We outline four major observations Mr Luqman Hakim and his Data team made in the recent flash report covering the HDB flat resale market.

Read last month’s HDB flash report cover here: 74 HDB units sold in January 2024 for over a million dollars, breaking records

HDB resale prices increased by 0.5%

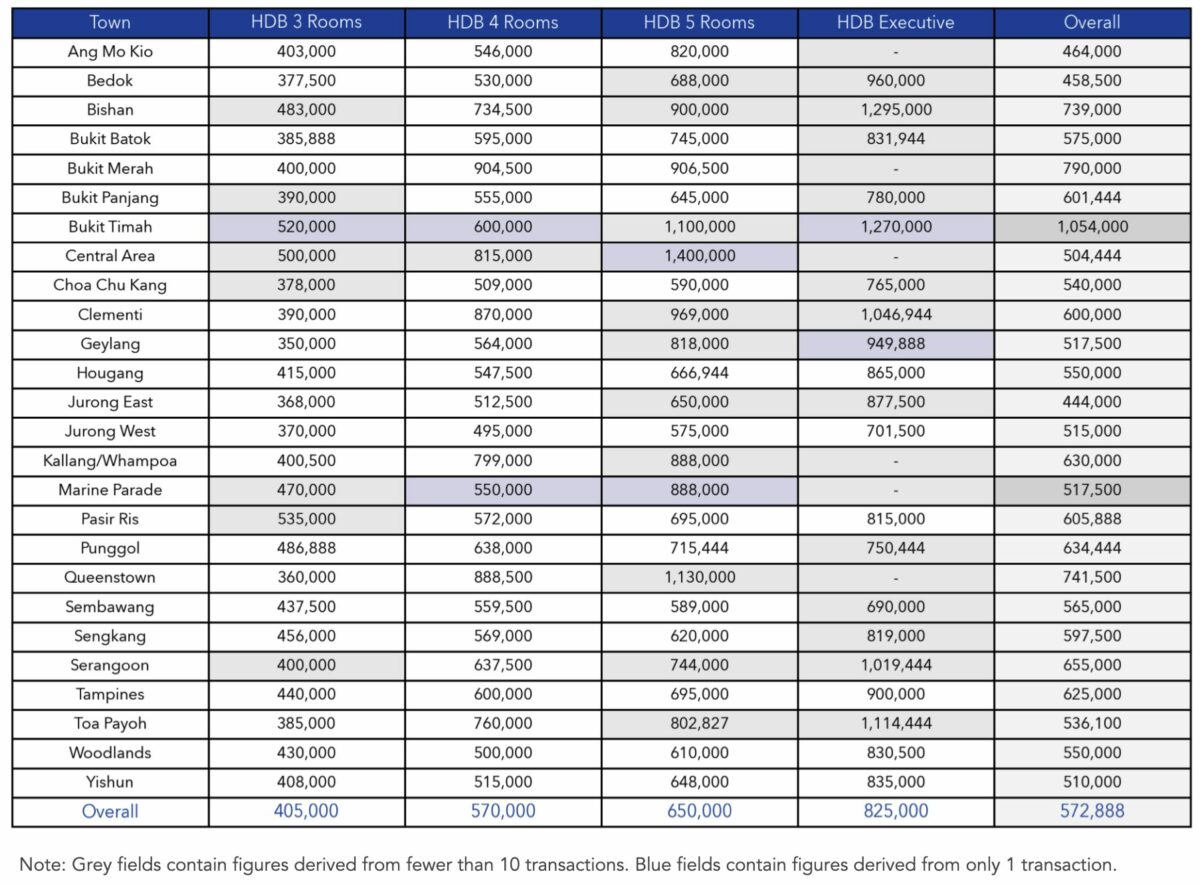

Based on the data provided, we can confidently state that there was a 0.5% increase in the Mature Estates and a 0.3% increase in the Non-Mature Estates for February 2024, compared to the previous month. Let’s take a look at the graph and table showing these numbers below:

Based on room types, we see a 0.9% increase for 3-rooms, 0.6% for 4-rooms, 0.4% for 5-rooms, and 0.7% for Executive unit prices, as we can see in the tables below:

According to the SRX Property Price Index for HDB Resale, there has been a significant increase in overall prices of 6.4% year-on-year since February 2023. This trend is consistent across all HDB room types, with 3-room flats experiencing a 5.4% increase, 4-room flats rising by 6.3%, 5-room flats by 7.0%, and Executive flats by 6.2%. The data also indicates that both Mature and Non-Mature Estates have seen a rise in prices by 6.1% and 5.9% respectively from the same time a year ago, indicating a broad-based growth in HDB resale market values.

