On 17 November 2020, HDB put up 5,795 new flats for balloting in the Nov 2020 BTO sales exercise. Application is officially open until 11:59pm on 23 November 2020 (Monday), and here’s what you must know about the prices for each project if you want to apply.

Can my income pay for a Nov 2020 BTO flat?

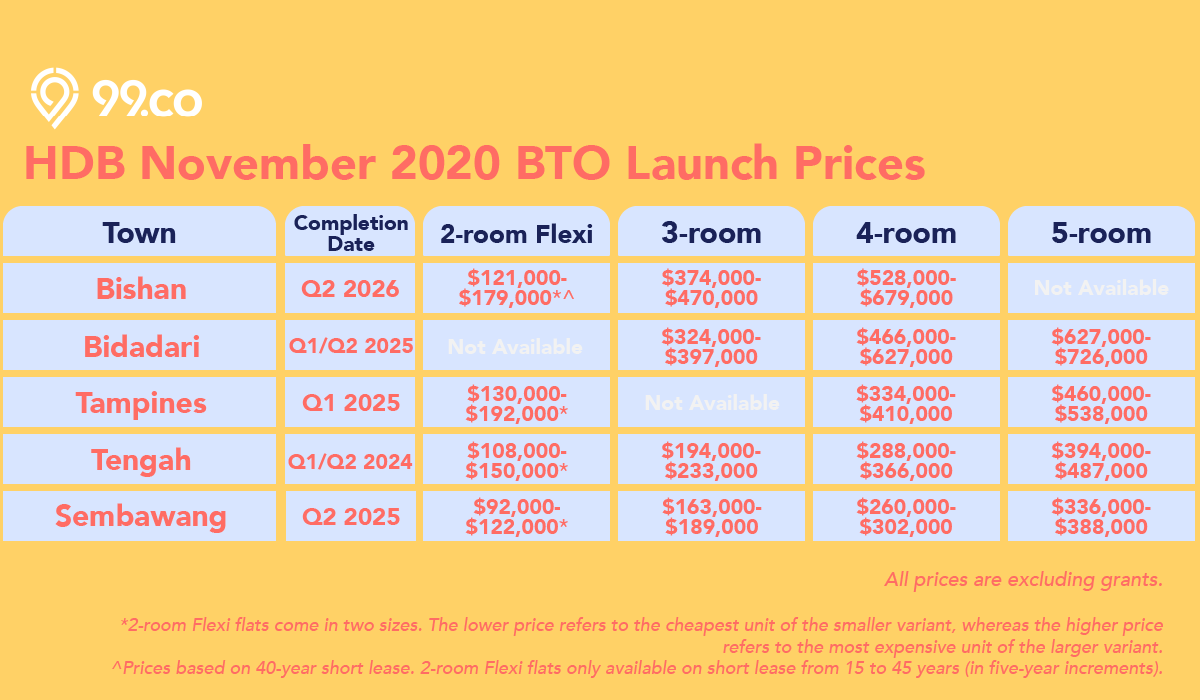

Because each applicant must choose from one of the five towns and the flat type they want, it’s important to make the right choice. Of key concern is pricing, because the projects in the Nov 2020 BTO sales exercise vary greatly in terms of how much they cost. We’ve prepared a rundown for you:

Unless you’re flush with cash, chances are that the price of the BTO flat will be limited by the amount you can borrow from HDB (via the HDB Concessionary Loan) or the bank/financing institution (‘bank loan’). To make sure Singaporeans don’t overspend on their HDB housing, the government has capped the maximum monthly home loan repayment amount at 30% of the combined income of the applicants, if you’re applying as a couple. Singles are also subject to this limit, which is called the Mortgage Servicing Ratio (MSR).

If you’re self-employed or have a variable income, then a ‘haircut’ of 30% is applied to your income before the calculation of MSR, further reducing the maximum price of the HDB flat you can afford.

As a guide, here’s the minimum combined household income to apply for a four-room flat in the following Nov 2020 BTO projects without grants, taking into account a 10% downpayment and a 25-year loan tenure at 2.6% interest rate:

Bishan: Minimum $7,200 combined monthly household income for a $528,000 four-room flat

Bidadari: Minimum $6,350 combined monthly household income for a $466,000 four-room flat

Tampines: Minimum $4,550 combined monthly household income for a $334,000 four-room flat

Tengah: Minimum $3,950 combined monthly household income for a $288,000 four-room flat

Sembawang: Minimum $3,550 combined monthly household income for a $260,000 four-room flat

Take note that the above amounts assume the purchase of the cheapest four-room flats at each location, and do not factor in the booking fee, stamp duty and legal fees, which are detailed here and can run into the thousands. (The booking fee is payable in cash only, whereas the stamp duty and legal fees can be paid via CPF Ordinary Account funds.)

Grants to the rescue?

