Government measures, including steps designed to increase the supply of public and private property, are helping to keep our real estate market in balance.

During the pandemic, low supply and high demand drove rapid rises in Singapore property prices. Recently, however, there have been indications of moderation in both the public and private property markets, and signs that government efforts to stabilise conditions are having the desired effect.

In an interview with CNA in March, the Minister for National Development, Desmond Lee, said the government was acutely conscious of the importance of keeping the property market stable and sustainable. “We will monitor and take whatever measures may be necessary to ensure stability in our property market, and ensure that the property market does not run ahead of economic fundamentals,” he said.

In response to the strong demand for homes witnessed during the pandemic, and to counter the risk of housing prices outpacing economic fundamentals, the government has already taken significant steps to keep the market in balance on both supply and demand sides.

Demand-side: Rounds of cooling measures

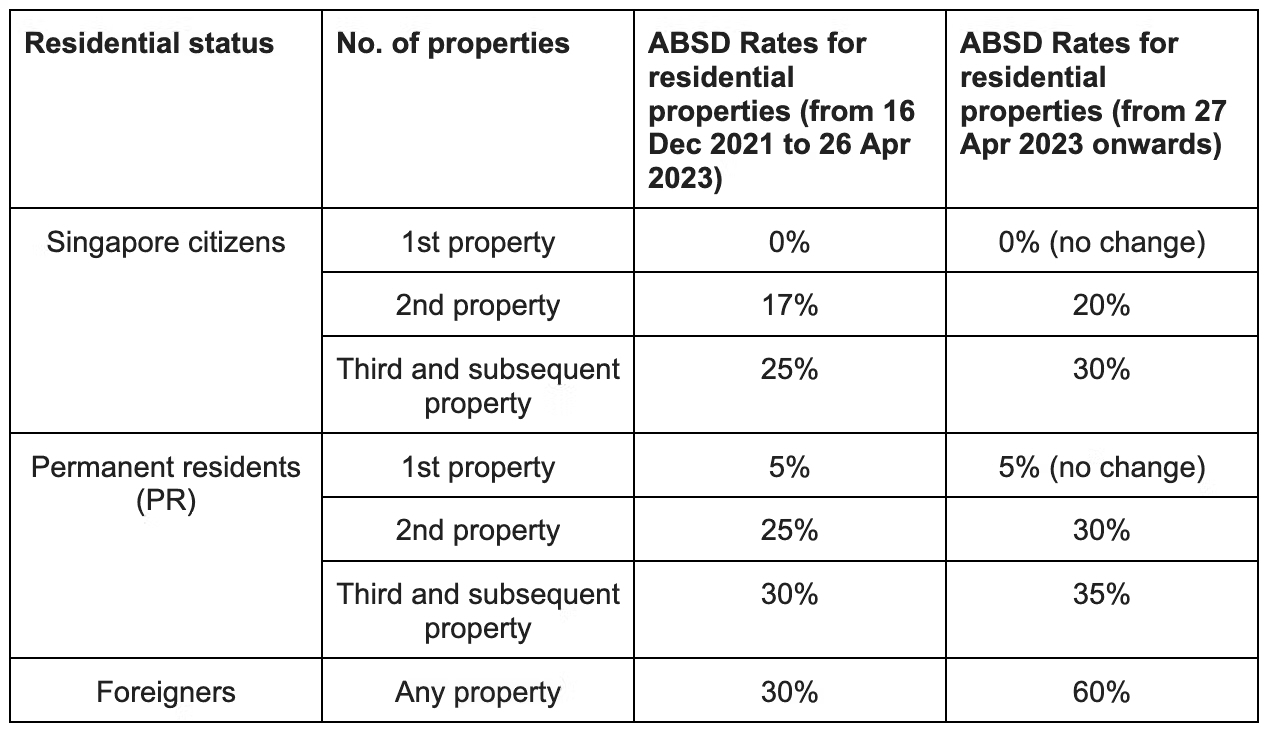

To address high demand, the Government introduced three rounds of cooling measures over recent years. In December 2021, a package of measures were introduced, which included increases to the Additional Buyer’s Stamp Duty (ABSD) rates across the board, except for Singapore Citizens and Permanent Residents buying their first property, and tightening the Total Debt Servicing Ratio (TDSR) and the Loan-to-Value (LTV) limits for HDB flats.

