Selling your HDB resale flat can be a significant milestone, whether you’re upgrading, downsizing, or simply moving to a new area. The process, while structured, involves several steps that require careful attention to detail. From registering your intent to sell to completing the final transaction, each stage plays a crucial role in ensuring a smooth and successful sale.

In this guide, we’ll walk you through the essential steps of selling your HDB resale flat, providing you with the insights and tools needed to navigate the process confidently.

-

- Step 1: Register Intent to Sell

-

Step 2: Know how much to sell your HDB Flat for

-

Step 3: Listing your HDB for sale

-

Step 4: Arranging viewings and negotiations

-

Step 5: Securing the sale

-

Step 6: Grant Option to Purchase (OTP) to HDB buyer

-

Step 7: Discuss Temporary Extension of Stay with HDB buyer

-

Step 8: Buyer will exercise the OTP and pay the Option Exercise Fee

-

Step 9: Submit HDB Resale Application

-

Step 10: Engaging a conveyancing lawyer

-

Step 11: Acknowledge HDB Resale documents

-

Step 12: Payment of legal fees and other HDB Resale costs

-

Step 13: Preparing for the Resale Completion Appointment

-

Step 14: Attending the Resale Completion Appointment

- Post Sales Considerations with ‘Transitioning to your New Home’

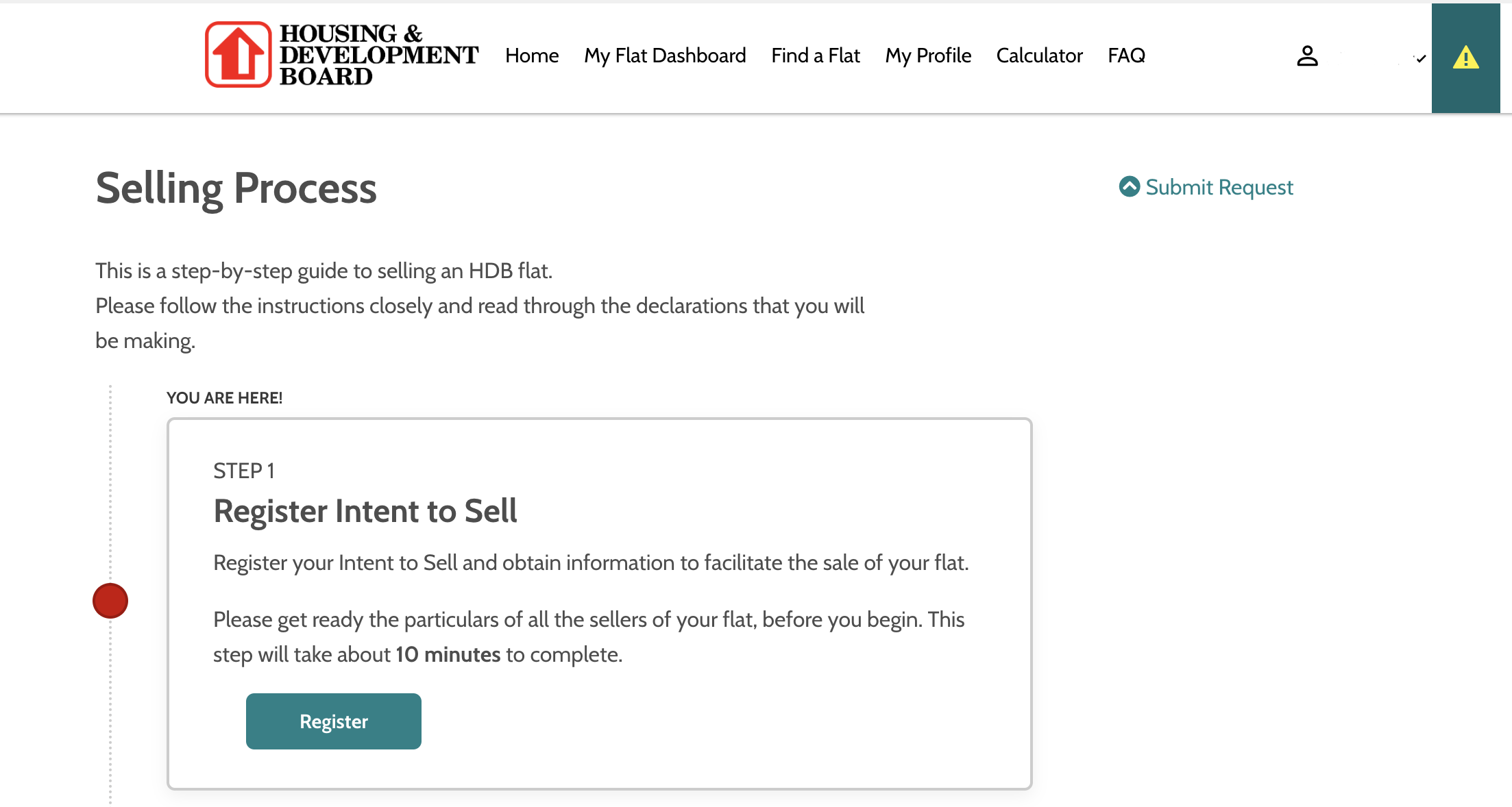

Step 1: Register Intent to Sell

To begin the process, the first step is to Register your Intent to Sell through the HDB Flat Portal:

- Go to the HDB Flat Portal

- Click “I am a Seller”

- Login with your Singpass

Upon registration, you will receive:

- An assessment of your eligibility to sell

- The Ethnic Integration Policy/Singapore Permanent Resident (EIP/SPR) Quota for your block

- The status of upgrading and billing of upgrading costs

- Recent transacted prices of nearby HDB flats

IMPORTANT: This is valid for 12 months, so you need to submit the HDB resale application within that time frame. Otherwise, you will have to submit a new application.

Step 2: Know how much to sell your HDB Flat for

- Use the Property Value Tool to get the best estimated amount

- If you want to know how much cash proceeds you will have after you sell, you may use the HDB Resale Cash Proceeds Calculator

If you are purchasing a new property, you may use our Affordability Calculator to plan your finances.

Step 3: Listing your HDB for sale

After registering your Intent to Sell with HDB, it is time to create a compelling listing for your HDB flat.

