In a recent article, we discussed how a recently MOP-ed HDB in Kallang witnessed a capital gain of S$500k. Building on this, the condo resale market is seemingly experiencing a surge in capital gains.

However, amidst this surge, a notable event unfolds – the first price drop in five months, signalling potential shifts in the real estate landscape.

Insights into January’s condo resale market trends

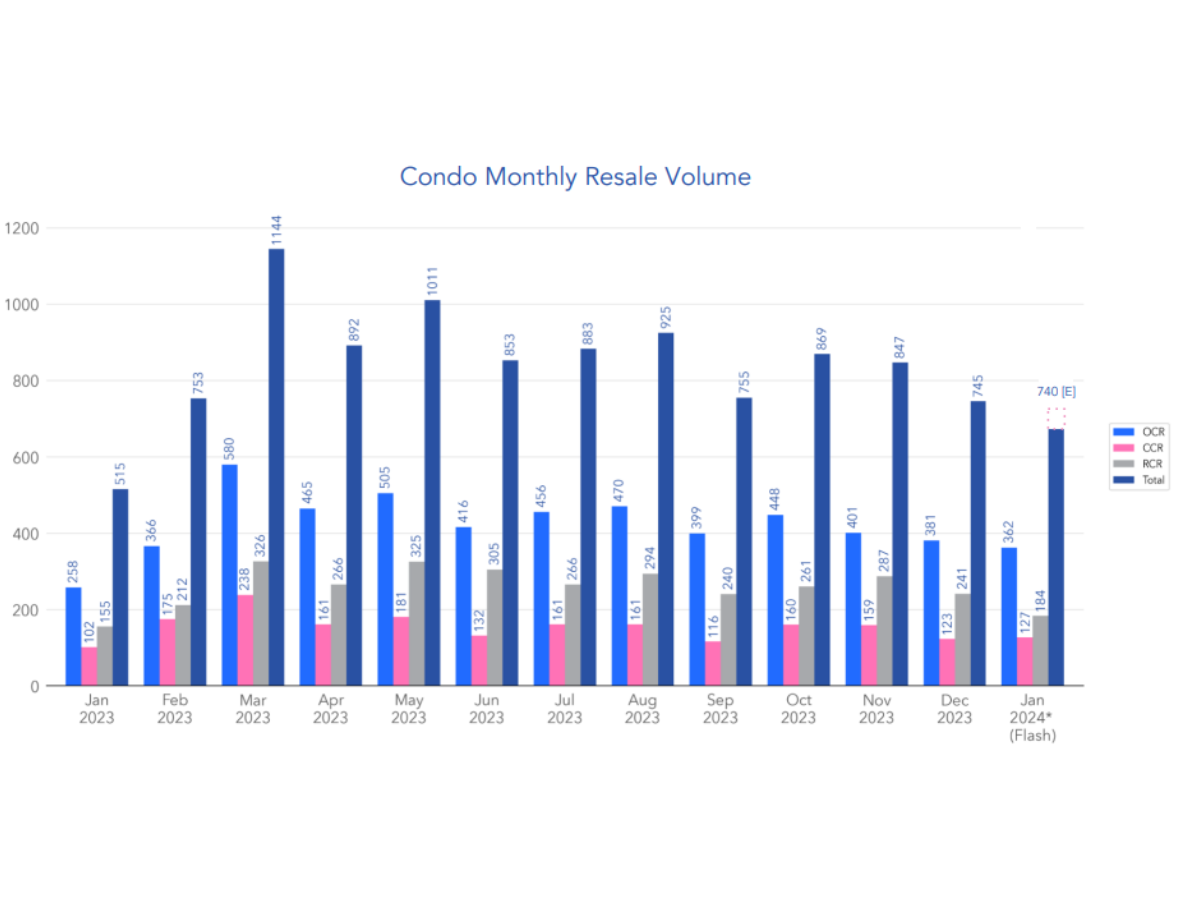

According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, January witnesses historically low condo resale volume, averaging 737 transactions over the past 5 years.

