Table of contents

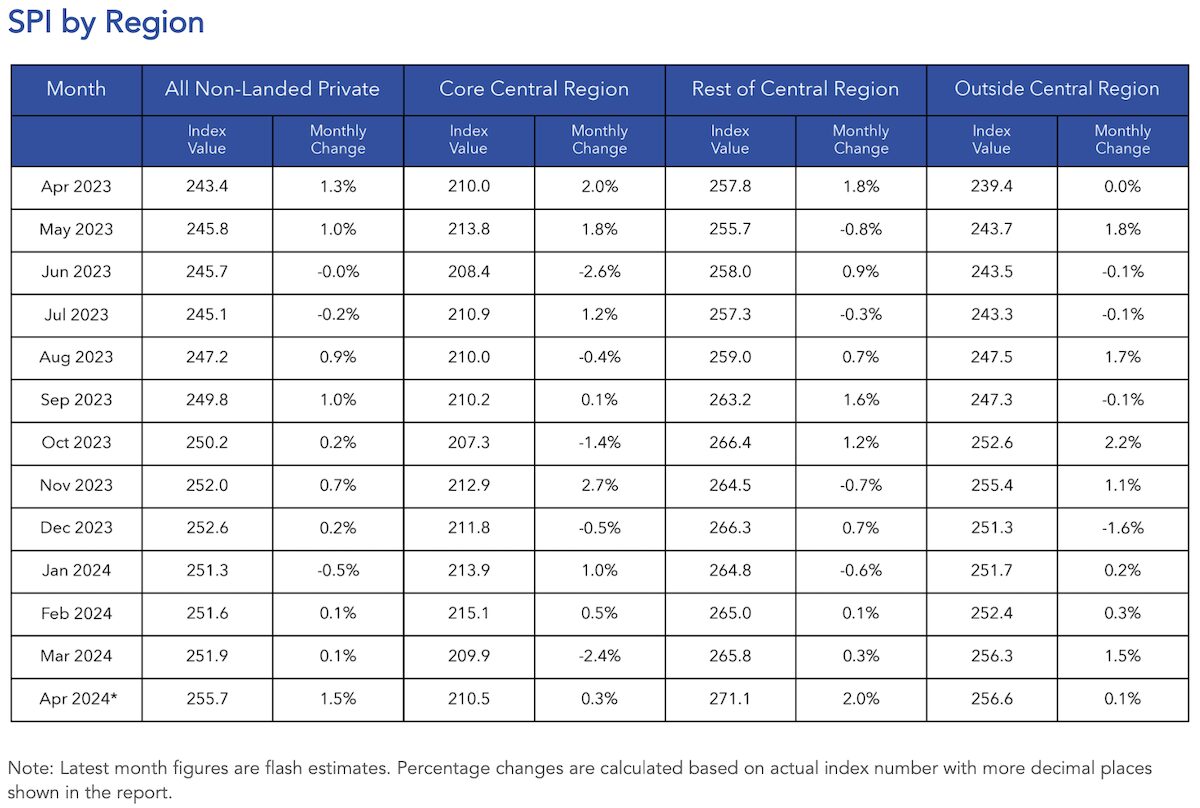

- CCR, RCR and OCR prices increase by 0.3%, 2.0% and 0.1% respectively in April 2024

