With the increase in new launch condo prices, homebuyers have much to consider before purchasing a new property. After all, an attractive price is not everything in the current economic climate. Buyers want to make sure that their monthly mortgage payments are within reach.

If you’re searching for a new condo and have a budget to stick to, you might be interested in condos below S$1 million.

We’ve compiled some statistics from 99.co’s Researcher data to find out which condos were transacted below S$1 million since the start of 2023.

Since the start of the year, there have been 934 condo transactions below S$1 million. Of these, 843 were resale transactions, 83 were sub-sales and 8 were new sale transactions (accurate as of 6 June 2023).

Here’s a breakdown of the unit types, locations, tenure and sizes of condo units transacted below S$1 million since the start of 2023.

Resale condos below S$1 million

Unsurprisingly, the bulk of condos below S$1 million were resale transactions. Based on unit sizes, it also makes sense that 1 and 2-bedroom units make up most of these transactions.

But we want to find out how many 3 or 4-bedroom condos were transacted below S$1 million.

4-bedroom

There were no 4-bedroom condo transactions below S$1 million.

However, when we increased the price slightly to S$1.3 million, there were six resale condo transactions.

Four of these were from Symphony Suites, a condo in Yishun which TOP-ed in 2019. With a size of 1,023 sqft, they were sold from S$1.25 to S$1.28 million (S$1,222 psf to S$1,252 psf). The other two transactions were from Regent Grove (TOP: 2000) and Rosewood (TOP: 2003).

It’s interesting that Symphony Suites just TOP-ed four years ago but prices are still comparable to the other two condos which TOP-ed more than 20 years ago. This is due to the smaller sizes of units at Symphony Suites. In terms of psf price, Regent Grove sold its 4-bedroom unit for S$916.67 while Rosewood sold for S$907.82.

3-bedroom

There were 14 transactions of 3-bedroom condos below S$1 million.

| Project | Location | Size (sqft) | Price (S$) | Price (S$) (psf) | Tenure | TOP |

| Floraview | Ang Mo Kio | 732 | 888,000 | 1,213 | Freehold | 2017 |

| Hougang Green | Hougang | 1,163 | 900,000 | 774 | 99-year | 1998 |

| Natura @ Hillview

(2 transactions) |

Hillview | 657 | 910,000 – 935,000 | 1,385 – 1,423 | Freehold | 2015 |

| Melville Park

(2 transactions) |

Simei | 1,044 | 930,000 – 990,000 | 891 – 948 | 99-year | 1996 |

| Symphony Suites

(2 transactions) |

Yishun | 786 – 797 | 965,000 | 1,211 – 1,228 | 99-year | 2019 |

| Kovan Grandeur | Kovan | 743 | 930,000 | 1,252 | 99-year | 2012 |

| Sun Plaza | Sembawang | 1,357 | 950,000 | 700 | 99-year | 2001 |

| Orchid Park Condominium | Yishun | 1,141 | 960,000 | 841 | 99-year | 1994 |

| Rosewood Suites | Woodlands | 1,097 | 980,000 | 893 | 99-year | 2011 |

| Crystal Lodge | Geylang | 1,152 | 980,000 | 851 | Freehold | 2001 |

| Central Imperial | Geylang | 603 | 830,000 | 1,376 | Freehold | 2015 |

Data source: URA, Realis, 99.co

All 3-bedroom units transacted below S$1 million were in the OCR (Outside Central Region).

The average psf price of 3-bedders below S$1 million is S$1,070.

While most of the condos in the table above are over 10 years old, some like Symphony Suites, Floraview and Central Imperial TOP-ed less than 10 years ago.

It’s also interesting that four condos, Floraview, Natura @ Hillview, Crystal Lodge and Central Imperial are freehold developments. These are boutique developments with less than 200 units and basic facilities, which would usually have a lower premium.

The general trend is that the older developments have larger 3-bedroom units (above 1,000 sqft) compared to newer ones. This could explain why the quantum for 3-bedroom units in the older and newer condos are almost the same even though the newer projects have a much higher average psf price.