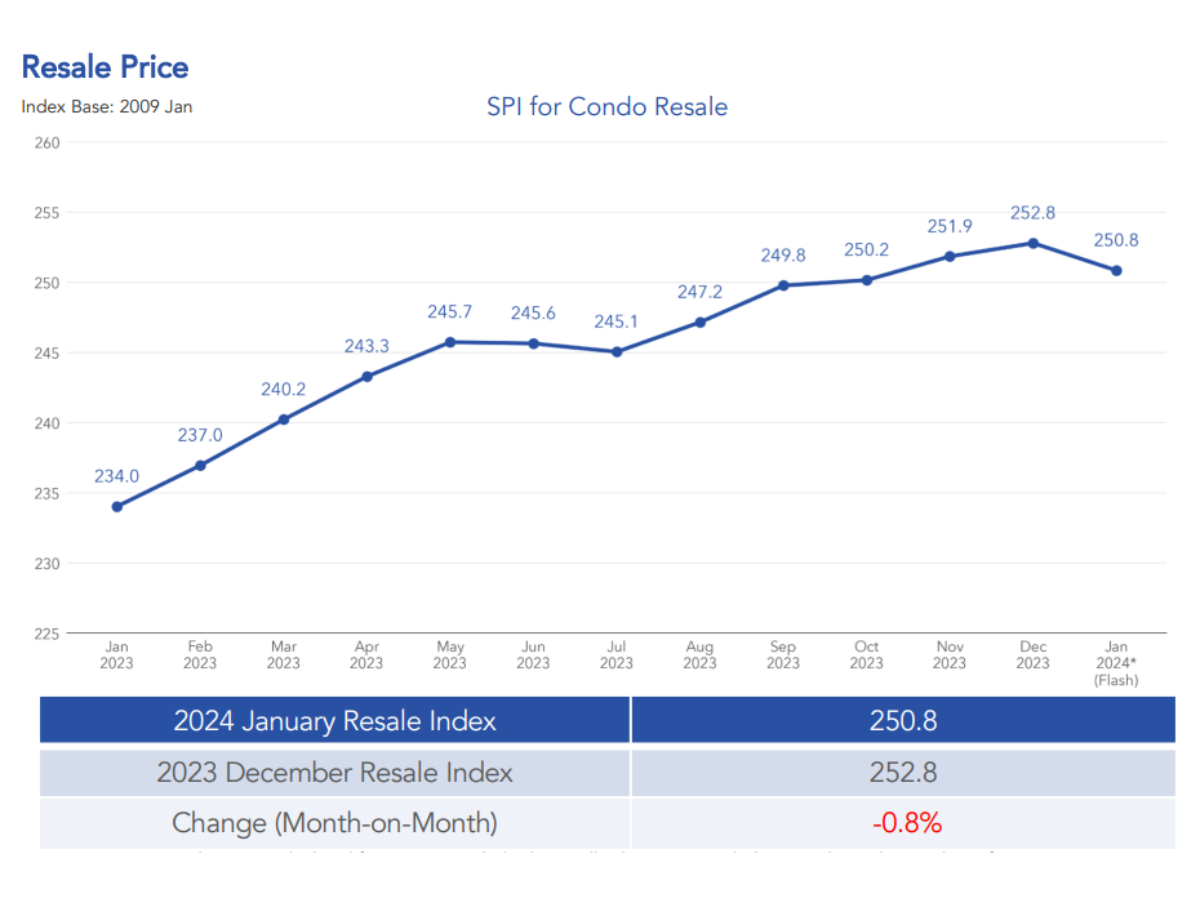

Interestingly, prices have dipped by 0.8% after five consecutive months of stability. This dip could be attributed to prospective buyers awaiting new launch developments such as The Arcady @ Boon Keng and Lumina Grand Executive Condominium.