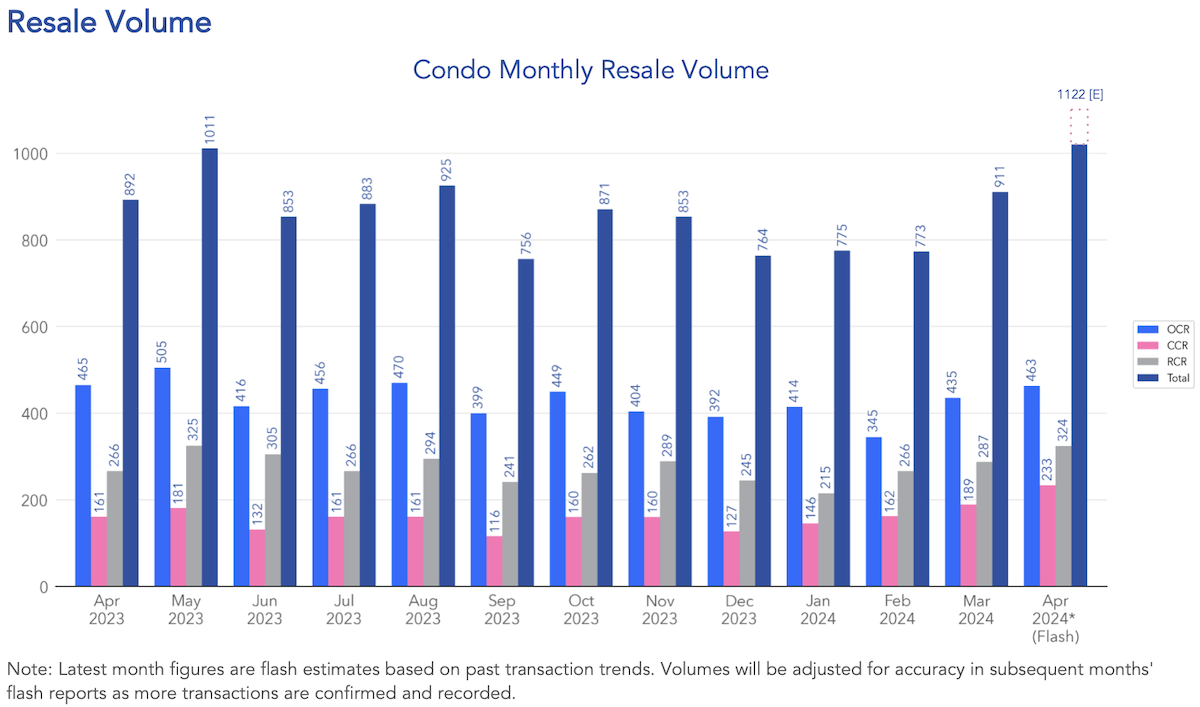

- An estimated 1122 units were resold in April 2024, a 23.2% increase from the 911 units resold in March 2024

- The highest transacted price in CCR for a resale unit in April is achieved at $13,000,000 at The Marq On Paterson Hill

- The overall median capital gain for resale condos is $337,000 in April 2024, a decrease of $40,000 from March 2024

- The overall median unleveraged return for resale condos is 29.3% in April 2024

- Conclusion

The property market in Singapore demonstrated dynamic performance in April 2024, with varying trends observed across different regions. Prices in the Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR) all experienced increases, reflecting the ongoing demand and value appreciation in these areas.

Read our report for last month: Condo sales hold steady in February despite CNY; prices on the rise

This report provides an overview of key metrics and highlights of the property market for April 2024, including price changes, resale volumes, notable transactions, and returns on investment across different districts.

CCR, RCR and OCR prices increase by 0.3%, 2.0% and 0.1% respectively in April 2024

In April 2024, the prices of properties in CCR, RCR, and OCR showed different levels of increase. The CCR experienced a price rise of 0.3%, while the RCR saw an increase of 2.0%. The OCR had a minimal increase of 0.1% during the same period.

The SRX Price Index for Condo Resale shows that condominium prices experienced a 1.5% month-on-month increase from March 2024. In the year-on-year comparison, there was an overall price increase of 5.1% in April 2024 compared to April 2023. Year-on-year price increases were also observed in each region: the CCR by 0.2%, the RCR by 5.2%, and the OCR by 7.2%. This data suggests an overall upward trend in the property market across all regions.

An estimated 1122 units were resold in April 2024, a 23.2% increase from the 911 units resold in March 2024

In April 2024, 1,122 units were sold, showing a 23.2% increase from the 911 units resold in March 2024. This increased resale activity indicates a strong property market. Compared to the same month in the previous year, volumes were 25.8% higher and exceeded the five-year average for April by 17.6%.

