Table of contents:

- Condo rental market report

- HDB rental market report

- Conclusion

In May 2024, the rental market in Singapore experienced significant fluctuations, encompassing various trends within the condominium and HDB segments. This report offers a comprehensive analysis of the recent adjustments in rental prices and volumes, emphasising the monthly and yearly variations in different regions and room types.

A comprehensive analysis of these trends is essential for renters, landlords, and investors to navigate the changing dynamics of Singapore’s rental market.

Condo rental market report

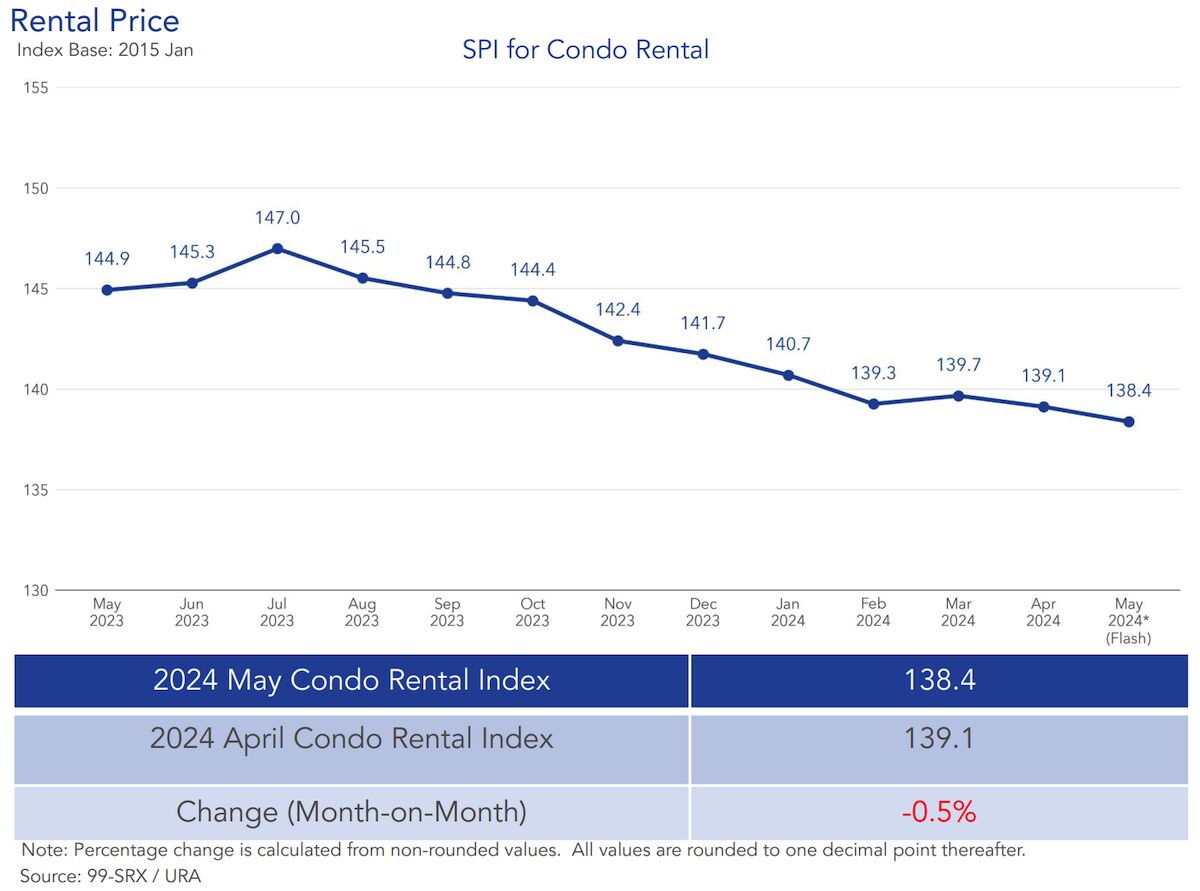

May 2024 rents decrease by 0.5% from April 2024

Rental prices decreased by 0.5% compared to April. This decline was observed across different regions, with the Core Central Region (CCR) experiencing a 0.2% reduction, the Rest of Central Region (RCR) seeing a 1.1% drop, and the Outside Central Region (OCR) rents decreasing by 0.7%.

