Table of contents:

- Can you merge/hack 2 HDB units together?

- What are jumbo HDB flat units?

- How does the HDB Conversion Scheme work?

- Final thoughts and remarks

Here’s what inspired the writing of this article:

Two adjacent five-room flats in Block 314C Anchorvale Link, Sengkang were advertised on the PropertyGuru platform as a single jumbo unit. The advertisement described the combined flats as a 2,400-square-foot property with six bedrooms and four bathrooms.

However, authorities, including the Ministry of National Development and the Council for Estate Agencies (CEA), flagged this as misleading because no such jumbo flats exist in that block. The listing was taken down following intervention from CEA, which noted that these flats are not eligible to be sold as a single unit.

The S$2,000,000 314C Anchorvale Link listing:

The listing had set the asking price for the combined flats at S$2 million, significantly above the typical market value, with comparable five-room flats trading for about S$580,000 each over the past six months. This discrepancy prompted a response from the CEA, which is now investigating potential breaches of real estate advertising regulations.

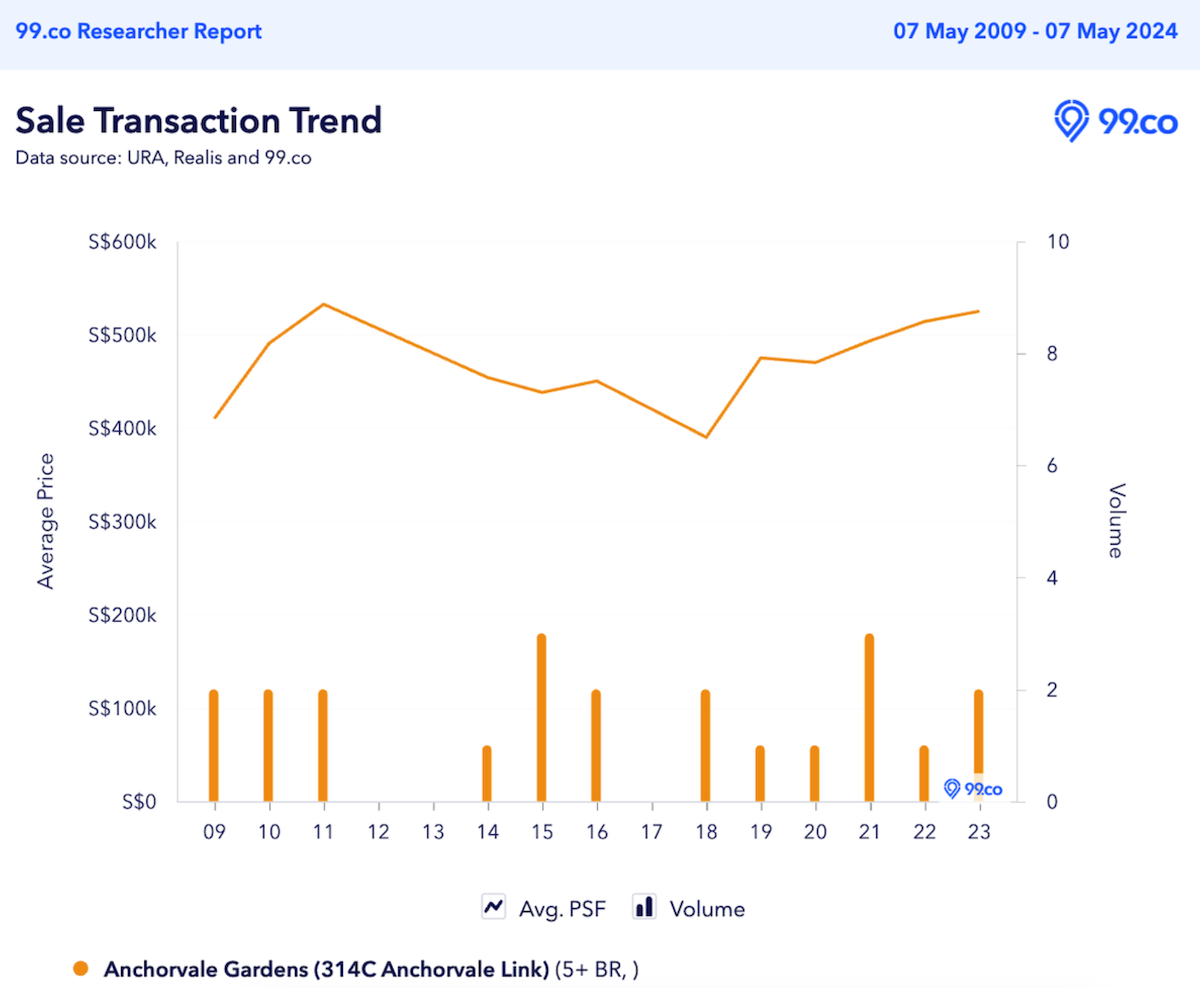

We can see more of the transactions of 5-bedroom units in Block 314C below:

Mr Andrew Nair from ERA Realty Network, who managed the listing, mentioned that the owners had previously obtained HDB approval to merge the living rooms of the two flats when they purchased them six years ago. However, the current regulations require the flats to be marketed and sold separately, necessitating their listing as individual units.

