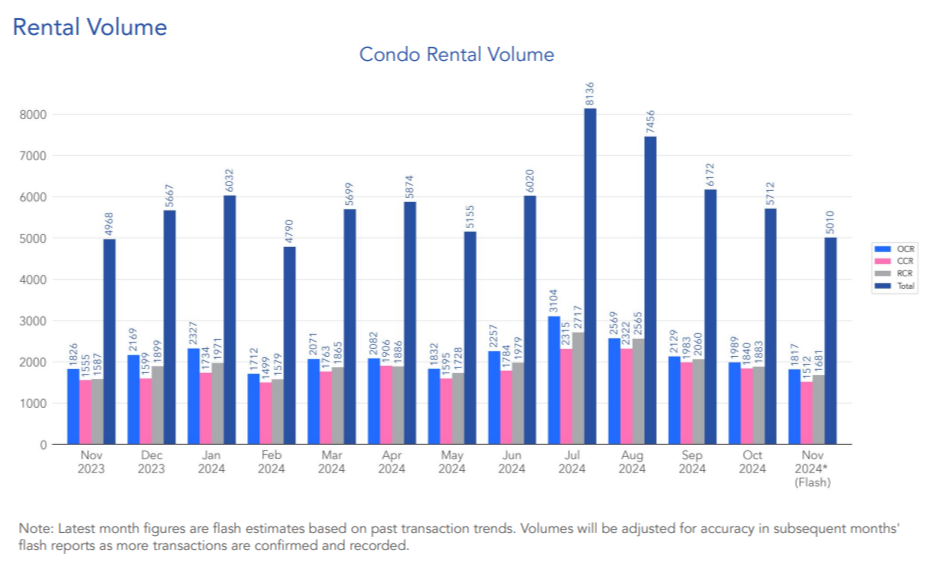

Rental volumes for condos dipped significantly in November, down by 12.3% from October 2024. Approximately 5,010 units were rented, compared to 5,712 units the previous month. This was not unexpected, given the seasonal slowdown. However, year-on-year volumes showed a marginal 0.8% increase, underscoring the sustained demand for rental properties.

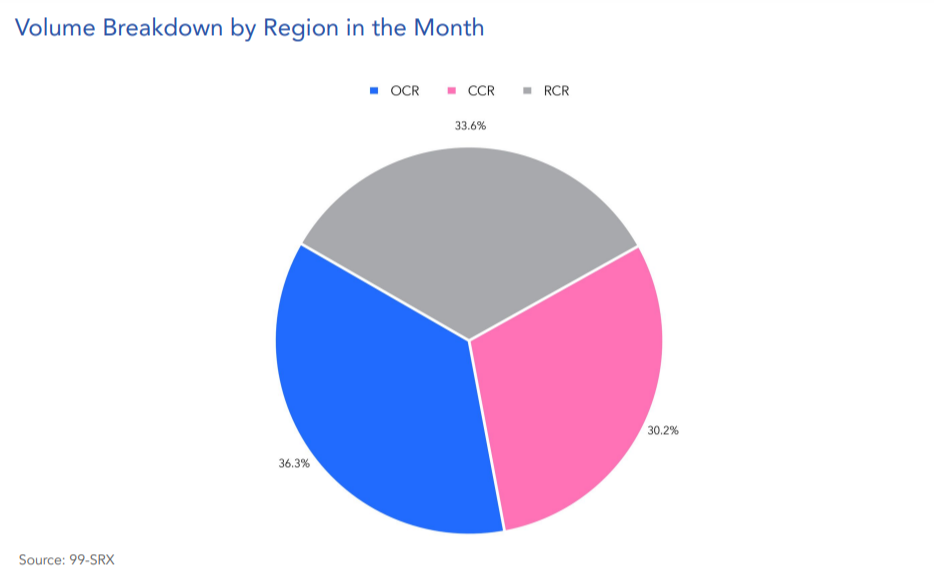

In terms of regional distribution, OCR accounted for the largest share of rentals at 36.3%, followed by RCR with 33.6% and CCR with 30.2%. These figures suggest that affordability in the OCR continues to attract a substantial share of tenants.