Read this: Million dollar HDB flats hit current record high again in May 2024; But prices only up by 0.3%

In the year-on-year analysis, the rental prices experienced a 4.5% decrease from May 2023. This trend was observed across specific regions, with rents in the CCR declining by 3.7%, and the RCR and OCR witnessing a more substantial drop of 4.9%.

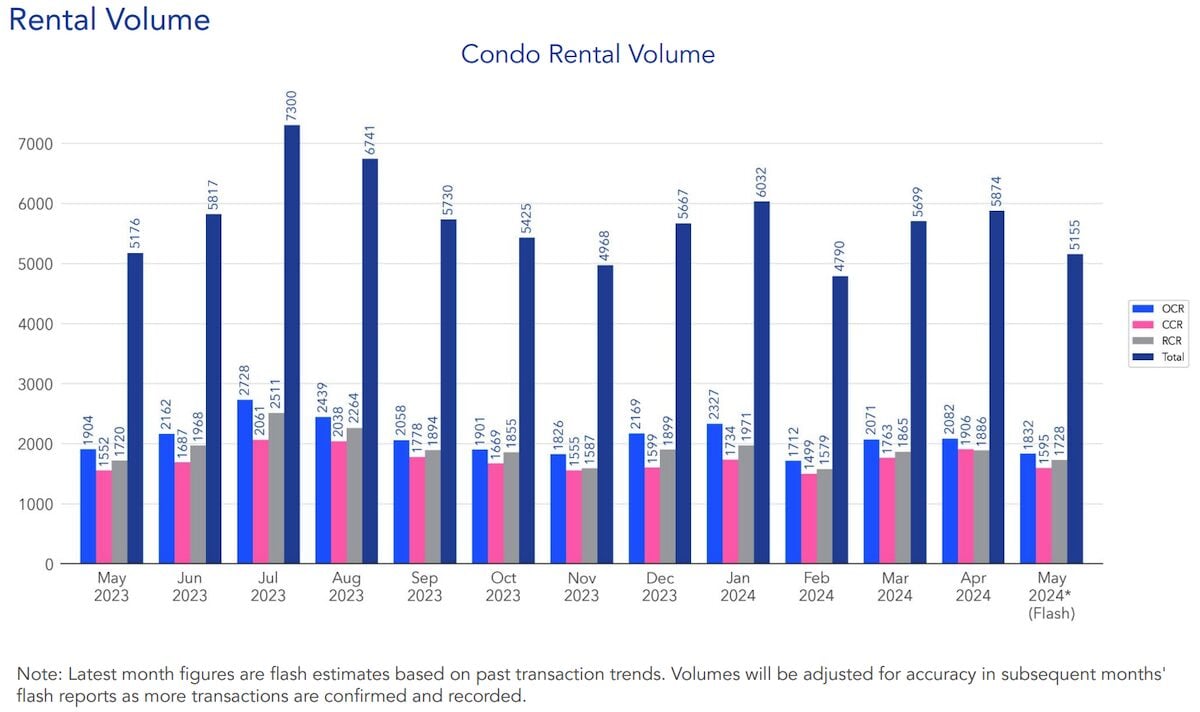

Volumes decreased by 12.2% month-on-month.

Rental volumes decreased by 12.2% from the previous month. An estimated 5,155 units were rented during this period, compared to the 5,874 units in April 2024. This decline in rental activity represents a significant trend in the market.

In the year-on-year comparison, rental volumes experienced a slight decrease of 0.4% from May 2023. Additionally, the rental volumes for May 2024 were 5.7% lower than the five-year average volume for May, indicating a broader trend of reduced rental activity compared to historical norms.

