When W (not her real name) bought her 3-bedroom, 104 sqm (1119 sqft) resale unit at Lakeside’s Park View Mansions in 2007, she paid in the range of S$200k-S$300k for it (declining to share the exact amount).

Little did she know, 16 years later, that she would be selling it for a significant sum of money in a collective sale.

After an en bloc attempt (2018-2019), Park View Mansions was finally sold for S$260m to a consortium in July 2022. W declined to share how much she got from the sale.

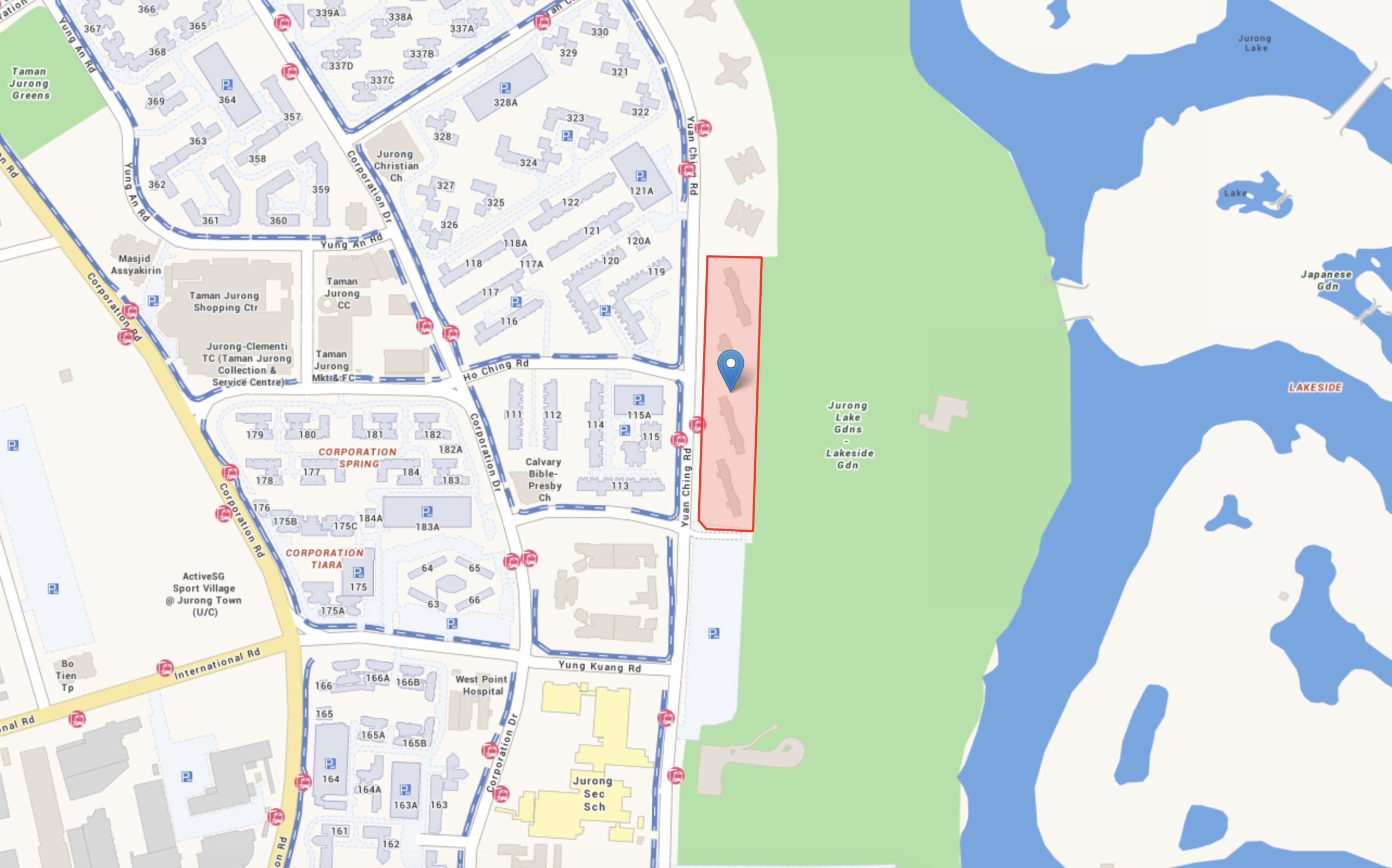

Located at 9A-9D Yuan Ching Road (near Taman Jurong), Park View Mansions was completed in 1976 and had 53 years left on its 99-year lease at the time of the sale. The development is next to Jurong Lake Gardens, and is about a 17-minute walk to Lakeside MRT station.

