When you’re approaching your golden years, planning your housing needs becomes crucial. Whether you’re looking to downsize, monetise your existing property, or find a new space tailored to your lifestyle, there’s a wealth of HDB grants for seniors that can help you save significantly.

These grants are designed to make it easier for you to manage your housing expenses, ensuring that you can enjoy your retirement with financial peace of mind.

Table of contents

- The basics of HDB grants for seniors

- Types of flats available for seniors

- Short-lease 2-room Flexi flats

- Community Care Apartments (CCA)

- 3-room flats

- HDB grants for seniors

- Silver Housing Bonus (SHB)

- Lease Buyback Scheme (LBS)

- Proximity Housing Grant (PHG) for seniors

- Enhancement for Active Seniors (EASE) Programme

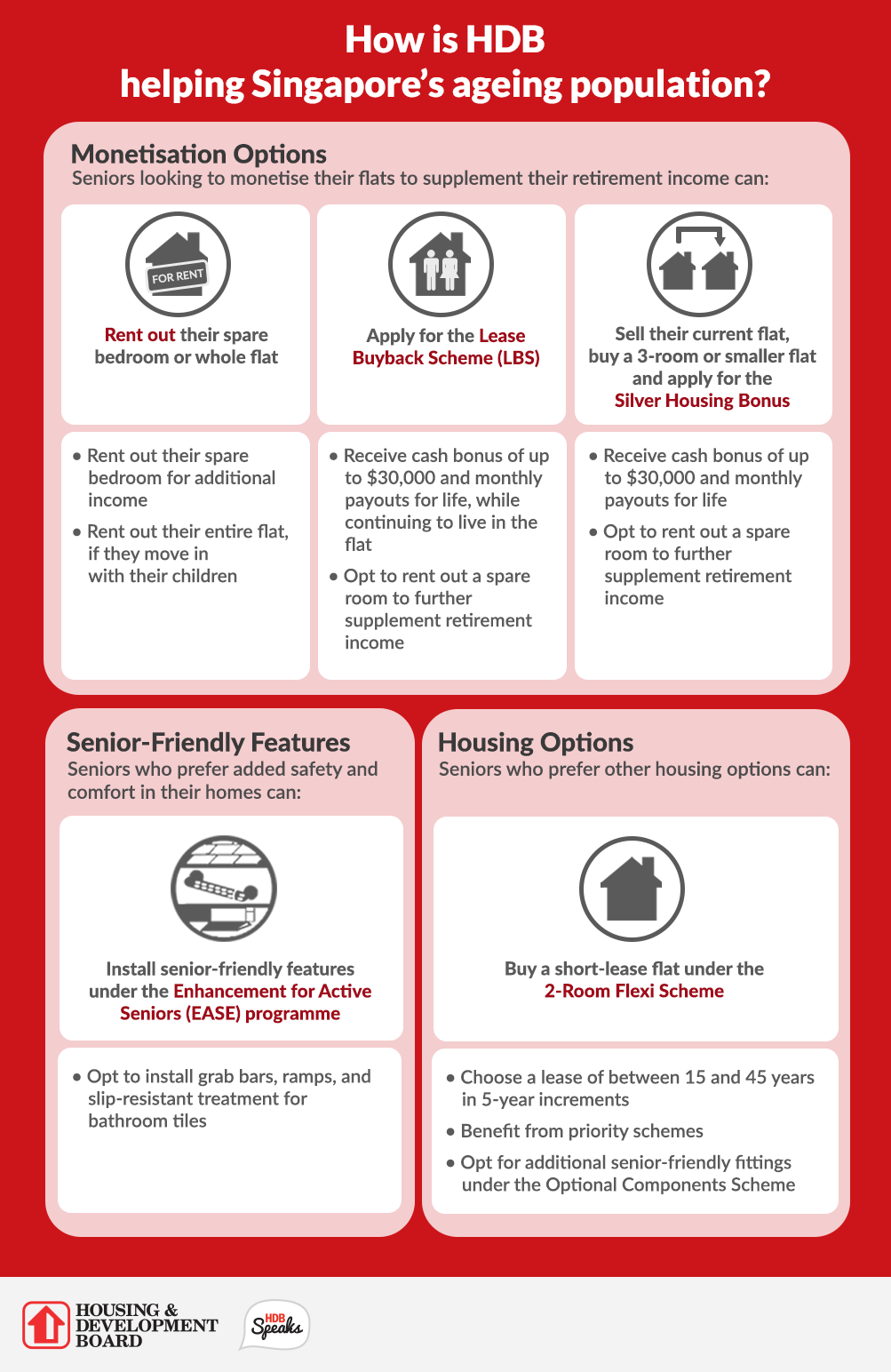

The basics of HDB grants for seniors

To make the most of these opportunities, you need to understand the eligibility conditions for purchasing flats that are designed to meet your specific needs. If you are a Singapore citizen aged 55 or above, you may apply for various CPF housing grants that can significantly offset the cost of your new home.

Before you start your home-buying journey, you should apply for an HDB Flat Eligibility (HFE) letter via the HDB Flat Portal. This step is essential because the HFE letter will give you a comprehensive understanding of your housing and financing options. It will inform you upfront about your eligibility to purchase a new or resale flat and the amount of CPF housing grants and HDB housing loans you are eligible for.

This way, you can plan your purchase confidently, knowing exactly what financial support is available to you.

Read more: Guide on how to apply for HDB Flat Eligibility (HFE) Letter

Types of flats available for seniors

HDB offers several types of flats catering to seniors, ensuring that you can find a home that suits your needs and lifestyle. These options include 2-room Flexi flats, Community Care Apartments (CCA), and 3-room flats, each designed with features that prioritise safety and comfort:

Short-lease 2-room Flexi flats

The 2-Room Flexi Flats are particularly popular among seniors due to their affordability and flexibility. These flats come in two sizes, 36 square metres and 45 square metres, allowing you to choose a space that fits your needs.

