HDB resale prices in Singapore have been on a record-setting streak, with new all-time highs being recorded almost weekly. This trend continues with the sale of an executive maisonette in 418 Serangoon Central for an eye-watering S$1,230,000.

Table of Content:

- 418 Serangoon Central sold for S$1,230,000 and is the most expensive flat in Serangoon

- 418 Serangoon Central location – What’s nearby?

- A 35-year-old maisonette for S$1.23M – Worth the price?

- The previous ATH in Serangoon was also another maisonette

418 Serangoon Central sold for S$1,230,000 and is the most expensive flat in Serangoon

Located in District 19, this property at 418 Serangoon Central stands out as the most expensive flat ever sold in the estate. The maisonette, situated on the 10th to 12th floors, spans a spacious 1,604 square feet. The sale price translates to S$766.83 per square foot (psf).

Given that HDB ceased building maisonettes several years ago, it’s only natural that this unit has limited years left on its lease. This particular maisonette has 64 years and one month remaining.

Check your affordability with 99.co’s affordability calculator!

418 Serangoon Central location – What’s nearby?

Convenience is a significant selling point for this maisonette.

It is merely a three-minute walk from Serangoon Central, making it exceptionally accessible. The property is also a seven-minute walk to Serangoon MRT Station, where you can access both the North-East Line and the Circle Line. From here, you are just two stops away from the North-South Line and six stops from Dhoby Ghaut.

Looking for a property close to an MRT station of your choice? Check out 99.co’s MRT map here.

The Serangoon Bus Interchange is an 11-minute walk away, while a short drive connects you to the CTE and the Central Business District (CBD) within 20 minutes.

For shopping and dining, NEX shopping mall, the largest mall in North-East Singapore and one of the largest suburban malls in the country, is just a 12-minute walk away. Additionally, you can find a FairPrice for grocery shopping. The Serangoon Central Market is a 10-minute walk away, and the Serangoon Market is a 17-minute walk away.

For those who enjoy outdoor activities, several parks are within walking distance. Serangoon Community Park is 17 minutes away, Interim Park is nine minutes away, and Maplewood Park and Surin Avenue Neighbourhood Park are a seven-minute drive away.

Families with school-going children will appreciate the proximity to several reputable schools. Within a 1km radius, there are Yangzheng Primary, Maris Stella High, St. Gabriel’s Secondary, and Zhonghua Secondary.

Within a 1 to 2km radius, there are Cedar Primary School, Paya Lebar Methodist Girls’ Primary School, Xinghua Primary, Zhonghua Primary, CHIJ Our Lady of Good Counsel, and St. Gabriel’s Primary.

A 35-year-old maisonette for S$1.23M – Worth the price?

When considering the purchase of a 35-year-old maisonette for S$1.23M, one must weigh the factors that justify the price. Firstly, the size of the property is notable. Among the 27 maisonettes in Serangoon, most range from 1,539 to 1,647 square feet, placing this unit on the larger end of the spectrum.

