Table of contents

- HDB flats: The foundation of public housing

- Executive condominiums: Bridging the gap

- Private condominiums: Luxury and convenience

- Landed properties: The pinnacle of real estate

- Conclusion

Singapore’s real estate market offers a variety of property types to accommodate different needs and budgets. The price gaps between public housing, private condominiums, and landed properties can be substantial, making it important for prospective buyers and investors to understand these differences.

This article explores the reasons behind these price gaps and examines the distinct characteristics of each property type.

HDB flats: The foundation of public housing

What are HDB flats?

HDB flats, or Housing Development Board flats, are a key component of Singapore’s public housing system. These properties are designed to be affordable and accessible to Singaporeans with prices generally lower than other property types.

HDB flats come in various configurations, including 2-room flexi, 3-room, 4-room, 5-room, 3Gen, and Executive flats, each catering to different family sizes and needs. The affordability of HDB flats is largely due to government subsidies, making homeownership attainable for a significant portion of the population.

Read this: 3-room, 4-room or 5-room HDB flat: Which property has the highest appreciation?

HDB flats are known for their affordability, but they have limitations such as limited space and fewer amenities compared to private housing options. The design and location of HDB estates are planned to maximise land use efficiency, often resulting in higher-density living environments.

However, recent developments have seen improvements in the quality and amenities of HDB flats, including green spaces and better connectivity to public transport, which aim to enhance the overall living experience for residents.