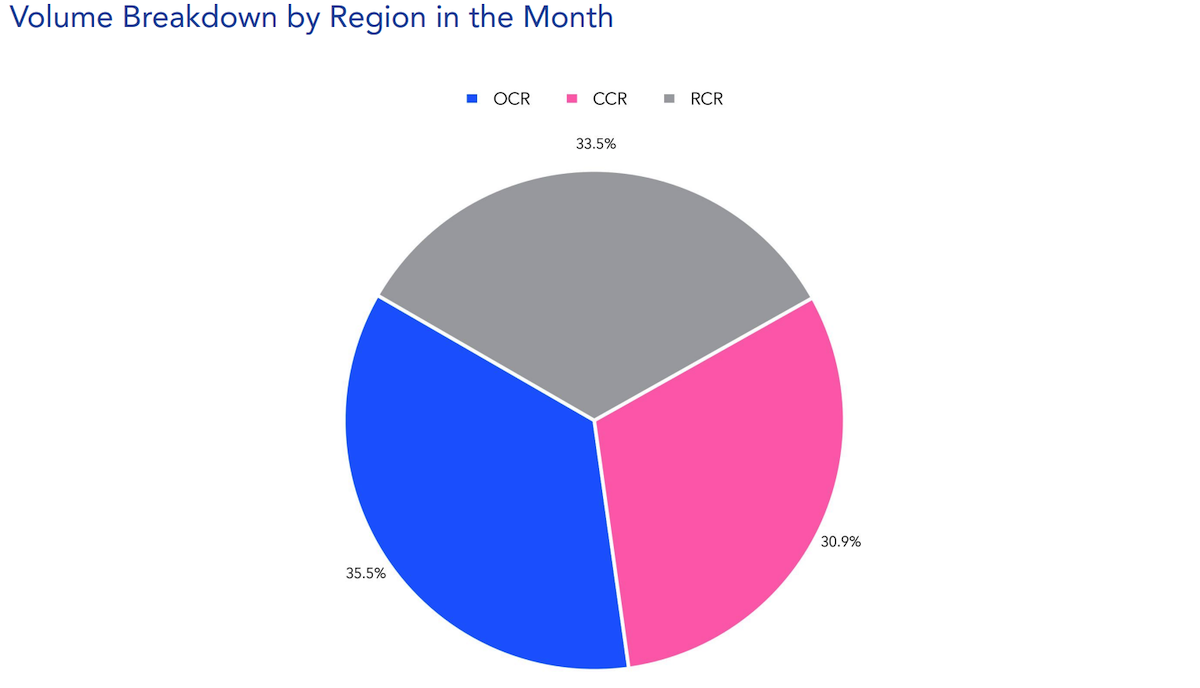

Rental volumes were distributed across different regions in the following manner: Outside Central Region (OCR) accounted for 35.5% of the total rental volumes, Rest of the Central Region (RCR) contributed 33.5%, and Core Central Region (CCR) represented 30.9% of the total rental activity. This distribution reflects the regional differences in rental demand across Singapore.

