In August 2024, condo resale prices remained relatively stable, with only a slight dip of 0.1 index points compared to July. Regarding the percentage difference, it shows a 0.0% change due to rounding. Historically, August tends to see a slight uptick in resale transactions compared to July. However, this year, the volume of resale transactions decreased, marking the first time this trend has reversed since 2020.

This article delves into the key trends and statistics that shaped the condo resale market in August 2024, offering valuable insights into the performance of different regions and the overall market landscape.

Table of contents

- Condo resale price index in August 2024

- Resale condo transaction volume: A slight decrease of 1.7% from July

- August 2024’s highest resale condo price: S$12,080,000 at Nassim Mansion

- The overall median capital gain for resale condos was S$357,000, a decrease from July

- The overall median unlevered return for resale condos was 30.7%

- Main takeaway of condo resale market in August 2024

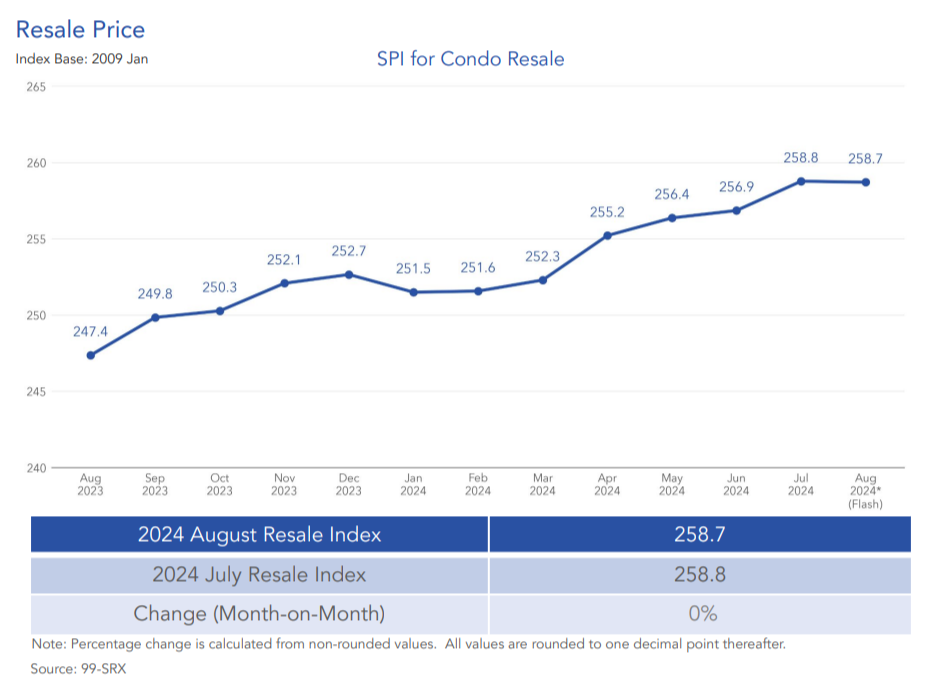

Condo resale price index in August 2024

According to the SRX Price Index for Condo Resale, the overall condo resale prices shifted slightly from 258.8 in July to 258.7 in August 2024, with regional performances as follows:

- CCR (Core Central Region): Prices dropped by 0.6%.

- RCR (Rest of Central Region): Prices increased by 0.9%.

- OCR (Outside Central Region): Prices remained flat at 0.0%, though they experienced a slight dip before rounding.

Despite the monthly stability, the overall year-on-year prices increased by 4.6% compared to August 2023. Breaking it down by regions, CCR, RCR, and OCR experienced price increases of 1.7%, 7.2%, and 4.2%, respectively.

