The rental market in August 2024 reveals key differences in the performance of the Condo and HDB sectors. Transaction volume for both decreased as expected after the strong month of July, partially due to the Hungry Ghost Festival.

While both sectors experienced volume drops, Condo rents showed early signs of recovery. On the other hand, HDB rents have softened, providing tenants with more options as Condo rental prices remain relatively low.

Table of contents

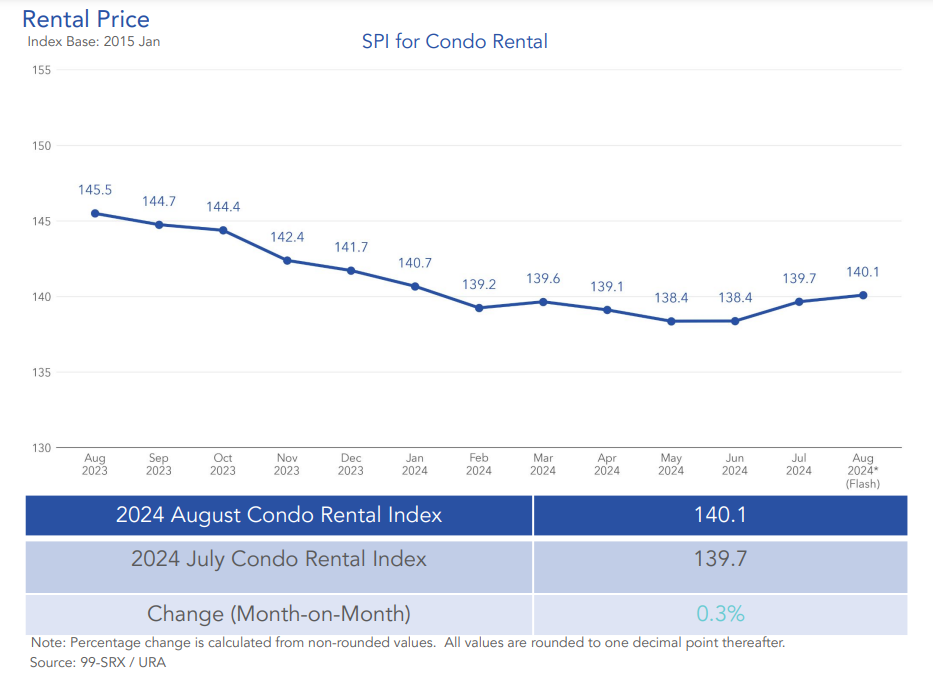

- Condo rental market: Price increased by 0.3%, volume decreased by 14%

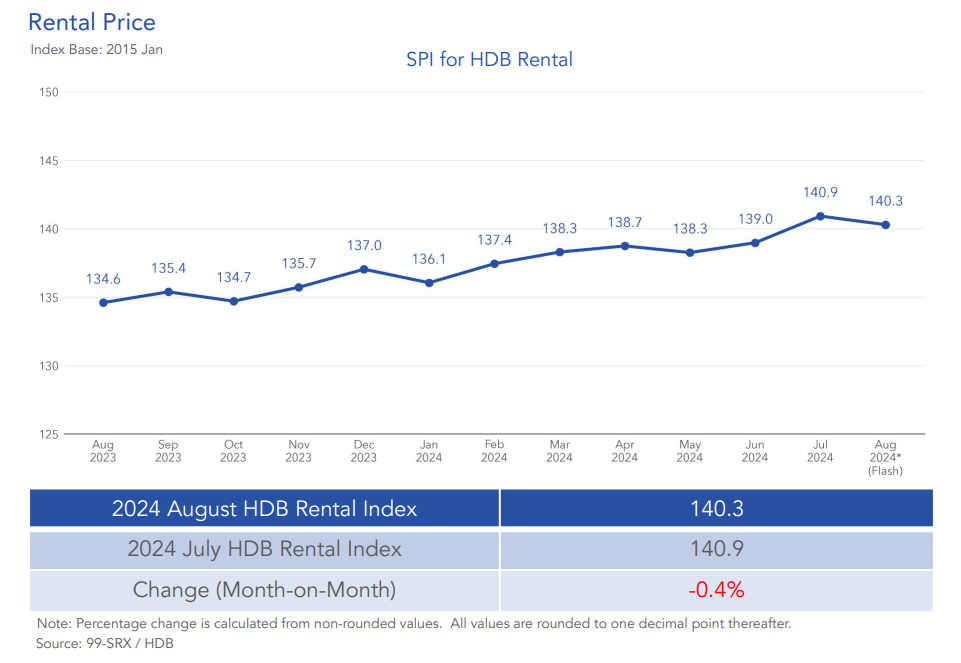

- HDB rental market: Price decreased by 0.4%, volume decreased by 12.3%

Let’s dive deeper into the rental market in August 2024!

Condo rental market: Price increased by 0.3%, volume decreased by 14%