Some of these developments are within walking distance of an MRT station, such as Sun Plaza, Orchid Park and Kovan Grandeur. Furthermore, Sun Plaza is a mixed-use development.

1 and 2-bedrooms

Since the start of the year, there were 503 1-bedroom resale transactions below S$1 million and 232 2-bedroom transactions below S$1 million.

For resale 1-bedders below S$1 million, 25 transactions were in the CCR, 198 in the RCR and 280 in the OCR.

The average psf price of 1-bedders below S$1 million is S$2,035 in the CCR, S$1,692 in the RCR and S$1,520 in the OCR.

Here are the lowest transactions in each region:

| Region | Project | Size (sqft) | Price (S$) | Price (psf) (S$) | Tenure | TOP |

| CCR | Suites @ Shrewsbury | 334 | 690,000 | 2,066 | Freehold | 2013 |

| RCR | Le Regal | 366 | 520,000 | 1,421 | Freehold | 2015 |

| OCR | Kovan Grandeur | 398 | 550,000 | 1,382 | 99-year | 2012 |

Data source: URA, Realis, 99.co

For 2-bedders below S$1 million, 34 transactions were in the RCR and 198 transactions were in the OCR. There were no transactions of 2-bedroom units below S$1 million in the CCR.

The average psf price of 2-bedders below S$1 million is S$1,591 in the RCR and S$1,235 in the OCR.

Here are the lowest transactions in each region:

| Region | Project | Size (sqft) | Price (S$) | Price (psf) (S$) | Tenure | TOP |

| RCR | Melosa | 484 | 690,000 | 1,426 | Freehold | 2015 |

| OCR | Qube Suites | 420 | 650,000 | 1,548 | Freehold | 2017 |

Data source: URA, Realis, 99.co

Freehold condos below S$1 million

We narrowed our search further to find freehold/999-year condos below S$1 million and there have been 273 transactions this year. 268 were resale transactions and 5 of them were sub-sale transactions.

There were no new sale transactions of freehold/999-year condos.

Other than five 3-bedroom resale condo transactions below S$1 million, the rest were 1 and 2-bedroom resale condo transactions. The five 3-bedroom resale freehold condo transactions were from Floraview, Natura @ Hillview, Crystal Lodge and Central Imperial which we mentioned earlier.

Only 23 transactions were in the CCR (all 1-bedroom transactions), while 168 transactions were in the RCR and 82 were in the OCR.

New condo sale transactions below S$1 million

What intrigued us were the 8 new condo sale transactions below S$1 million.

In the past year, average psf prices of new launches in the RCR and OCR have soared above S$2,000 psf. For instance, since the start of 2023, the average psf price of new condo sale transactions is S$2,504 in the RCR and S$2,060 in the OCR. This would mean the chances of purchasing a new launch below S$1 million are slim.

| Project | Location | Size (sqft) | Price (S$) | Price (S$) (psf) | Tenure | TOP |

| Sceneca Residence

(6 transactions) |

Tanah Merah | 463 (1-bedroom) | 958,000 – 999,000 | 2,069 – 2,158 | 99-year | 2026 |

| The Botany at Dairy Farm | Hillview | 506 (1-bedroom) | 988,000 | 1,953 | 99-year | 2027 |

| Riverfront Residences | Hougang | 517 (2-bedroom) | 820,000 | 1,586 | 99-year | 2024 |

Data source: URA, Realis, 99.co

Nevertheless, we found 8 new launch units were transacted for less than a million dollars. Except for one 2-bedroom transaction from Riverfront Residences, the other condo sale transactions were 1-bedroom units.

Most new condo sale transactions in 2023 (6 transactions) were from Sceneca Residence, which launched in January this year. This was for its 463 sqft 1-bedroom unit, with prices ranging from S$958,000 to S$999,000 (S$2,069 psf to S$2,158 psf).

The Botany at Dairy Farm was the other condo launched this year in March and there was one 1-bedroom transaction.