Park View Mansions collective sale

After the attempt in 2018, the 160-unit apartment-type development was finally sold to a consortium comprising of developers CEL Development, Sing-Haiyi Pearl and TK 189 Development.

On average, each unit would have gotten anywhere betweeen S$1.6m to S$1.7m (lower for smaller units) before deducting fees and costs.

Spanning 191,974 sqft (with a Gross Plot Ratio of 2.1), the site could potentially be redeveloped into a mid-sized development with a gross floor area of up to 403,141 sqft, or up to 440 units.

Latest: Park View Mansions will be redeveloped into a project named Sora – expect the new launch previews to either be in late 2023 or early 2024.

Waiting to move out

W (who declined to reveal her name and age, except that she’s somewhere in the “45-60 range”), currently lives on her own.

She still resides in the en bloc apartment when interviewed, and is currently waiting for the right time to move out. When asked how she was drawn to purchase her apartment initially, she shared that the price was reasonable at the time.

“It wasn’t so much of a strategy to pick a home with en bloc potential. It was near my office in the West and it was near the park, which I understand was unblocked, and it won’t be sold for development of any kind. Price was my main motivating factor, as well as size,” W said.

Was it the right time to sell?

“For me, I felt it was about time to do so. The apartment is getting old and dated. Too many issues with maintenance. Leakages everywhere. My bathroom concrete was spalling and stalactites were growing out of another area because of water leakage.

“It was also one of the reasons why the CSC (Collective Sale Committee) wanted to push ahead because our maintenance cost was increasing and residents would have to top up the sinking fund more often. I’m not sure about others, but I can see some were excited about becoming millionaires.”

Regarding the sale, W shared that she has no regrets.

“I certainly have many memories here, but nothing to miss really. I also don’t quite like some of my neighbours, but that’s another story…” When asked what she meant, she referenced an incident, which happened about eight years ago.

How the first en bloc process began

Anyway, W clarified that the collective sale moved into motion in 2018.

“It started many years back, even before COVID, sometime in January 2018. Then, the proposal was quite bullish, with an asking price of about S$318M.

“Even then, some of the residents wanted more, which I thought was crazy. As with most en bloc processes, there was some drama, and one particular SP (subsidiary proprietor) called the first meeting illegal as he accused the sale committee of not following ‘rules’ (eg. giving ample notice for EOGM, or Extra-Ordinary General Meeting), which they did of course.

“Most of the residents agreed to the sale, but it took a while to achieve the 80% quorum required,” W shared. On hindsight, she believes the first en bloc attempt failed mainly because the price was high.

“While the bid price then was lower than our reserved price, the developer(s) who bidded was interested and wanted to negotiate.

“It fell through because we were not ready. Expectations were way too high, and I felt that residents expected to make a windfall from the sale – seeing how others before turned many into instant millionaires.”

Negotiations with JTC

Another unexpected challenge owners had to navigate was with Jurong Town Council (JTC).

According to W, the privatised land (including land where Lakeside Tower and the former Lakeside Apartments reside) belongs to JTC. For the Park View Mansions collective sale, owners needed JTC to agree to the sale, extend the lease of the land and gross plot ratio.

Much to her surprise, JTC’s computation of differential premium was higher than the estimates provided by SLA. The CSC had to work hard to negotiate with JTC to ensure that the price would be fair for all parties. Sadly, it was also due to this uncertainty that negotiations with interested parties fell through.

“The CSC had to work hard to negotiate with JTC to ensure that residents’ earnings would not be eroded (and that JTC would be satisfied with the sale as well).”

