In the expansive landscape of the Government Land Sales (GLS) programme for H1 2024, a total of 10 promising sites have emerged. This article is dedicated to unravelling the potential of residential sites that are poised to attract substantial demand from developers.

But first, here’s an overview of of what we’re working with:

GLS H1 2024 Confirmed List sites

On the Confirmed List, there are nine private residential sites, featuring one Executive Condominium (EC) site and one long-stay Serviced Apartments site.

Together, they have the potential to yield around 5,450 private residential units, including 710 EC units and 515 long-stay Serviced Apartments.

Additionally, these sites offer a commercial and residential blend, contributing 13,900 sqm GFA of commercial space across the 10 sites.

| Location | Site (ha) | Estimated no. of units, rooms, commercial space | Estimated launch date |

| Residential sites | |||

| Holland Drive | 1.23 | 680 | February 2024 |

| River Valley Green (Parcel A) | 0.93 | 380 | March 2024 |

| Canberra Crescent | 2.05 | 375 | April 2024 |

| De Souza Avenue | 1.92 | 355 | April 2024 |

| Jalan Loyang Besar (EC) | 2.84 | 710 | May 2024 |

| Margaret Drive | 0.95 | 460 | May 2024 |

| Media Circle | 0.57 | 515, with 400 sqm of commercial space | May 2024 |

| Dairy Farm Walk | 2.16 | 530 | June 2024 |

| Tengah Garden Avenue | 2.55 | 860, with 3,000 sqm of commercial space | June 2024 |

| Commercial and residential sites | |||

| Tampines Street 94 | 2.35 | 585, with 10,500 sqm of commercial space | June 2024 |

GLS H1 2023 Reserve List sites

The Reserve List introduces a variety of prospects with six private residential sites, two EC sites, and one site incorporating mandatory long-stay Serviced Apartments.

Further expanding the spectrum, there is one commercial site, one White site, and one hotel site.

These nine Reserve List sites have the potential to add 3,460 private residential units, 855 EC units, 220 long-stay Serviced Apartments, 93,850 sqm GFA of commercial space, and 530 hotel rooms.

| Location | Site (ha) | Estimated no. of units, rooms, commercial space | Estimated launch date |

| Residential sites | |||

| Lentor Gardens | 2.06 | 500 | Available |

| Senia Close (EC) | 1.01 | 295 | Available |

| Tampines Street 95 (EC) | 2.24 | 560 | Available |

| Zion Road (Parcel B) | 0.93 | 610 | Available |

| River Valley Green (Parcel B) | 1.17 | 575, with 500 sqm of commercial space | March 2024 |

| Bayshore Road | 0.98 | 480 | June 2024 |

| Commercial sites | |||

| Punggol Walk | 1.00 | 13,350 sqm of commercial space | Available |

| White sites | |||

| Woodlands Avenue 2 | 2.75 | 440, with 78,000 sqm of commercial space | Available |

| Hotel sites | |||

| River Valley Road | 1.02 | 530 with 2,000 sqm of commercial space | Available |

Not sure how to read the URA master plans? Read our article for an in depth guide here: URA Master Plan for property buyers: How to read and understand it