Additional reading: July 2024 condo resale market: CCR prices up by 2.8%; volumes in all regions surged by 32.2%

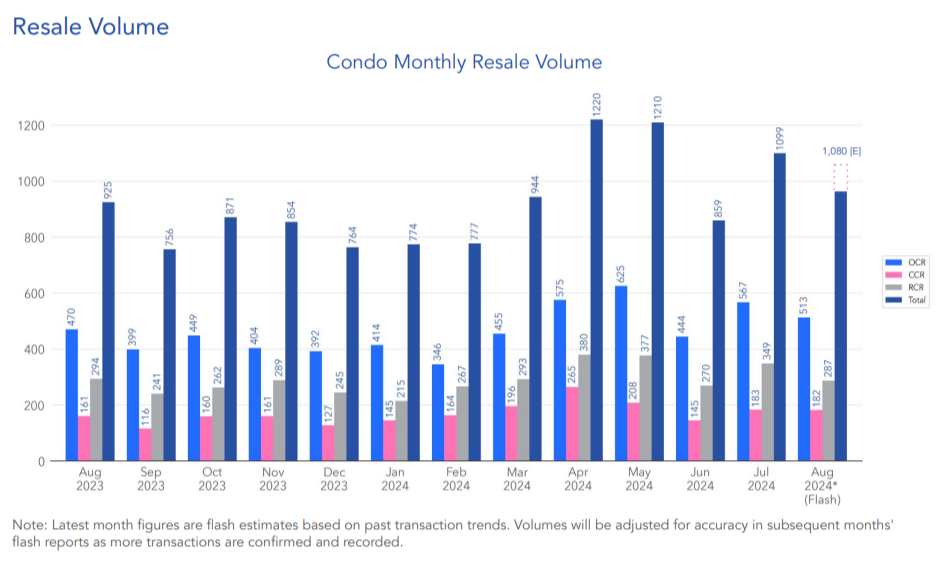

Resale condo transaction volume: A slight decrease of 1.7% from July

An estimated 1,080 resale units were transacted in August 2024, reflecting a 1.7% decrease from July’s 1,099 units. Despite the month-on-month drop, volumes were 16.8% higher than in August 2023 and 5.2% above the 5-year average for August. Regionally, condo resale transactions in August 2024 were distributed as follows:

- OCR: 52.2%

- RCR: 29.2%

- CCR: 18.5%

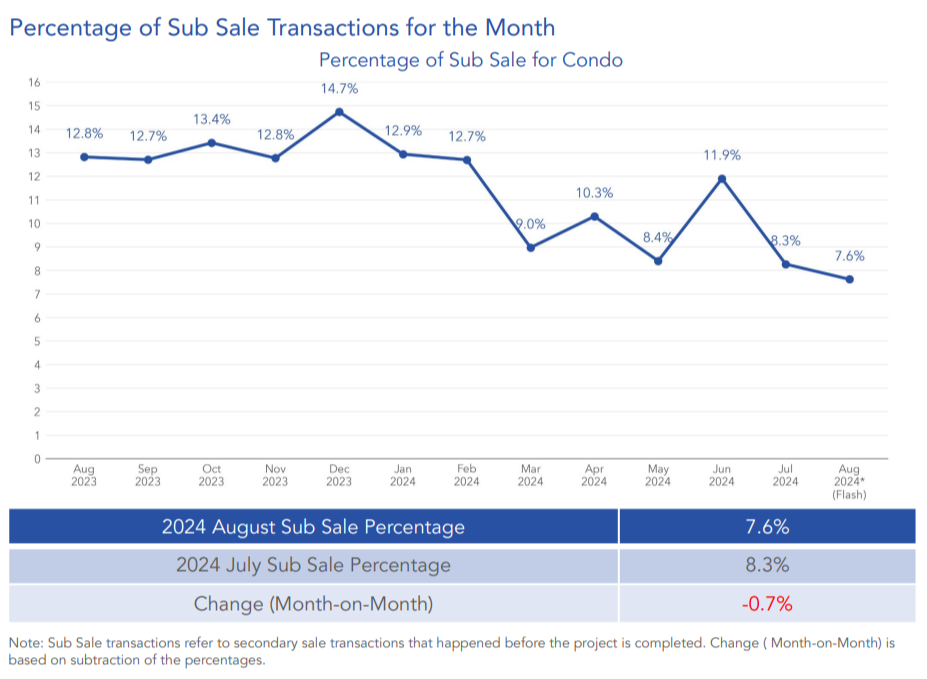

The percentage of sub-sale transactions, which are secondary sales that occur before a project is completed, comprised 7.6% of the overall secondary sales (resale and sub-sale) transactions in August. It reflected a 0.7% decrease from July 2024.