In August 2024, condo rental prices slightly rose by 0.3% compared to July 2024. This increase is for the second consecutive month, signalling a potential recovery after a prolonged 10-month decline that began in August 2023 and ended in May 2024.

The rental market began stabilising in June 2024, with prices remaining steady for three consecutive months (June to August), which may suggest a gradual rebound in the condo rental sector.

Regionally, rental price increases were observed across all areas:

- CCR (Core Central Region): +0.2%

- RCR (Rest of Central Region): +0.4%

- OCR (Outside Central Region): +0.6%

However, year-on-year, rents were still down by 3.7%, with CCR rents decreasing by 4.5%, and both RCR and OCR rents falling by 3.4%.

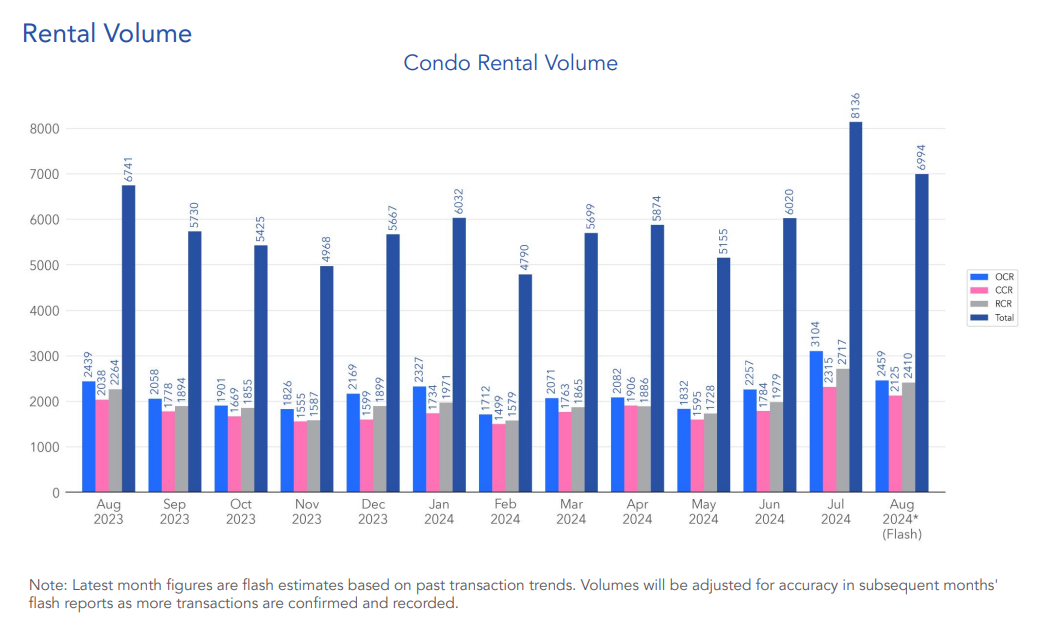

Despite this upward trend, overall transaction volumes fell by 14% month-on-month, with 6,994 units rented in August 2024 compared to 8,136 in July 2024. Year-on-year, rental volumes were 3.8% higher than August 2023, but 7.6% below the 5-year average for August.