Prime locations set to ignite demand

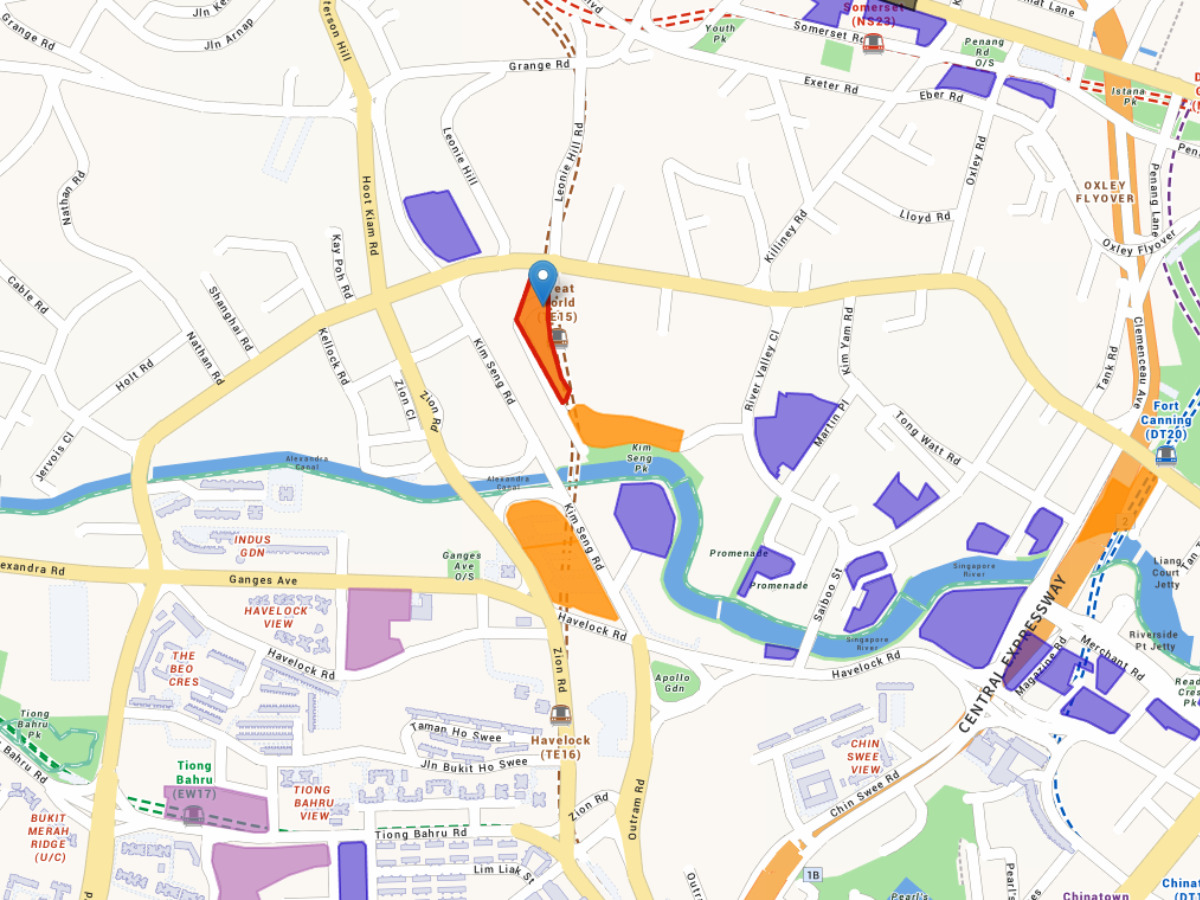

One standout site in the heart of River Valley, known as River Valley Green (Parcel A), is gearing up for a launch in March 2024. Strategically positioned near the Great World MRT station and the renowned Orchard shopping belt, it promises to be a sought-after development.