What makes these flats stand out is the option to purchase them on short leases (hence, its namesake), ranging from 15 to 45 years, in 5-year increments, providing you with the flexibility to choose a lease that aligns with your personal needs and financial situation. Plus, these flats are equipped with senior-friendly features such as grab bars, non-slip flooring, and accessible layouts, ensuring that you can live comfortably and safely.

To be eligible for the Short-Lease 2-Room Flexi Flat Scheme, you must be at least 55 years old, with a gross monthly household income ceiling of S$14,000. Additionally, you cannot own other properties.

Community Care Apartments (CCA)

For those who may need more support, the Community Care Apartments (CCA) offer an integrated living environment where housing and care services are combined.

These apartments are part of a joint initiative by MND, MOH, and HDB designed to help seniors age independently within the community. Each flat comes with senior-friendly design features, including wide, wheelchair-friendly main doors with a built-in bench, a large accessible toilet with grab bars and slip-resistant flooring, built-in wardrobes and cabinets, a furnished kitchen, and a service yard with a clothes drying rack accessible from the toilet. The design of these apartments ensures that you have everything you need to live comfortably while also having access to care services that can be scaled according to your needs.

Notably, new Community Care Apartments in Geylang (MacPherson) will be available for application during the October 2024 Build-To-Order (BTO) exercise.

3-room flats

While not exclusively designed for seniors, 3-room flats offer more space, which can be particularly beneficial if you prefer a larger living area or if you live with caregivers or family members. These flats can be easily modified to enhance accessibility, such as by widening doorways or adding wheelchair ramps.

The additional space also allows for easier movement and provides the flexibility to make your home as comfortable and functional as possible.

HDB grants for seniors

There are several HDB grants available that are specifically designed to help seniors like you save on your next home or monetise your existing property:

Silver Housing Bonus (SHB)

The Silver Housing Bonus (SHB) offers a practical way for you to unlock the value of your current home while boosting your retirement savings. This option is available if you’re a senior aged 55 and above and are considering downsizing from a larger flat to a 3-room or smaller flat. With this bonus, you can receive up to S$30,000 in cash, but only after you top up your CPF Retirement Account (RA) and join CPF LIFE.

