Singapore is a renowned global destination famous for its exceptional standard of living, strong economy, and diverse cultural heritage. This island city-state attracts people from all over the world, including expatriates and professionals, who want to participate in its dynamic business landscape and experience its first-class amenities.

Table of contents:

- Understanding Singapore’s living costs

- Housing and accommodation

- Daily living expenses

- Food and dining

- Healthcare and insurance

- Education and childcare

- Employment and salaries

- Lifestyle and recreation

- Making the most of your money in Singapore

- Conclusion

Nevertheless, along with its many advantages, Singapore is also known for its high cost of living, which can be a crucial factor for those considering moving or travelling to the country.

Warm-up reading: Navigating the waves: Singapore’s Cost-of-Living Support Package and its impact on the real estate market

If you’re considering moving to Singapore, it’s important to have a clear understanding of the everyday expenses you’ll face. Whether you’re relocating for work, retirement, or education, knowing the financial landscape is essential to making an informed decision.

This guide aims to provide a comprehensive overview of the costs associated with living in this Southeast Asian city-state, from housing to healthcare and beyond. By the end, you’ll have a better idea of what to expect and be better prepared to make a smart move.

Understanding Singapore’s living costs

Singapore ranks as one of the more expensive cities globally, often compared with metropolises like New York City, London, and Sydney. The city-state’s high cost of living is reflected in its accommodation costs, lifestyle choices, and even everyday necessities which can be substantially higher than in many Western countries.

The Singapore Dollar (SGD), the local currency, plays a critical role in these costs, affecting everything from grocery prices to rent.

For expatriates, managing money involves not just budgeting but also smart currency conversion. While banks offer convenience, they often incorporate hefty fees or unfavourable exchange rates in their services.

Alternative services such as Wise (formerly known as TransferWise) are recommended for their lower fees and more favourable rates that mirror those found on Google, ensuring expatriates and travellers can maximise their financial resources in Singapore.

Housing and accommodation

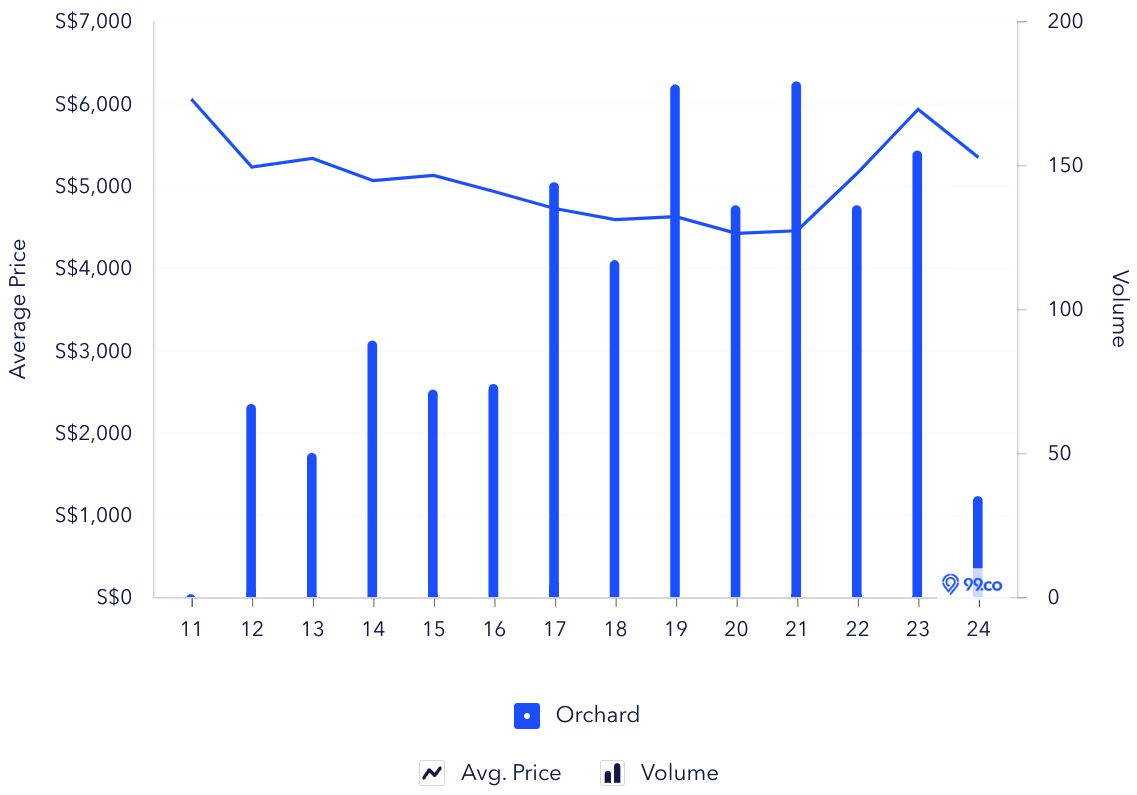

If you’re planning to move to Singapore, you’ll need to consider the cost of housing, especially in the central areas like Orchard and River Valley. Expatriates often live in these areas, as they are close to work and offer high-end amenities. However, due to their desirability and centrality, rental prices in these areas are quite high. Let’s put up a chart to show this:

For example, renting a one-bedroom apartment in the city centre can cost up to S$5,341 per month, a significant expense for most people. It’s essential to plan your budget and consider your options before making decisions regarding accommodation in Singapore.