Following the directive from ERA’s legal and compliance team, Mr Nair removed the misleading listing and plans to re-list the properties as separate units after obtaining the necessary approvals.

Read about another piece of news in Sengkang: Sengkang’s HDB resale breaks S$1,000,000 transaction threshold

So, what now?

This situation underscores the regulatory challenges and the need for clear communication in the real estate market to ensure that listings are accurate and compliant with existing housing policies. The ongoing investigation by CEA into this incident highlights the agency’s role in maintaining market integrity and protecting consumer interests in Singapore’s dynamic real estate environment.

But why is this? And can you actually merge HDB units? AND what are jumbo HDB units? We answer these questions below:

Can you merge/hack 2 HDB units together?

Well, to answer the question above directly, yes and no.

While there is such a thing as a jumbo HDB flat (we will talk about it in the next section), can you actually purchase two adjacent HDB units and merge them into one? It’s a little complicated to answer but let us try:

Based on the HDB Conversion Scheme (which we will also be talking about further down this article), you can merge two (2) separate but adjacent HDB units if the units and the owners fall under strict rules and regulations.

A Glossary break for you: HDB Conversion Scheme

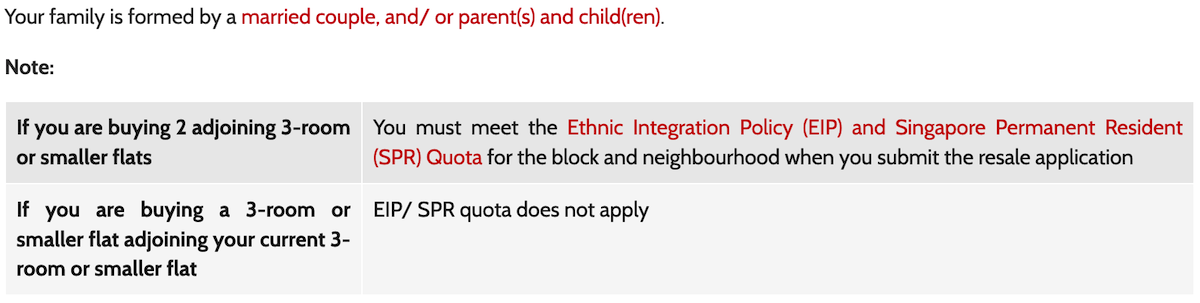

In short; if you’re buying two units to be merged, you must meet both the EIP and the SPR Quota, and if you’re buying a unit to be merged with your present purchased unit, the aforementioned quota does not apply.

More below.

What are jumbo HDB flat units?

Jumbo HDB flats were introduced in the 1990s as a solution to an oversupply of smaller units in areas like Yishun and Woodlands, and have since become a unique housing option for Singaporeans. These flats were created by merging multiple smaller units into one, resulting in living spaces ranging from 1,442 to over 2,000 square feet.

This concept was later applied in mature estates such as Ang Mo Kio and Jurong East, offering homes with multiple bedrooms and often large living areas, sometimes equipped with balconies.

The allure of jumbo flats

They are desirable due to their spaciousness and affordability in a nation where housing is increasingly compact and costly. They are particularly beneficial for extended families, offering enough room to accommodate multiple generations under one roof comfortably.

With prices lower than those in the private sector for comparable space, and the possibility to finance up to 90% of the home value, these flats represent a feasible option for large families who also benefit from shared financial responsibilities. The rarity of these units adds a layer of exclusivity and investment potential, with their values showing resilience and growth prospects in the long-term property market.

A more in-depth take on jumbo HDB units we wrote: What are jumbo HDB flats and where can you find them?

Why buyers want jumbo flat units

Jumbo HDB flats offer ample opportunities for creative interior design and can be a lucrative investment in rental income. Owners can opt to partition their units, renting them out as whole units rather than individual rooms, thus maximising privacy and rental yield.

For those looking for even more space, the HDB’s Conversion Scheme allows owners of adjacent smaller units to merge them officially, creating a custom jumbo flat. This flexibility and potential make jumbo HDB flats a coveted option in Singapore’s housing market, blending practicality with potential profitability.