To qualify for the SHB, the following conditions must be met:

- At least one flat owner must be a Singapore citizen.

- Your gross monthly household income must not exceed S$14,000.

- The existing property must either be an HDB flat that has met the minimum occupation period for resale, or private housing with an housing property with an Annual Value of S$21,000 or less.

- You should not own any other property at the time.

- The next property you plan to buy should be a 3-room or smaller flat from HDB or the resale market, and the purchase price should not exceed the selling price of your current or last sold property.

For the full cash bonus you’ll need to top up your CPF RA with S$60,000. If the top-up is less than this amount, the bonus will be pro-rated, where you will receive S$1 for every S$2 top-up made. The top-up amount is calculated based on the proceeds from the sale of your current property, minus any outstanding loan, the purchase price of your next flat, and any applicable resale levy.

It’s also important to note that your SHB application must be submitted within one year from the date of completion of your second housing transaction. This ensures that you can access the bonus in a timely manner, supporting your transition to a smaller flat while enhancing your retirement income.

Lease Buyback Scheme (LBS)

If your household qualifies for the Lease Buyback Scheme (LBS) , you’ll have the opportunity to sell the remaining lease of your flat to HDB. The amount of the cash bonus you receive depends on the size of your flat and how much you top up your CPF Retirement Account (RA). For example, you could receive up to S$30,000 if you own a 3-room or smaller flat, up to S$15,000 for a 4-room flat, or up to S$7,500 for a 5-room or larger flat, depending on the top-up amount to your CPF RA.

Top-up requirements

To benefit from the LBS, the net proceeds from selling your lease must be used to top up your CPF RA. The specific top-up requirements vary based on the flat owner’s age and the number of owners in the household. For applications received from January 1, 2024, the required top-up amounts are as follows:

- For households with one owner: The owner must use the proceeds to top up the RA to the current age-adjusted Full Retirement Sum (FRS).

- For households with two or more owners: Each owner must use their share of the proceeds to top up their RA to the current age-adjusted Basic Retirement Sum (BRS).

Here are the top-up requirements based on the flat owner’s age:

|

Flat owner’s age |

Top-up requirement for 1 owner |

Top-up requirement for 2 or more owners |

|

65 – 69 |

S$205,800 |

S$102,900 |

|

70 – 79 |

S$195,800 |

S$97,900 |

|

80 and above |

S$185,800 |

S$92,900 |

What about the LBS bonus?

Your household will receive the full LBS bonus as long as the total top-up to the flat owners’ RA is S$60,000 or more. If the top-up is less than this amount, a pro-rated bonus will be provided based on the following ratios:

- S$1 for every S$2 CPF top-up for 3-room or smaller flats.

- S$1 for every S$4 CPF top-up for 4-room flats.

- S$1 for every S$8 CPF top-up for 5-room or larger flats.

Please note that if all flat owners have already reached the Full Retirement Sum (FRS) before joining the LBS, and no further top-up is required, the household will not receive the LBS bonus.

What happens to excess proceeds?

After you’ve topped up your RA to meet the specified requirements, you can retain up to S$100,000 in cash per household. If there are any remaining proceeds after this, they must be used to further top up the RA to the current FRS before any additional balance can be kept as cash.

CPF LIFE and lease retention options

If your RA balance is at least S$60,000 after the top-up, you will automatically be enrolled in CPF LIFE, which provides a lifelong monthly payout. However, if you are 80 years old or above, you will not be eligible for CPF LIFE.