February 2024 saw 2,134 HDB resale flats transacted

The number of units sold this month is 2,134, which is 18.8% less than the number of units sold last month.

In February 2024, there was a significant increase of 15.4% in the resale volume of HDB flats compared to the same period in the previous year. When analysing the sales volume by room type, 3-room flats constituted 24.9% of the transactions, while 4-room flats accounted for the majority at 42.5%. Additionally, 5-room flats comprised 23.1% of the sales, and Executive flats contributed 6.4%. From a geographical perspective, most of the resale activities were concentrated in Non-Mature Estates, representing 64.3% of the total volume, whereas the remaining 35.7% of transactions occurred in Mature Estates. This highlights a diverse demand for different housing types and locations.

S$1,480,000 was the highest transacted price

In February 2024, the market observed a record-breaking resale at S$1,480,000. The flat was an Executive, located at Bishan Street 24. This sale emphasises the high value placed on strategically located properties. On the other hand, within Non-Mature Estates, an executive apartment at Hougang Central was sold for S$1,045,000, marking the highest transactional value achieved in that region. This comparison of the highest prices in Mature and Non-Mature Estates illustrates the diverse range of investment potentials available in different residential areas.

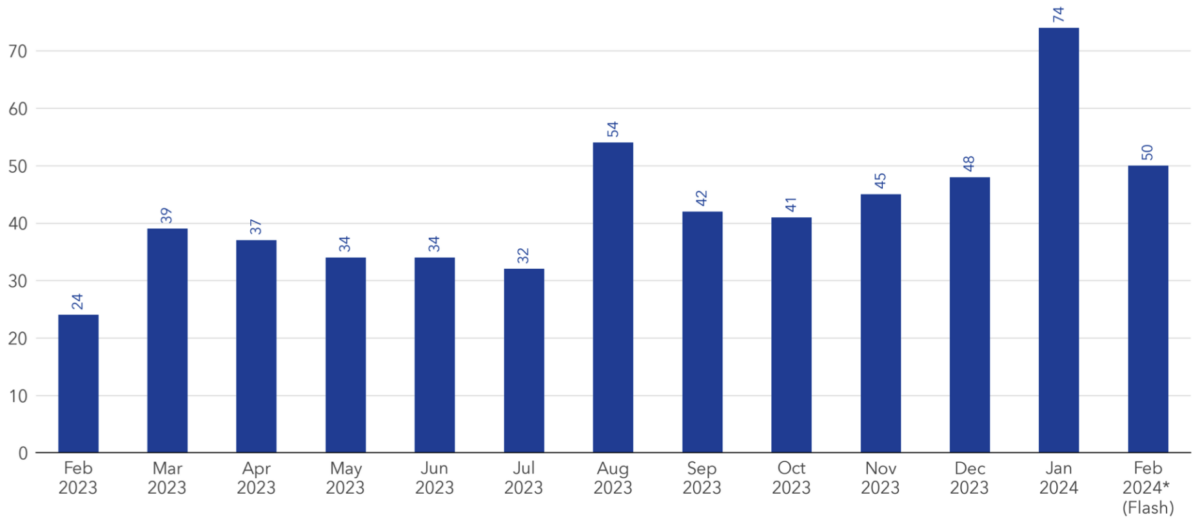

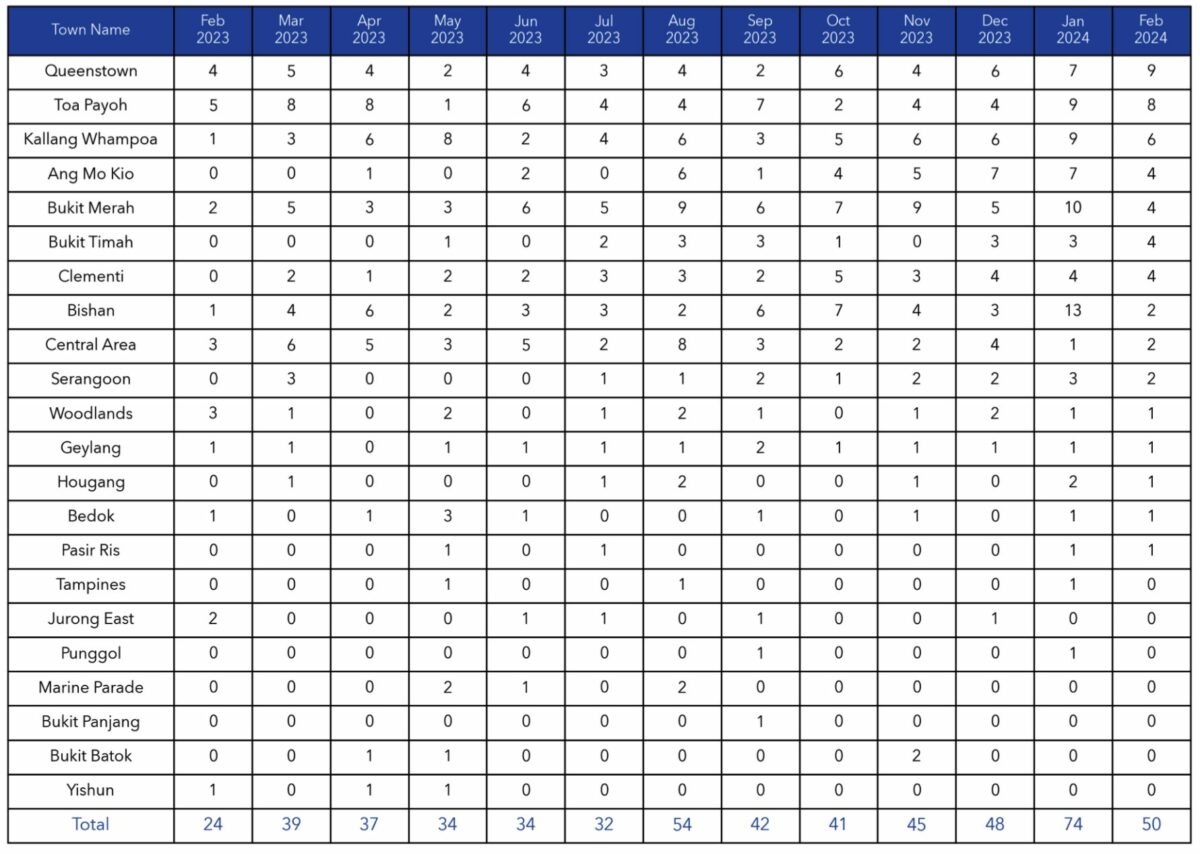

We can take a look at the numbers of million-dollar HDB resale flats below:

50 HDB resale flats crossed the S$1 million transacted threshold

The HDB resale market recorded a total of 50 flats that were sold at or above the $1,000,000 mark in February 2024. This marked a decrease from the 74 units sold in January 2024. These million-dollar transactions constituted only 2.3% of the total resale volumes for the month, indicating that it is a notable but niche market segment. Queenstown was the top-performing neighbourhood with nine units sold at this premium price point, followed by Toa Payoh with six units. The remaining high-value transactions were spread across various other neighbourhoods, including Kallang Whampoa, Ang Mo Kio, Bukit Merah, Bukit Timah, Clementi, Bishan, the Central Area, Serangoon, Woodlands, Geylang, Hougang, and Bedok. This highlights the widespread appeal of select HDB flats across Singapore.

