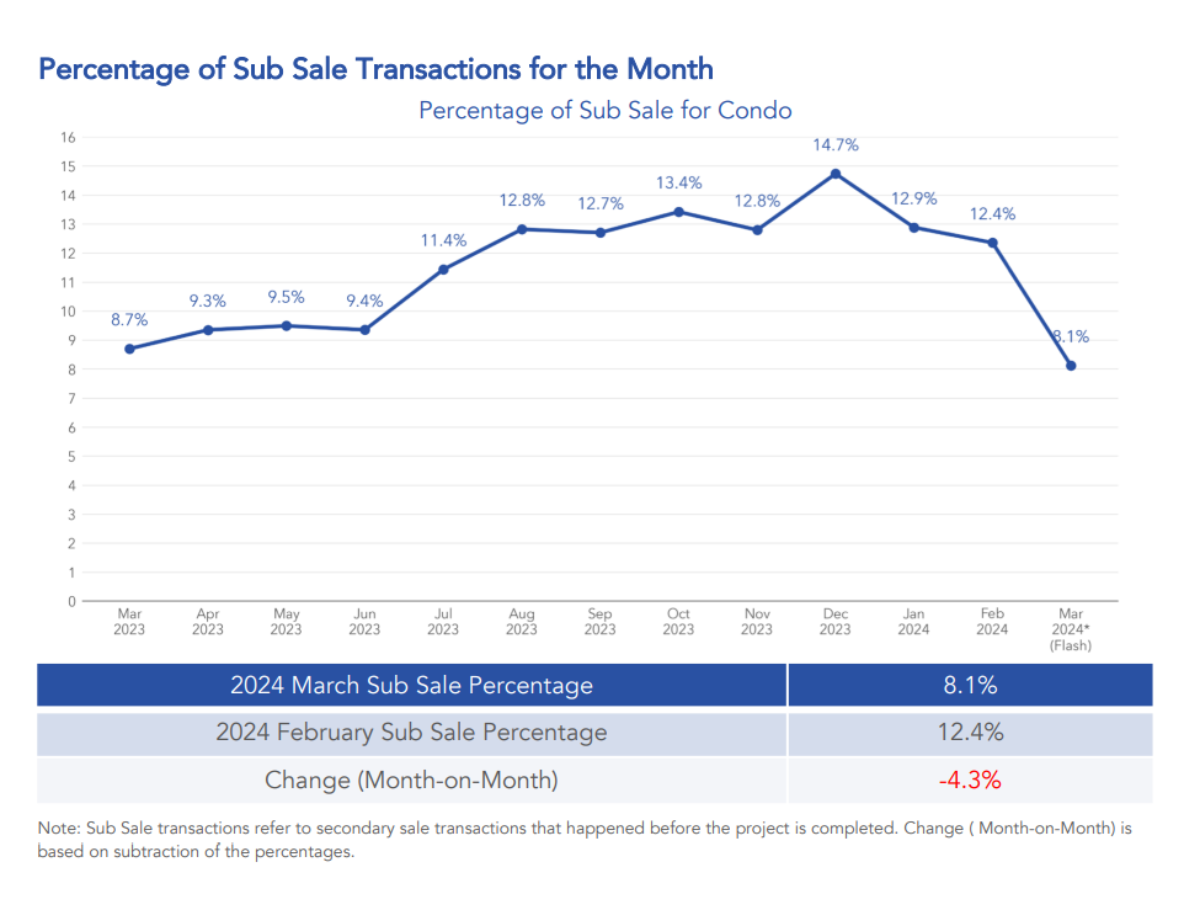

In our previous condo flash report, we discussed a slight 1.2% dip in sub sale transactions since January 2024. Fast forward a month and the numbers have taken a significant nosedive, hitting their lowest point in a year.

Let’s break things down a little further:

March pricing trends across all regions

As per the latest data, Residential Core Region (RCR) and Outside Central Region (OCR) prices have slightly increased by 1.2% and 1.6%, respectively. Meanwhile, prices in the Core Central Region (CCR) have experienced a 2.8% decrease in March 2024.