You can either list it on HDB Resale Flat Listing Portal or engage our 99 Advisors to assist you. The objective is to create a listing that effectively attracts potential buyers by highlighting the unique features of the flat and ensuring visibility on 99.co’s HDB Resale Flat Listing Portal or HDB Resale Flat Listing Portal.

Owner Listings

99.co offers a free ‘Owner Listings‘ service that allows all property owners to advertise their sales units directly to thousands of real estate agents in Singapore, helping you to sell faster. Here, you can reach out to more than 18,000 real estate agents with a large buyers and renters network.

Step 4: Arranging viewings and negotiations

After listing your HDB flat, the next step is to arrange viewings and begin negotiations with interested buyers.

Scheduling all viewings in a single day can create a sense of urgency among potential buyers, which may drive up offers. Skilled negotiation is crucial at this stage to ensure securing the best possible price for the property.

Here at 99.co, we have a network of experienced 99 advisors who will walk you through a stress-free selling process and ensure all negotiation and paperwork procedures are taken care of.

Step 5: Securing the sale

Before granting the Option to Purchase (OTP) to your buyer, remember these 3 important things:

- You need to complete the Intent to Sell at least 7 days before granting the OTP.

- The buyer must have a valid HDB Flat Eligibility (HFE) letter before you can grant the OTP.

- If the buyer intends to get a bank loan, they must have a Letter of Offer before they can exercise the OTP.

Step 6: Grant Option to Purchase (OTP) to HDB buyer

During this period, the buyers have to pay a deposit to you (comprising the Option Fee and Option Exercise Fee). You may negotiate the amount of deposit with the buyers, and it will form part of the sale proceeds.

The OTP can be issued to a buyer after a 7-day cooling-off period following the registration of the Intent to Sell. This document is crucial in the resale process as it formalises the buyer’s intent to purchase the flat. Once issued, the seller cannot accept other offers for 21 days, giving the buyer sufficient time to make a decision.

| Payment | When to make payment | Amount to pay (in cash) |

| Option fee | Granting of OTP | S$1 to S$1,000 |

| Option Exercise fee | Exercising of OTP | Does not exceed S$5,000 (when including the Option Fee) |

Step 7: Discuss Temporary Extension of Stay with HDB buyer

A Temporary Extension of Stay allows sellers to remain in the flat for up to three months after the sale is completed to facilitate the moving process. If you wish to request for the extension, it is advisable that you and the buyers discuss it while negotiating the sale of the flat.

