In the upcoming August 2021 HDB BTO launch, we’ll see seven projects launched in Queenstown, Jurong East, Kallang/Whampoa, Hougang and Tampines. What’s notable about this launch is that it will be the first time in a decade that a BTO is launched in Queenstown and Jurong East. This will also be the first launch in five years for Hougang.

Over the past weeks, we’ve done an in-depth review of each project in the launch, considering various aspects like accessibility, amenities and future development. You can check them out here:

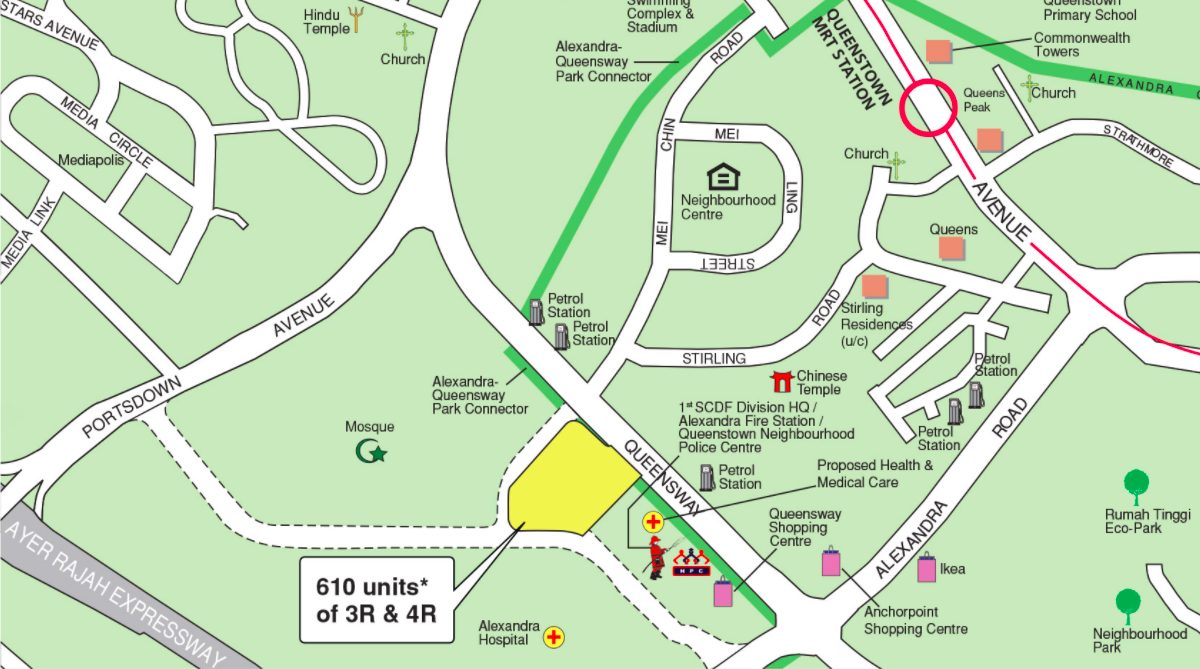

- Queenstown

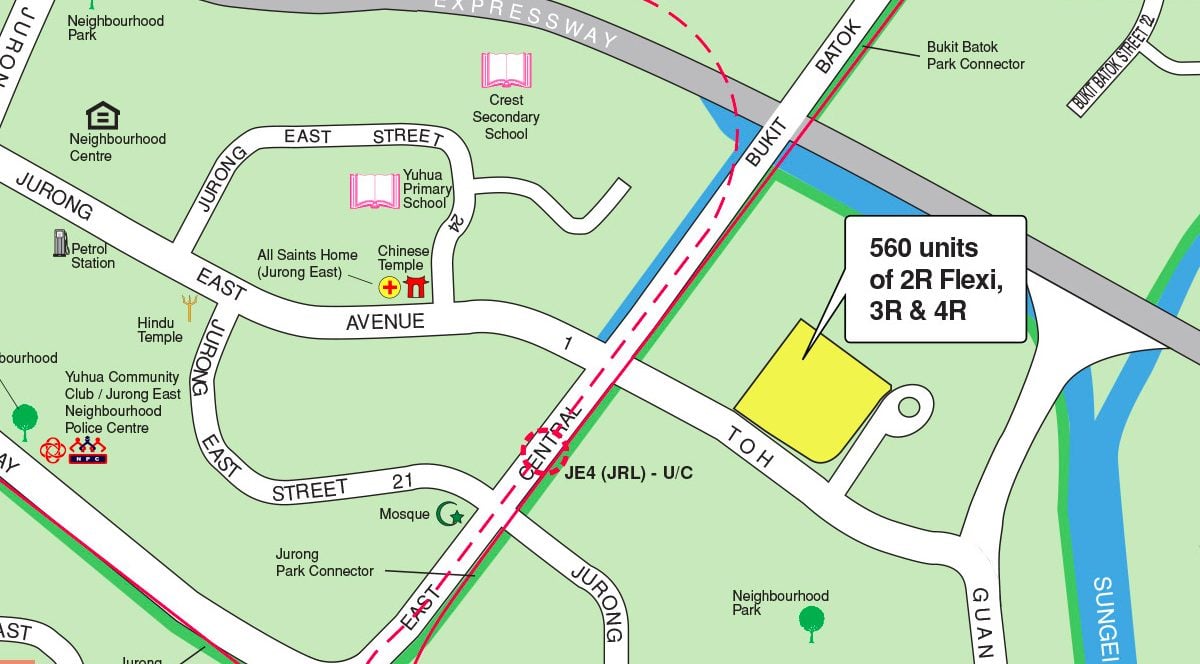

- Jurong East

- Kallang/Whampoa

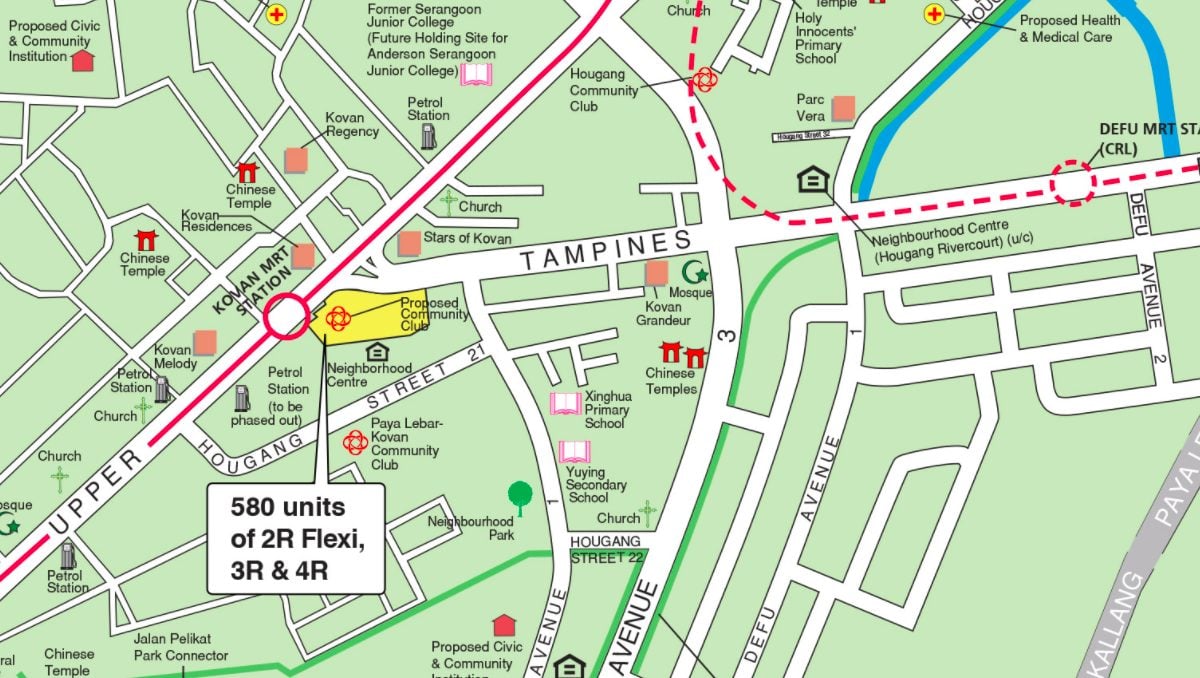

- Hougang

- Tampines

The good thing about BTO launches is that information about its exact location, flat types and estimated number of units is available a few months in advance. (As of 25 May 2021, HDB will announce them three months in advance.) This gives you some time to research and figure out which project suits your housing needs.

The bad thing is that the starting prices will only be announced on the launch itself. So it’s a little harder to gauge how much you’ll have to pay. One way to estimate the flat price is to look at the prices during the previous launch and resale transactions in the area.

Here’s an estimation of the August 2021 BTO price ranges done by SRX, based on nearby resale transactions and launch prices from recent BTO launches.

| Queenstown | Jurong East | Kallang/Whampoa | Hougang | Tampines | |

| 3-room | S$450,000 – S$550,000 | S$190,000 – S$250,000 | S$340,000 – S$450,000 | S$300,000 – S$340,000 | S$250,000 – S$290,000 |

| 4-room | S$650,000 – S$750,000 | S$280,000 – S$370,000 | S$510,000 – S$650,000 | S$430,000 – S$600,000 | S$350,000 – S$430,000 |

| 5-room | – | – | – | S$570,000 – S$750,000 | S$480,000 – S$570,000 |

These estimations take into account property age and location. If a launch is nearer to an MRT or commercial development, it’s likely to be more expensive.