When participating in the LBS, your household can choose the length of lease to be retained, which depends on the age of the youngest flat owner. The options available provide flexibility, allowing you to unlock more or less of your flat’s value based on your retirement needs.

|

Age of youngest owner |

Lease retained (Minimum) |

Other options |

|

65 – 69 |

30 years |

35 years |

|

70 – 74 |

25 years |

30 years, 35 years |

|

75 – 79 |

20 years |

25 years, 30 years, 35 years |

|

80 and above |

15 years |

20 years, 25 years, 30 years, 35 years |

Consider the case of Mr. and Mrs. Huang, both 65 years old, who are joint owners of a fully paid 5-room flat valued at S$520,000 with a remaining lease of 65 years. The couple has S$20,000 and S$5,000 in their respective CPF Retirement Accounts (RA). As they approach retirement, they are considering different ways to monetize their flat to enhance their retirement income.

Option 1: Moving to a new flat and applying for the Silver Housing Bonus (SHB)

If Mr. and Mrs. Huang decide to sell their current 5-room flat and purchase a 3-room resale flat in the same town, they could apply for the Silver Housing Bonus (SHB). This option would allow them to:

- Receive a S$30,000 cash bonus after using part of their proceeds to top up S$60,000 to their CPF RA.

- Benefit from a CPF LIFE monthly payout of S$530 to help cover their retirement expenses.

- Retain S$210,000 in cash proceeds after the purchase of their new flat and the required CPF top-up.

- Have the possibility of renting out a room in their new flat for additional income if they choose.

Option 2: Staying in their current flat and using the Lease Buyback Scheme (LBS)

Alternatively, if they prefer to stay in their current home, Mr. and Mrs. Huang could consider the Lease Buyback Scheme (LBS). By retaining 30 years of their flat’s lease and selling the remaining 35 years back to HDB, they could:

- Obtain a S$7,500 cash bonus after topping up S$167,000 to their CPF RA to meet the Basic Retirement Sum.

- Enjoy a CPF LIFE monthly payout of S$1,100 to supplement their retirement income.

- Receive S$52,300 in cash proceeds after the required top-up.

- Still have the option to rent out a room for extra income.

Proximity Housing Grant (PHG) for seniors

Another grant that may benefit you is the Proximity Housing Grant (PHG). This grant is designed to encourage families to live closer together by providing financial incentives for seniors who buy a resale flat near their children. If you choose to live within 4 kilometres of your child’s home, you could receive a S$20,000 grant. If you’re a single senior buying near your parents, a S$10,000 grant is available.

To qualify, at least one applicant must be a Singapore citizen, and the flat must be located within 4 kilometres of your parents’ or child’s home.

Enhanced CPF Housing Grant (Singles)

If you’re a single senior and buying a flat for the first time, the Enhanced CPF Housing Grant (Singles) is designed to help make your purchase more affordable. With this grant, you can receive up to S$40,000 to support your purchase, whether you’re buying the flat on your own or with a non-resident spouse. If you and another eligible single are purchasing a flat together, you can combine your grants, giving you access to a total of up to S$80,000.

The amount you’ll receive from the Enhanced CPF Housing Grant (Singles) depends on your monthly income and employment status. The lower your income, the higher the grant amount you may be eligible for. This means that the grant is tailored to help those who need it most, ensuring that singles have the financial support they need to own a home.

Read more about your eligibility here: HDB Grants for singles – The ultimate guide on BTO and HDB Resale Grants

Enhancement for Active Seniors (EASE) Programme

Unlike the other schemes that focus on helping you buy, sell, or monetise your HDB, the Enhancement for Active Seniors (EASE) Programme is designed to help you, well, enhance your current home. This programme provides subsidies for modifications that improve mobility and safety within your HDB flat. Whether it’s installing grab bars, applying slip-resistant treatments to your floor tiles, or adding ramps, these improvements make daily life more comfortable and secure.

With a subsidy of up to 95% of the cost, this programme ensures that you can afford the necessary modifications to make your home safer and more accessible. To qualify, at least one family member must be aged 65 or above, or between 60 and 64 with specific mobility or health issues.

Planning on using any of these schemes on your next HDB resale purchase? Let us know in the comments section below or on our Facebook page.

The post HDB grants and eligibility for seniors – Here’s how you can save on your next HDB home appeared first on .