HDB properties for you

3

2

3

2

4

2

3

3

3

2

3

2

3

2

2

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

2

2

3

2

3

2

2

2

3

2

3

2

2

2

3

2

3

2

3

2

See all For sale >

2

2

4

2

3

2

-1

2

2

3

2

-1

3

2

-1

-1

-1

1

3

2

3

2

3

2

3

2

3

3

-1

3

1

-1

-1

3

2

3

2

3

2

-1

-1

-1

1

-1

3

2

3

2

2

1

3

2

-1

1

-1

-1

2

2

-1

See all For rent >

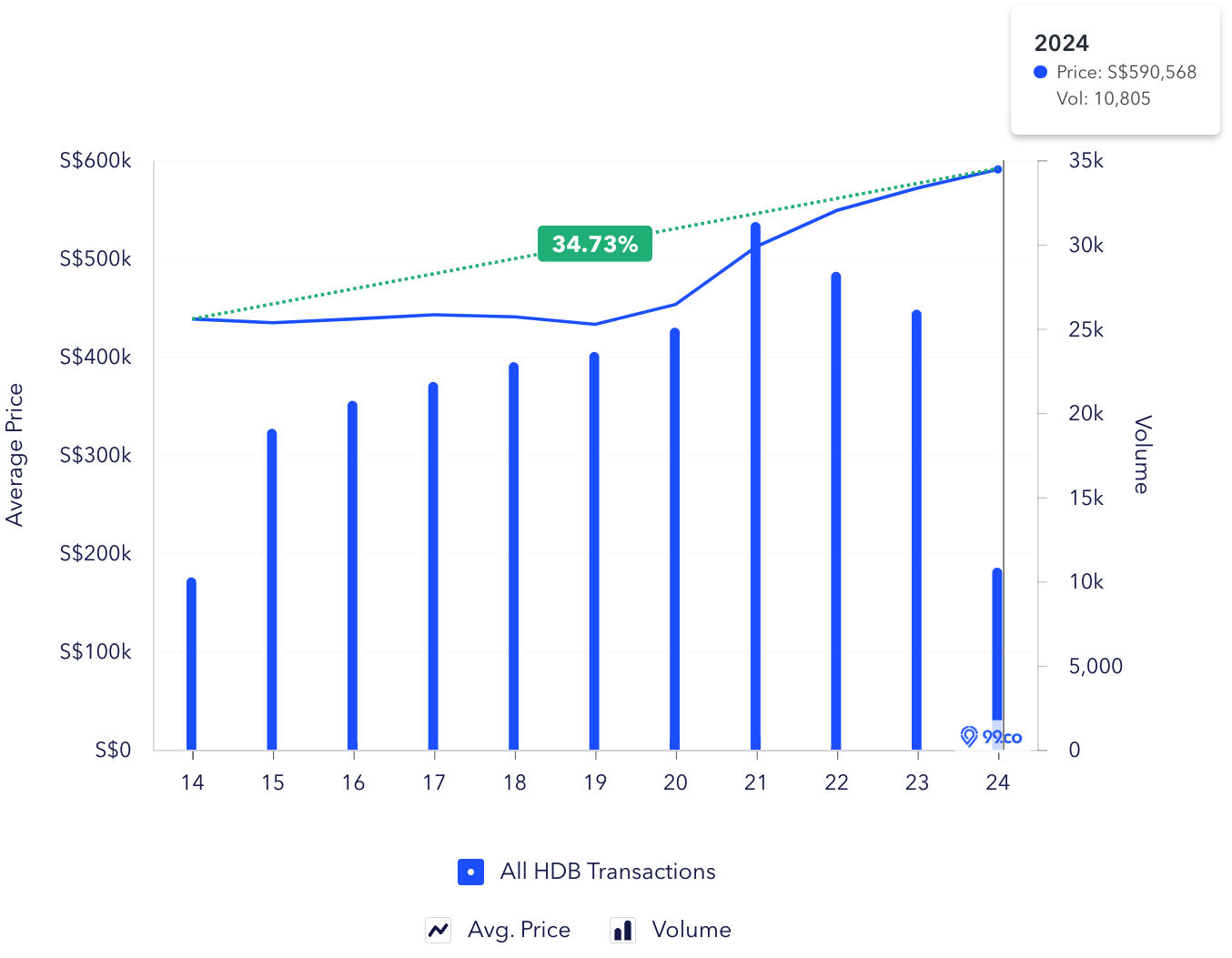

HDB flat price trends

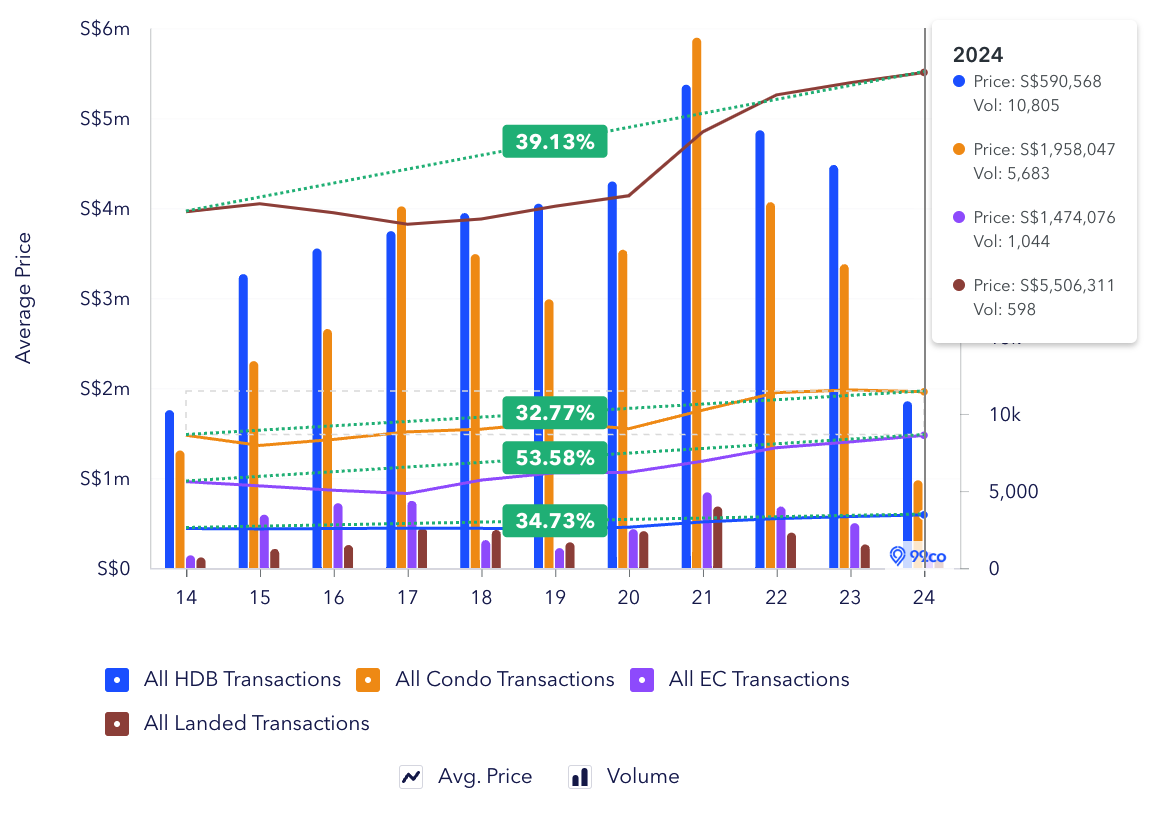

Over the past decade, the average price has generally shown an upward trend, starting from below S$400,000 in 2014 and reaching approximately S$590,568 in 2024, indicating a 34.73% increase. The transaction volume has displayed significant variation, reaching peaks in certain years and declining in others, with a notable drop to 10,805 transactions in 2024.

This trend highlights the growth of the property market in terms of value, despite fluctuating sales volumes.

Executive condominiums: Bridging the gap

What are executive condominiums?

Executive Condominiums (ECs) function as a housing option that caters to Singaporeans who fall between the income eligibility for HDB flats and private condominiums. They are developed by private developers but receive government subsidies, making them more affordable than private condominiums.

ECs offer amenities similar to private condos, such as swimming pools, gyms, and security features, providing a blend of affordability and luxury. The price of ECs is higher than HDB flats but lower than private condos, reflecting their hybrid nature. One key feature of ECs is the Minimum Occupation Period (MOP) of five years, during which the unit cannot be sold or leased out entirely.

Read this: Why are Executive Condos still popular amongst home buyers

After the MOP, ECs can be sold on the open market as private property, potentially appreciating significantly in value. This potential for capital gain makes ECs an attractive option for many middle-income families in Singapore.