Based on the pricing forecast, we can also estimate the cash outlay and monthly instalments to be made. This estimation is based on the following assumptions:

- You’re taking an HDB loan (maximising the 90% loan-to-value and paying the 10% downpayment) with a maximum tenure of 25 years, at an interest rate of 2.6%

- You’ve fulfilled all eligibility requirements, such as the income ceiling and property ownership (i.e. you do not own any property)

- You’re not paying any other housing loans

For illustration purposes, we’ll use the median of the estimated price range to do the calculations. This means that the median price for a 4-room Queenstown flat will be S$700,000. We’ll also not take into account CPF grants in the calculations.

With that, here’s an estimation of how much you’ll have to pay per month, based on your preferred flat location and flat type.

Queenstown

| Flat type | Median price | Loan amount (90%) | Minimum downpayment 10%) | Estimated monthly instalment |

| 3-room | S$500,000 | S$450,000 | S$50,000 | S$2,041.51 |

| 4-room | S$700,000 | S$630,000 | S$70,000 | S$2,858.12 |

This means that if you’re balloting for a 4-room flat, your income should minimally be S$9,527 to meet the MSR requirement. You’ll also need to ensure that each monthly instalment doesn’t exceed 30% of your gross monthly income. This is based on the mortgage servicing ratio (MSR), which limits the property loan amount that buyers can take for an HDB flat or a new EC.

| Flat type | Minimum gross monthly income |

| 3-room | S$6,805 |

| 4-room | S$9,527 |

Jurong East

| Flat type | Median price | Loan amount (90%) | Minimum downpayment 10%) | Estimated monthly instalment |

| 3-room | S$220,000 | S$198,000 | S$22,000 | S$898.27 |

| 4-room | S$325,000 | S$292,500 | S$32,500 | S$1,326.98 |

So for a 4-room flat in Jurong East in this August 2021 BTO launch, your gross monthly income should be at least S$4,423.

| Flat type | Minimum gross monthly income |

| 3-room | S$2,994 |

| 4-room | S$4,423 |

Kallang/Whampoa

| Flat type | Median price | Loan amount (90%) | Minimum downpayment 10%) | Estimated monthly instalment |

| 3-room | S$395,000 | S$355,500 | S$39,500 | S$1,612.80 |

| 4-room | S$580,000 | S$522,000 | S$58,000 | S$2,368.15 |

With an estimated monthly instalment of S$2,368.15 for a 4-room flat, this translates to a minimum gross monthly income of S$7,894.

| Flat type | Minimum gross monthly income |

| 3-room | S$5,376 |

| 4-room | S$7,894 |

Hougang

| Flat type | Median price | Loan amount (90%) | Minimum downpayment 10%) | Estimated monthly instalment |

| 3-room | S$320,000 | S$288,000 | S$32,000 | S$1,306.57 |

| 4-room | S$515,000 | S$463,500 | S$51,500 | S$2,102.76 |

| 5-room | S$660,000 | S$594,000 | S$66,000 | S$2,694.80 |

If you’re planning to ballot for a 4-room flat in Hougang, your gross monthly income should be at least S$7,009 to meet the MSR and qualify for an HDB loan.

| Flat type | Minimum gross monthly income |

| 3-room | S$4,355 |

| 4-room | S$7,009 |

| 5-room | S$8,983 |

Tampines

| Flat type | Median price | Loan amount (90%) | Minimum downpayment 10%) | Estimated monthly instalment |

| 3-room | S$270,000 | S$243,000 | S$27,000 | S$1,102.42 |

| 4-room | S$390,000 | S$351,000 | S$39,000 | S$1,592.38 |

| 5-room | S$525,000 | S$472,500 | S$52,500 | S$2,143.59 |

For a 4-room flat in the estate, your gross monthly income should be at least S$5,308.

| Flat type | Minimum gross monthly income |

| 3-room | S$3,675 |

| 4-room | S$5,308 |

| 5-room | S$7,145 |

You can also use a mortgage calculator to calculate the monthly repayments and interests.

Which August 2021 BTO project is the most affordable?

Looking at all these estimations, the Jurong East BTO and Tampines BTO flats are expected to be the more affordable options in this August 2021 launch.

For a 4-room flat in either of these estates, we predict that the monthly instalment will be below S$2,000. This translates to an income range of S$4,000 to S$6,000 to meet the MSR requirement to qualify for an HDB loan.

The key thing here is that regardless of the location and property type you’re buying, you should only purchase one within your means. For HDB flats and new ECs, the MSR requirement helps to ensure that you’re not overleveraged.

But on top of the MSR, you should have enough money to cover the monthly instalments throughout the loan tenure. A good rule of thumb is to have at least six months of savings, so that in case of a loss of income, you’ll still have some cash to pay your mortgage.

Which August 2021 BTO will you be balloting for? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Deciding between HDB loans and bank loans? Here’s a quick reference and Common mistakes you’ll want to avoid when paying off your mortgage.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post Estimated monthly instalment for an August 2021 BTO flat appeared first on 99.co.