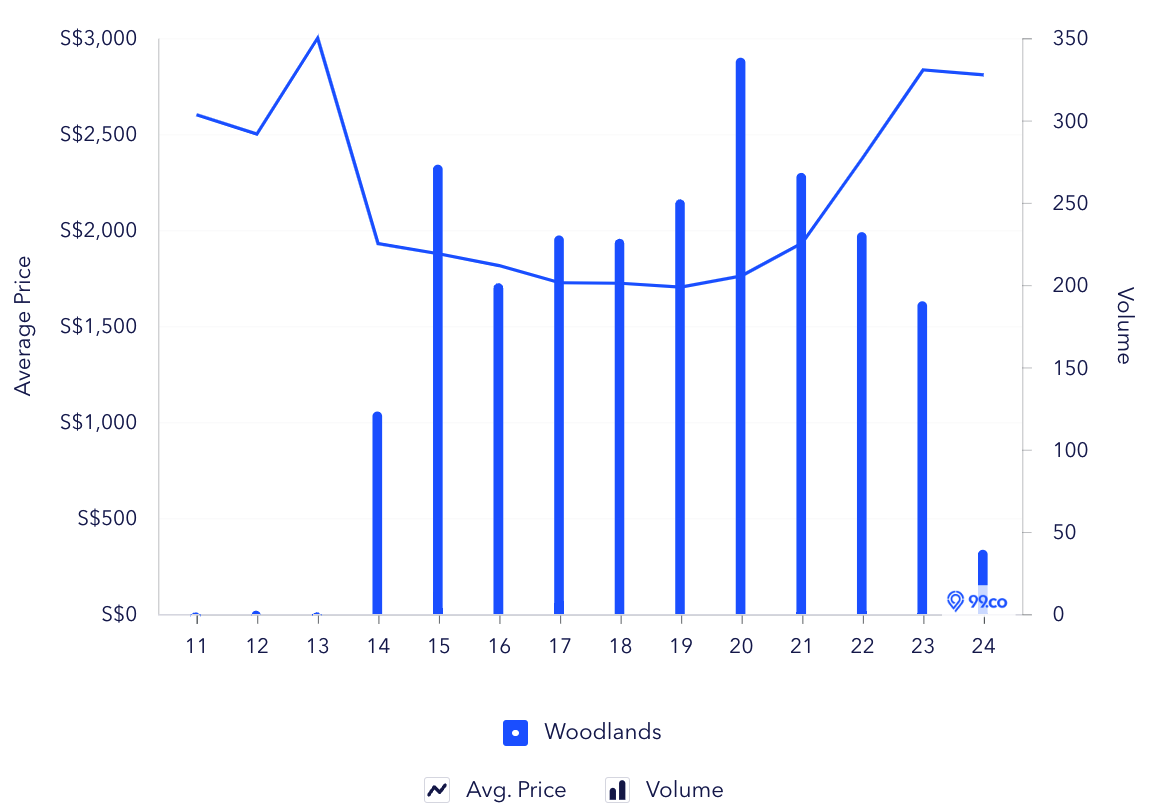

If you are looking for affordable rental options in Singapore, consider exploring regions outside of the central districts. The North and East regions, Woodlands and Tampines like as well as suburban areas, offer lower rental prices compared to the city centre. These options are popular among expatriates who want to balance accessibility with affordability.

By choosing to live in these areas, you can save a considerable amount of money on rent without compromising location and lifestyle. For instance, renting a one-bedroom apartment outside the city centre can cost around S$2,808 per month, which is significantly less expensive than renting a similar apartment in the city centre.

Properties to look at

Daily living expenses

If you’re planning to live in Singapore, it’s important to consider various daily expenses besides rent to prepare a realistic budget. For a single person, the monthly living expenses excluding rent usually amount to around S$1,502.3, based on the numbers crunched by Numbeo. This figure includes costs for necessities like utilities, transportation, groceries, and other miscellaneous items.

It’s worth noting that these expenses may vary depending on one’s personal habits and lifestyle choices. Therefore, it’s essential to factor in all these expenses while budgeting to ensure a comfortable living experience in Singapore.

In Singapore, utility costs can vary based on usage, with electricity bills often being higher due to the demand for air conditioning in the country’s tropical climate. Water and gas expenses also add up, and the average monthly utility bill for a small apartment can be around S$202.67.

Therefore, it is crucial to budget intelligently for these essential services to ensure that both expatriates and locals can manage their monthly expenses effectively.

Additional reading: SP utilities guide 2024 – Quick guide to setting up utilities in Singapore for your new home

Food and dining

Singapore is a food lover’s paradise with a diverse range of culinary options available throughout the city. From world-renowned hawker centres serving up authentic Singaporean cuisine to high-end restaurants offering gourmet meals, there’s something for everyone.