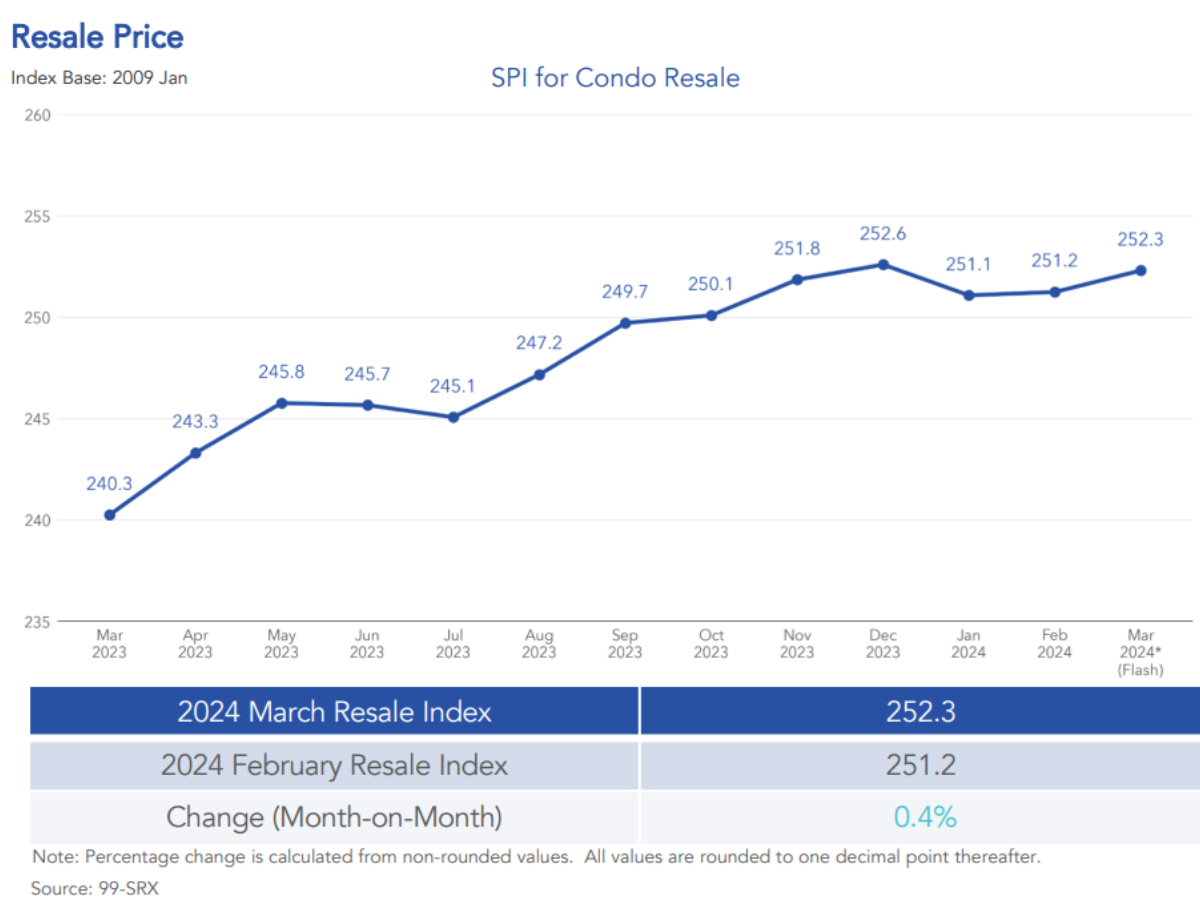

According to the SRX Price Index for condo resale:

- Month-on-month, overall prices have seen a modest rise of 0.4% compared to February 2024.

- Year-on-year, overall prices exhibit a healthy increase of 5.0% over March 2023.

- All regions have witnessed year-on-year price hikes, with CCR up by 1.5%, RCR by 5.6%, and OCR by 7.1%.

Rather look at condos that will MOP this year? Have a read here: Upcoming Executive Condos (ECs) that will MOP in 2024 & 2025

