In the recent flash report for the Housing & Development Board (HDB) resale flat market, Mr Luqman and his Data team summarised that overall resale prices increased slightly despite a drop in volume for March 2024.

In this article, we tackle the main points of the flash report to give you a clear-cut, drawn-out version of the report.

Table of contents

- HDB resale prices increased by 0.3% in March 2024 compared to February 2024

- 2,063 HDB resale flats were transacted in March 2024

- The highest price for a resale flat in the month is achieved at S$1,450,000

- In March 2024, there are 61 HDB resale flats transacted for at least S$1,000,000

- Wrapping up

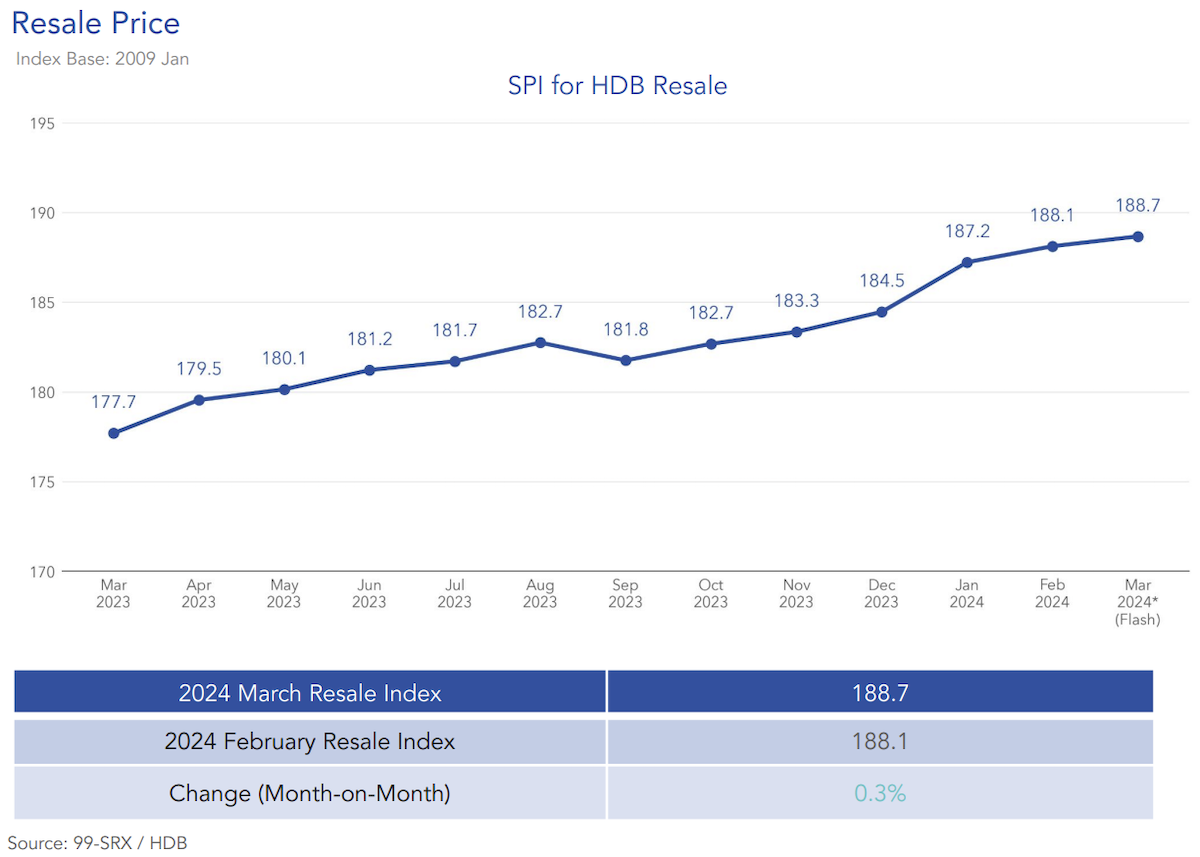