Executive condominiums for you

3

3

3

3

2

2

3

2

3

3

3

2

1

1

4

3

2

2

1

1

1

1

3

2

2

2

3

3

2

2

2

2

4

3

3

2

3

3

3

2

3

3

2

1

1

1

4

3

2

1

0

1

3

2

2

2

2

2

2

2

4

3

0

1

1

1

1

1

1

1

3

2

See all For sale >

2

2

2

2

1

1

4

3

2

2

3

3

1

1

1

2

1

1

1

1

2

1

3

2

2

1

2

2

4

6

3

3

3

2

3

3

3

2

2

2

-1

0

1

0

1

-1

1

4

3

1

1

2

1

3

3

1

1

-1

-1

1

2

2

1

1

4

3

2

1

3

2

See all For rent >

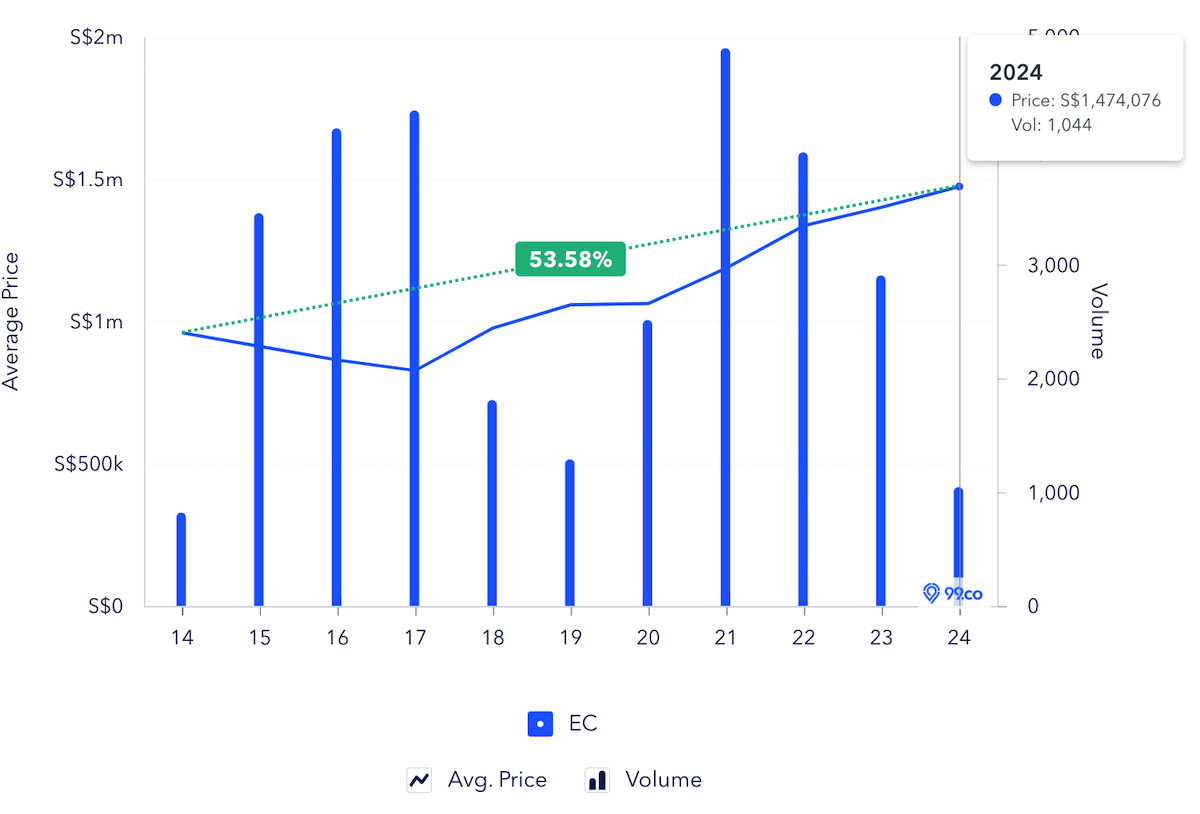

Executive condominium price trends

The average price of ECs has shown an upward trend over the past ten years, starting below S$1 million in 2014 and rising to approximately S$1,474,076 in 2024, reflecting a 53.58% increase. The transaction volume exhibits considerable variability, with peaks and dips throughout the years, and a notable decline to 1,044 transactions in 2024.

This trend highlights an appreciation in the value of ECs over the decade, despite fluctuations in sales volume, indicating a strong demand and increasing market value for this category of property in Singapore.

Private condominiums: Luxury and convenience

What are private condominiums?

Private condominiums are popular for individuals looking for upscale living spaces with a wide range of amenities. Private companies develop these properties and do not receive government subsidies, leading to relatively higher prices.

Private condos are available in different sizes and layouts, from small studio apartments to large penthouses, accommodating various lifestyle needs and preferences.

Read this: Upgrading from an HDB flat to a condo? The guide to end all guides

Private condominiums offer a variety of amenities such as swimming pools, gyms, clubhouses, and landscaped gardens. Their strategic locations near business districts, shopping centres, and good schools make them desirable.

Additionally, the ability for foreigners to purchase private condos contributes to the demand, potentially impacting prices compared to HDB flats and ECs.