HDB rental market report

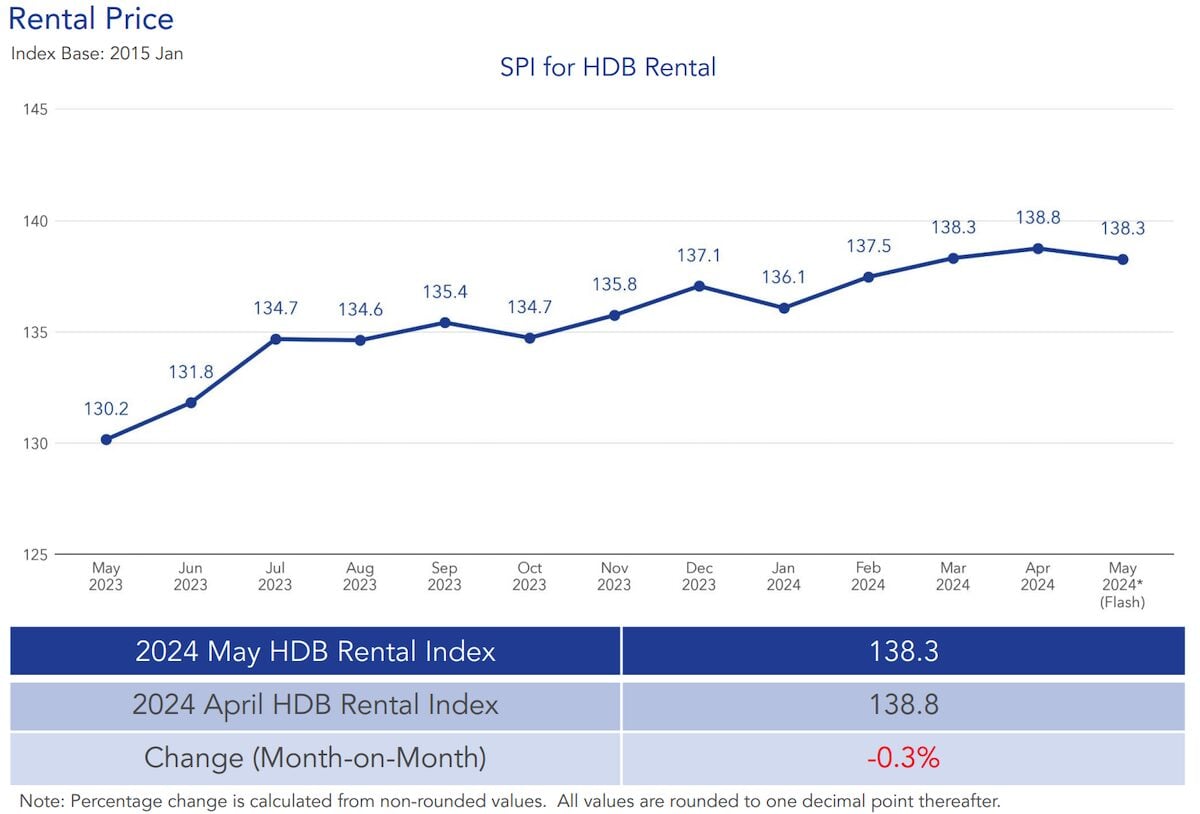

May 2024 HDB rents decrease by 0.3% from April 2024.

