The rental property tax treatment perspective here is drive by the policy intent of owner-occupier tax rates to encourage home ownership in Singapore

From a tax treatment perspective, the first thing you need to do before resorting to property rental is to ensure that your tenancy agreement is e-Stamped, and you should also make sure to pay income tax on the rental income you receive.

Before starting property rental, you should notify IRAS on the Start of Lease. All lease documents are required to be e-Stamped. IRAS will be notified of the rental and you need NOT inform IRAS separately.

You would also have to ensure that your tenant e-Stamps the rental agreement (including rental agreements for rental of rooms). You may request for a copy of the stamp certificate from your tenant to ensure that the rental agreement has been stamped. The penalty for non-compliance of the above obligation is a fine of up to $5,000 and an interest on the tax at such rate as may be prescribed (if any).

For rental property tax treatment perspective, if you let out your property entirely, any owner-occupiers tax rates applied on your property will be withdrawn from the date of letting. You will need to pay higher property tax based on residential tax rates.

Mr Paul Ho, chief mortgage officer at iCompareLoan, said: “The policy intent of owner-occupier tax rates is to encourage home ownership in Singapore. They are only applicable if owners are residing in their residential property.”

The owner-occupier tax rates are progressive tax rates based on the annual value of your property. This means for rental property tax treatment, residential properties of higher annual value are taxed at higher rates while most owner-occupied properties (including all HDB flats) will continue to enjoy lower tax rates.

| Owner-Occupier Tax Rates | ||

|---|---|---|

| Annual Value ($) | Effective 1 Jan 2015 | Property Tax Payable |

| First $8,000 Next $47,000 |

0% 4% |

$0 $1 ,880 |

| First $55,000 Next $15,000 |

– 6% |

$1,880 $ 900 |

| First $70,000 Next $15,000 |

– 8% |

$2,780 $1,200 |

| First $85,000 Next $15,000 |

– 10% |

$3,980 $1,500 |

| First $100,000 Next $15,000 |

– 12% |

$5,480 $1,800 |

| First $115,000 Next $15,000 |

– 14% |

$7,280 $2,100 |

| First $130,000 Above $130,000 |

– 16% |

$9,380 |

For rental property tax treatment, the owner-occupier tax rates can only be applied to one home owned and occupied by an individual or a married couple.

Even if a married couple were to occupy two homes, the owner-occupier tax rates can only apply to one of the homes. This is regardless of whether it is owned jointly or separately by the spouses.

As for Residential Tax Rates, it applies to non-owner occupied residential properties like condominiums, HDB flats or other residential properties, where the owner does not live in, or occupy, the property and, therefore, owner-occupier tax rates do not apply.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

| Residential Tax Rates | ||

|---|---|---|

| Annual Value ($) | Effective 1 Jan 2015 | Property Tax Payable |

| First 30,000 Next $15,000 |

10% 12% |

$3,000 $1,800 |

| First $45,000 Next $15,000 |

– 14% |

$4,800 $2,100 |

| First $60,000 Next $15,000 |

– 16% |

$6,900 $2,400 |

| First $75,000 Next $15,000 |

– 18% |

$9,300 $2,700 |

| First $90,000 Above $90,000 |

– 20% |

$12,000 |

Residential properties on the exclusion list will continue to be taxed at 10%.

Properties on Exclusion List are:

- Accommodation facilities within any sports and recreational club

- Chalet

- Child care centre, student care centre, or kindergarten

- Welfare home

- Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

- Hotel, backpackers’ hostel, boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax

- Student’s boarding house or hostel

- Workers’ dormitory

For the existing 10% tax rate to apply, the property must have received planning approval for the above use. No application to IRAS is required. Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value. The owner-occupier tax rates do not apply to non-residential properties even if you have bought the properties for your own use / occupation.

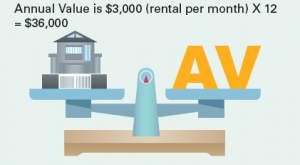

As for the Annual Value (AV), it is the basis for determining and revising the AV of buildings, land and development sites, and specialised properties. The AV of buildings is the estimated gross annual rent of the property if it were to be rented out , excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

As for the Annual Value (AV), it is the basis for determining and revising the AV of buildings, land and development sites, and specialised properties. The AV of buildings is the estimated gross annual rent of the property if it were to be rented out , excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

If you are done with your property rental and want to reinstate you Owner-Occupier Tax Rates you must reapply for Owner-Occupier tax rates to be applied to their property if they have moved back into that property. Owner-Occupier tax rates will NOT be automatically applied upon the end of a tenancy. This applies to early termination of tenancy as well. If owners choose not to move back into the flat and leave it vacant, residential tax rates will continue to be applied.

The rent that you receive from property rental in Singapore may be subject to income tax. Income Tax is a tax payable on all income earned or received in Singapore, including any payout or profit arising from investments unless the investments are specifically exempted under the Income Tax Act. There is no double taxation since Property Tax and Income Tax are two separate taxes.

For rental property tax treatment, ‘property rental income’ refers to the full amount of rent and related payments you receive when you rent out your property.

This includes rent of the premises, maintenance, furniture and fittings. Rental income is subject to income tax. This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable. Your property is still subject to property tax, which can be calculated by multiplying the Annual Value (AV) of the property to the applicable Property Tax Rate.

The rental deposit is generally considered as being part of your rental income. Forfeiture of the rental deposit is considered as part of your gross rent and is taxable. However, depending on the reason for the forfeiture of the rental deposit (e.g. rental deposit forfeited due to damages to property by tenant), Inland Revenue Authority of Singapore (IRAS) may consider excluding it as part of the gross rent. When filing your tax return, provide IRAS with reasons for the forfeiture of the rental deposit.

The post Renting out an investment property? What do you need to know about taxes? appeared first on iCompareLoan Resources.