In a surprising turn of events, August 2023 has witnessed an unprecedented surge in million-dollar resale flat transactions in Singapore’s Housing and Development Board (HDB) market. According to our recently released flash report, this remarkable trend defies the overall market dynamics and expectations.

Let’s take a closer look at these numbers, what drove them, and what you can expect in the upcoming months.

Noteworthy mentions from 99-SRX media flash report

Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, shared his insights on this remarkable occurrence. “HDB Resale volume saw an increase of 20.3% between July and August, marking a second consecutive month of increase. Notably, year-on-year resale volume is also up by 6.4%,” he pointed out.

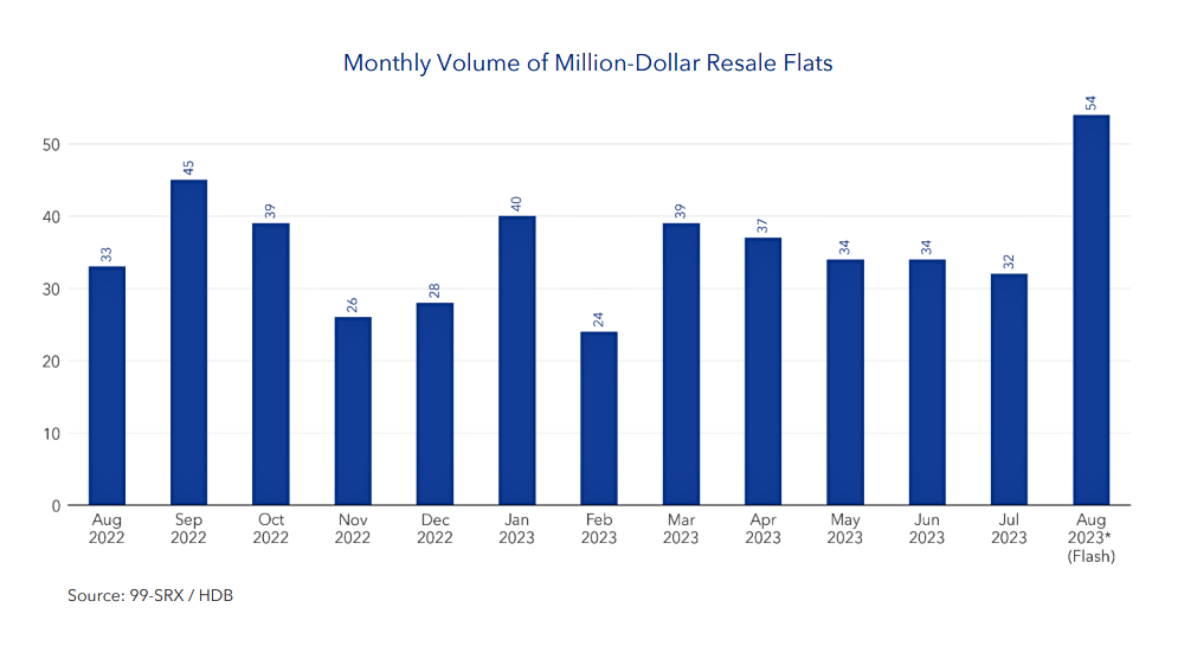

In addition to this, Mr. Hakim highlighted the significance of the 54 HDB flats transacting for a million dollars or more in August, which marks the highest number of million-dollar transactions to date. Impressively, 50 of these flats were situated in Mature estates. Mr. Hakim’s comments reinforce the observation that more buyers are willing to pay a premium when purchasing larger public HDBs in prime locations compared to more expensive private properties.

While the condo resale market has experienced a decline for two consecutive months, with data from the Condo Resale report for July supporting this trend, HDB resale prices continue to see a steady increase. In August, HDB resale prices saw a 0.6% increase, corresponding to a year-on-year increase of 7.2%. This suggests that property buyers may be opting for more reasonably priced HDBs in the current market compared to the high prices of condos.

Key data and statistics

Let’s further break down the key data and statistics from August 2023’s resale flat market:

HDB resale prices

- Overall, HDB resale prices increased by 0.6% in August 2023 compared to July 2023.

- Non-Mature Estates prices increased by 0.5%, while Mature Estates increased by 1.3% compared to July 2023.

- By room types, 3 Room prices decreased by 0.4%, 4 Room prices increased by 0.9%, 5 Room prices increased at 1.5%, while Executive prices increased by 1.6%.

Resale volume

Year-on-year, the overall price increase was 7.2% from August 2022, with all room types seeing increases over the same period.

- In August 2023, 2,473 HDB resale flats were transacted, representing a remarkable 20.3% increase from July 2023.

- Year-on-year, resale volume in August 2023 was 6.4% higher than the previous year.

- Breaking it down by room type, 44.6% of the volume came from HDB 4 Room, 22.8% from 5 Room, 26.3% from 3 Room, and 6.3% from Executive flats.

