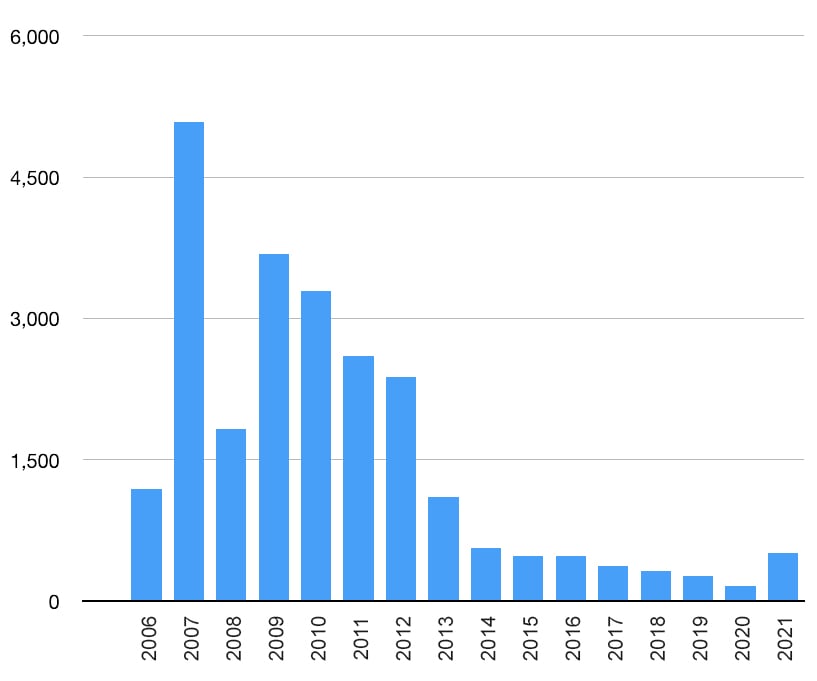

Seller’s Stamp Duty was introduced more than a decade ago in 2010 in a bid to curb speculation and disincentivize house flipping in the real estate market. Since then, sub-sales of condos have been steadily declining, with numbers spiking again in 2021.

Looking at the numbers over the last decade (since 2012), the top 3 districts with the most sub-sales are:

• District 19 (Hougang/ Punggol/ Sengkang): 986 sub-sales

• District 18 (Pasir Ris/ Simei/ Tampines): 653 sub-sales

• District 15 (East Coast): 480 sub-sales

The areas with the lowest number of sub-sales are:

• District 6 (City Hall/ Clarke Quay): 0 sub-sales

• District 25 (Admiralty/ Woodlands): 27 sub-sales

• District 7 (Beach Road/ Bugis/ Rochor): 42 sub-sales

| District | Number of sub sales from 2012 |

| 1 | 51 |

| 2 | 65 |

| 3 | 210 |

| 4 | 188 |

| 5 | 337 |

| 6 | 0 |

| 7 | 42 |

| 8 | 57 |

| 9 | 272 |

| 10 | 246 |

| 11 | 192 |

| 12 | 417 |

| 13 | 170 |

| 14 | 477 |

| 15 | 480 |

| 16 | 418 |

| 17 | 143 |

| 18 | 653 |

| 19 | 986 |

| 20 | 88 |

| 21 | 79 |

| 22 | 197 |

| 23 | 276 |

| 24 | 0 |

| 25 | 27 |

| 26 | 75 |

| 27 | 317 |

| 28 | 233 |

What is a sub-sale?

Sub-sales occur when a property is bought from a developer and sold to another buyer before the development is completed and receives the Certificate of Statutory Completion (CSC). While the terms CSC and Temporary Occupation Permit (TOP) are often used interchangeably amongst property owners, they mean different things.

A development can only be open for residential living after obtaining a TOP. Remaining works such as completing the swimming pool or other amenities can be carried out in the meantime.

On the other hand, the CSC has more requirements to certify that the development is completely done.

The legal completion dates for TOP and CSC may be completely different. Just because the condo has residents already living there doesn’t mean it has obtained its CSC.

According to the Building and Construction Authority (BCA) guidelines, the general period given to developers to obtain the CSC is one year after obtaining TOP.

Seller’s stamp duty (SSD)

Bought a private property last year and want to flip it this year for a fat profit? Not so fast. Owners looking for a sub-sale opportunity need to factor in seller’s stamp duty (SSD), which will take a hefty bite out of your sale proceeds.

Paying SSD is compulsory if you decide to sell your residential property within three years of purchase. The rate is based on the property’s market valuation or selling price (whichever is higher).