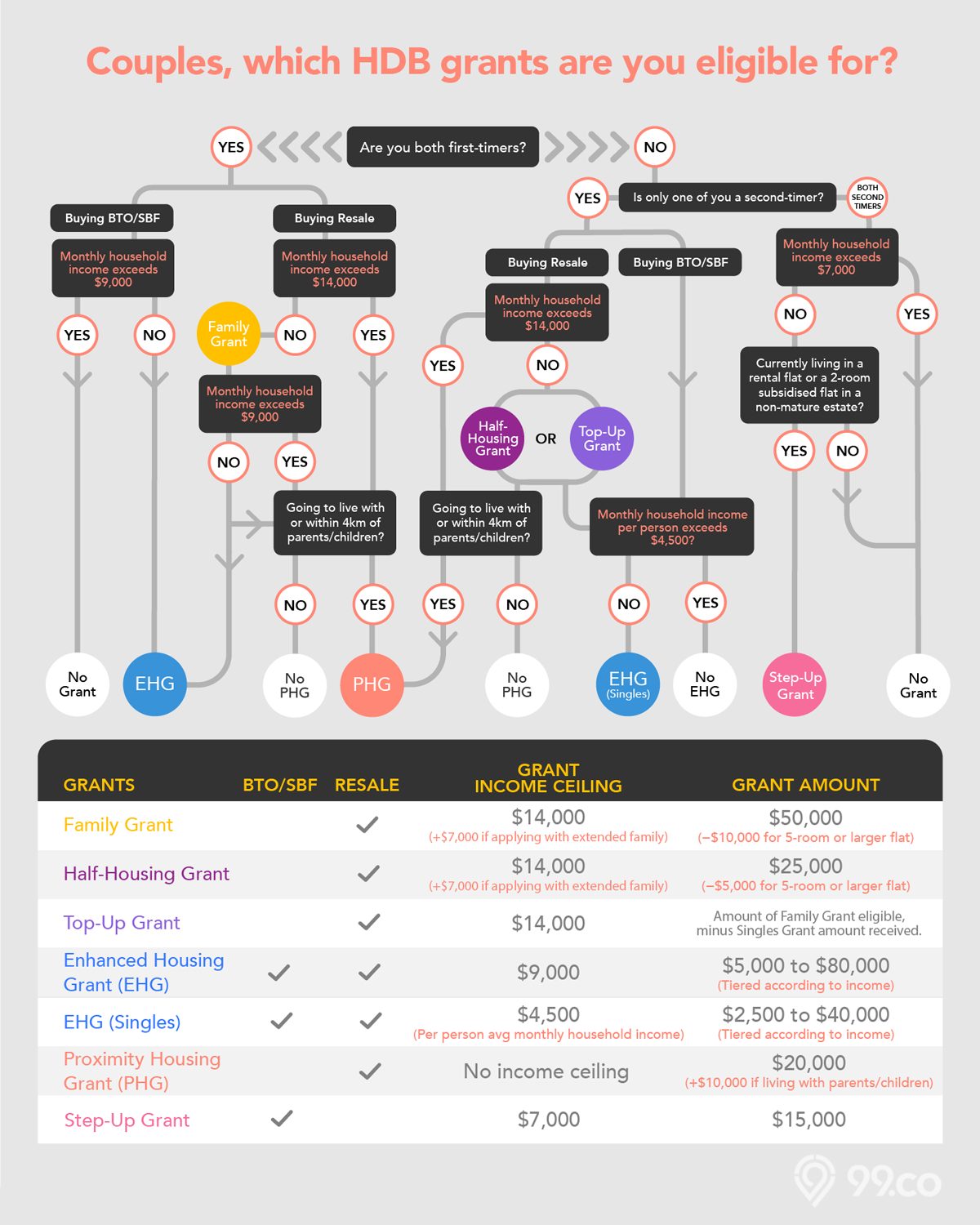

Take note that while the Enhanced Housing Grant (EHG) is available for first-timer applicants of BTO flats, the grant amount for EHG is tiered according to household income and capped at a monthly household income of $9,000.

For instance, if you and your co-applicant (e.g. fiancee) earn a combined $7,200, you’re eligible for $20,000 worth of EHG to offset the price of the flat.

Those earning a lower income will get a bigger EHG amount. A couple applicant earning a combined $2,300 will be eligible for $70,000 in EHG.

For any given flat, the EHG grant can lower the minimum combined monthly household income required under MSR guidelines. For instance, if you wanted to buy the cheapest four-room flat in Bishan BTO with EHG, a 10% cash/CPF payment, and 25-year loan at 2.6% interest, the absolute minimum you and your co-applicant needs to earn is $6,850 (down from $7,200 without grants), which still puts the flat out of reach for most young couples.

At the other end of the spectrum, taking the EHG with similar loan terms can make the cheapest four-room BTO flats in Sembawang available to those with a monthly household income at least $2,500 (down from $3,550 without grants).

As a guide, here’s the minimum combined household income to apply for a four-room flat in the following Nov 2020 BTO projects with grants, taking into account a 10% CPF/cash payment and a 25-year loan tenure at 2.6% interest rate:

Bishan: Minimum $6,850 combined monthly household income for a $528,000 four-room flat

Bidadari: Minimum $5,850 combined monthly household income for a $466,000 four-room flat

Tampines: Minimum $3,800 combined monthly household income for a $334,000 four-room flat

Tengah: Minimum $2,950 combined monthly household income for a $288,000 four-room flat

Sembawang: Minimum $2,500 combined monthly household income for a $260,000 four-room flat

Essentially, the EHG helps the cheaper flats get even cheaper for those who earn a lower income, helping low-income earners own their first home.

For the cheapest 3-room flats in the Nov 2020 BTO sales exercise (in Sembawang), couples/households earning a combined income as low as $1,300 will be able to afford a unit with the downpayment fully covered by the EHG. The monthly home loan instalment? Just $380.

The full breakdown of the EHG is available in this other article, which also lets you compare the grant amounts available for BTO and resale flats. (FYI: The EHG is also applicable for the purchase of resale flats.)

Also note that any grant taken must be fully paid back into the applicant’s CPF account(s) if selling the flat, together with accrued interest.

Done with budgeting for your first home? Read our in-depth Nov 2020 BTO reviews:

- Bishan

- Bidadari

- Tampines

- Tengah

- Sembawang

Want to check out resale HDB flats on the market right now? 99.co has it all.

The post Nov 2020 BTO prices: Can your income pay for a new HDB flat in Bishan? appeared first on 99.co.