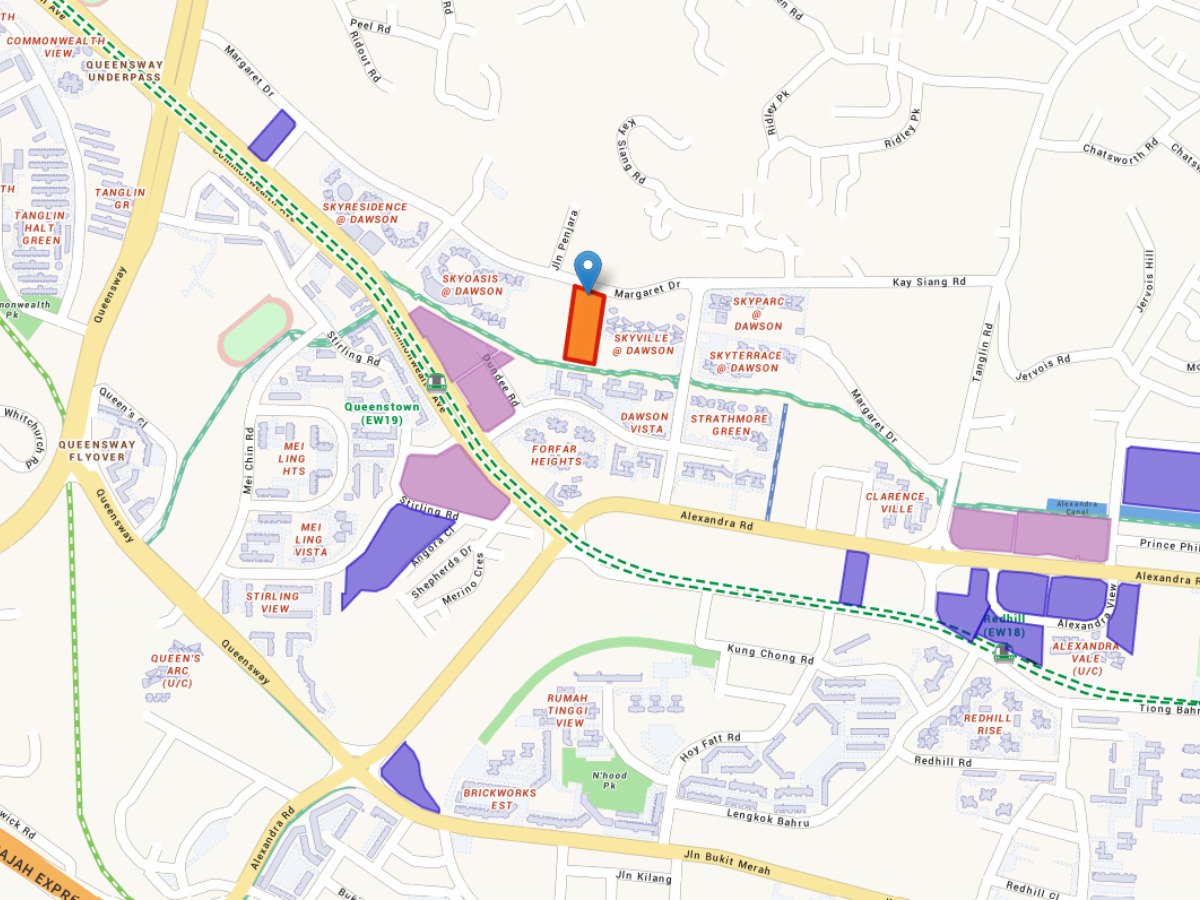

Another noteworthy location along Margaret Drive in Queenstown, expected to launch in May 2024, adds to the allure of the H1 2024 GLS programme.

More interested Holland Drive and De Souza Road land? Read our article here for a closer look: URA’s latest lands for sale: Holland Drive and De Souza Avenue (proximity to MRT and costs predictions)

Desirability of River Valley plot

Analysts are optimistic about the River Valley site, expecting strong interest owing to its central location and accessibility. Notably, previous condo launches in the vicinity, including CanningHill Piers, Riviere, and Irwell Hill Residences, have witnessed robust buyer interest.

But while the desirability of the River Valley plot is apparent, caution is advised due to its “rather longish and irregular shape.” Experts say that developers should be careful and think creatively when designing and developing projects on this site because of its unique characteristics.

Read more: Singapore’s new pilot for ‘long-stay’ serviced apartments

Margaret Drive parcel history

The Margaret Drive site makes historical strides as the first land sale in the area since 2017, which now holds Stirling Residences.

Positioned in the popular housing area of Queenstown, renowned for high Housing & Development Board (HDB) resale values, this parcel is expected to tap into the demand from upgraders.