Now we go a little in-depth into the HDB Conversion Scheme work:

How does the HDB Conversion Scheme work?

The Conversion Scheme offers families the opportunity to acquire adjacent 3-room or smaller flats and merge them into a single unit, subject to specific terms and conditions.

Eligibility requirements must be met, including compliance with the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) Quota for certain purchase scenarios. Here’s what the eligibility conditions look like:

Before any transaction, it is necessary to apply for confirmation of the feasibility of merging flats, and the authorities will evaluate and inform potential buyers if the process is feasible. Here is the Enquiry on Combination of Flats under the Conversion Scheme form. Once completed, you can send it to HDB’s e-Feedback form.

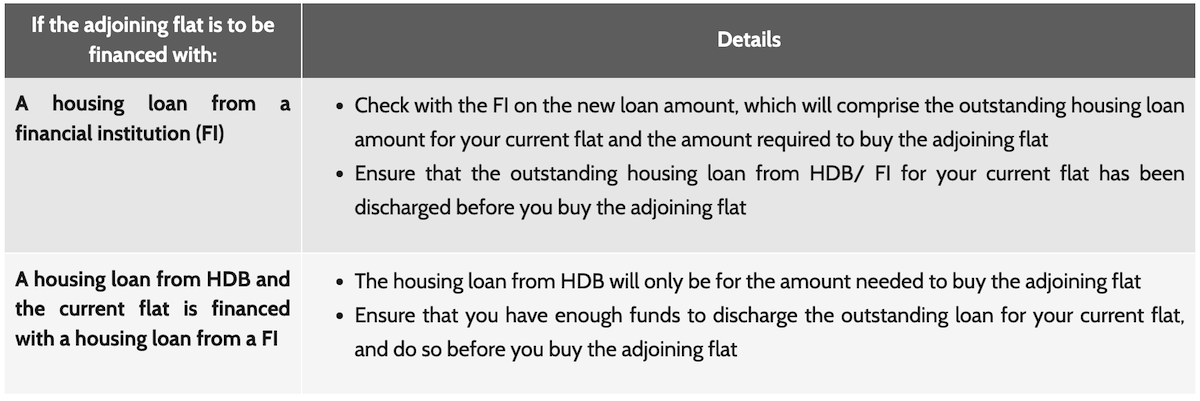

Financing for the purchase of adjoining flats is subject to several factors such as the buyer’s current housing loan status and the source of the new loan. The source of the loan may be either HDB or a financial institution. If a buyer is purchasing an adjoining flat next to a current one, any existing housing loan must be discharged before the new purchase can be completed.

To combine financing and discharge loans, specific arrangements are required, and buyers must ensure they have sufficient funds to cover all financial obligations before proceeding. After purchasing, the physical conversion of the flats into a single unit requires hiring licensed contractors to make structural changes and remove redundant utility meters.

After the successful conversion and combination of flats, it is important to adhere to certain post-purchase obligations. These obligations include complying with the Minimum Occupation Period (MOP) before reselling the flat, understanding the financial implications of subsidies and resale levies, and being aware that the new unit cannot be subdivided for sale or any other purpose.

Upgrading costs must also be paid, which are dependent on the timing of the purchase regarding polling on upgrading programs. It is essential to plan carefully regarding finances and logistics throughout the conversion process to ensure a smooth transition.

You can find out more by heading straight to HDB’s own page about the scheme.

Final thoughts and remarks

The case of the two merged five-room flats at Anchorvale Link in Sengkang highlights the complexities involved in real estate transactions concerning HDB units in Singapore. Although jumbo flats are not a new concept, the regulatory requirements and compliance nuances associated with such modifications are strict, emphasising the importance of clear communication and strict adherence to housing policies to ensure that property listings are accurate and lawful.

It also highlights the need for potential buyers and real estate professionals to be fully informed about the legal and procedural aspects of merging HDB units, to avoid misleading advertisements and legal complications.

The recent incident at Anchorvale serves as a critical reminder of the essential role regulatory bodies such as the Council for Estate Agencies (CEA) play in maintaining the integrity of Singapore’s real estate market. The ongoing investigations into the misleading listing protect consumer interests and reinforce the standards of transparency and accountability expected in the housing market.

This article is a product of 99.co and is based on information gathered from various sources, including The Straits Times. These sources are used in good faith to provide valuable insights. The source of the referenced content is duly credited and we recommend readers refer them for a comprehensive understanding of the topic. 99.co is not responsible for errors, omissions, or consequences from using this information.

The post Hacking to merge two 5-bedroom HDB units: Can or cannot? appeared first on .