HDB resale prices increased by 0.3% in March 2024 compared to February 2024

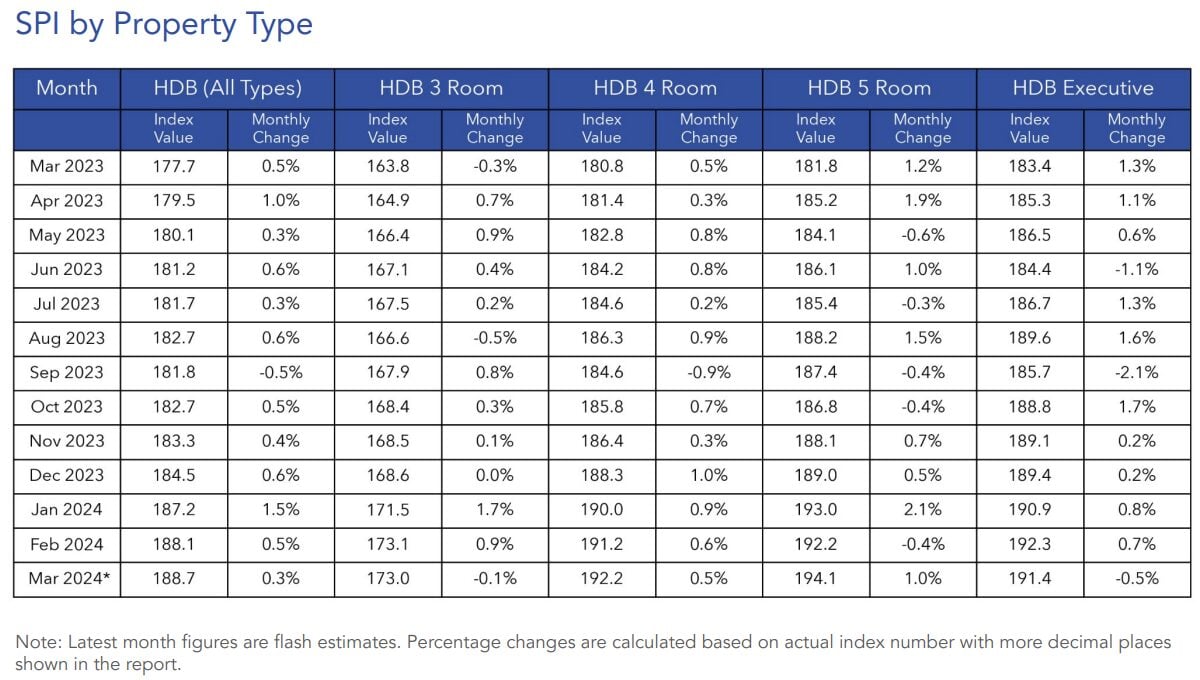

In March of 2024, HDB resale prices experienced a modest 0.3% increase in comparison to the previous month, February 2024. This growth was widespread, with both Mature and Non-Mature Estates seeing respective price increases of 0.5% and 0.6%.

Regarding the various kinds of HDB flats, the trends varied: 3-room flat prices saw a slight decrease of 0.1%, while 4-room and 5-room flat prices rose by 0.5% and 1.0%, respectively. However, Executive flat prices experienced a dip of 0.5%.

Read our cover for the HDB resale flat flash report for February 2024 here.