- In terms of estates, 59.7% of the resale volume in August 2023 came from Non-Mature Estates, with the remaining 40.3% from Mature Estates.

Here’s a summary of the information:

| HDB resale | Price increase (%) | Percentage of total volume |

| 3 Room | -0.4% | 26.3% |

| 4 Room | +0.9% | 44.6% |

| 5 Room | +1.5% | 22.8% |

| Executive | +1.6% | 6.3% |

| Non-Mature Estates | +0.5% | 59.7% |

| Mature Estates | +1.3% | 40.3% |

Highest transacted price

In August 2023, the highest transacted price for a resale flat was achieved at S$1,480,000 for a 5-Room unit at The Pinnacle@Duxton. In Non-Mature Estates, the highest transacted price was S$1,080,888 for an Executive Apartment at Woodlands St 81.

Read also: Pinnacle @ Duxton sees another record-breaking HDB resale at S$1.48M

Properties at The Pinnacle @ Duxton

4

2

3

2

2

2

3

2

1

1

2

2

4

2

5

6

2

1

1

1

Million-dollar resale flats

August 2023 saw a staggering 54 HDB resale flats transacted for at least S$1,000,000, representing a significant increase from July 2023, which recorded 32 such units.

This is also the highest volume of resale flats transacted for at least S$1,000,000 to date, comprising 2.2% of the total resale volumes for the month.

Notably, 50 of these million-dollar flats were located in Mature estates, reaffirming the trend that more buyers are willing to pay a premium for larger HDBs in prime locations as compared to more expensive private properties.

The table below provides a breakdown of the top estates with million-dollar resale flats, highlighting the diversity of locations where these notable transactions took place:

| Top estates with million resale flats | Number of units |

| Bukit Merah | 9 |

| Central Area | 8 |

| Ang Mo Kio | 6 |

| Kallang/ Whampoa | 6 |

The remainder of the million-dollar transactions were distributed across various estates, including Queenstown, Toa Payoh, Bukit Timah, Clementi, Bishan, Woodlands, Hougang, Marine Parade, Geylang, Tampines, and Serangoon.

Resale flats for you

-1

3

3

2

2

3

4

1

1

3

2

2

2

2

2

3

3

5

4

3

2

3

3

3

2

2

2

2

2

3

2

2

2

2

2

2

2

2

2

3

2

2

1

2

2

4

4

2

2

5

5

3

2

3

3

3

3

3

2

2

2

3

3

3

3

1

1

1

1

See all Bukit Merah >

1

1

2

2

4

5

2

2

6

6

1

1

1

1

2

2

2

2

4

4

1

1

1

1

3

3

1

1

1

1

2

2

3

3

0

1

2

2

1

1

4

4

1

1

1

1

4

4

1

1

2

1

4

5

3

2

3

2

3

2

2

2

1

1

3

2

1

1

2

2

See all Central Area >

3

2

3

3

3

2

3

2

3

2

2

2

3

2

2

2

3

2

5

5

4

4

2

2

4

2

2

2

5

3

2

2

3

2

2

2

2

2

3

2

-1

2

2

2

2

2

2

5

4

3

2

2

2

3

2

5

4

-1

3

2

2

1

-1

2

2

4

4

See all Ang Mo Kio >

Reasons behind the surge

Experts suggest several reasons behind this record-breaking surge:

- Hungry Ghost Festival: The seventh lunar month is considered inauspicious by some Chinese buyers, and this festival typically runs from August 16 to September 14. To avoid purchasing property during this period, some buyers may have expedited their purchases in the first half of August.

- HDB policy changes: The reclassification of housing types in the HDB resale market has resulted in more stringent resale conditions for prime location housing. This includes an extended minimum occupation period and a resale levy. Buyers looking to live in central areas may have rushed to purchase their units due to concerns that the supply of existing units in these locations will remain unchanged.

- Mid-Year holidays: The number of transactions climbed for a second consecutive month as buyers returned to the market after the mid-year holidays and more people obtained their HDB Flat Eligibility letters.

Read also: Spirited away: Singapore’s Hungry Ghost Festival and its impact on property and lifestyle

Future trends

According to experts in the field, it is anticipated that the demand for resale flats in mature estates will likely remain strong in the upcoming months. This trend is driven by buyers’ preferences for newer flats without resale restrictions.

Furthermore, experts suggest that there could be a notable increase in the number of million-dollar flat transactions throughout the year due to recent policy changes. However, this surge may level off once there is greater clarity surrounding the new policy adjustments.

Wrapping up

In conclusion, August 2023 has defied market expectations with an extraordinary surge in million-dollar resale flat transactions. This remarkable trend, accompanied by rising HDB resale prices, suggests a shifting preference among property buyers who are currently favouring reasonably priced HDBs over more expensive condominiums.

The combination of market dynamics, policy changes, and cultural factors has contributed to this record-breaking month in Singapore’s real estate market.

The post August 2023 sees record breaking surge in million-dollar resale flat transactions appeared first on .