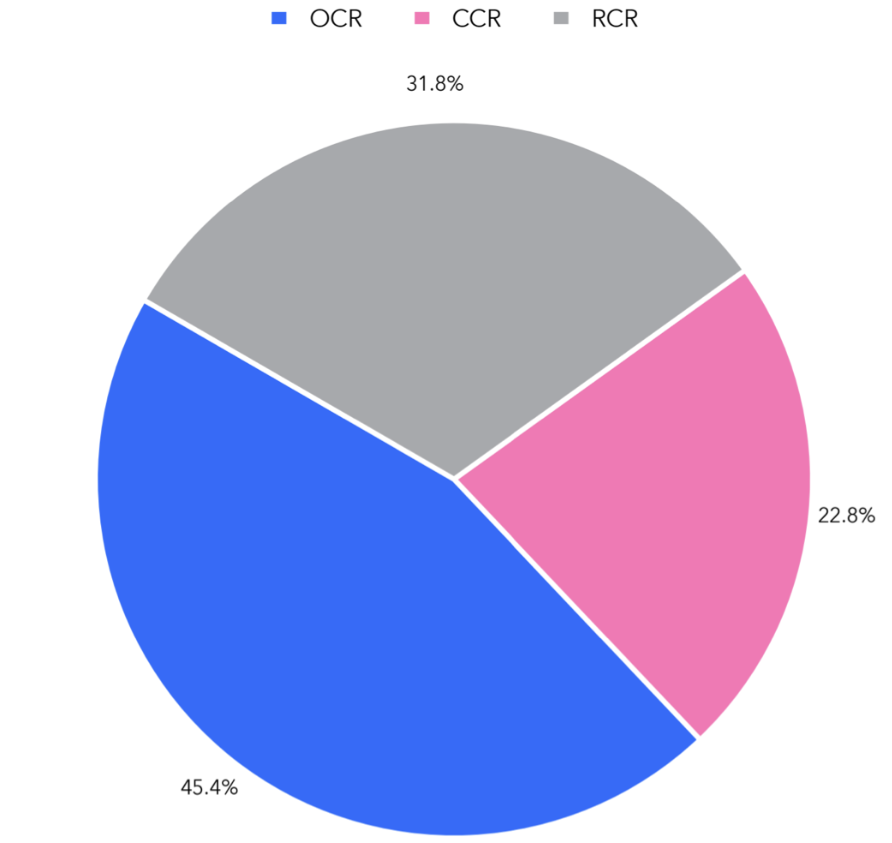

OCR represented 45.4% of the total resale transactions, RCR contributed 31.8%, and CCR accounted for 22.8%. These figures demonstrate the distribution of resale activity across various regions.