Condominiums for you

3

3

3

3

2

2

3

2

3

3

3

2

1

1

4

3

2

2

1

1

1

1

3

2

2

2

3

3

2

2

2

2

4

3

3

2

3

3

3

2

3

3

2

1

1

1

4

3

2

1

0

1

3

2

2

2

2

2

2

2

4

3

0

1

1

1

1

1

1

1

3

2

See all For sale >

2

2

2

2

1

1

4

3

2

2

3

3

1

1

1

2

1

1

1

1

2

1

3

2

2

1

2

2

4

6

3

3

3

2

3

3

3

2

2

2

-1

0

1

0

1

-1

1

4

3

1

1

2

1

3

3

1

1

-1

-1

1

2

2

1

1

4

3

2

1

3

2

See all For rent >

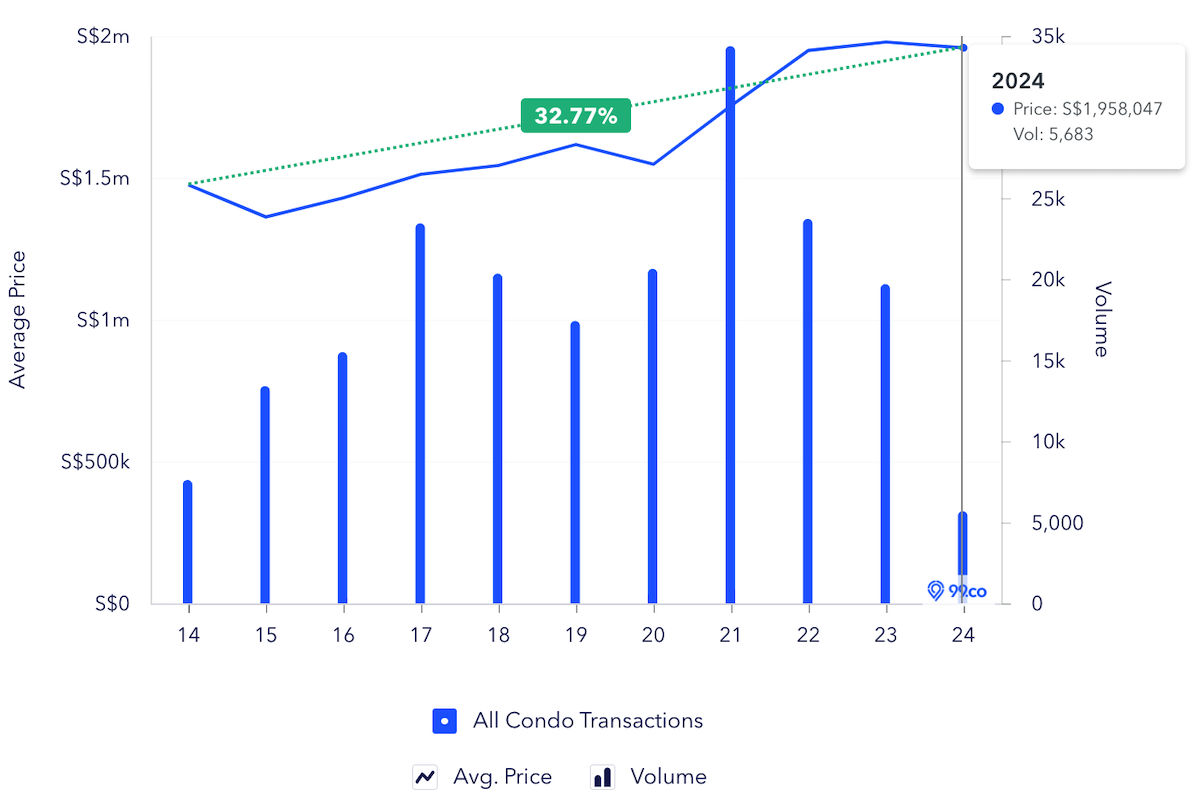

Private condominium price trends

The average price of condominiums has exhibited an upward trend over the past decade, starting below S$1.5 million in 2014 and reaching approximately S$1,958,047 in 2024, indicating a 32.77% increase. Transaction volumes have varied significantly, with notable peaks and dips, culminating in a significant drop to 5,683 transactions in 2024.

This data highlights the consistent appreciation in condo prices over the years despite the fluctuating number of transactions, underscoring a resilient and growing property market in Singapore.

Landed properties: The pinnacle of real estate

What are landed properties?

Landed properties are considered the highest tier of real estate in Singapore, providing ample space and privacy. This category includes terrace houses, semi-detached houses, and bungalows, and generally commands higher prices compared to both HDB flats and private condominiums.

The high cost of landed properties can be attributed to the ownership of land, which is limited and highly sought after in Singapore.

Read this: What’s the appeal of 99-year leasehold landed properties?

Landed properties are generally classified into two main types: freehold and leasehold. Freehold properties offer permanent ownership and are typically priced higher than leasehold properties, which usually have a 99-year tenure. The long-term value and security associated with freehold properties contribute to their higher prices.

Furthermore, the exclusivity and privacy of landed properties, often situated in residential enclaves with strict zoning regulations, make them a desirable choice for affluent buyers.