Properties for you in Margaret Drive

Sole Executive Condo (EC) site

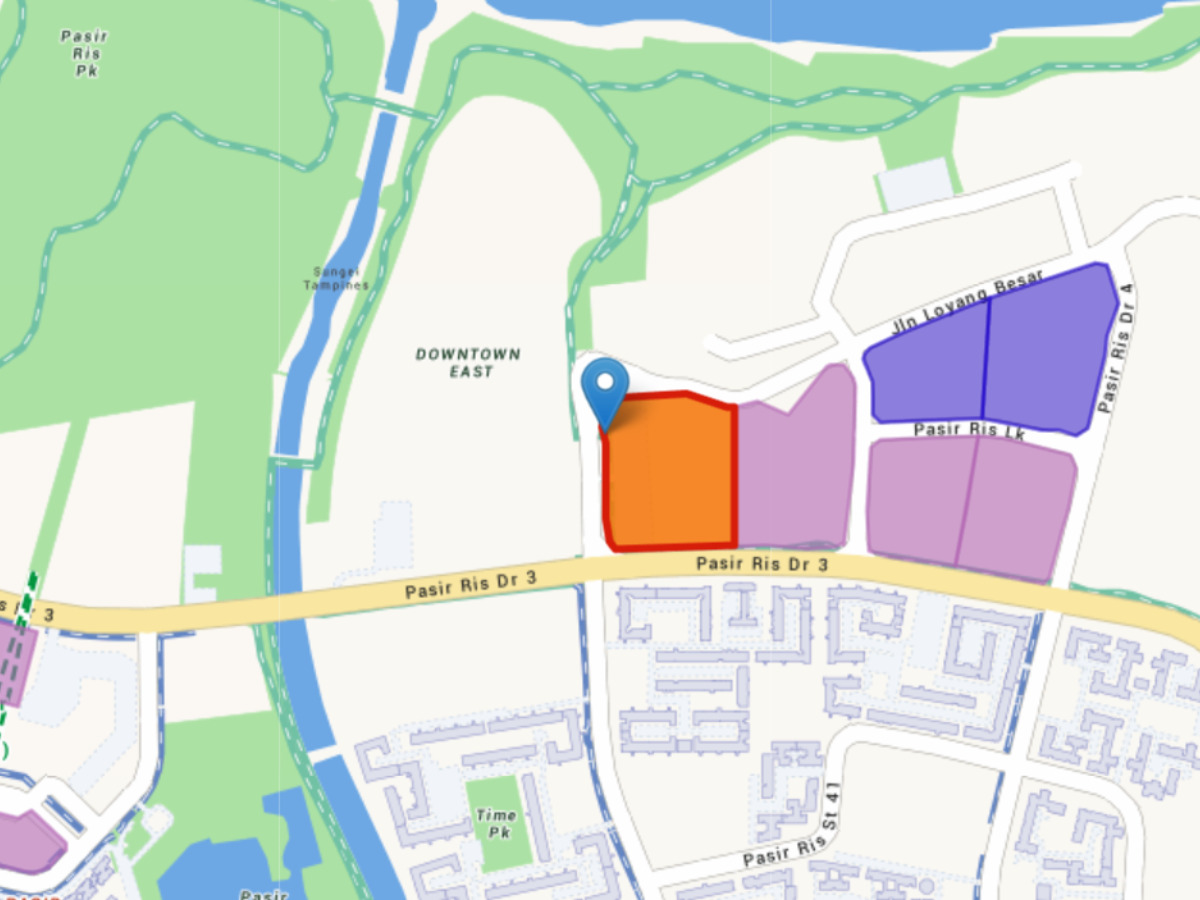

Jalan Loyang Besar introduces an exclusive EC site, slated for launch in May 2024. Situated within walking distance of Pasir Ris MRT interchange, this site holds the distinction of being the sole EC site on the confirmed list.

Anticipation runs high among developers, with industry observers predicting intense competition during the tender process in May 2024, given the site’s compelling value proposition.