Lessons from first failed en bloc attempt and heated discussions during COVID

After the first failed attempt, W recalled the Collective Sale Committee (CSC) regrouping and looking for alternatives. When COVID happened, they couldn’t do much then.

“Sometime during the pandemic, they wanted to get it going again in 2021.”

This time, the group held the meeting over Zoom.

“It was quite chaotic. Most of the residents here are quite old, and they have trouble getting Zoom to work properly. Furthermore, the sale committee had no experience conducting a Zoom Townhall as well.

“Everyone talked over each other. Some residents were not happy with the price, arguing over the fact that residents with smaller units are getting more $/psf over larger units. I mean, if you buy a small unit in the market, their psf price is always higher than a larger unit, right?

“Anyway, the committee brought in an expert valuer to give his opinion and assessment – someone with a lot of experience in the industry.

“People were still unhappy and wanted a ‘second opinion’. Whatever it was, residents with larger units do walk away with higher earnings, but greed is greed and they wanted more.”

W also shared that the many of the owners of Park View Mansions were not owner-occupiers, with some being out of the country.

“Because of that, it took us a long time… months to get the required 80%. However, once we passed the threshold, we went ahead to market the sale.

“Our marketing partner worked with residents who had questions, and I saw them a couple of times going around the apartment talking to residents who have yet to sign.”

Tender close and final negotiations

W shared that the tender closed in end of July 2021. There were a couple of bids and last minute back-and-forth negotiations, which went late into the night.

“Thank goodness we managed to settle on an agreement, with some amendments to the contract clauses.

“After that, we proceeded to carry on and accept the bid. There were more back-and-forth with residents and it was off to the Strata Title Board to get the approval, because we did not get 100% of signatures from residents.

“Yet again, there was one final hiccup. There was one objection from one greedy owner – asking for more, what else? So we hit another roadblock there, but the CSC negotiated with the owner and managed to get it settled out of court.

“Personally, it would have been silly to go to the High Court over that. Anyway, once that was settled, it was more about following the timeline.”

W shared that the mass signing of the property transfer was done on 23 June 2023, and unit owners collected their first payment on 29 June 2023. The first tranche of payment was for 95% of the purchase price. After vacating the unit, they will receive the remaining 5%. Some sole proprietors have already moved out, so they’ve received 100% of the payment on 29 June.

“Under the agreement, we can live here rent-free for 6 months while we find a place but we absolutely have to vacate by 28 Jan 2024. Failure to do so will incur massive costs, on a daily basis. Something to the tune of S$8k per day.”

–

–

Sourcing for an alternative place to stay

When asked if W has found an alternative place to stay, she shared that she is unable to buy a HDB flat because of the 15-month rule.

This is part of the September 2022 cooling measures, where anyone who has recently sold a private property (including in an en bloc sale), have to wait at least 15 months before they’re able to buy a HDB resale flat.

“I can’t buy from HDB, because of the new 15-month rule. It sucks because what I got from the sale isn’t enough to buy a resale condo of the same size, unless it is in some ulu (remote) area.

“For now, I have no immediate housing plans yet, because I feel that prices are way over-inflated. I’m just going to stay on until I have to move out and likely rent somewhere.

“Maybe if I’m lucky, I can find a private apartment somewhere at the right price. Otherwise, I’ll have to wait 15 months. FYI: The 15 months start from the day the sale is completed, which is the day I collected my cheque.”

Advice for other residents undergoing or hopeful for a collective sale

“Don’t be greedy. Know your property’s true value and don’t be led by marketing agents that promise you the sky. Ultimately, developers need to make money out of the land too, so you’ll have to factor in redevelopment costs and all that. If you have greedy owners, most likely the collective sale would fail.”

Any views, thoughts, and opinions expressed by W are solely W’s and do not reflect the views, opinions, policies of 99.co.

–

Looking to sell your house to buy a new one? Let us help you by connecting you with a property agent.

If you found this article helpful, 99.co recommends Which ECs have transacted for less than S$1 million in 2023 so far? and Is there an optimal holding period to maximise capital gains? We look at resale EC transactions in June 2023.

The post Owner shares experience after selling 104-sqm apartment in collective sale (en bloc) appeared first on .