Landed properties for you

6

6

4

3

4

3

8

9

6

6

6

7

5

5

4

3

3

2

4

4

5

5

4

3

7

7

6

7

4

6

4

2

8

8

3

2

4

8

4

2

6

4

4

3

6

6

5

5

3

4

3

3

4

6

5

6

3

3

3

4

5

5

5

5

9

9

4

2

5

5

5

4

See all For sale >

1

1

6

5

4

2

0

1

-1

1

2

3

6

7

5

5

5

6

5

4

-1

1

-1

1

6

7

7

4

4

3

0

1

4

4

-1

10

10

4

5

-1

1

3

3

3

2

4

3

5

5

4

3

-1

1

7

6

6

6

6

3

-1

0

4

4

4

4

2

2

3

2

6

7

See all For rent >

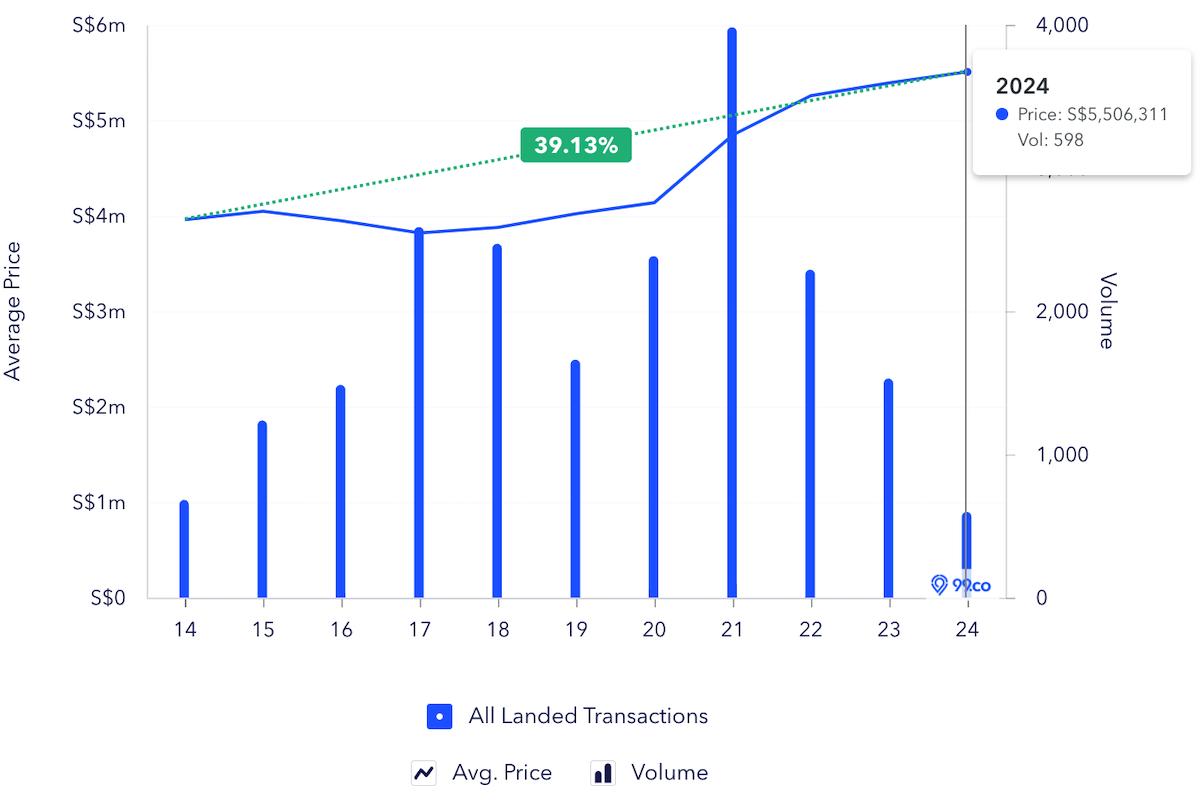

Landed property price trends

In the past decade, the average price of landed properties has shown a consistent upward trend, starting at approximately S$4 million in 2014 and increasing to around S$5,506,311 in 2024, representing a 39.13% growth. The transaction volume has displayed significant fluctuations, with distinct peaks and troughs, and a noticeable decrease to 598 transactions in 2024.

This pattern highlights a continual appreciation in the value of landed properties over the period, despite fluctuations in sales volumes, indicating sustained demand and escalating market worth for this category of property in Singapore.

Conclusion

The price differences between various property types in Singapore are influenced by multiple factors, including government subsidies, ownership tenure, and the amenities provided.

HDB flats offer affordable housing options for the masses, while Executive Condominiums provide a middle ground with a combination of public and private benefits. Private condominiums cater to individuals seeking luxury and convenience, while landed properties offer the ultimate in space and privacy.

Understanding these distinctions is crucial for making informed property decisions in Singapore’s dynamic real estate market.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post Price gaps between property types: Why are they different? appeared first on .