Buying a new HDB flat is almost a rite of passage for new couples in Singapore. But with the excitement of owning a home, comes the scary part: the payment timeline to pay for the flat.

That’s why our top advice for prospective homebuyers is to make sure that their finances are sorted before applying for a new flat from HDB (whether it’s via BTO, Sales of Balance Flats or Open Booking). This ensures that they’re able to afford the payments when they’re due.

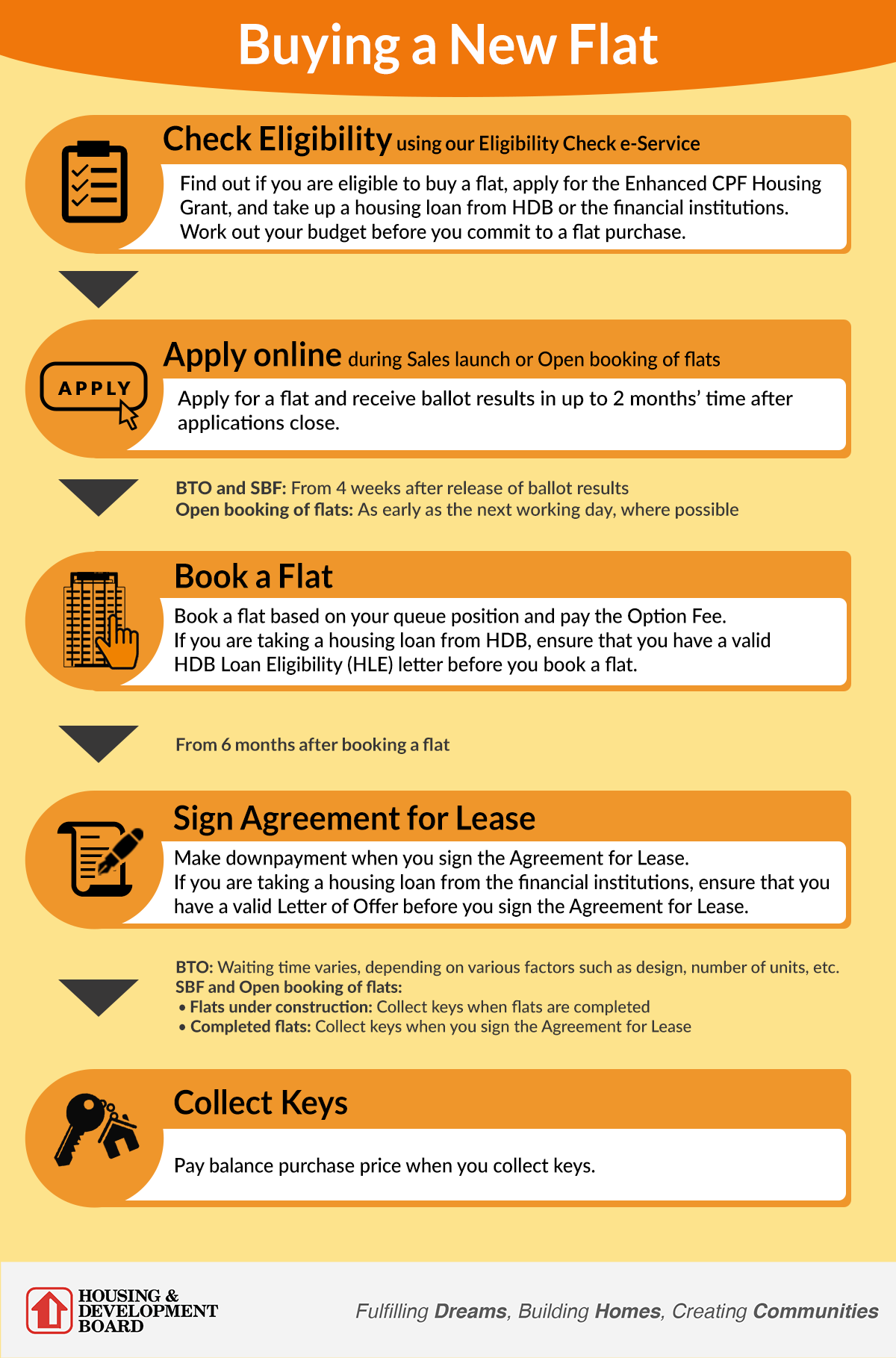

For that reason, we’ve come up with this little cheat sheet summarising the payment timeline to help you figure out what you’re in when you sign the dotted line.