• Sell within one year of purchase – 12% SSD

• Sell within two years of purchase – 8% SSD

• Sell within three years of purchase – 4% SSD

Example: You purchase a condo for S$2 million. You decide to sell it next year. This means you have to pay a 12% SSD of S$240,000. Not factoring in the myriad of other legal fees, you need to sell your unit at S$2.24 million or more just to break even.

You should only sell your unit four years after signing the sales and purchase agreement (S&PA) to avoid paying SSD.

Want to sub-sell your unit?

If you’ve already signed the S&PA and the developer has not yet conveyed the legal title of the unit to you, you’ll need to inform the developer of the sub-sale. This can be done through the agent in charge of your original sale.

The developer will then enter into a new S&PA agreement with the sub-purchaser, with the same terms and conditions you received when purchasing the unit.

Other cost considerations

You need to consider more than just SSD when selling a sub-sale.

Buyer’s stamp duty. You would’ve had to pay Buyer’s Stamp Duty (BSD) when you first purchased your unit.

Just like SSD, BSD is based on the higher of your property purchase price or market valuation.

Here are the current BSD rates:

| Purchase price or market value of property | BSD rates for residential properties |

| First S$180,000 | 1% |

| Next S$180,000 | 2% |

| Next S$640,000 | 3% |

| Remaining amount | 4% |

On a S$2 million property, here’s the BSD you need to pay:

| Market value of property | BSD rate | Calculation | Total |

| First S$180,000 | 1% | 1% x S$180,000 | S$1,800 |

| Next S$180,000 | 2% | 2% x S$180,000 | S$3,600 |

| Next S$640,000 | 3% | 3% x S$640,000 | S$19,200 |

| Remaining S$1,000,000 | 4% | 4% x S$1,000,000 | S$40,000 |

| BSD Payable: S$1,800 + S$3,600 + S$19,200 + S$40,000 = S$64,600 | |||

Agent fees. You pay zero agent commissions when you first purchase a new launch unit from the developer. However, if you choose to engage an agent to assist in your sub-sale, you need to pay your agent 2% of the selling price.

The commission will likely be co-shared between both your agent and the buyer’s agent.

Accrued interest. To ensure all Singaporeans have enough funds for retirement, the government requires that accrued interest be returned to your CPF Ordinary Account (OA) at 2.5% per annum. This would be the amount of interest you would’ve earned if you didn’t use your CPF OA for your home downpayment and to service your monthly home loans.

Let’s say you bought your condo at S$2 million. Your loan-to-value (LTV) limit is 75%, which means a downpayment of 25% (5% cash and 20% from your OA).

Downpayment amount taken from OA

S$2 million x 20% = S$400,000

If you held your condo for two years before selling it via sub-sale, you will need to pay accrued interest.

Accrued interest

S$400,000 x 2.5% x 2 years = S$20,000

Total amount to be returned to CPF

S$400,000 + S$20,000 = S$420,000

This amount will go back into your OA, which you can then use for future property transactions.

If you allocate more cash towards your downpayment, you can pay lesser accrued interest.

Total cost considerations

Now that we’ve addressed all the cost concerns let’s see how they add up on a S$1 million property sold after two years.

BSD: S$64,600

SSD (8%): S$160,000

Agent fees (2%): S$40,000

Accrued interest: S$20,000

Total costs = S$284,600

After totalling all costs, you need to sell your property at S$2,284,600 just to break even.

Still wanting to sell your property before TOP? Here’s how you can save more

• Wait as long as possible to decrease or avoid paying SSD. After 4 years, there’s zero SSD payable.

• Use more cash instead of CPF OA when paying your downpayment to decrease accrued interest payable.

• Market the unit yourself to a direct buyer to save on agent fees (although we don’t recommend this, as the process for a sub-sale can get complicated and lengthy).

Why some choose to buy a sub-sale property

Compared to purchasing resale, buying a sub-sale means getting a brand new unit. Those looking for a shorter TOP period may choose to purchase a sub-sale and cut the waiting time.