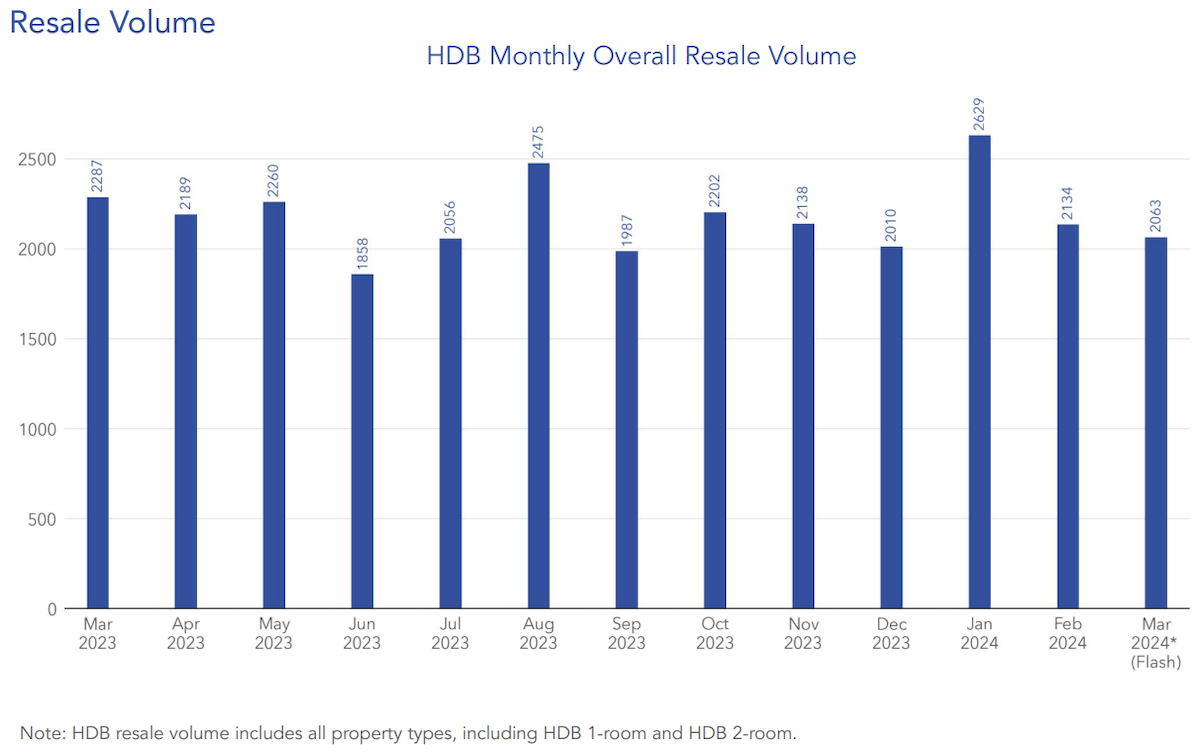

2,063 HDB resale flats were transacted in March 2024

The market experienced a slight dip in activity, with a total of 2,063 flats changing hands. This represents a 3.3% decrease in transactions compared to February of the same year. When looking at the market on a year-on-year basis, the resale volume was 9.8% lower than the previous year, indicating a noticeable slowdown in resale transactions.

