Necessary property tax info is useful since there is an obligation to pay tax – calculating the tax payable, tax rates applicable, payment of property tax, and tax implications – when you sublet or sell your flat

Necessary property tax info for HDB Owners’ Obligation to Pay Tax

Property tax is a tax on ownership of property, irrespective of whether the property is occupied or vacant. It is different from Income Tax, which applies to the rental income earned from renting out the property. To encourage home ownership, owner-occupied HDB flats are taxed at substantially lower owner-occupier tax rates.

HDB Flat Owners Information Checklist

Necessary property tax info requires IRAS to bill the owners in the months of Nov and Dec for property tax in the ensuing year. HDB flat owners have to ensure that the yearly property tax is paid by 31 Jan.

If you buy a new flat direct from HDB, within a year of taking possession of your flat, the Inland Revenue Authority of Singapore (IRAS) will send you a Valuation Notice notifying you of the proposed Annual Value (AV) of your flat, and your first Property Tax Bill showing you the amount of property tax payable from the date of possession. You are to pay your tax within 30 days of the Bill.

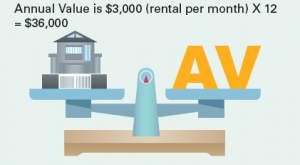

The AV of buildings is the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

If you buy a new Design, Build & Sell Scheme (DBSS) flat from the Developer, within a year of the Temporary Occupation Permit (TOP) date, IRAS will send you a Valuation Notice to notify you of the proposed Annual Value (AV) of your flat, and your first Property Tax Bill showing the amount of property tax payable from the date of issuance of TOP. You are to pay your tax within 30 days of the Bill.

The apportionment of property tax liabilities during property transfer is a private arrangement between the developer/vendor and the purchaser. You may wish to approach the developer based on the terms of your contract.

Necessary property tax info for Amount of Property Tax Payable

The property tax is calculated by multiplying the Annual Value (AV) of the property with the prevailing property tax rate. If you live in your flat, your flat will be taxed at the substantially lower owner-occupier tax rates .

For owner-occupied HDB flats, you need not pay tax on the first $8,000 of the AV from 2014. The remaining AV will be taxed at the lowest tier of 4%. Non-owner-occupied HDB flats are taxed at 10% of their AVs as their AVs do not exceed $30,000.

Example: 4-Room HDB flat with AV of $10,140 (1 Jan – 31 Dec 2018)

| Owner-Occupied | Non-Owner Occupied | ||

|---|---|---|---|

| AV and Tax Rates | Tax Payable | AV and Tax Rates | Tax Payable |

| First $8,000 @0% |

$0 | First $10,140@10% | $1,014.00 |

| Next $2,140 @4% |

$85.60 | ||

| Tax Payable | $85.60 | Tax Payable | $1,014.00 |

As for the Annual Value of the flat, IRAS assesses HDB flats by analysing the recent rental rates of the various room types. The data for rental rates is available from the e-stamping records. Generally, bigger room types command higher rental rates than the smaller room types within the same location. HDB flats in central locations also command higher rental rates compared to flats located in outlying locations. The AVs would have reflected the differences in the property location as well as the room types.

Necessary property tax info for Temporary Extension of Stay

HDB has a policy to allow sellers to extend their stay for a default period of 3 months after the sale of the flat to the new owner. If you have agreed to this arrangement with the seller, you would have been informed by HDB that you must pay property tax at Residential Tax Rate (10% of your AV) for the 3 months. Owner-occupier tax rates will not be applied on your flat for the extension period because you are not staying in the flat. This is stated in the HDB Terms and Condition and the Letter of Acceptance and Indemnity when you applied for the temporary extension of stay.

After the 3 months extension of stay is over, owner-occupier rates will automatically apply. Owners need not write in to IRAS to request owner-occupier rates.

You will be responsible for the payment of property tax as the new owner of the flat from the date of transfer. Property Tax will be based on 10% of the Annual Value of the flat during the 3 months extension stay period and at owner-occupier tax rates thereafter. You need not apply for the owner-occupier tax rates.

For all applications for extension of stay, HDB will give the maximum period of 3 months from the date of completion of the resale. Should the seller terminate their extension of stay early, you are required to update HDB by logging in to My HDBPage with your Singpass within 7 days of the termination. Once you have updated or notified the HDB branch, HDB will transmit the information to IRAS. No further action is required from you and IRAS will notify you of the tax adjustments in the following month.

If you planning to buy an HDB flat but unsure if you should go for a HDB loan or bank loan, you should approach mortgage broker as they can set you up on a path that can get you a home loan in a quick and seamless manner. Most mortgage brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. You should also find out about money saving tips.

The post Property tax info for HDB flat owners – what you need to know appeared first on iCompareLoan Resources.