By region, OCR accounted for 35.2% of rental transactions, RCR for 34.5%, and CCR for 30.4%. This volume decline in August 2024 is partly attributed to seasonal factors like the post Hungry Ghost Festival, which often leads to a slowdown in market activity.

Additional reading: August 2024 HDB resale market: 0.5% price increase, 14.6% drop in transaction volume, and fewer million-dollar flats

HDB rental market: Price decreased by 0.4%, volume decreased by 12.3%

In contrast, the HDB rental market saw a slight 0.4% price decline in August 2024 across all flat types. Mature Estate rents fell by 0.5%, and Non-Mature Estate rents dipped by 0.4%. The breakdown of rent decreases by room type includes:

- 3-Room Flats: -0.9%

- 4-Room Flats: No change

- 5-Room Flats: -0.1%

- Executive Flats: -0.3%

Despite the month-on-month decline, HDB rents remained higher on a year-on-year basis, up by 4.2% overall from August 2023. Year-on-year increases were seen across all room types:

- 3-Room Flats: +3.8%

- 4-Room Flats: +4.2%

- 5-Room Flats: +4.6%

- Executive Flats: +5.9%

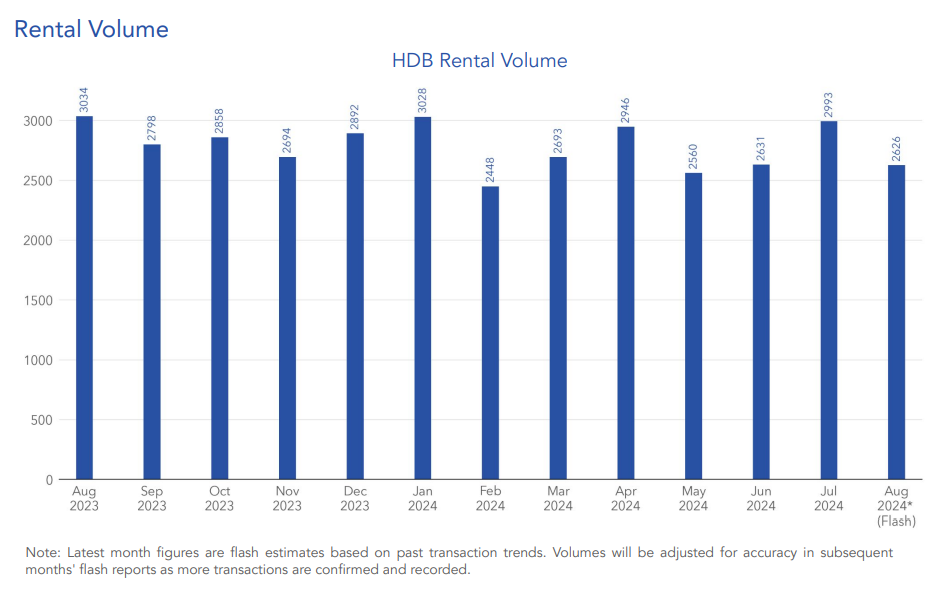

HDB rental volumes also declined by 12.3% month-on-month, with 2,626 flats rented in August 2024 compared to 2,993 in July 2024. In terms of distribution, 32.5% of the rented flats were 3-room units, 39.3% were 4-room, 22.7% were 5-room, and 5.6% were Executive units.

Year-on-year, rental volumes for HDB were down by 13.4%, and 4.3% below the 5-year average for August. With Condo prices at a local low, there are more rental options for prospective tenants. This might lead to the decrease in HDB rental volume as tenants might prefer to look for rental Condos, which offer more privacy and luxury, instead.

The featured image is credited to Anatoliy Shostak from Unsplash.

What do you think about the rental market in August 2024? Share your thoughts in the comments section below or on our Facebook page.

The post August 2024: Rental volume drops on both Condo and HDB; 12.3% decrease amid a year-on-year decline for HDB appeared first on .