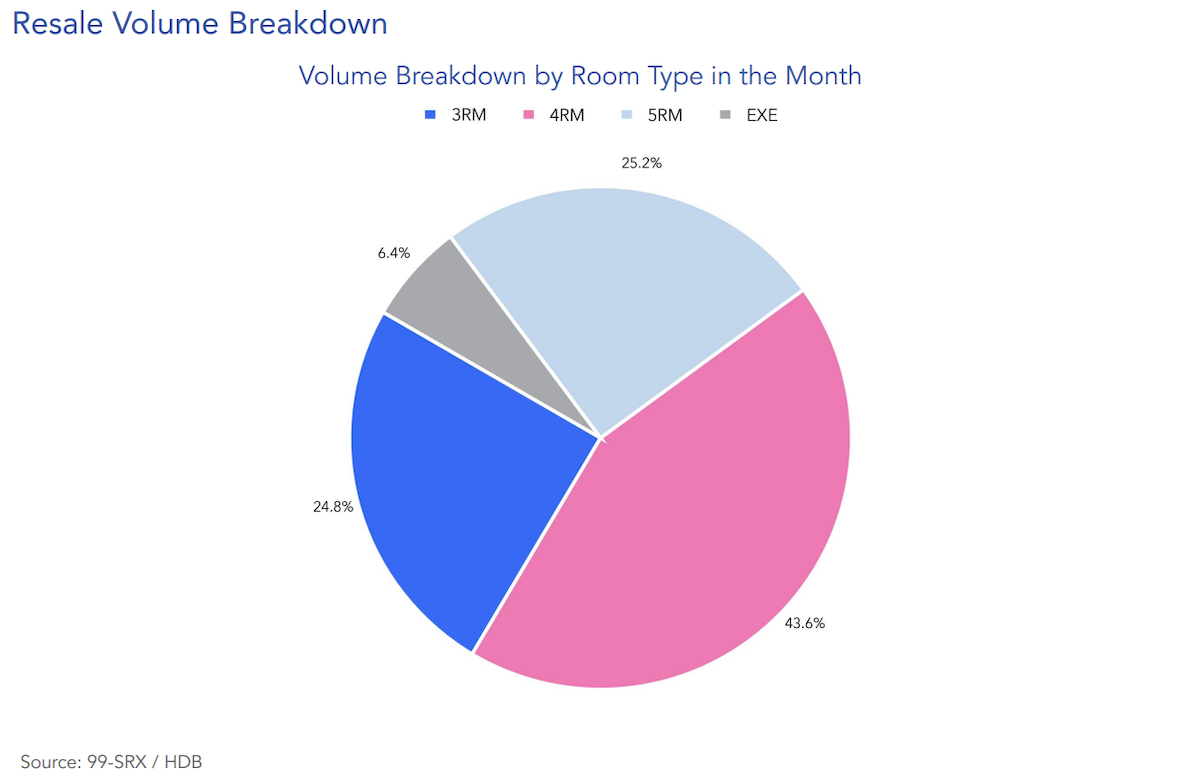

The sales were distributed across different flat types, with the majority being 4-room flats, accounting for 43.6% of the total transactions, followed by 5-room flats at 25.2%, and 3-room flats at 24.8%. Executive flats constituted the smallest share at 6.4%. This breakdown demonstrates the varied demand across different flat types within the resale market.