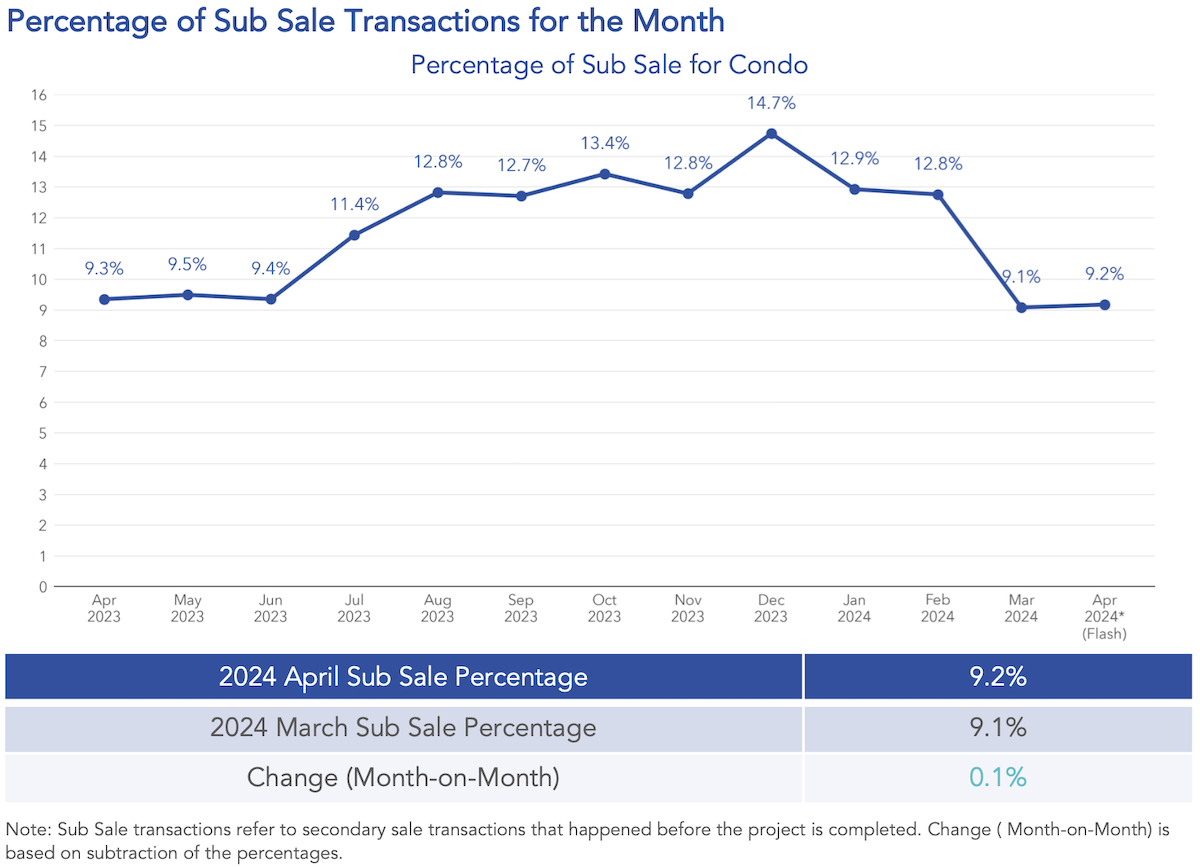

The percentage of sub-sale transactions to the total secondary sale transactions, comprising both resale and sub-sale, was 9.2%. This shows a slight increase of 0.1% from March 2024. Sub-sale transactions refer to secondary sales before the project is completed, indicating a segment of the market activity involves properties still under development.

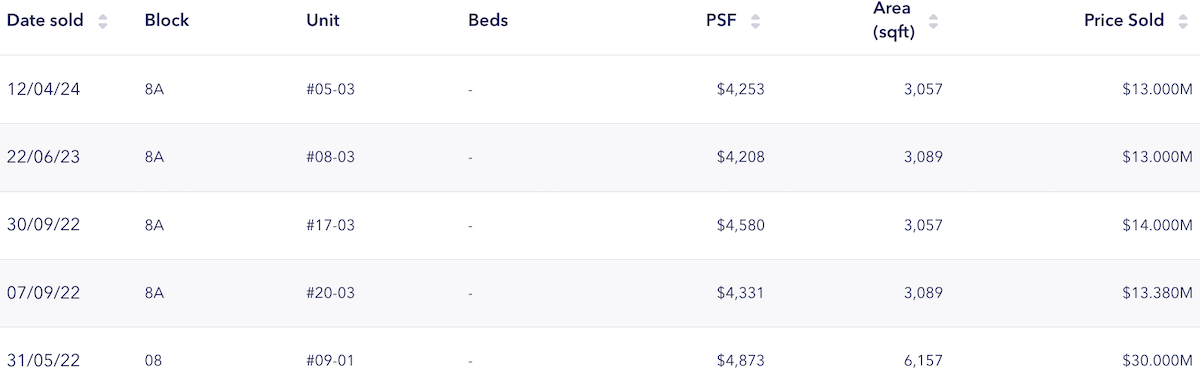

The highest transacted price in CCR for a resale unit in April is achieved at $13,000,000 at The Marq On Paterson Hill

The highest transacted price for a resale unit in CCR was $13,000,000, achieved at The Marq On Paterson Hill. This transaction highlights the high value associated with properties in this area.