In April 2023, further measures were introduced to pre-emptively moderate local and foreign investment demand, so as to prioritise local owner-occupation and promote a sustainable property market. The table below outlines the changes that took place in April 2023, which remain in effect.

Supply-side: Ramped up private and public housing supply

An important element of the government’s measures was an effort to ramp up both public and private housing supply, keeping home ownership affordable and accessible for all Singaporeans.

Insofar as private housing goes, in 2023, the Confirmed List supply of private housing in the Government Land Sales (GLS) Programme was increased by roughly half to 9,250 units — up from 6,290 units in 2022. The GLS supply injection has been increased in the first half of 2024, with a release of 5,450 units (compared to 5,160 units in the second half of 2023 and 4,090 units in the first half of 2023). This represents the highest supply on the Confirmed List in a single GLS Programme since the 2H2013 GLS Programme.

On the public side, HDB is on track to meeting the target of launching 100,000 new flats between 2021 and 2025. This year, HDB will launch 19,600 BTO flats, including 2,800 flats with shorter waiting times of below three years.

A stable and sustainable property market

“It does take time to restore that balance because injecting supply, changing the property market psychology, adjusting the parameters of various cooling measures, all these take time to filter through the market,” the Minister told CNA.

However, government efforts to increase supply and moderate demand are proving successful in improving market stability and sustainability. Price appreciation in the private residential market has eased from 8.6 percent in 2022 to 6.8 percent in 2023. HDB resale prices rose 4.8 percent in 2023, less than half the increase in 2022, and BTO application rates for first-timer home buyers have also fallen.

While we have seen some headline-grabbing transactions of million-dollar HDB flats, these make up a very small minority of all HDB resale transactions. They are also usually for flats with particular attributes, such as maisonettes or jumbo flats, or flats in very attractive locations.

The Minister believes buyers today are becoming increasingly prudent in their housing purchases; this is sensible, given current circumstances. “We see interest rates staying higher for longer. We see economic uncertainties in the road ahead of us. We see geopolitical tensions, and all these will have an impact on the property sector,” Lee told CNA.

What to think about as a first-time homebuyer

High interest rates can make potential buyers think twice, which could lead to decreased demand in the housing market and a softening of price growth. Equally, in a high-interest environment, mortgage repayments become more expensive, and homebuyers must ensure they are doing their sums with this in mind, especially if they’ll need to rely heavily on borrowed funds.

Sabrina, 30, recently put down a deposit on their first home, a BTO HDB flat in Tengah Area. “With today’s high interest rates, my partner and I did our calculations very carefully before committing to purchase,” she said. “We wanted to ensure that we were maintaining a comfortable financial balance, leaving room for expenditures such as renovations and other discretionary spending that comes with buying a home.”

Beyond local conditions, those considering a property purchase must also be conscious of international economic uncertainty, rising inflation, stock market volatility and conflict, all of which affect us here in Singapore. These factors could impact buyers just as much as the Government’s measures to keep the housing market in line with economic fundamentals.

Property outlook for 2024

Speaking in January at the BCA-REDAS Built Environment and Property Prospects Seminar 2024, Mr Lee said the Government’s efforts were proving effective, with both the private and public residential markets showing signs of moderating. “Demand is beginning to stabilise, and transaction volumes across both markets have come down,” he pointed out.

On the supply side, he said, “We expect a large supply of housing to come onstream: we completed about 43,000 homes in 2023, and remain on track to complete another 28,000 homes this year and 24,000 homes next year, making a total of close to 100,000 private and public homes between 2023 and 2025.”

Numbers such as these bode positively for a sustainable property market in Singapore. Taken in perspective, the high rates of appreciation witnessed in the past three years were anomalous, and buyers should more realistically expect appreciation in line with what has been observed historically.

The market inevitably has its ups and downs, and buyers should factor this into their considerations when looking at any property purchase. It is always wise to seek advice from a real estate professional, who can help you make more informed decisions based on your individual requirements, financial situation, long-term plans, the market outlook, and other relevant factors.

The post Ensuring the Sustainability and Stability of Singapore’s Property Market appeared first on .