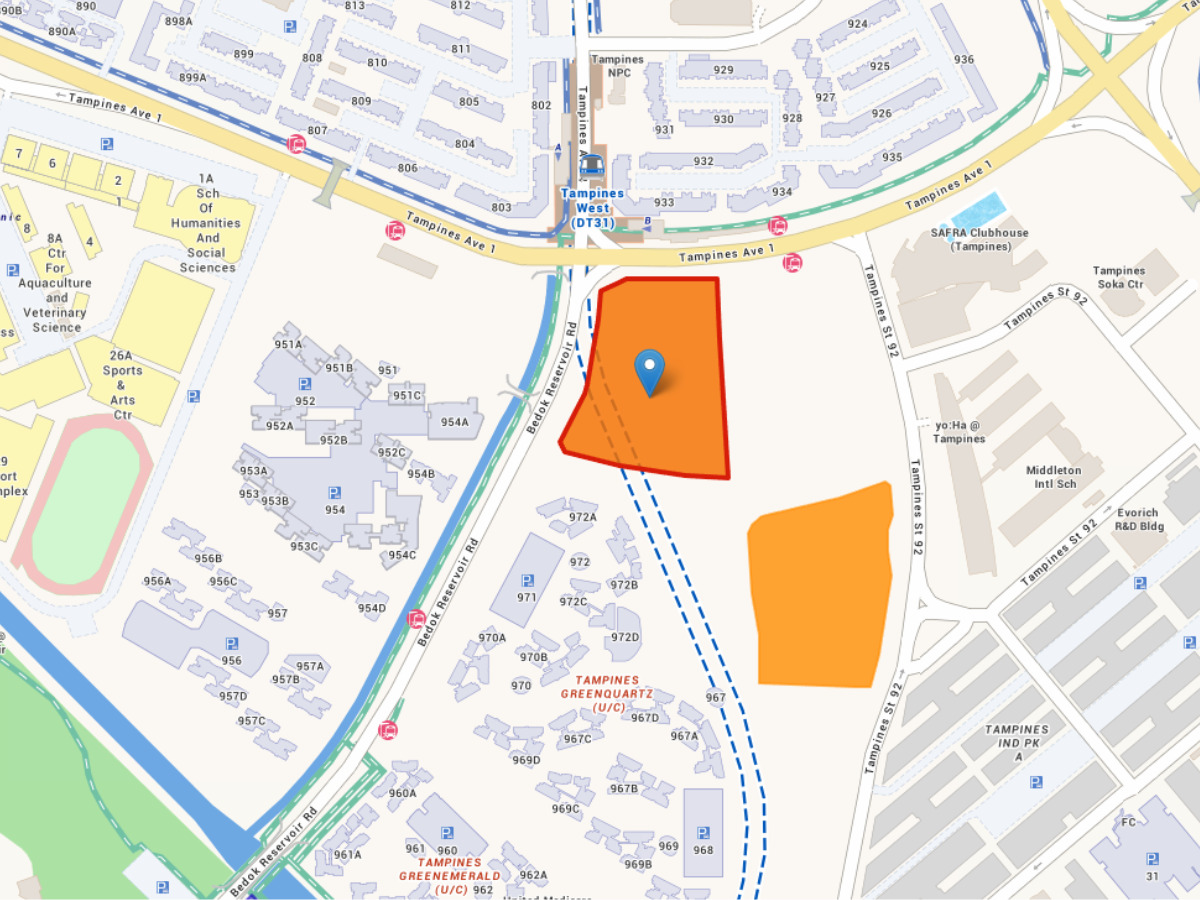

Tampines mixed-use development

A mixed-use development in Tampines Street 94, designated for long-stay serviced apartments, forms part of the confirmed list.

This site is poised to attract developers seeking exposure to heartland retail, potentially offering the only major mall within 800 metres for the growing residential community in the area.