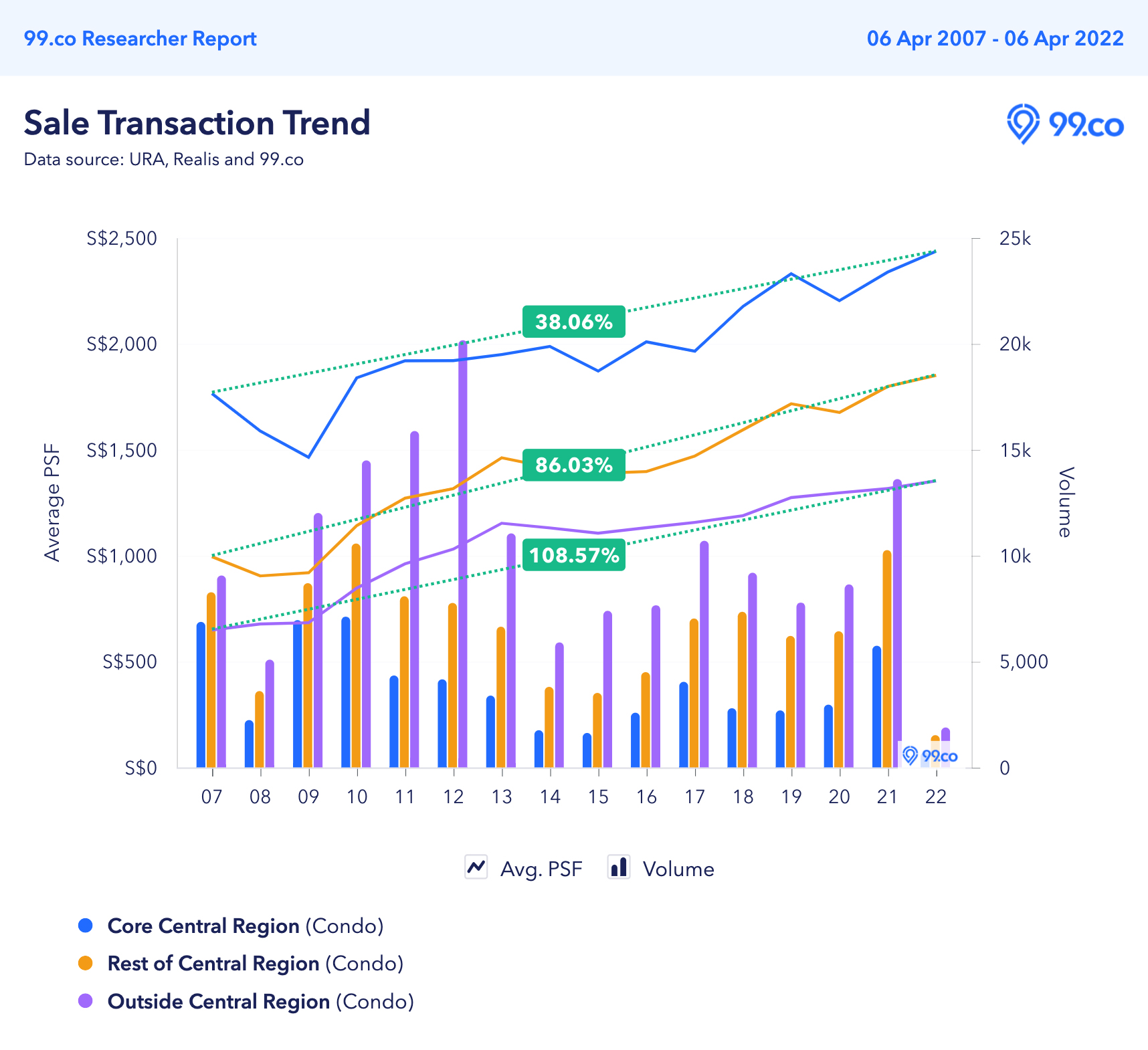

| Average price (S$) psf | ||||||||

| Location | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| CCR | S$1,871 | S$2,008 | S$1,964 | S$2,176 | S$2,330 | S$2,203 | S$2,341 | S$2,436 |

| RCR | S$1,388 | S$1,396 | S$1,469 | S$1,593 | S$1,716 | S$1,676 | S$1,800 | S$1,850 |

| OCR | S$1,105 | S$1,131 | S$1,156 | S$1,188 | S$1,274 | S$1,296 | S$1,318 | S$1,352 |

The average price psf has been climbing year-on-year for condos island-wide, but is it climbing fast enough for you to turn a profit on your sub-sale?

As with all properties, resale prices depend heavily on location and what buyers are looking for at that point in time (proximity to schools, amenities, transport, connectivity etc.).

As long as you can find a willing buyer who can accept your price, it’ll be possible to break even or even make a profit.

Considering to buy or sell a sub-sale unit? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Why you should consider buying completed / TOP condos and Sub-sale: What property sellers and buyers need to know.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Selling your condo before TOP? Here’s what you should know about sub-sale and SSD appeared first on 99.co.