(Image credit: Jiachen Lin on Unsplash)

In a world rocked by economic uncertainty, Singapore’s government has extended a helping hand with a comprehensive cost-of-living support package. As citizens breathe a sigh of relief, the real estate market holds its breath in anticipation. This article delves into the intricate web of this financial aid and its potential ripple effects on property prices, investments, and rentals.

Overview of the Cost-of-Living Support Package

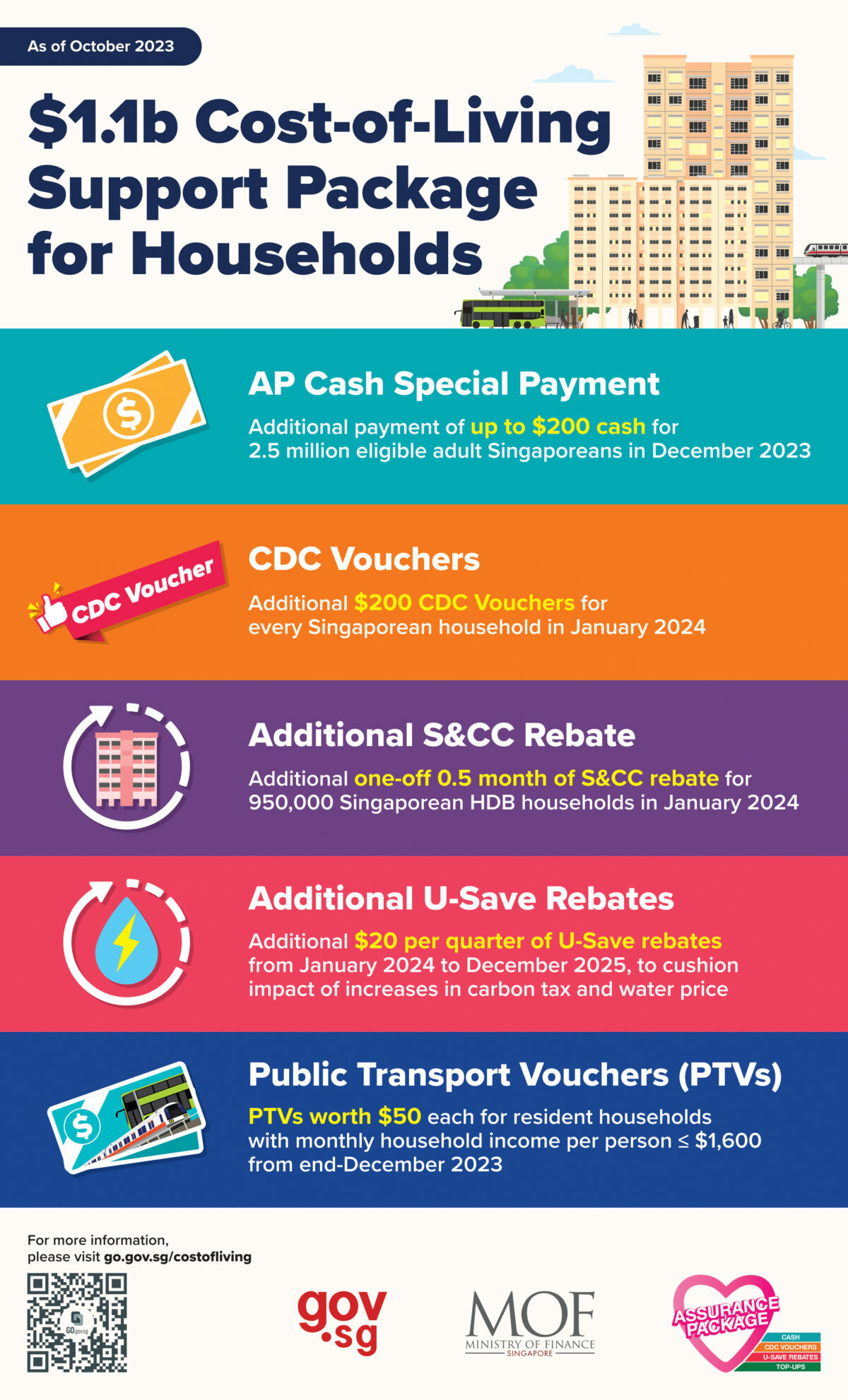

The cost-of-living support package is a generous gesture by the Singapore government, aiming to alleviate the financial strain on its citizens. The package includes cash payouts, CDC vouchers, and additional subsidies and rebates, ensuring a wide-reaching impact.

With up to $200 cash for 2.5 million Singaporeans and $200 CDC vouchers for Singaporean households, the government’s commitment to supporting its citizens in these trying times is clear. This package is part of a $1.1 billion initiative to help Singaporeans with the cost of living, further highlighting the government’s dedication to its citizens’ welfare.

The potential impact on real estate pricing

The government’s vigilant eye on real estate pricing, coupled with this financial boost, could usher in a new era of fairness in property pricing. The additional income flowing into households may influence the real estate market, potentially stabilising prices and offering more opportunities for first-time buyers.

The government’s monitoring ensures that this influx of funds does not inadvertently inflate property prices, maintaining affordability for all. The government’s commitment to monitoring the impact of this package on various sectors, including real estate, ensures that the benefits reach the citizens without unintended negative consequences.

Read more: Rising water bills, rising rents: The unavoidable connection between your bills & housing affordability

How Singaporeans might utilise the additional funds

The windfall from the support package opens a realm of possibilities for Singaporeans. Some may channel these funds into property investments, seizing the opportunity to enter the real estate market. Others might prioritize paying off their mortgages, lightening their financial burdens for the long term.

Alternatively, the extra cash could enhance the quality of rentals, allowing families to upgrade their living conditions without the commitment of a property purchase. The government’s additional support in the form of U-Save rebates and Service & Conservancy Charges rebates further bolsters Singaporeans’ financial stability, enabling more informed and confident real estate decisions.

The ripple effects on the real estate market

The real estate market stands on the cusp of significant change as the support package rolls out. The increased financial capacity could spur a surge in property investments and mortgage payments, reshaping the landscape of property ownership in Singapore.

The potential for increased property purchases or rentals looms large, as citizens harness their enhanced purchasing power to secure better homes and investment opportunities. The government’s continued support and monitoring ensure that this financial boost translates into genuine improvements in the real estate sector, benefiting both property owners and renters alike.

Read more: Condo and HDB rental markets dip in volumes in August 2023

Conclusion

In conclusion, the cost-of-living support package is not just a financial lifeline for Singaporeans; it’s a catalyst for change in the real estate market. As the government continues its vigilant monitoring, ensuring fair and stable property prices, citizens are empowered to make informed, beneficial real estate decisions. The future of Singapore’s property market, buoyed by this substantial support, looks bright and promising, offering new opportunities and stability for all.

The post Navigating the waves: Singapore’s Cost-of-Living Support Package and its impact on the real estate market appeared first on .