In the ever-evolving landscape of Singapore’s real estate, 2024 stands as a pivotal year with significant shifts in the Build-To-Order (BTO) strategy and a nuanced outlook on housing prices. These changes reflect the city-state’s ongoing efforts to adapt to both local demand and broader economic conditions, underscoring a period of strategic transition and economic responsiveness in its public housing policies.

New BTO strategy

Reduction in BTO sales exercises

The Housing and Development Board (HDB) has made a notable change for 2024, reducing the number of BTO sales exercises from the usual four to three. This decision, the first of its kind since 2015, marks a strategic shift aimed at optimising the allocation and availability of new housing units. It is a move that addresses both logistical challenges and the evolving needs of applicants.

Launch of 19,600 BTO flats

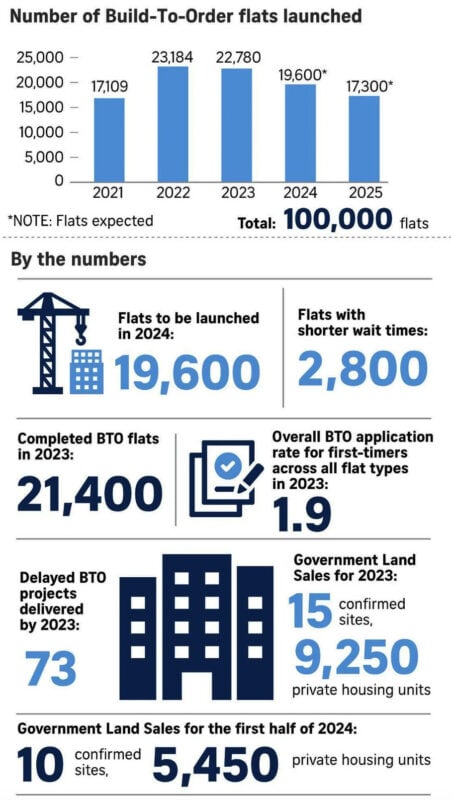

Amidst this restructuring, HDB plans to launch approximately 19,600 flats across the three sales exercises. This distribution allows for a more concentrated selection of housing options during each exercise, potentially enhancing the variety and appeal for prospective homeowners.

Shorter waiting time flats

Included in the 2024 launch plan are 2,800 flats that boast shorter waiting periods of less than three years. This feature aims to cater to the immediate housing needs of certain segments of the population, providing a quicker transition to homeownership.

New classification system

A significant change in 2024 will be the introduction of a new classification system for BTO flats, encompassing Prime, Plus, and Standard categories. This new system, taking effect from the October launch, is set to replace the existing mature and non-mature estate categories, offering a more nuanced classification that aligns with modern housing preferences and needs.

Additional reading: What the BTO classification changes would mean for first-time home buyers, parents, couples & singles

Implications of reduced BTO launches

Benefits for applicants

The shift to three launches per year is expected to offer several advantages to applicants. One key benefit is an increased choice of flats and locations in each launch. This change is anticipated to enhance the chances of applicants successfully securing a flat that aligns with their preferences and requirements.

Challenges and adjustments

While the reduction in the number of launches may initially appear to limit opportunities, it is intended to streamline the application process. With fewer launches, the overlap in application periods is reduced, thus alleviating some of the practical challenges faced by applicants in previous years.

Housing price outlook and economic context

Moderation in housing price increase

National Development Minister Desmond Lee has indicated that the increase in housing prices in Singapore, for both public and private sectors, is expected to moderate. This trend suggests a stabilising market, moving away from the steep price escalations seen in recent years.

Impact of mortgage rates

Amidst this changing landscape, mortgage rates are expected to remain at their current high levels, ranging between 3.7% and 4.4%. This persistence of high mortgage rates is likely to influence the decisions of both prospective buyers and current homeowners.

Global economic and geopolitical influences

External factors, including global economic slowdowns and geopolitical tensions, are playing a significant role in shaping the housing market. These influences are prompting a more cautious approach among Singaporeans, who are increasingly mindful of the broader economic environment in their housing decisions.

Government measures and future plans

Addressing supply-demand imbalance

In response to the evolving housing needs, the government has maintained its commitment to launching 100,000 BTO flats from 2021 to 2025. This initiative is a cornerstone of the strategy to balance the supply and demand in the housing market.

PLH model and resale market considerations

The implementation of the Prime Location Public Housing model has brought about changes in application rates and is influencing the dynamics of the resale market. This model is part of the broader efforts to ensure sustainable and equitable access to housing in prime locations.

Long-term goals and pandemic recovery

The government is also focused on recovering from the setbacks caused by the COVID-19 pandemic. This includes the completion of all pandemic-delayed projects by early 2025, an effort that underscores the commitment to meeting the housing needs of the population.

Conclusion

The upcoming year is set to be a defining period in Singapore’s housing market, characterised by thoughtful adjustments in the BTO strategy and a balanced outlook on housing prices. These developments reflect a careful balancing act between meeting immediate housing needs and planning for sustainable long-term growth in the city-state’s vibrant real estate sector.

The post Singapore’s new BTO strategy and housing market outlook for 2024 appeared first on .