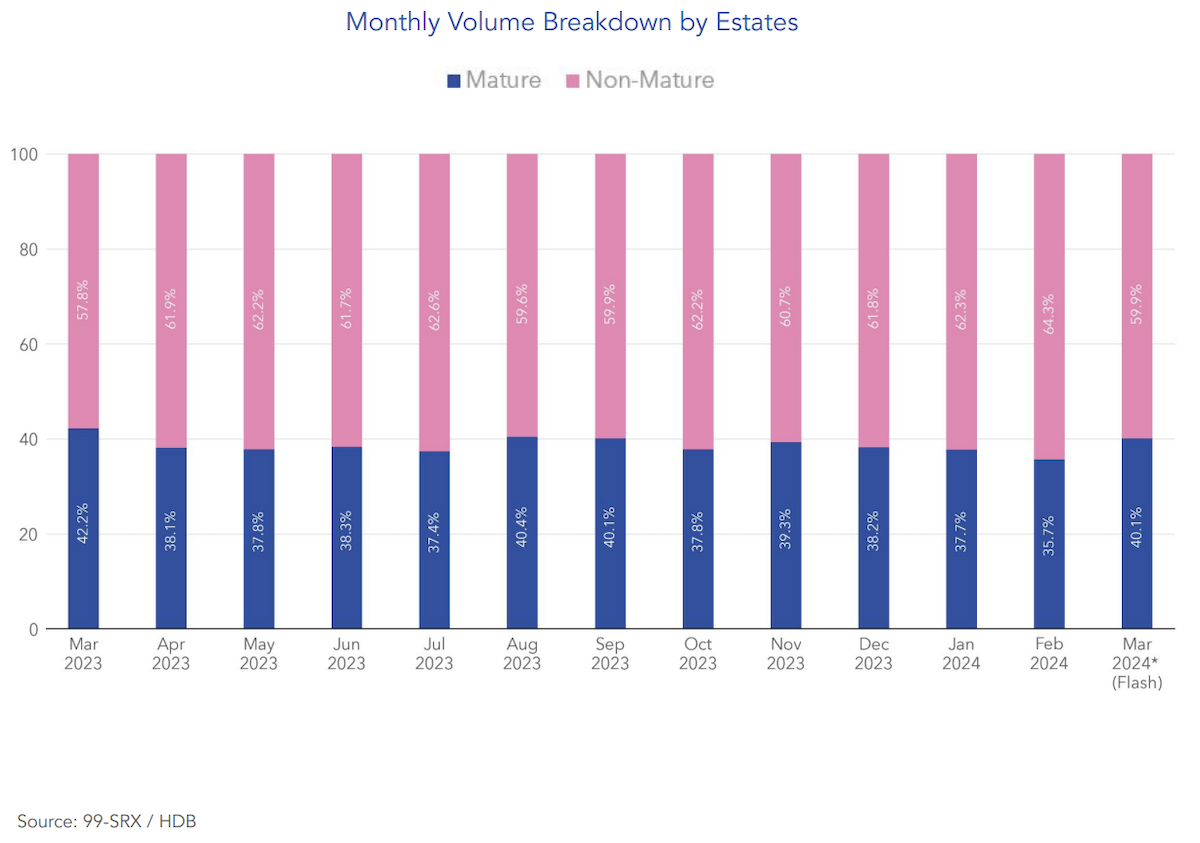

When examining the transactions by estate type, it’s evident that the majority of the resale activity in March 2024 occurred in Non-Mature Estates, accounting for 59.9% of the volume. The remaining 40.1% of transactions took place in Mature Estates. This distribution highlights the different dynamics at play in various parts of Singapore, with Non-Mature Estates seeing more resale activity than their Mature counterparts.

The highest transacted price for a resale flat in the month is achieved at $1,450,000

During the month, a notable transaction occurred in the HDB resale market, as a 5-room flat located at Boon Tiong Road sold for an impressive S$1,450,000. This highlights the significant value that prime properties can command.

Furthermore, an Executive apartment in Yishun Ave 4 achieved the highest price in the Non-Mature Estates category, selling for S$1,200,000. This transaction demonstrates that considerable demand and high valuations are not limited to flats in mature estates or central locations, but can also be found in the wider HDB resale market.

Read about the transaction here: Yishun HDB sold for S$1,200,000: An ATH benchmark in-the-making