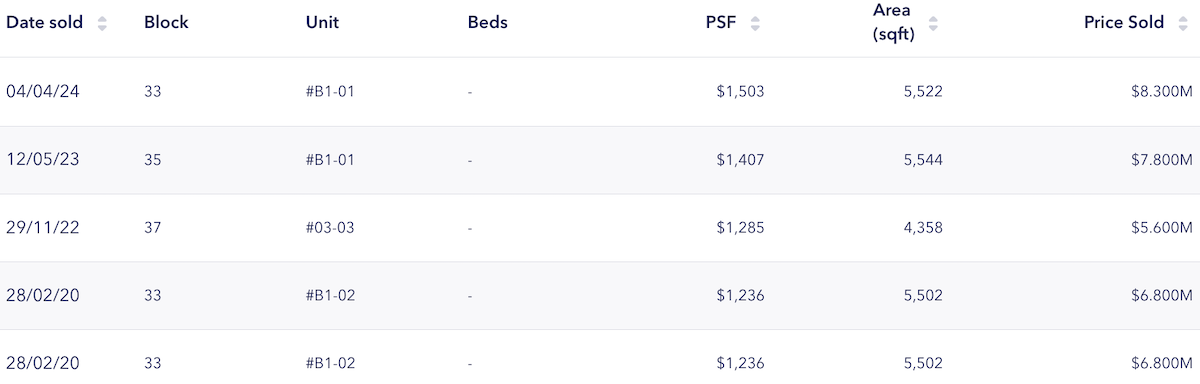

In RCR, the highest resale price was recorded at The Peak, where a unit was sold for $8,300,000. This transaction indicates strong demand and significant value of properties within the RCR.

Read about all the districts: Singapore’s 28 districts mapped across Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR)

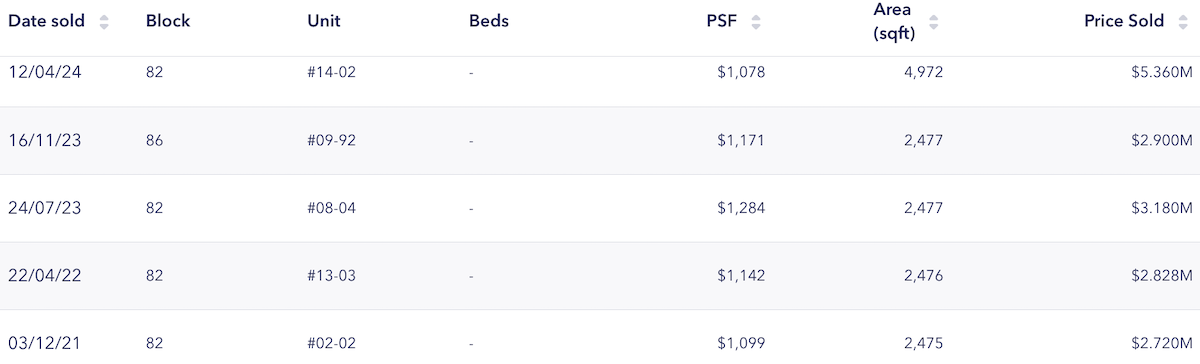

In OCR, the highest transacted price for a resale unit was $5,360,000 at Windy Heights. This transaction reflects the strong market value and demand for properties in the OCR, extending beyond the central regions.