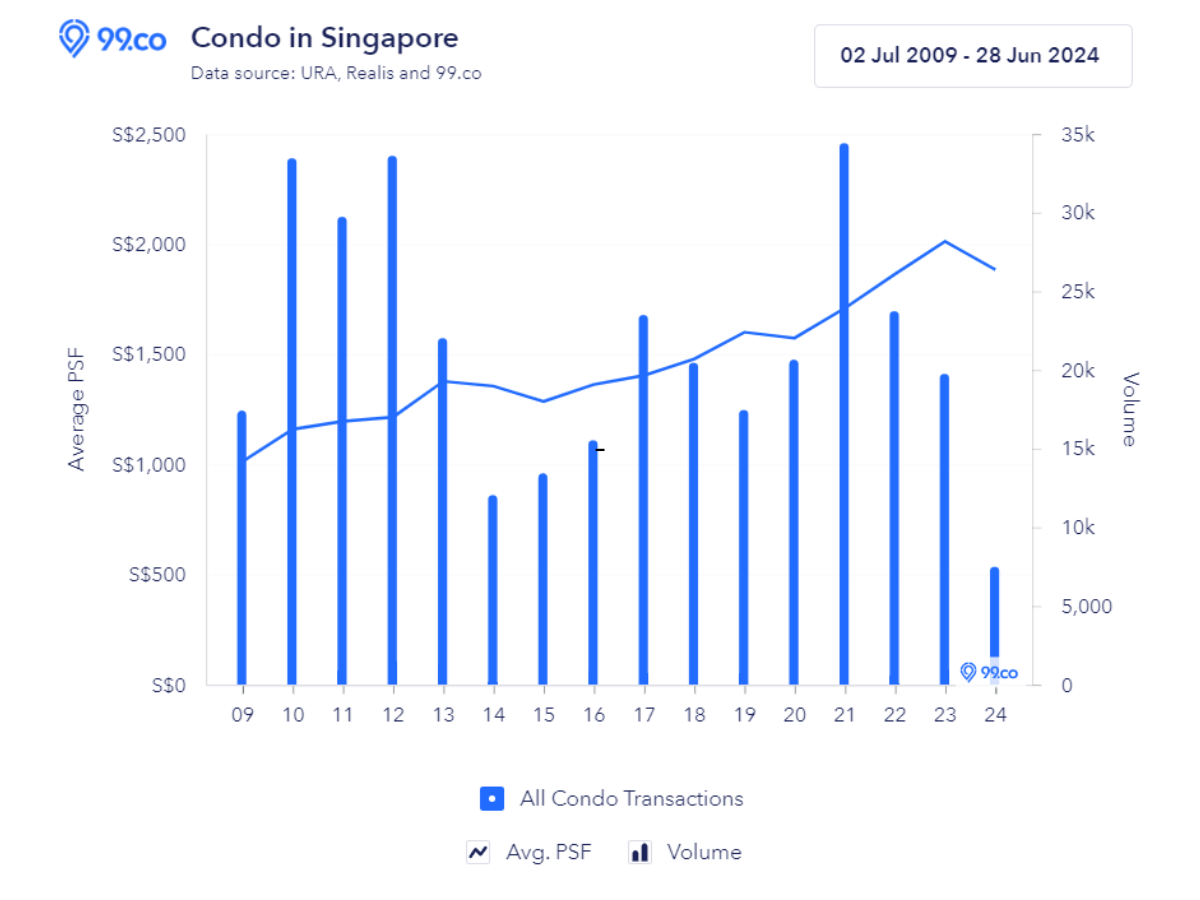

As of June 2024, the average price of a private, resale non-landed property in Singapore is S$1,884 psf and S$1,705 psf in Serangoon. Therefore, a 1,604-square-foot condo unit would cost around S$3.021 million in Singapore and more than S$2.7 million in Serangoon. This means that the average psf of similar-sized condo units is 55.02% higher in Serangoon and almost 60% higher in Singapore overall.

HDB estates, especially mature ones like Serangoon, offer a range of amenities, from proximity to MRTs and malls to wet markets and reputable schools. This accessibility and convenience justify why a buyer would willingly pay over S$1 million for a maisonette, even one that is over 30 years old. The living space available at this price is hard to find elsewhere in Singapore.

However, the worthiness of this investment depends on the buyer’s intentions.

For those seeking convenience and comfort, maisonettes provide ample space for extended families or a comfortable retirement. In this context, a maisonette might make more sense than a similarly sized condo unit.

From a strict investment perspective, maisonettes present challenges. They are not ideal for asset progression or as retirement assets, especially as the stock of executive maisonettes ages and lease decay becomes a more significant factor. The appeal of maisonettes as million-dollar prospects is likely to diminish over time.

Looking for HDB flats that MOP-ed recently: Full list of BTO projects hitting MOP in 2024/2025 & Our top picks near the MRT

The previous ATH in Serangoon was also another maisonette

The last all-time high (ATH) in Serangoon was recorded in March 2024, when an executive flat in 321 Serangoon Avenue 2 sold for S$1.208 million. This 1,615 square foot unit was located between the 7th and 9th floors, achieving a price of S$747 psf. The recent S$1.23M sale represents a 1.82% increase, with a difference of S$22,000.

Over the past three years, Serangoon’s maisonettes have seen a 19.86% increase in average psf, and over five years, the increase is 31.06%. The average psf for maisonettes in Serangoon this year is S$626 psf. In comparison, the S$1.23M sale at S$766.83 psf indicates the buyer paid 18.37% more than the estate’s average.

Interested in upcoming new launches for the year? Take a look at your options here: 8 new launches expected in Q2 of 2024

So, would you buy a 35-year-old unit for S$1.23M? Share your thoughts in the comments section below or on our Facebook page.

The post Wise move? 35-year-old maisonette in 418 Serangoon Central sold for S$1.23M appeared first on .