Additional reading: HDB rental price surge as condo rental market stabilises in October 2024

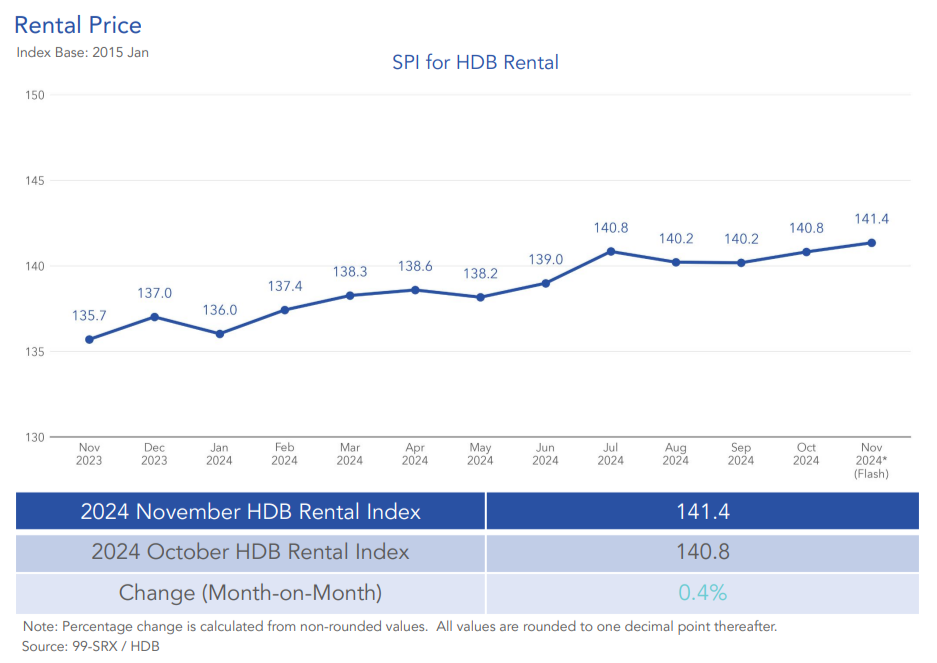

HDB rental market: 4.2% price increase year-on-year

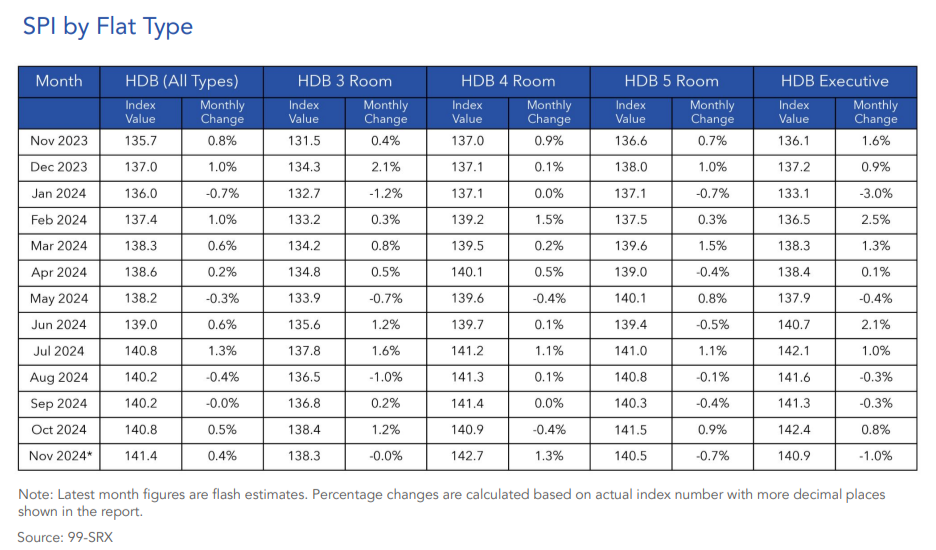

The HDB rental market also saw prices increase in November, with a month-on-month rise of 0.4%. Rentals in Non-Mature Estates led the growth with a 0.5% increase, while Mature Estates posted a 0.2% uptick. Among room types, 4-room flats saw the highest price growth at 1.3%, while 5-room and Executive flats experienced declines of 0.7% and 1%, respectively.

On a year-on-year basis, HDB rental prices increased by 4.2% compared to November 2023, with gains recorded across all flat types. The strongest price growth was observed in 3-room flats, which saw a 5.1% rise, while 4-room, 5-room, and Executive flats grew by 4.1%, 2.8%, and 3.6%, respectively.