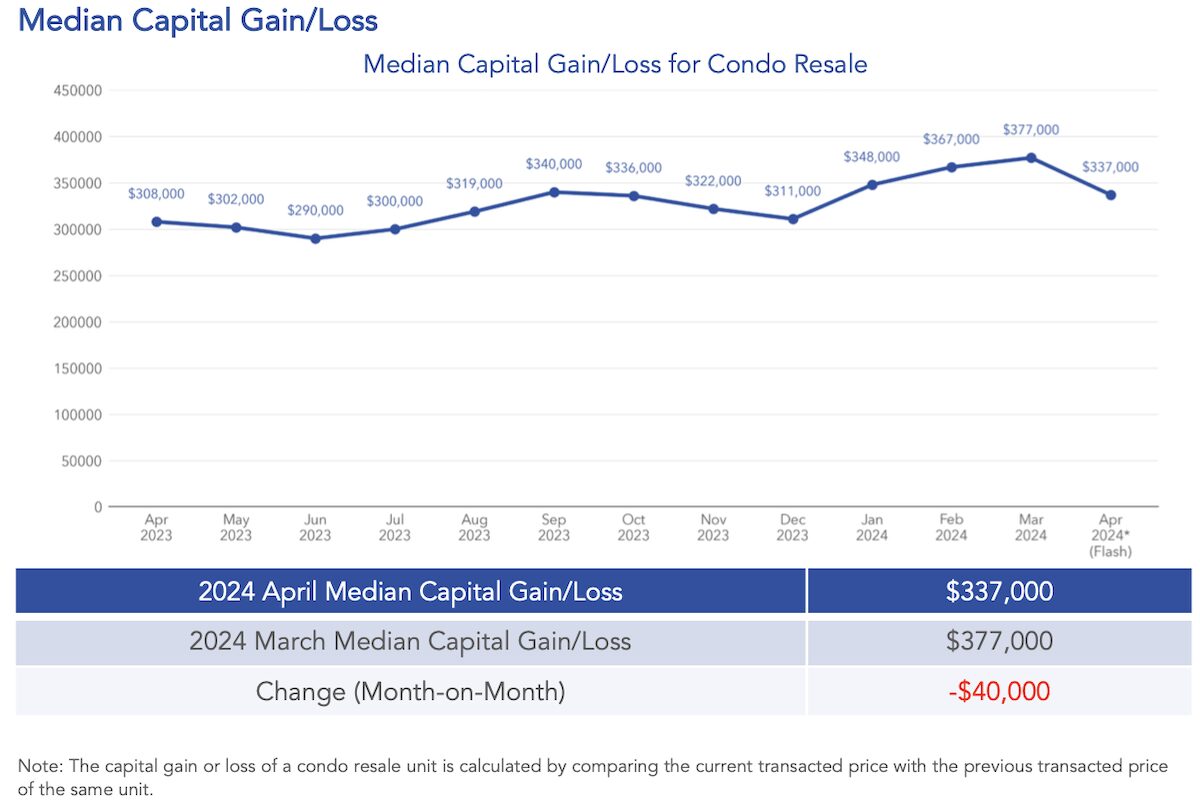

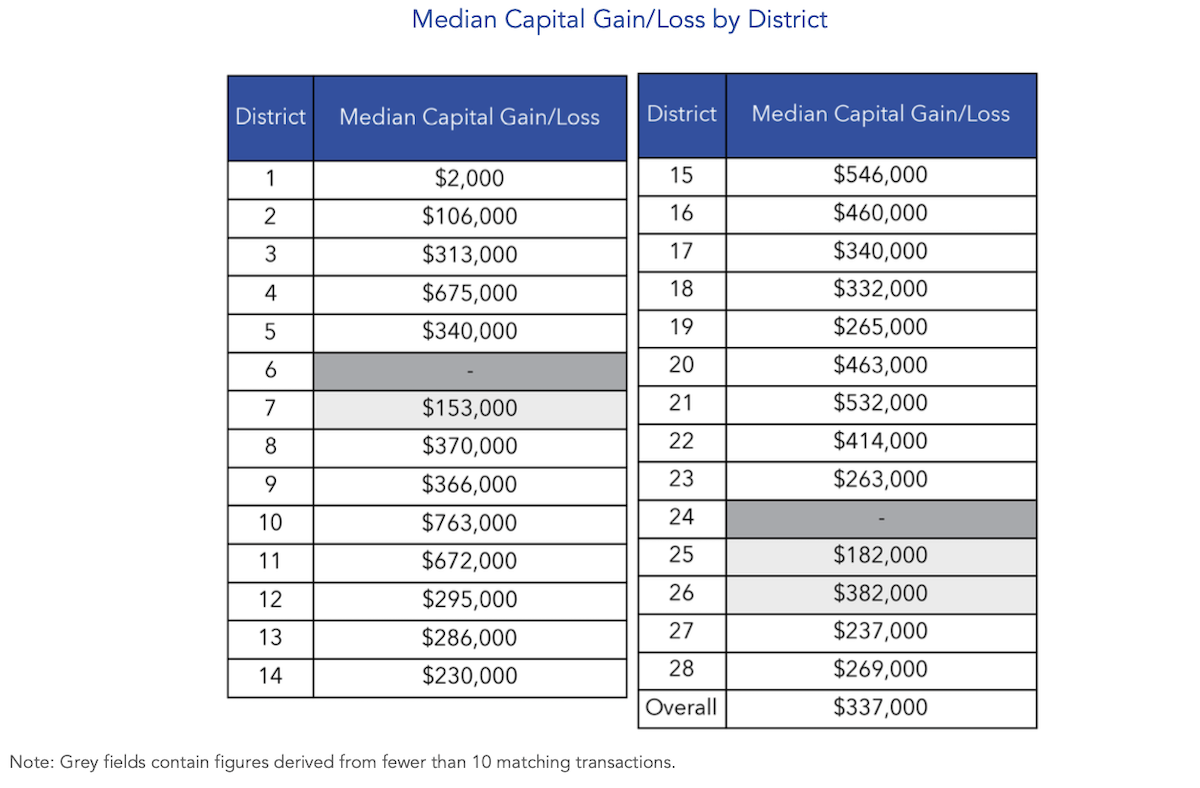

The overall median capital gain for resale condos is $337,000 in April 2024, a decrease of $40,000 from March 2024

The median capital gain for resale condominiums in April 2024 was $337,000, which indicates a $40,000 decrease from March 2024. This reflects a slight dip in profitability for property sellers during this period.

District 10, including Tanglin and Holland, recorded the highest median capital gain at $763,000, indicating strong market performance and high property values in this affluent district. In contrast, District 1, encompassing Boat Quay, Raffles Place, and Marina, posted the lowest median capital gain at just $2,000, illustrating significant variation in capital gains across different districts in Singapore.