If you’re looking to experience local flavours and save some money, food courts and hawker centres are the perfect choice. These venues offer delicious meals at affordable prices, with dishes ranging from S$4 to S$15, making them an excellent option for budget-conscious travellers.

Other than that, there is also a diverse range of dining options to suit different budgets and preferences. While mid-range to upscale restaurants provide occasional indulgences, prices can be significantly higher, with a three-course meal for two costing around S$92.5 on average, and even more at upscale establishments.

It is advised to balance these dining options with more budget-friendly choices to fully enjoy Singapore’s culinary offerings without overspending.

Healthcare and insurance

Singapore has established a reputation for its superior healthcare system, which is recognised for its high-quality and efficient services, consistently ranked among the best in Asia and the world. Despite the high quality of healthcare services, the cost of healthcare can be substantial, particularly for expatriates who do not have access to the subsidised services available to permanent residents.

For example, without insurance, a visit to a family doctor can cost the average between S$39 and S$59, and the costs can be much higher for specialised care.

If you’re planning to relocate to Singapore as an expatriate, it is highly advised that you secure a comprehensive health insurance plan to cover any potential medical expenses. It’s important to note that premiums and plans can vary, but having coverage for both minor and major medical procedures can help you avoid any financial strain.

Given the high standard of medical services available in Singapore, investing in good health insurance is a wise decision for anyone residing in the country. By doing so, you can ensure that you have access to the best medical care without having to worry about the costs involved.

Education and childcare

In Singapore, education is a crucial aspect that comes with a significant financial commitment, particularly for expatriates who prefer private or international schools. While these institutions provide top-notch educational standards, their annual fees can start at S$30,000, making them quite expensive.

The decision to choose between local schools, which are relatively cheaper, and international schools often depends on the duration of stay and the specific academic requirements of the children.

Childcare and preschool programs can be a great option for younger children. However, it’s important to note that the cost of these programs can vary depending on the quality and range of services provided. For parents considering enrolling their children in a reputable preschool, it’s important to note that monthly fees can average around S$1,492.

This makes early childhood education a significant investment. Therefore, families must plan these expenses carefully and weigh the benefits of high-quality education against their other financial priorities.

Some more reading: Private schools in Singapore: A pricey path to prestige?

Employment and salaries

Singapore boasts a thriving job market that offers competitive salaries, commensurate with the city’s high cost of living. The pay scale in Singapore is generally high, which helps to balance out the expenses of living in a vibrant urban environment.

For instance, a financial analyst can earn an average of S$73,126 annually, while a software engineer can earn around S$85,512 per year.

If you plan on moving to Singapore or becoming a resident, it is important to do your research and gain an understanding of the salary expectations for your particular profession.

By having this knowledge, you can negotiate a salary that not only covers your living expenses but also provides enough for a comfortable lifestyle while taking into account any other financial commitments and goals you may have. This research can be crucial in ensuring a successful transition to living and working in Singapore.

Lifestyle and recreation

Singapore is a great place to live if you enjoy recreational activities. You can indulge in high-end mall shopping or explore the local parks and nature reserves. While some activities can be expensive, there are many free or low-cost options available that offer great opportunities for relaxation and leisure without putting a strain on your wallet.

Singapore offers public sporting facilities and well-maintained parks, making it easy to maintain an active lifestyle.

Singapore offers a variety of cultural and entertainment activities, such as cinema, theatre, and concerts. The prices of these activities are comparable to those in other major cities worldwide. For instance, on weekdays, a standard movie ticket costs around S$11, while on weekends, it costs around S$15.

However, the prices can be higher for special formats such as IMAX or 3D. To make the most of what Singapore has to offer without overspending, it is important to balance costly activities with more affordable or free options.

Making the most of your money in Singapore

Living in Singapore can be quite pricey, but there are several ways to manage your expenses and make the most of your money. For instance, shopping at local markets and eating at hawker centres can significantly reduce your daily expenses. Additionally, the city-state boasts an efficient public transportation system that is not only affordable but also environmentally friendly.

Moreover, by keeping an eye out for promotions and discounts that are frequently available across various sectors, from retail to services, you can save a lot of money in the long run. By adopting these local habits and making smart choices, you can relish your time in Singapore without worrying about exceeding your budget.

Living in Singapore can be a fulfilling experience for both expatriates and locals. However, it’s essential to have access to financial planning tools and resources to manage your finances effectively.

With the right knowledge, you can learn where to shop for groceries, how to commute efficiently and find affordable leisure activities. By understanding these aspects, you can make living in Singapore a manageable and enjoyable experience.

To convince you a little bit more: 20 reasons to make Singapore your home

Wrapping it up

Singapore is a vibrant and exciting place to live, but it can also be quite expensive. To fully enjoy the benefits of this city-state, it’s important to understand and manage the costs involved. Whether you’re an expatriate or a resident, making informed financial decisions is essential.

This means taking advantage of local dining options, choosing the best transportation options, and selecting appropriate healthcare and education services. By strategically managing expenses, you can make the most of your time in Singapore and ensure a fulfilling and sustainable lifestyle.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post The cost of living in Singapore: What you need to know appeared first on .