Additional reading: August 2024: Rental volume drops on both Condo and HDB; 12.3% decrease amid a year-on-year decline for HDB

August 2024’s highest resale condo price: S$12,080,000 at Nassim Mansion

One of the notable transactions in Singapore’s condominium market involved the resale of a unit at Nassim Mansion in the coveted CCR area, fetching an impressive S$12,080,000, the highest recorded resale price in August 2024.

Completed in 1977, Nassim Mansion is a freehold condominium located in Tangin, District 10. Although the development is relatively old, the freehold tenure keeps its value up in the resale market. Its location, which is a quick walk away from Napier MRT adds more value, providing residents with easy access to other parts of Singapore.

This sale underscores the enduring allure and value of luxury properties in the CCR, where prime locations and exclusive developments consistently command substantial market prices. In July 2024, the nearby Nassim Park Residences saw an even higher resale price at S$14,200,000.

The top transacted price within the RCR area in August 2024 was recorded for a freehold unit at The Makena, amounting to S$7,000,000 upon resale. This transaction highlights the robust demand for residential properties in the East Coast area and the upscale developments in the RCR region.

In the OCR region, a record-breaking resale transaction for the month occurred at St. Patrick’s Residences, with a freehold unit being sold for S$3,668,000. This transaction underscores the increasing appeal of the OCR, as there is a growing demand for larger units in well-established neighbourhoods, even at higher price points.