Step 8: Buyer will exercise the OTP and pay the Option Exercise Fee

Once you’ve agreed on a price with the buyer and the terms of the Temporary Extension of Stay (if necessary), the buyer can then exercise the OTP and send you the payment for the Option Exercise Fee.

IMPORTANT: The OTP is only valid for 21 days and must be exercised within that period. Buyers have up to 4 p.m. on the 22nd day after the date of OTP issuance to exercise the OTP.

Step 9: Submit HDB Resale Application

Both you and the buyer will need to complete the resale application on the HDB Flat Portal. You can agree on a deadline for submission, as both parties (seller and buyer) must submit the application separately within 7 days of each other. Here’s a list of details you will need to provide when filling up the HDB resale application form:

- Resale flat address

- OTP details

- Soft copy of OTP

- Your personal particulars

- Application for Temporary Extension of Stay (if applicable)

- Application for Enhanced Contra Facility (if applicable)

- Others (refer to HDB Resale Application)

To submit your HDB resale application, you’ll need to pay an administrative fee: S$40 for 1- and 2-room flats, and S$80 for 3-room and larger flats. You can check the status of your application on the HDB Flat Portal.

Step 10: Engaging a conveyancing lawyer

For a smooth transfer of ownership, it is recommended to involve a conveyancing lawyer. The lawyer will manage the sale’s legal aspects, such as checking for any existing mortgages or legal claims on the property. Whether you use HDB’s Legal Fees Enquiry Facility service or hire a private solicitor, this step is important for finalising the sale.

Step 11: Acknowledge HDB Resale documents

Upon submission of the HDB resale application, you will receive an SMS from HDB within 10 working days, informing you when you can accept the terms and conditions for all documents prepared for you through the HDB Flat Portal. You must endorse all the HDB resale documents within 6 days of receiving the SMS notification. Once endorsed, an in-principle approval for your HDB resale flat will be provided.

Step 12: Payment of legal fees and other HDB Resale costs

It is important to settle any legal fees and HDB Resale costs, such as administrative fees for the HDB resale transaction. If you have engaged a private lawyer, they will advise you on the payable fees. Alternatively, if you choose to use HDB’s legal services, you can use their Legal Fees Enquiry Facility to obtain information on the fees.

Step 13: Preparing for the Resale Completion Appointment

As we conclude the HDB Resale process, it is important to ensure that all preparations are made for the resale completion appointment. This includes settling all outstanding payments and terminating all GIRO arrangements for payments relating to the flat. Refer to the resale completion letter sent by HDB for the documents and items required for you to bring to the appointment.

Step 14: Attending the Resale Completion Appointment

At this stage, you are one step closer to selling your property successfully. You will need to attend the HDB Resale Completion Appointment together with the buyer at HDB Hub, where you will:

- Sign the transfer document for the resale flat

- Sign the mortgage document/agreement (only applicable for HDB loans)

- Hand over the keys (if the buyer has opted for a bank loan, the bank’s lawyer can be authorised to collect the keys on the buyer’s behalf)

At this appointment, you will receive your net sale proceeds. HDB will refund any CPF monies to your CPF account within 10-14 working days from the date of the completion appointment.

If you need help in understanding your property needs, you can book a free consultation with our Seller Concierge

Post Sales Considerations with ‘Transitioning to your New Home’

To facilitate a seamless transition, it is important to ensure that proper arrangements have been made in the purchase of your new home and plan your move accordingly. If you have requested for Enhanced Contra Facility (ECF), you may use the sale proceeds (comprising CPF refund and cash) to buy a resale HDB flat. If a Temporary Extension of Stay has been arranged, this period can be utilised to settle into the new home without feeling rushed.

To facilitate a seamless transition, it is important to ensure that proper arrangements have been made in the purchase of your new home and plan your move accordingly. If you have requested for Enhanced Contra Facility (ECF), you may use the sale proceeds (comprising CPF refund and cash) to buy a resale HDB flat. If a Temporary Extension of Stay has been arranged, this period can be utilised to settle into the new home without feeling rushed.

<span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span></span>

Conclusion

Selling an HDB flat involves several key steps, but with proper preparation and a clear understanding of the process, you can achieve a smooth and successful transaction. Whether you choose to work with a real estate agent or manage the sale on your own, this guide will help ensure a streamlined and satisfying experience.

The post Selling your HDB Resale Flat in 2024 [Comprehensive Guide] appeared first on .