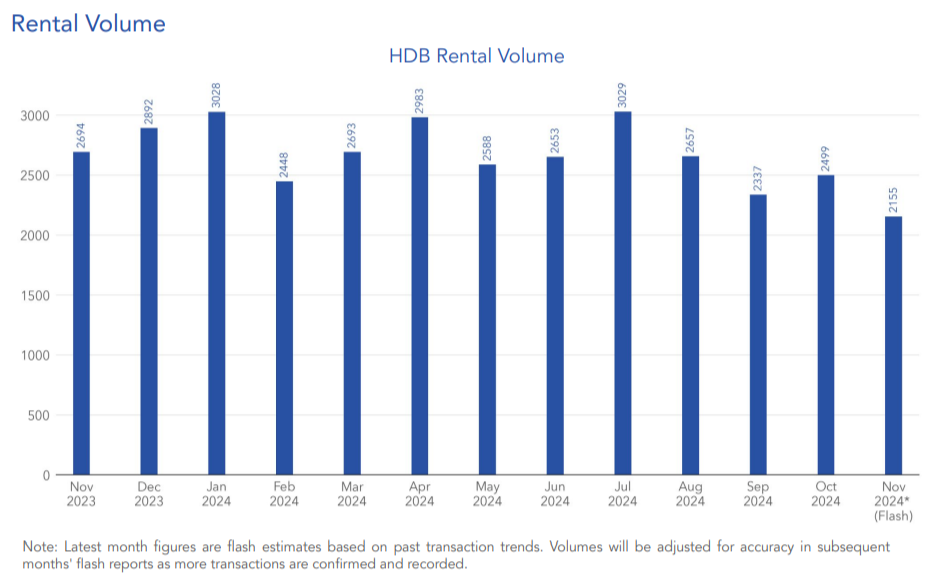

Rental volumes for HDB flats fell sharply, down 13.8% month-on-month and 20% year-on-year. An estimated 2,155 flats were rented in November, significantly lower than the five-year average for the month. This decline in volumes is likely attributable to the year-end slowdown, as many tenants and landlords deferred rental activities.

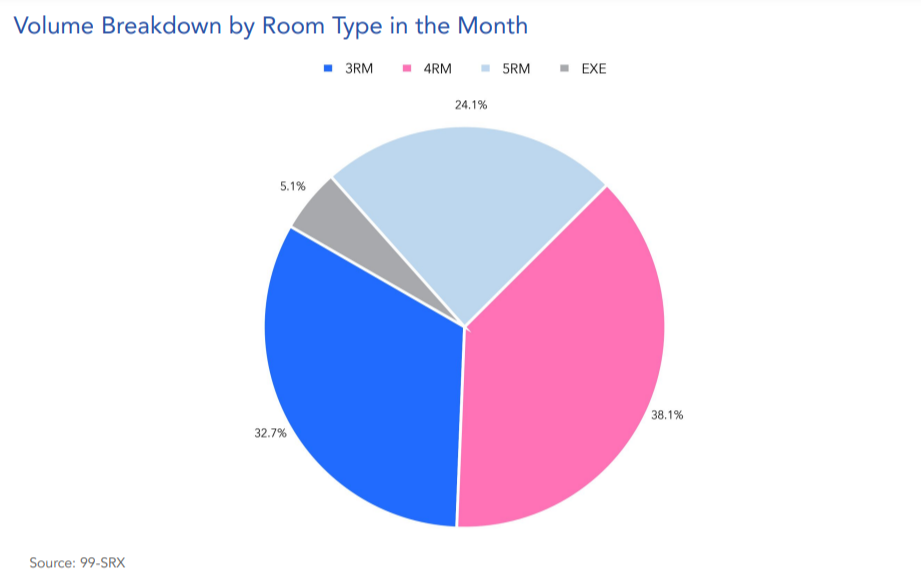

Room type preferences remained stable, with 4-room flats making up 38.1% of total HDB rentals, followed by 3-room (32.7%), 5-room (24.1%), and Executive flats (5.1%).

Additional reading: HDB resale price trend spiked over 10% YoY in November 2024

Rental market outlook for 2025: Price growth expected to continue

As 2024 draws to a close, the rental market’s performance in November highlights the resilience of both condo and HDB segments despite the seasonal slowdown. With condo rental prices showing signs of recovery and HDB rentals remaining an affordable option for tenants, the market is poised for further growth.

Interested in becoming a property owner instead? Use 99.co’s affordability calculator to see if it fits your budget!

An improving economic outlook and declining interest rates are likely to drive rental demand in 2025. For condos, the OCR’s affordability and continued attractiveness to tenants could sustain price increases. In the HDB market, flats in Non-Mature Estates are expected to see steady demand as value-seeking tenants look for cost-effective housing options.

With a strong foundation established in 2024, the Singapore rental market appears set for a dynamic year ahead, driven by affordability, location preferences, and broader economic trends.

What do you think about the rental market in November 2024? Share your thoughts in the comments section below or on our Facebook page.

The post Condo and HDB rental prices continue to surge in November 2024 despite year-end market slowdown appeared first on .