In March 2024, there are 61 HDB resale flats transacted for at least $1,000,000

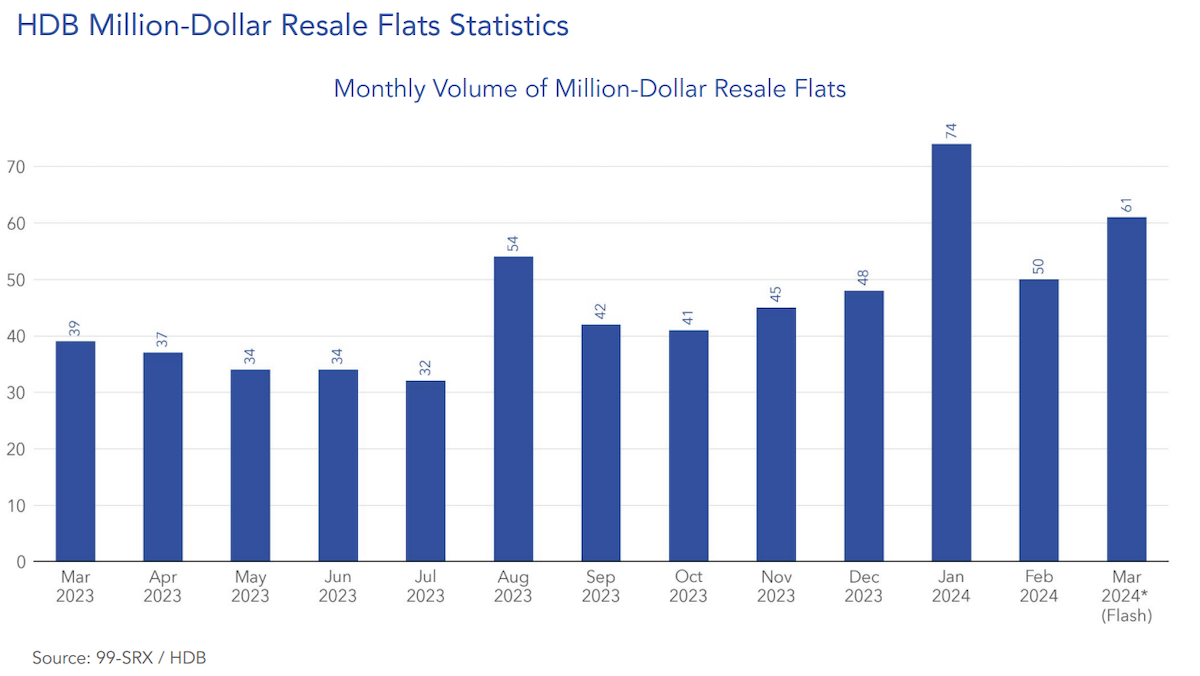

The HDB resale market experienced a noticeable surge in high-value transactions, with 61 flats sold for at least S$1,000,000 in March. This represents a significant increase from February 2024, when 50 such units were recorded, indicating an upward trend in the premium segment of the HDB resale market. These million-dollar sales accounted for 3.0% of the total resale volume for the month, suggesting a growing presence of high-value flats in the overall market landscape.