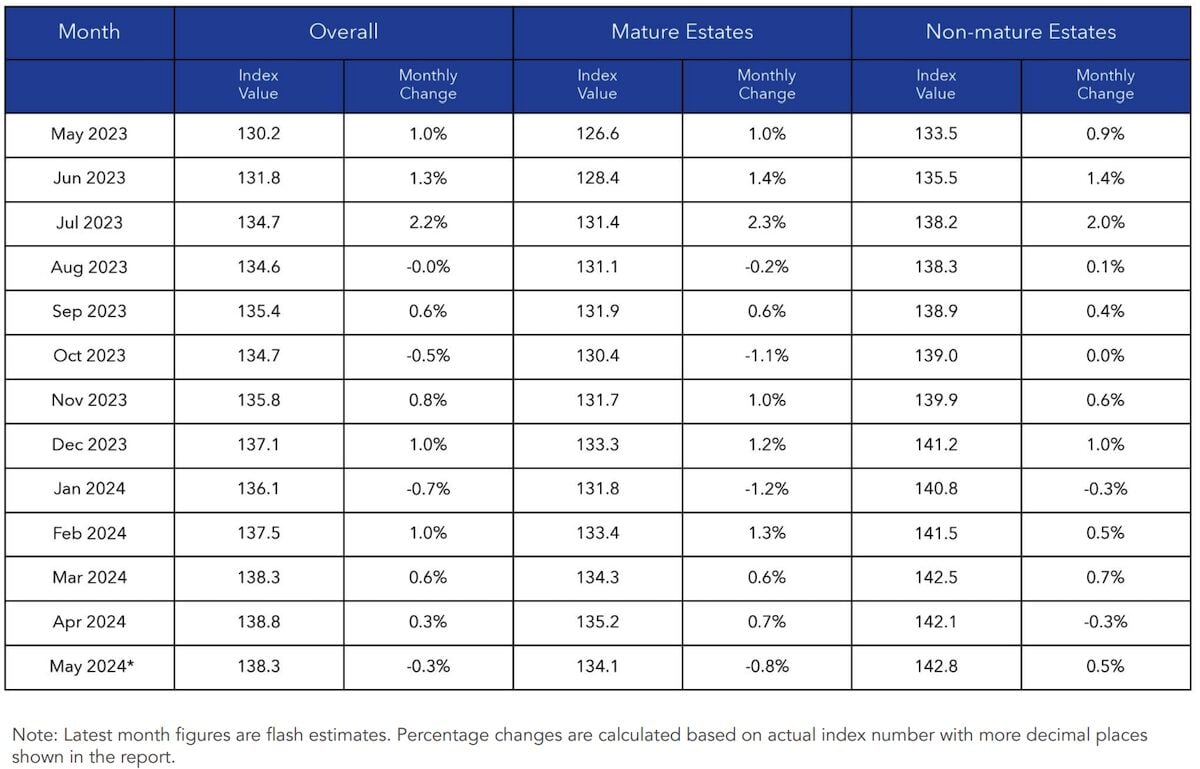

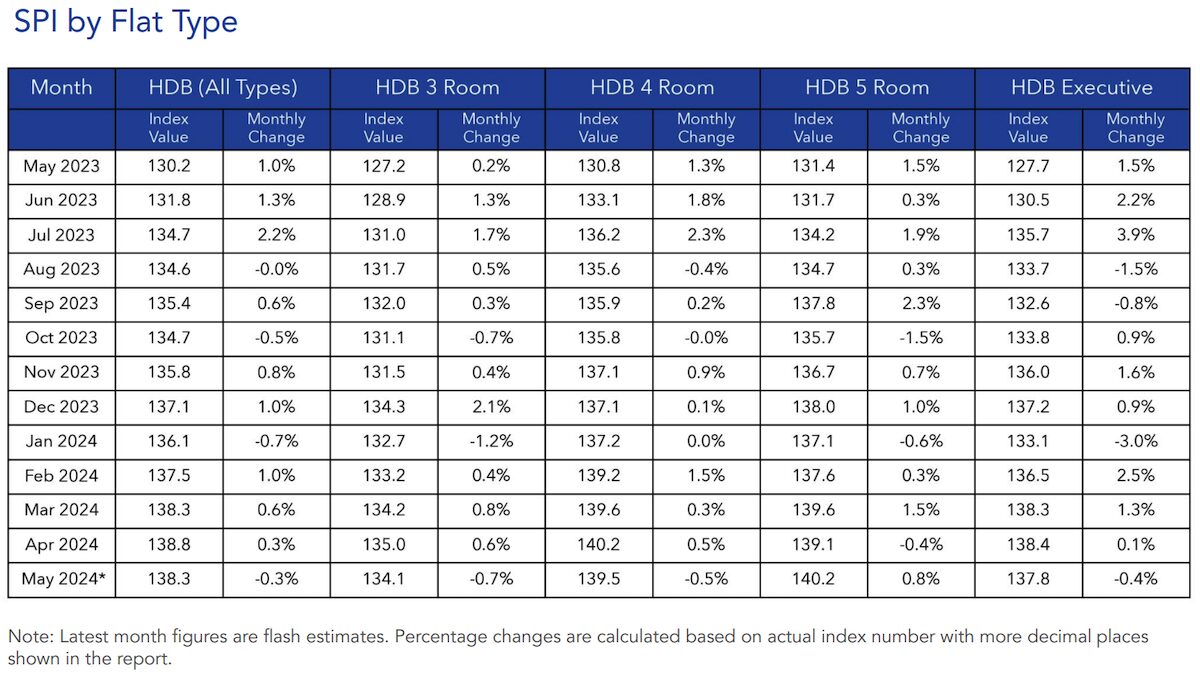

HDB rental prices saw a slight overall decrease of 0.3% compared to April 2024. This change varied across different areas and room types.

Rents in Mature Estates decreased by 0.8%, while Non-Mature Estates increased by 0.5%. Looking at specific room types, 3 Rooms, 4 Rooms, and Executive flats experienced decreases in rent by 0.7%, 0.5%, and 0.4%, respectively. In contrast, rents for 5-room flats increased by 0.8%.

Amid monthly fluctuations, there was a noteworthy annual rise in overall HDB rents, increasing by 6.2% from May 2023. This trend was evident in both Mature and Non-Mature Estates, with rents increasing by 5.9% and 6.9%, respectively.

The various room types all experienced year-on-year rent increases. Rent for 3-room flats increased by 5.4%, while both 4-room and 5-room flats saw increases of 6.7%, and Executive flats experienced the highest increase at 8.0%. This data indicates significant growth in rental prices across the HDB market over the past year.