(Specifically for Open Booking of Flats, given that you can book for a flat as early as the next working day, you’ll need to get the HDB Loan Eligibility (HLE) letter before the application.)

HDB BTO, SBF and Open Booking payment timeline

| Stage of purchase | Fees payable | Amount payable | Payment mode |

|---|---|---|---|

| BTO application | Application fee | S$10 | Credit card or mobile payment app (eg. DBS PayLah!, UOB TMRW, OCBC Pay Anyone, etc.) |

| Flat booking | Option fee (forms part of the downpayment) | 2-room Flexi: S$500

3-room: S$1,000 4-room and bigger: S$2,000 |

NETS |

| Signing of Agreement for Lease | Buyer’s Stamp Duty (BSD) | First S$180,000: 1%

Next S$180,000: 2% Next S$640,000: 3% Next S$500,000: 4% Next S$1.5m: 5% Remaining amount: 6% (Given the price of BTO flats, the BSD rate payable should be up to 3%.) |

GIRO, PayNow, AXS, internet banking, SingPost, cheque |

| Conveyancing fee (also known as legal fee) | First S$30,000: S$0.90 per S$1,000

Next S$30,000: S$0.72 per S$1,000 Remaining amount: S$0.60 per S$1,000 Rounded up to nearest dollar before applying for GST. |

||

| Downpayment | If taking HDB loan: 10% of purchase price, with CPF or cash

If taking bank loan with LTV of 75%: 5% cash, 15% CPF and/or cash If taking bank loan with LTV of 55%: 10% cash, 10% CPF and/or cash |

||

| Key collection | Registration fee | Lease In-Escrow: S$38.30

Mortgage In-Escrow: S$38.30 |

Cashier’s Order, CPF |

| Survey fee | 1-room: S$162

2-room: S$162 3-room: S$229.50 4-room: S$297 5-room: S$351 Executive: S$405 (inclusive of 8% GST) |

||

| Stamp duty for Deed of Assignment | 0.4% of the loan amount, up to S$500 | ||

| Home Protection Scheme (HPS) annual premium | If you’re using CPF to pay for loan instalments, depends on factors like outstanding loan | ||

| Fire insurance

premium for 5 years |

If you’re taking HDB loan.

1-room: S$1.63 2-room: S$2.73 3-room: S$4.91 4-room: S$5.99 5-room: S$7.19 Executive: S$8.18 (inclusive of 8% GST) |

Cannot be paid with CPF | |

| Downpayment | For flat applications received between 16 Dec 2021 and 29 Sep 2022: 5% of purchase price, with CPF or cash

For flat applications received after 29 Sep 2022: 10% of purchase price, with CPF or cash If taking bank loan with 75% LTV: 5% of purchase price with CPF and/or cash If taking bank loan with 55% LTV: |

||

| Balance of purchase price | This will be covered by the home loan if you’re taking it | ||

Calculate how much you can afford with 99.co’s affordability calculator!

Here’s an illustration for taking an HDB loan

Let’s take the example of newlywed couple Mark and Sophie, who are both Singapore Citizens in their 20s.

They are first-timer applicants with a combined income of S$8,000/month. They’re looking to purchase a 4-room BTO Flat, with a purchase price of S$500,000.

In addition, they qualify for the Staggered Downpayment Scheme (SDS), and will be financing their purchase with an HDB loan which will cover up to 80% of the purchase price (for flat applications from 30 September 2022, in line with the recent cooling measures), for a term of 25 years. With a loan-to-value (LTV) ratio limit of 80%, this means their loan amount will be S$400,000.