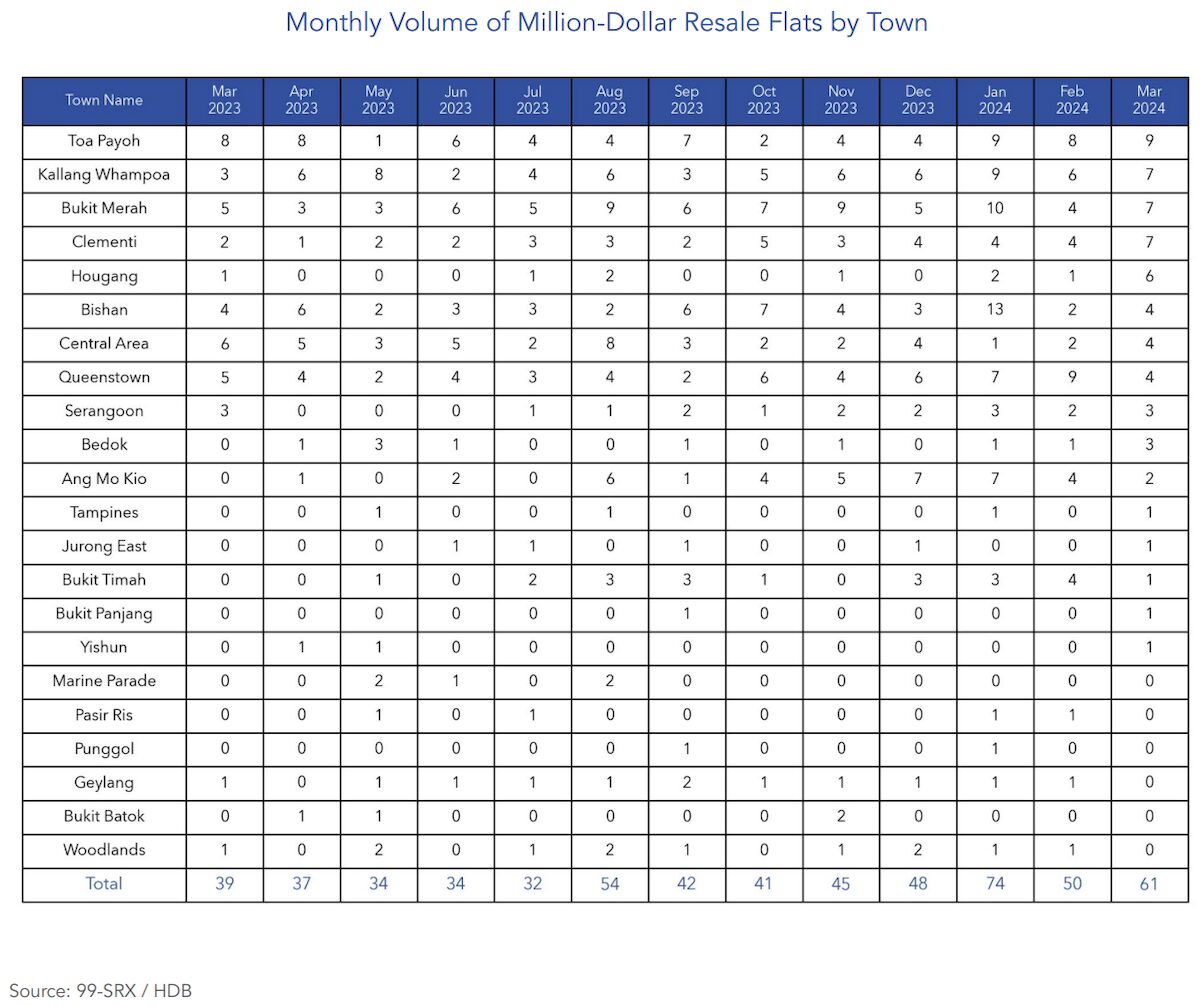

Toa Payoh emerged as the leading location for million-dollar flats in March, with nine units achieving or surpassing the million-dollar mark. Kallang/Whampoa, Bukit Merah, and Clementi followed closely behind, each recording seven such transactions. This distribution demonstrates the broad appeal of various neighbourhoods for buyers seeking premium HDB flats.

Read more about a recent ATH transaction in Toa Payoh here.

In addition, the remaining million-dollar flats sold during the month were dispersed across a diverse range of locations, including Hougang, Bishan, the Central Area, Queenstown, Serangoon, Bedok, Ang Mo Kio, Tampines, Jurong East, Bukit Timah, Bukit Panjang, and Yishun. This widespread geographical distribution highlights the fact that high-value HDB resale flats are not restricted to traditional prime areas but can be found across the island, reflecting the diverse appeal of Singapore’s various districts.

Wrapping up

Mr. Luqman and his Data team have compiled a comprehensive flash report on the HDB resale market, offering an insightful snapshot of its performance in March 2024. Despite a slight decrease in volume, the report highlights the market’s resilience with prices gradually increasing. This trend reflects Singapore’s ever-changing housing landscape and the enduring appeal of HDB flats.

As we analyse this report, we can discern several key insights – a moderate increase in overall resale prices, a decrease in transaction volume indicating a tighter market, and noteworthy high-value transactions that emphasize the premium some buyers are willing to pay for choice units in both mature and non-mature estates. The range of million-dollar flats across various estates is particularly striking, highlighting the diverse appeal and value found across Singapore.

<span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”><span data-mce-type=”bookmark” style=”display: inline-block; width: 0px; overflow: hidden; line-height: 0;” class=”mce_SELRES_start”></span></span>

This report not only captures the current state of the HDB resale market but also points to broader trends that could shape its future. The robust demand for premium units, alongside the market’s overall resilience, suggests that HDB flats remain a cornerstone of Singapore’s housing market. They offer a blend of affordability, community, and increasingly, luxury.

As the market continues to evolve, it will be fascinating to observe how these trends develop and what new patterns emerge. Prospective buyers and sellers can navigate the complexities of the HDB resale market with confidence by staying informed through detailed analyses like this one.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post HDB prices up slightly while volumes drop in March 2024 appeared first on .