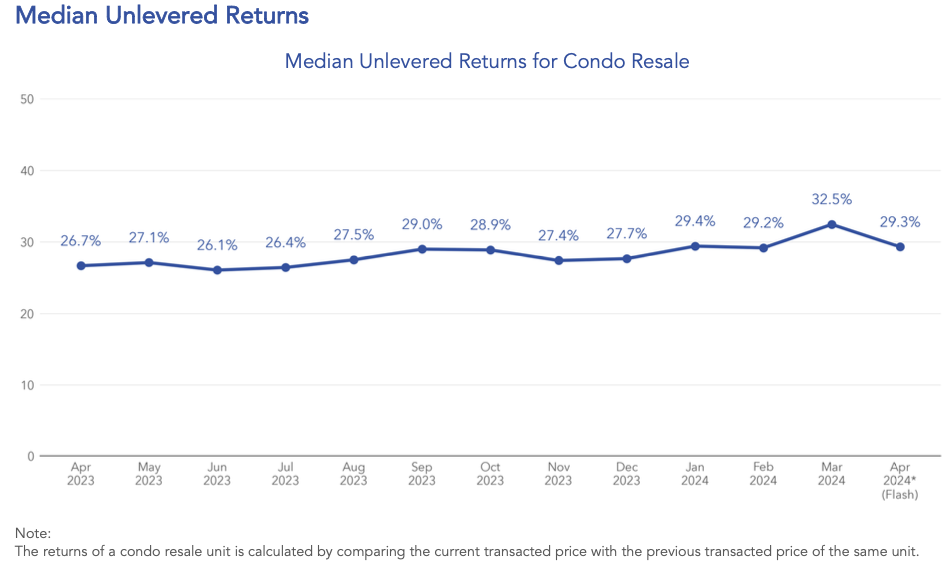

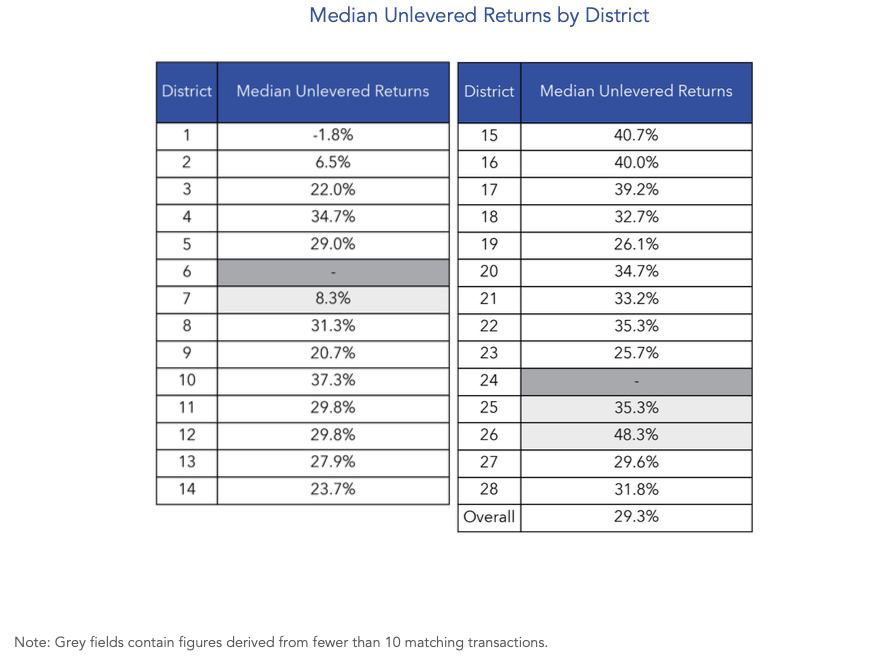

The overall median unleveraged return for resale condos is 29.3% in April 2024

According to the data, the overall median unlevered return for resale condominiums was 29.3%. This metric represents the percentage return on investment without considering leverage, indicating a healthy return for property investors.

District 15, encompassing the East Coast and Marine Parade areas, achieved the highest median unlevered return at 40.7%. This indicates a strong performance and desirability of properties in this district. In contrast, District 1, including Boat Quay, Raffles Place, and Marina, posted the lowest median unlevered return at -1.8%, suggesting a decline in property values for resale units in this area.

The capital gains and returns for a resale condo unit are determined by comparing the current transacted price with the previous transacted price of the same unit. To ensure accuracy and relevance in the rankings, only districts with at least 10 matching transactions are included in the analysis. This approach provides a more reliable measure of market performance across different regions.

Conclusion

There was a notable increase in activity and growth in Singapore’s property market. Significant price increases were observed across all regions, along with a surge in resale volumes. Additionally, there were substantial capital gains and returns in several districts. Despite a slight dip in the overall median capital gain, the market’s vibrancy is evident in the high transaction values and robust unlevered returns.

The data shows variations in performance across different regions, with certain districts demonstrating exceptional value and demand. This detailed analysis offers valuable insights for investors and stakeholders, emphasizing the continued attractiveness and potential of Singapore’s real estate market.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post April 2024: Condo prices up 1.5%, sales surge 23.2% appeared first on .