They also intend to service their loan instalments using their CPF savings.

| Stage of purchase | Fees payable | Amount payable |

|---|---|---|

| BTO application | Application fee | S$10 |

| Flat booking | Option fee (forms part of the downpayment) | 4-room: S$2,000 |

| Signing of Agreement for Lease | Buyer’s Stamp Duty (BSD) | S$9,600 |

| Conveyancing fee | S$338.04 (after rounding up and applying 8% GST) | |

| Downpayment less option fee | 5% of purchase price minus option fee: S$23,000

(cash or CPF) |

|

| Key collection | Registration fee | Lease In-Escrow: S$38.30

Mortgage In-Escrow: S$38.30 |

| Survey fee | 4-room: S$297 | |

| Stamp duty for Deed of Assignment | S$500 | |

| Home Protection Scheme (HPS) annual premium | S$254 | |

| Fire insurance for 5 years | 4-room: S$5.99 | |

| Downpayment (for Staggered Downpayment Scheme) | 15% of purchase price (for BTO application after 29 Sep 2022): S$75,000

(cash or CPF) |

|

| Balance of purchase price | Loan amount:

S$400,000 |

|

| Total | S$511,081.63 |

Calculate how much you need to pay for the BSD 99.co’s stamp duty calculator!

If you’re taking a bank loan for the BTO flat

Now let’s see how the finances work out if they were to take out a bank loan with a 30-year tenure. Since it’s their first loan, they are entitled to a loan of up to 75% of the purchase price. This means the loan amount will be S$375,000

In this case, they decide to go with legal counsel that their bank recommends, at a cost of S$2,500.

| Stage of purchase | Fees payable | Amount payable |

|---|---|---|

| BTO application | Application fee | S$10 |

| Flat booking | Option fee (forms part of the downpayment) | 4-room: S$2,000 |

| Signing of Agreement for Lease | Buyer’s Stamp Duty (BSD) | S$9,600 |

| Legal fees | S$2,500 | |

| Downpayment less option fee | 10% of purchase price minus option fee: S$48,000

(5% cash + 5% cash or CPF) |

|

| Key collection | Registration fee | Lease In-Escrow: S$38.30 |

| Survey fee | 4-room: S$297 | |

| Stamp duty for Deed of Assignment | S$500 | |

| Home Protection Scheme (HPS) annual premium | S$254 | |

| Downpayment (for Staggered Downpayment Scheme) | 15% of purchase price: S$75,000

(cash or CPF) |

|

| Balance of purchase price | Loan amount: S$375,000 | |

| Total | S$513,199.30 |

Not sure on which bank loan to go for? Speak to 99.co’s mortgage broker to find out more.

HDB flats for sale

2

2

2

2

2

2

1

1

2

2

2

2

1

1

2

2

2

1

1

1

1

1

2

2

2

2

1

1

1

1

1

1

2

2

2

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

2

2

2

2

1

1

1

1

1

1

See all 2-room >

3

2

3

2

3

2

3

2

3

3

3

2

2

2

3

2

2

2

3

2

2

2

2

1

2

2

3

2

2

2

3

2

2

2

2

2

2

2

2

2

2

1

3

2

2

2

3

2

2

2

2

2

2

2

2

2

3

2

3

2

2

2

2

1

2

3

3

2

3

2

See all 3-room >

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

1

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

3

4

3

3

2

3

2

See all 4-room >

3

2

3

2

3

2

4

2

3

3

3

2

3

2

3

2

4

2

3

2

4

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

3

3

2

3

2

3

2

3

2

5

2

3

2

4

2

3

2

4

2

See all 5-room >

4

2

4

4

4

3

4

2

3

2

4

3

4

2

6

2

4

3

4

2

3

3

4

3

3

2

8

4

4

3

4

2

6

2

4

3

4

3

4

3

4

3

6

2

4

3

3

2

4

3

3

2

3

2

3

3

4

3

4

2

3

2

3

2

3

3

5

2

3

3

See all Executive >

What’s your experience with the HDB BTO payment process? Let us know in the comments section below.

If you found this article helpful, 99.co recommends 99.co’s guides: Buying a BTO – The Process & Procedures and My complete BTO experience: From balloting to renovation regrets.

[Additional reporting by Virginia Tanggono]

Frequently asked questions

For HDB loan, if you’ve applied for BTO between 16 December 2021 and 20 September 2022, the downpayment is 15% of the purchase price. For BTO applications from 30 September 2022 onwards, the down payment will be 20%. On the other hand, if you take a bank loan, the downpayment will be 25%.

The wait time is usually three to four years. However, due to supply constraints, manpower shortages and delays, it can take around five years to complete.

As long as you’ve not bought a new HDB, DBSS or EC, or received a CPF Housing Grant before, you can buy a BTO up to two times.

The post Buying via BTO, SBF or Open Booking? Everything you need to know about the payment timeline appeared first on .