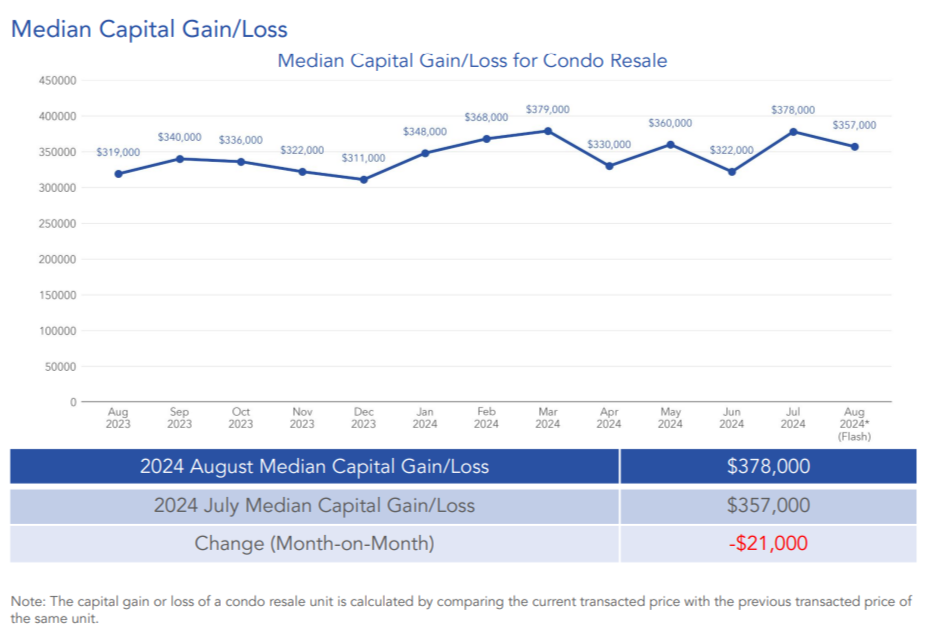

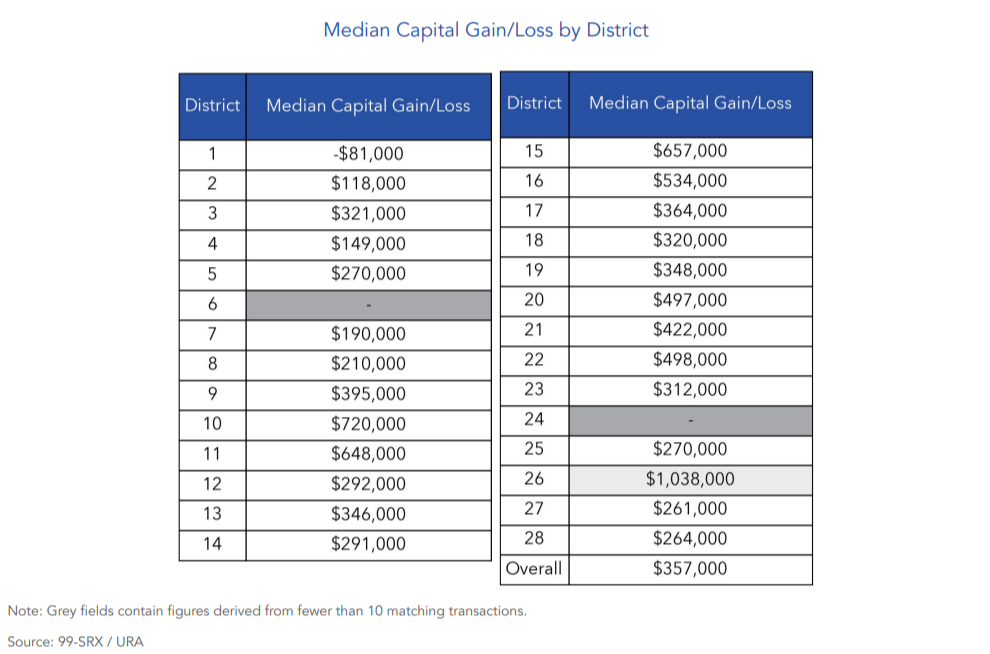

The overall median capital gain for resale condos was S$357,000, a decrease from July

The overall median capital gain for condo resale units in August 2024 was S$357,000. It translates to a decline of S$21,000 from July 2024. The slight decrease in capital gains suggests that investors and homeowners are likely to reap less benefits of property values across the island this month.

Breaking it down by districts, District 10 (Tanglin/Holland/Bukit Timah) led with the highest median capital gain at S$720,000. This substantial increase underscores the enduring allure of properties in this locality, renowned for its seamless integration of a vibrant community and convenient access to the city centre.

District 1 (Boat Quay/Raffles Place/Marina), on the other hand, posted the lowest at -S$81,000. This negative capital gain indicates a possible short-term correction in property values within this prominent business district or suggests that resale properties in the area were sold at a loss relative to their original purchase price.

