This article was contributed by Lilian Sim

The property market in Singapore is always a topic of interest, especially when it comes to buying a second home. With the country’s growing population and limited land, property has always been viewed as a stable investment. However, as with any investment, there are pros and cons that you need to consider before making such a big decision. In this article, we will dive deep into the advantages and disadvantages of buying a second home for investment in Singapore. Along the way, you will find useful insights to help you determine if this is the right step for you.

How do you read the property market?

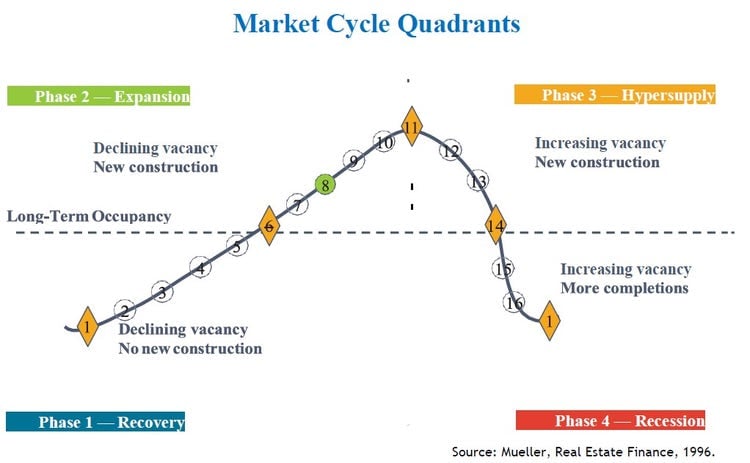

Before getting into the specifics of buying a second home, it is crucial to understand how Singapore’s real estate market behaves. This can help you decide the best time to buy or sell a property. The property market moves in cycles, and you would want to know which phase the market is in when you are considering buying a second home.

This idea comes from Mueller’s Real Estate Finance Cycle (1995), which, although originally designed for commercial properties, works just as well for residential markets, including Singapore’s. Understanding the vacancy rates during these cycles can give you a leg up when it comes to making smarter investment decisions.

- Expansion Phase: During this phase, demand for space increases, vacancy rates fall, and rents begin to climb. New constructions also begin to pop up to meet this growing demand.

- The Peak: At the market’s peak, supply and demand are balanced. Vacancy rates hit their lowest, rents are high, and there are significant new construction happening, which can lead to oversupply in the near future.

- Recession Phase: As supply surpasses demand, vacancy rates rise, and rents fall. Construction halts as developers see less value in starting new projects.

- Trough Phase: This is the bottom of the market. Vacancy rates are high, rents are low, and no new construction takes place. Properties might even be repurposed.

- Recovery Phase: Gradually, the excess supply is absorbed, vacancy rates decline, and rents start stabilising, which sets the stage for the next expansion.

In Singapore, though, this cycle is influenced by a number of factors. For one, government intervention through cooling measures has kept the market from becoming overheated. Additionally, the market has shown resilience after downturns, bouncing back quickly. Foreign investments, especially in luxury properties, also play a major role in expansion phases.

Plus, Singapore’s property cycles tend to be shorter and less severe due to the proactive measures taken by the government. Different segments, like HDB, private non-landed, and landed properties, also experience these phases differently.

Read more: Guide to buying a second property in Singapore: Learn about the 99-1 strategy and decoupling

What is currently going on in Singapore’s real estate market?

Based on the latest trends, we appear to be nearing the tail end of a hyper-supply phase and possibly heading toward a recession. For instance, private rental prices have been declining in recent months, and more than double the usual supply of private real estate was completed last year.

As per the Urban Redevelopment Authority (URA), the price of private residential properties went up by 0.9% in the second quarter of 2024, which was a slight slowdown compared to the 1.4% increase seen in the previous quarter. Landed property prices rose by 1.9%, again moderating from a 2.6% rise earlier, while non-landed property prices saw a 0.6% increase.

In terms of rental trends, URA also reported a decrease in private residential rental prices by 0.8% in the second quarter of 2024, following a 1.9% dip in the previous quarter. Non-landed rental properties saw a similar trend, with a 0.8% decrease in rents.

If you are considering buying an HDB as your second property, note that prices are on the rise there as well. HDB resale prices went up by 2.3% in the second quarter of 2024, up from a 1.8% increase in the previous quarter. Resale transactions also increased by 4% from Q1 to Q2 2024, driven by broad-based demand and some supply tightness.

Given this market behaviour, it is essential to weigh the pros and cons of making a second property purchase for investment in Singapore. Let’s break down the advantages first.

Pros of buying a second home for investment in Singapore

Potential for capital appreciation

Singapore’s property market has historically shown long-term growth, especially due to limited land supply and strong economic development. If you own multiple properties, you stand to gain from the appreciation of real estate prices over time. One popular way to benefit from this is by flipping properties – buying them at a lower price and selling them for a profit when the market appreciates. However, while this can be a lucrative strategy, it does depend on market conditions, which you may not always have control over.

Check your affordability with 99.co’s affordability calculator!

Rental income can help cover mortgage payments

Singapore is a global business hub, meaning there is always a steady demand for rental properties, especially among expatriates and professionals. When you purchase a second home, you can rent it out and use the rental income to cover your monthly mortgage repayments. In some cases, you might even generate additional cash flow after covering your mortgage and other expenses, making it a potentially rewarding form of passive income.