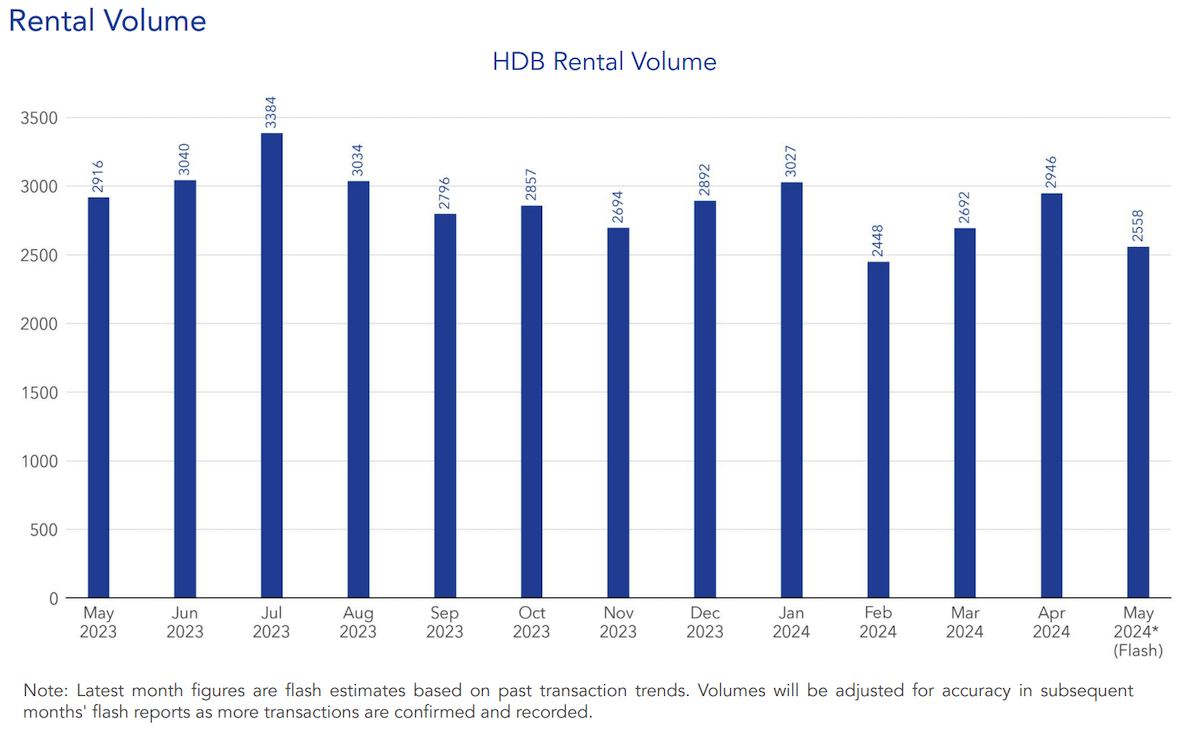

Volumes decrease by 13.2% month-on-month.

There was a notable 13.2% month-on-month decrease in HDB rental volumes. An estimated 2,558 HDB flats were rented during this period, compared to 2,946 units in April 2024, indicating a reduction in rental activity within the market.

Read this: April 2024: Condo prices up 1.5%, sales surge 23.2%

The year-on-year decline in rental volumes was significant, with a 12.3% decrease from May 2023. Additionally, the rental volumes for May 2024 were 8.0% lower than the five-year average volume for May, indicating a broader trend of reduced rental activity compared to historical norms.