Reserve list sites

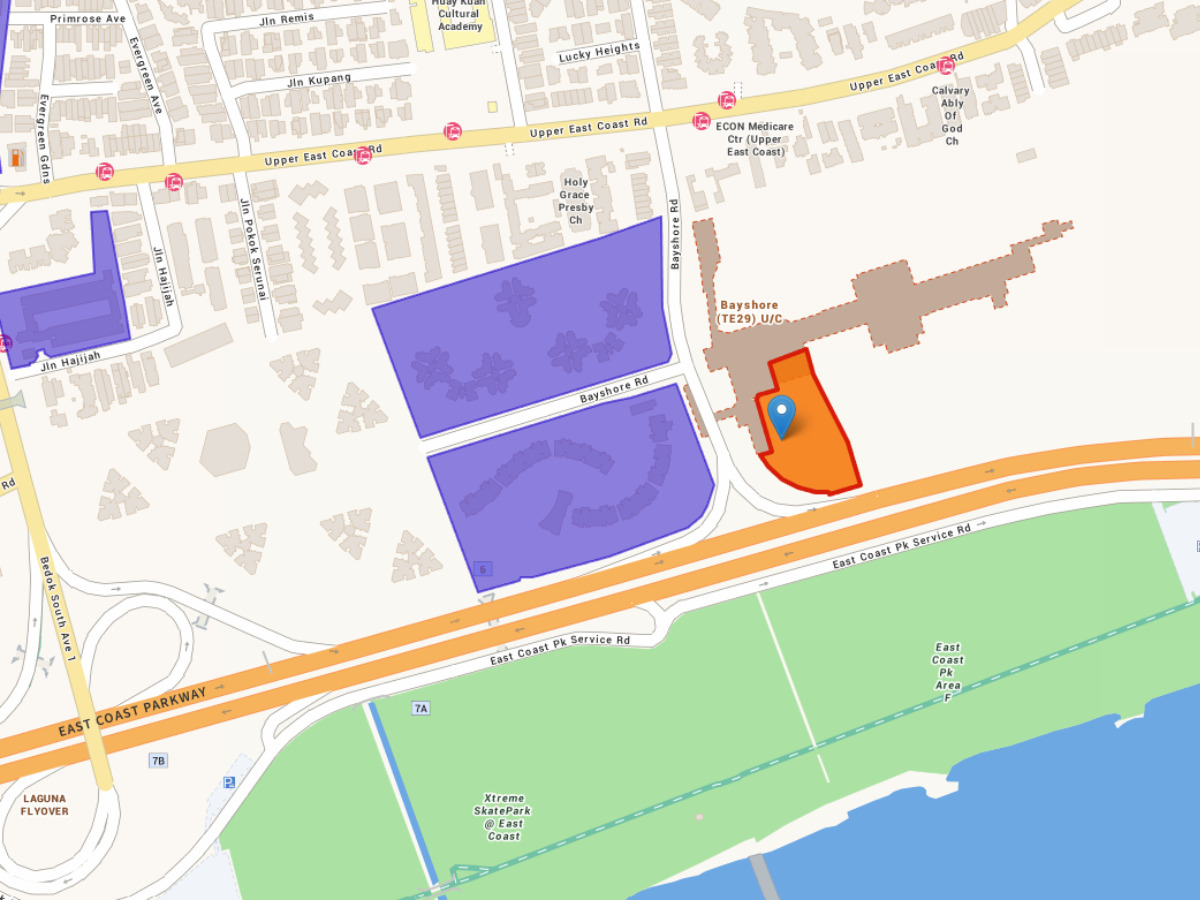

Two new sites have been added to the reserve list: one in River Valley Green (Parcel B) and the other in Bayshore Road. The Bayshore Road site marks a significant milestone because it’s the first time they’re selling land for private houses in that area.

As such, a lot of developers are likely to be interested in buying this land, and there will probably be strong competition for it. This is also because the land is close to East Coast Park and the upcoming Bayshore MRT station.

Read more: Bayshore BTOs to be launched for sale in H2 2024

But here’s something to keep in mind: the price for the Bayshore Road site might be higher because of the Long Island development happening off the eastern coast of Singapore. Analysts are also expecting the development to affect how the market competition shapes up in the future.

Read more: ‘Long Island’ land reclamation project set to expand East Coast by 800ha

Planning an upgrade for your next home? Which of these sites would you rather move to? Share your comments below or on our Facebook page.

The post GLS H1 2024: Prime residential sites for development opportunities appeared first on .