Portfolio diversification

Investing in real estate is a great way to diversify your investment portfolio. It acts as a hedge against inflation and is less volatile compared to other asset classes like stocks. By investing in different property types – such as residential, commercial, or industrial – you can spread your risk. Moreover, real estate in different areas offers various growth potentials, allowing you to tap into a variety of markets and protect yourself against potential downturns in any single sector.

Potential for early financial freedom or retirement income

Purchasing a second property to rent out can also provide an opportunity for financial independence earlier than expected. By generating a steady rental income, you can create a reliable stream of revenue that not only helps cover ongoing expenses but may also supplement your retirement fund. Over time, this additional income could help you reduce reliance on other sources, offering greater financial flexibility or even allowing you to retire earlier than planned. And if renting is not a long-term strategy for you, the property can still serve a valuable purpose. You can rent it out for the time being and later keep it as a future home for your children, providing them with a financial head start.

Interested in upcoming new launches for the year? Take a look at your options here: Upcoming new launches: New Launch condos in H2 2024

Tax benefits

When renting out your second home, there are tax benefits you can enjoy. For instance, the interest on your housing loan, property tax, and fire insurance premiums paid during the rental period can be deducted from your taxable rental income. Moreover, expenses incurred on maintenance, repairs, and even hiring property managers can also be deducted, helping you reduce your tax liabilities. However, it is essential to keep track of allowable and non-allowable expenses to ensure you are maximising these benefits legally.

Cons of buying a second home for investment in Singapore

High initial costs

While the potential returns can be attractive, the cost of buying a second property in Singapore is not to be underestimated. The Additional Buyer’s Stamp Duty (ABSD) is one of the biggest barriers to entry. As of 2024, Singapore citizens buying a second residential property have to pay 20% ABSD, which significantly raises the upfront cost. For Permanent Residents (PRs), the rate is even higher at 30%, and for foreigners, it is a whopping 60%. These hefty taxes make buying a second property a much more expensive affair, especially when compared to your first purchase.

Financing a second property is often also more difficult than financing your first. For one, the Loan-to-Value (LTV) ratio is lower for second and subsequent property purchases, meaning you’ll need to fork out a larger down payment. For example, the maximum LTV for a second property is capped at 45%, compared to up to 75% for your first property. This higher upfront capital requirement can be a significant challenge for many investors. Additionally, banks may also view second property buyers as higher-risk borrowers, leading to stricter lending criteria and higher interest rates.

Read a more comprehensive cover on ABSD rates here: Additional Buyer’s Stamp Duty (ABSD) in Singapore explained (2024 Guide)

Cooling measures could affect market growth

Here, the government has put in place cooling measures to prevent the property market from overheating. These include restrictions on loans, raising stamp duties, and limiting foreign ownership. While these measures help to stabilise the market, they also mean that the rate of property appreciation might slow down. For example, if you are looking for quick gains, the market may not move as fast as you would like because of these regulations.

Risk of negative cash flow

While rental income can potentially cover your mortgage, there is always a risk of experiencing negative cash flow. This happens when your rental income is not enough to cover the property’s expenses, such as the mortgage, maintenance fees, and property taxes. In times of economic downturns or when the property market faces high vacancy rates, you may find it difficult to keep your property tenanted. This could result in you having to dip into your own savings to cover the shortfall, which can be a stressful experience for many investors.

Market volatility and liquidity

Unlike stocks or bonds, real estate is not a liquid asset. If you ever need to sell your second property quickly, you may find it challenging, especially during a market downturn. Real estate transactions take time due to the need for property valuations, inspections, and legal processes. Furthermore, property values can fluctuate, and if the market is in a recession or trough phase, selling your second home might result in a loss or lower-than-expected returns.

Not sure how much your home can sell for? Find out its worth with 99.co’s Property Value Tool

Increased maintenance and management costs

Owning a second property means you will have to manage two properties, which can lead to higher maintenance costs. Even if you hire a property manager, the fees can add up over time. Maintenance, repairs, and regular upkeep are necessary to ensure your property remains attractive to tenants. In some cases, these costs might eat into your rental income, diminishing your returns on investment. You will need to carefully assess whether the rental income will outweigh these ongoing expenses.

Additional considerations for buying a second home in Singapore

When investing in a second home, it is essential to consider the legal guidelines and restrictions that apply. For example, foreigners are limited in their property purchases in Singapore. They are typically only allowed to buy private condominiums and not landed properties unless they receive special approval from the government.

When investing in a second home, it is essential to consider the legal guidelines and restrictions that apply. For example, foreigners are limited in their property purchases in Singapore. They are typically only allowed to buy private condominiums and not landed properties unless they receive special approval from the government.

It is also important to evaluate whether you are emotionally prepared for the risks and rewards of property investment. While it can be a lucrative venture, it requires long-term planning, a good understanding of the market, and the financial stability to weather potential downturns.

Finally, before making any decisions, be sure to consult with a real estate professional. They can offer valuable advice on whether now is the right time to invest in a second home, based on current market trends and future projections.

Lilian Sim

From a corporate career to real estate, I have quickly grown into a top producer at PropNex Singapore. I specialise in asset progression and portfolio restructuring, offering exceptional service to clients. I help buyers, especially the first-timer make informed decisions and safeguard their investments, guiding them through a detailed process. My goal is to empower clients to achieve financial success through real estate.

I have seen many property owners losing their money or have their money stuck in their property investment. Mostly because of bad decisions made based on lack of information, bad advice and unchecked emotions. I would love to meet up with every one of you and help you in your real estate journey, but this may not be possible. So, I contribute this article to share my insights and hope they will help you make a better decision.

The post Pros and Cons of Buying a Second Home for Investment in Singapore appeared first on .