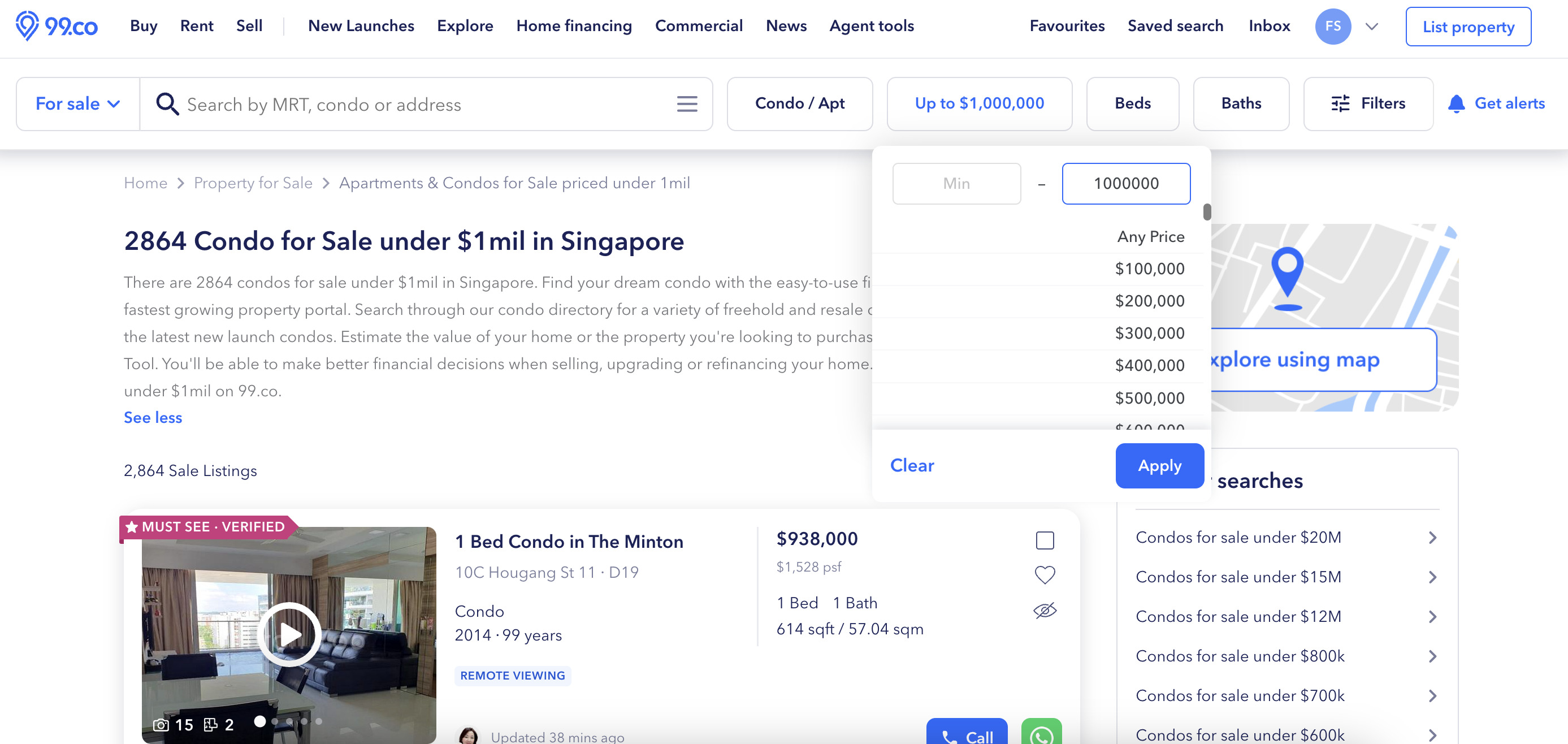

Find condos below S$1 million on 99.co

If you’re looking for condos below S$1 million on 99.co, you can input the price range by using the price filter function. You can also filter your search based on the number of bedrooms, the tenure of your property and more.

Planning to sell your property and upgrade to a condo below S$1 million? Let us help you get the right price by connecting you with a premier property agent.

If you find this article helpful, 99.co recommends Here’s how much you need to earn to afford a condo (2023) and All you need to know about the condo payment schedule.

The post Which types of condos were bought below S$1 million since the start of 2023? appeared first on .