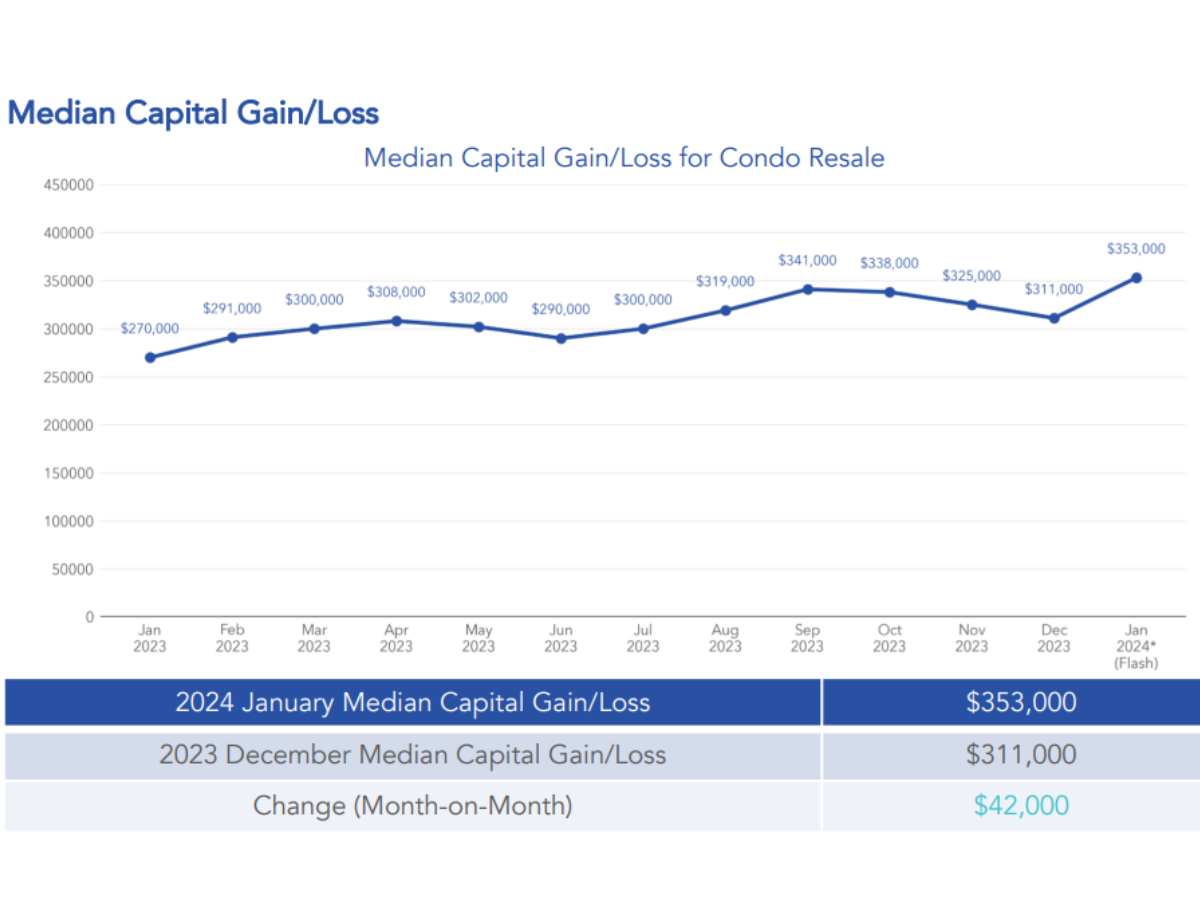

Despite the lower volume and price levels, median capital gains have surged by S$42k, indicating owners’ inclination to capitalise on the appreciating market.

This surge suggests an anticipation of a subdued condominium resale market in the months to come.

Interested in reading more on this trend? Head on over to our article here: Here’s why January had the lowest private home sales in 15 years

CCR and OCR prices increase, while RCR prices decrease

The SRX Price Index for condo resale reveals that CCR and OCR prices have seen an increase of 1.4% and 0.2%, respectively, in January 2024.

However, RCR prices have witnessed a decrease of 0.6% during the same period.

Exploring the idea of living near an MRT station? Check out our MRT directory for valuable insights and information to guide your decision.

Decrease in resale volume

In January 2024, an estimated 740 units were resold, marking a 0.6% decrease from December 2023. Despite this, volumes remain significantly higher compared to January 2023, with a 43.7% increase.

Notably, 53.8% of the volume comes from OCR, 27.3% from RCR, and 18.9% from CCR.

Highest transacted price

The highest transacted price for a resale unit in January was achieved at S$16,500,000 at The Ritz-Carlton Residences Singapore Cairnhill.

In RCR, Meyerhouse saw the highest transacted price at S$9,280,000, while in OCR, Grand Duchess At St Patrick’s recorded the highest transacted price at S$3,900,000.

Interested in taking a look at recently MOP-ed BTO projects? Dive into our article here: Full list of BTO projects hitting MOP in 2024/2025 & Our top picks near the MRT

Median capital gain and unlevered return

As mentioned, the overall median capital gain for resale condos in January 2024 is S$353,000, indicating an increase of S$42,000 from December 2023.

District 11 (Newton / Novena) posts the highest median capital gain at S$668,000, while District 1 (Boat Quay / Raffles Place / Marina) records the lowest at S$5,000.

Additionally, the overall median unlevered return for resale condos stands at 30.0% in January 2024. District 26 (Mandai / Upper Thomson) records the highest median unlevered return at 73.8%, while District 1 (Boat Quay / Raffles Place / Marina) sees the lowest at 2.4%.

Planning on selling your property? Let us connect you with a premium agent today.

The post Condo resale capital gains surge by S$42k; First price drop in 5 months appeared first on .