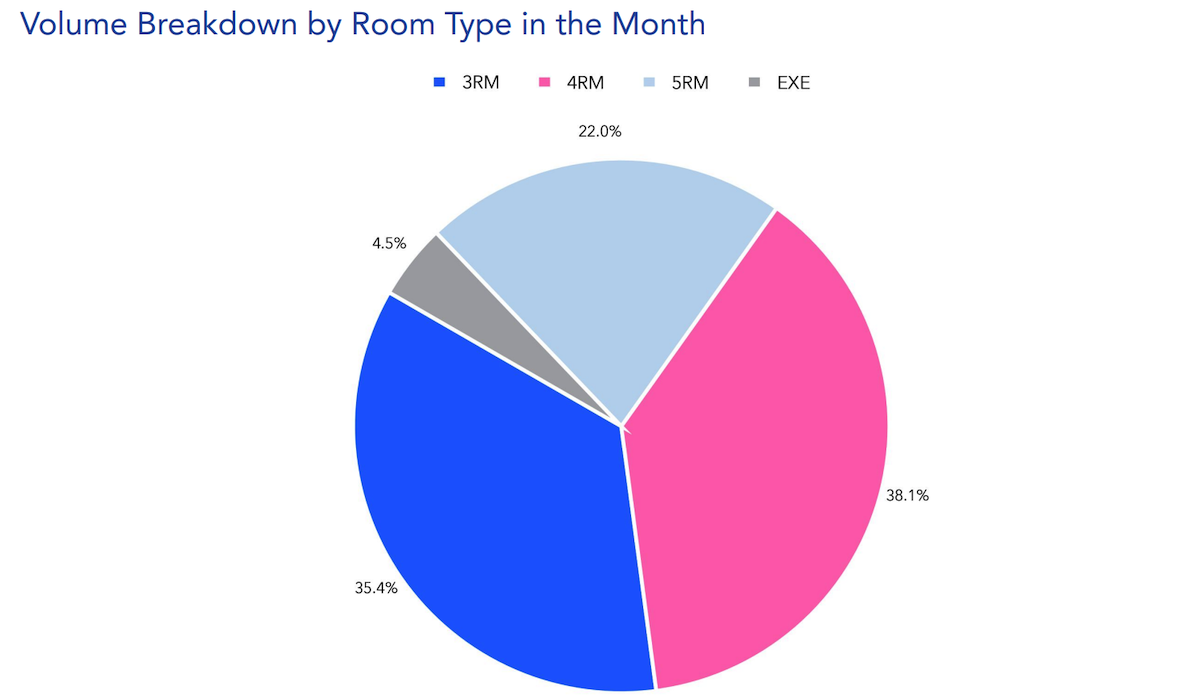

The rental volume breakdown by room type was as follows: 35.4% for 3-room flats, 38.1% for 4-room flats, 22.0% for 5-room flats, and 4.5% for Executive flats. This breakdown indicates the diverse levels of demand for different HDB flat types.

Conclusion

The rental market in Singapore showed diverse trends in May 2024, with declines in both condo and HDB rental prices and volumes on a month-on-month basis. However, the year-on-year data indicated significant growth in HDB rents, highlighting the dynamic nature of the rental market.

Regional variations and room type preferences highlight diverse demand patterns. Stakeholders should take these factors into account to make well-informed decisions and adjust to the evolving rental market in Singapore.

Properties for you

4

2

3

3

3

3

3

2

3

3

2

2

4

4

2

2

3

3

2

2

2

1

3

2

2

2

1

1

5

5

1

1

3

3

3

3

3

2

2

2

2

2

4

3

1

1

3

4

3

3

3

3

3

3

2

2

3

3

5

4

3

2

2

1

3

3

1

1

3

2

See all Condos for sale >

2

2

3

2

1

1

2

2

1

1

2

2

1

1

1

1

3

3

3

3

3

2

1

1

0

1

3

2

2

2

2

2

3

3

-1

1

1

2

2

0

1

3

2

2

2

2

1

2

2

4

5

3

3

1

1

2

2

3

3

4

3

2

2

3

3

1

1

3

3

See all Condos for rent >

2

2

3

2

3

2

4

2

3

2

3

2

2

2

4

2

3

2

3

2

3

2

1

1

3

2

2

2

3

2

3

2

2

1

3

2

4

3

3

2

3

2

4

2

4

2

3

2

3

2

3

3

3

2

3

2

4

2

3

2

3

2

3

2

3

2

2

2

3

3

See all HDBs for sale >

3

2

2

1

2

2

-1

2

2

3

2

-1

1

-1

-1

3

2

-1

-1

2

2

-1

-1

3

2

-1

1

2

2

-1

1

-1

-1

-1

-1

3

2

2

2

3

2

2

2

-1

-1

3

2

-1

3

2

3

2

3

2

1

1

See all HDBs for rent >

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post Slight dip in condo rents, yearly growth for HDBs appeared first on .