Volume trends and Sub Sale transactions

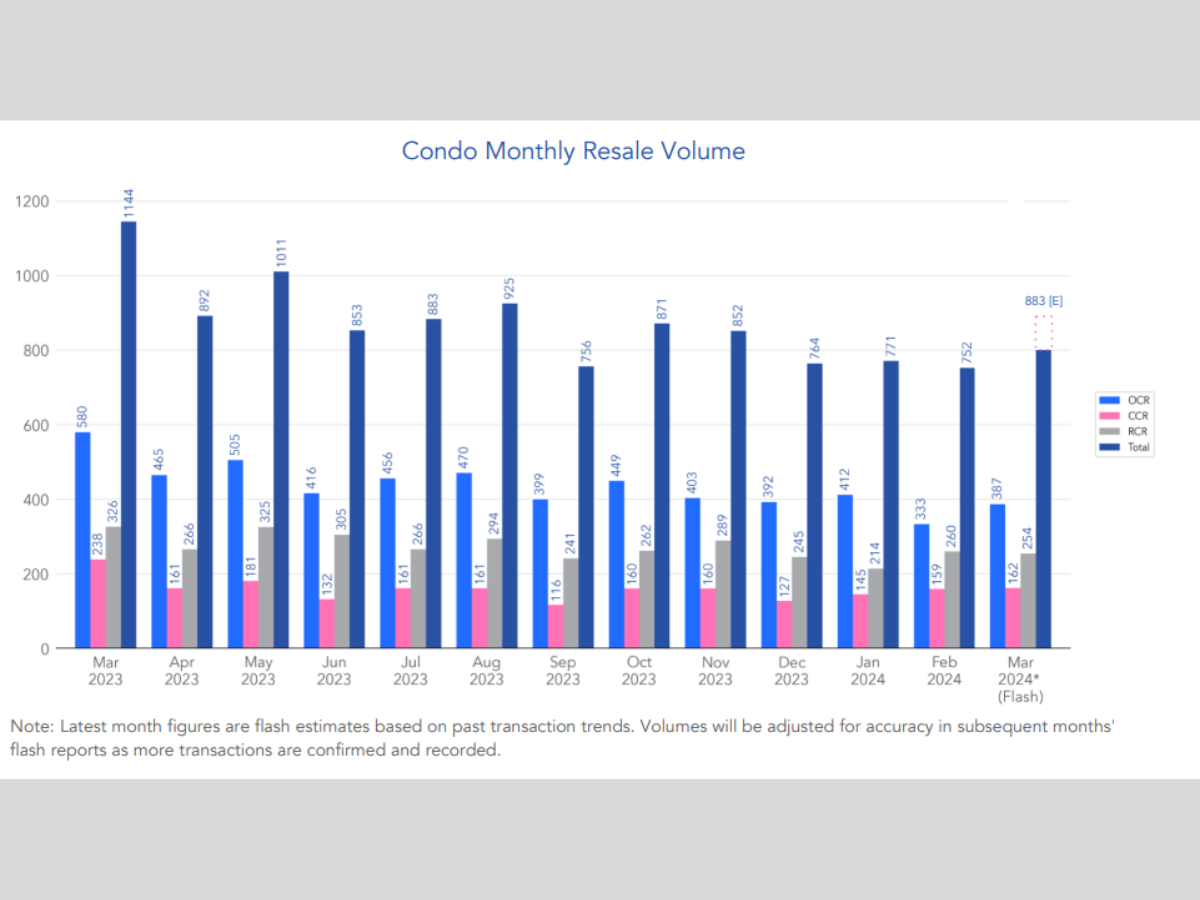

Despite the fluctuating prices, March 2024 saw a notable uptick in the number of units resold, totalling an estimated 883 units – a significant 17.4% increase from the previous month. However, compared to March 2023 figures, the volumes witnessed a decline of 22.8%, indicating a shift in market activity over the past year.

Breaking down the volume distribution by region, OCR accounted for 48.2%, RCR for 31.6%, and CCR for 20.2% of the total volume in March 2024.

Notably, the percentage of Sub Sale transactions to the total secondary sale transactions stood at 8.1%, marking a 4.3% decrease from February 2024. Sub Sale transactions refer to secondary transactions occurring before project completion, offering insights into buyer preferences and investment trends.

Read more: Sub-sale: What property sellers and buyers need to know

Looking for a property close to an MRT station of your choice? Check out 99.co’s MRT map here.

Highlights of high-value transactions

A standout transaction in March was the resale of a unit at Astrid Meadows, fetching an impressive S$7,050,000.

Similarly, in RCR, a unit at Corals at Keppel Bay was resold for S$8,700,000, marking the highest transacted price in the region.

In OCR, Seaside Residences witnessed the highest transacted price, reaching S$3,410,000.

Check your affordability with 99.co’s affordability calculator!

Capital gains and returns

The overall median capital gain for resale condos in March 2024 stood at S$380,000, reflecting a S$20,000 increase from February 2024. District 11 (Newton / Novena) emerged with the highest median capital gain at S$823,000, while District 1 (Boat Quay / Raffles Place / Marina) reported the lowest median capital gain at -S$63,000.

Additionally, the median unlevered return for resale condos in March 2024 was recorded at 33.4%. District 26 (Mandai / Upper Thomson) had the highest median unlevered return at 63.3%, whereas District 1 reported the lowest at -5.8%.

Interested in upcoming new launches for the year? Take a look at your options here: 8 new launches expected in Q2 of 2024

Wrapping up

The recent dip in condo sub sale transactions highlights the evolving dynamics within the real estate market. Despite fluctuations in prices and transaction volumes, key indicators such as capital gains and returns provide valuable insights for investors and homeowners alike, guiding informed decision-making in the ever-changing landscape of property sales.

Looking for more HDB flats that will MOP this year? Check out our article here: Full list of BTO projects hitting MOP in 2024/2025 & Our top picks near the MRT

Considering to sell your flat? Let us help you get the best prices by connecting you with a premier property consultant.

The post Condo sub sale transactions dips to lowest level in 12 months appeared first on .