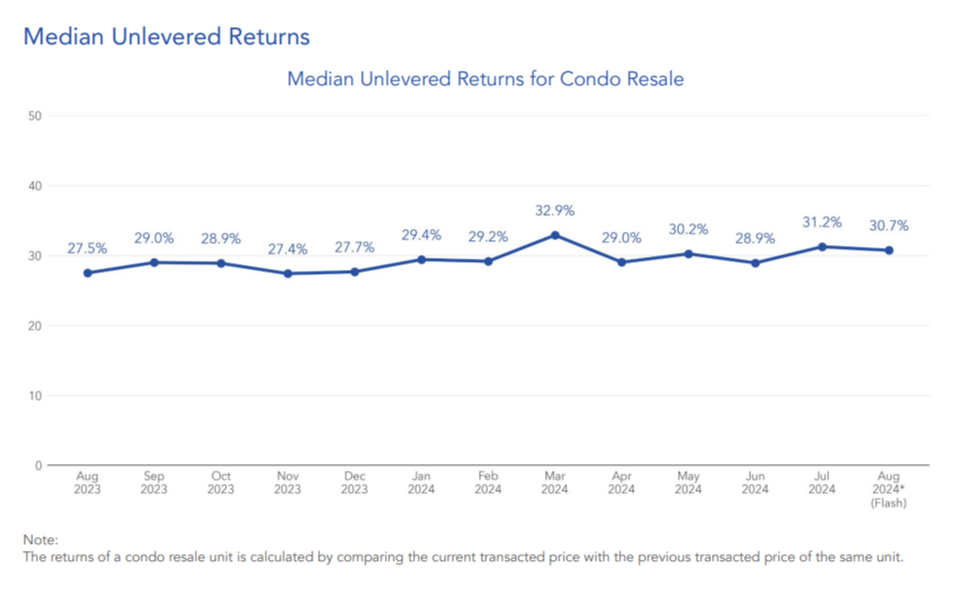

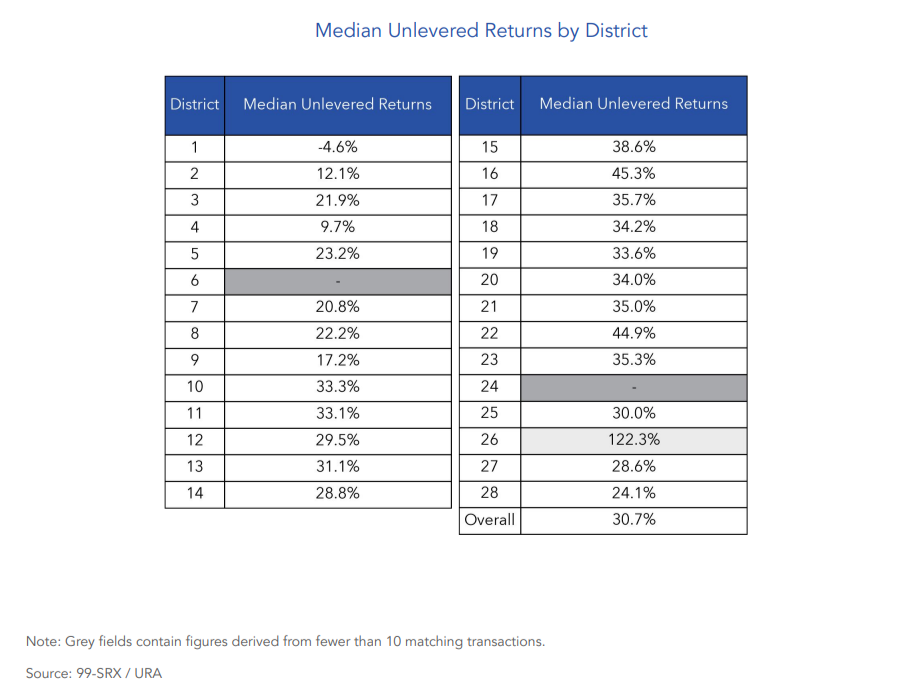

The overall median unlevered return for resale condos was 30.7%

In terms of unlevered return (return without accounting for borrowing), the overall median stood at 30.7%. This figure indicates the percentage increase in value that property owners have realised upon selling their properties, showcasing the profitability of investing in Singapore’s condominium market.

District 16 (Bedok/Upper East Coast) has demonstrated remarkable performance, with the highest median unlevered return of 45.3%. This significant return underscores the district’s robust appreciation of property values, attributed to its abundant green spaces, proximity to East Coast Park, and surrounding schools of all levels. It is a preferred choice for families and astute long-term investors.

In contrast, District 1 (Boat Quay/Raffles Place/Marina) reported the lowest median unlevered return at -4.6%. This negative return indicates that certain resale transactions within this prominent business district may have incurred a financial loss compared to their initial purchase prices. Factors such as market fluctuations or shifts in the demand for properties within this vibrant commercial centre could influence this situation.

These gains and returns are calculated by comparing the current transacted price with the previous sale price of the same unit. Districts with fewer than 10 matching transactions are excluded from the ranking.

Main takeaway of condo resale market in August 2024

While condo resale prices remained stable in August 2024, lower transaction volumes and slight regional price declines suggest a cautious market. The drop in activity extends beyond the resale market, as the lowest number of new private home sales in 16 years was also recorded in August 2024.

This suggests potential negative sentiment toward purchasing private condominiums, with many prospective buyers waiting for more favourable conditions, such as reduced interest rates, before making their moves.

Planning on purchasing a property? Check your affordability now!

Interested in more condo market news? Visit our condo news page for more!

The post Condo resale prices remained stable in August 2024, while the volume declined by 1.7% across all regions appeared first on .