HDB properties in Queenstown

Closing remarks

The recent flash report by Mr Luqman Hakim and his Data team revealed that the HDB flat resale market is evolving and nuanced. The market is adjusting steadily to demand dynamics, as indicated by the modest month-on-month price increases across both Mature and Non-Mature Estates, coupled with the varied price adjustments among different room types. The year-on-year growth of 6.4% in overall prices, consistent across all room types and estates, suggests a healthy demand for HDB resale flats amidst a complex real estate environment.

The decrease in the number of transactions in February 2024 compared to the previous month, along with the significant year-on-year increase in resale volume, highlights the market’s volatility and the potential impact of external factors on buyer and seller behaviour. Furthermore, the record-breaking resale prices, particularly the S$1,480,000 transaction in Bishan, reflect the premium buyers are willing to pay for well-located and desirable properties.

The presence of million-dollar HDB resale flats across a broad range of neighbourhoods showcases the diverse appeal of HDB flats in Singapore. It underlines the intrinsic value in different parts of Singapore, not just traditionally sought-after areas. This comprehensive analysis provides a snapshot of the current state of the HDB resale market, hints at underlying trends, and potential shifts in the housing landscape of Singapore. The market resilience, amidst fluctuations, suggests a continued confidence in HDB flats as a valuable and desirable form of housing. As we move forward, it will be crucial to monitor these trends, as they will undoubtedly influence future policies, market expectations, and the broader socioeconomic fabric of Singapore.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post HDB prices on the rise throughout Feb 2024 despite volume drop during CNY appeared first on .