We’ve been covering monthly condo gains and losses for the past few months. Last month, we found that condo units that earned at least a 200% gain in April 2023 were held for at least 15 years. On the other hand, 32 condo units were sold at a loss in the same month.

Last week, we focused on the capital gains of executive condo units that were sold on the resale market in May 2023.

Today, we’ll be looking at the profitable condo transactions last month. We’ll also do an article on the condo units that made a loss in the coming days, so stay tuned for that.

(Shout out to the data team at 99.co, who have helped us match the latest and previous transactions of the same units to calculate the capital gains and losses of the respective units. Other costs, such as stamp duty, legal fees and agent’s commissions, are not taken into account.)

Condos sold in May 2023 made a profit averaging S$470k

Based on URA data captured as of 21 June 2023, there were 820 condo units resold last month that made a capital gain, averaging around S$470,000.

Interestingly, this is around the same average capital gain made by ECs that were resold in the same month. (Based on URA data captured as of 21 June 2023, the average capital gain made by ECs was around S$473,000.)

But when we look closer at the capital gains of last month’s profitable transactions, the capital gains are more varied.

For instance, the highest capital gain recorded in May 2023 is a whopping S$7,046,101 for a 2,885 sqft unit at Ardmore Park. Bought in July 1996 for S$5,853,899, the unit was sold 27 years later for S$12.9 million last month. This works out to a capital gain of 120% and an annualised gain of 2.97%.

In recent years, the development is best known for its resident celebrity. Back in April 2020 (when Singapore had just started Circuit Breaker), Vicki Zhao and her husband bought a penthouse at Ardmore Park for nearly S$28 million!

Read more: Inside the $28 million penthouse that Vicki Zhao’s husband, Huang Youlong, bought.

Meanwhile, at the other end of the spectrum, the lowest profit recorded last month was S$1,100 for a 398 sqft unit at Oceanfront Suites. The owner(s) had bought it around 10 years ago in June 2013 for S$608,900, before selling it at S$610,000 last month. This also means that the owners had only made a 0.2% capital gain (or an annualised gain of 0.02%).

Top 10 gains made by condos in May 2023 (by quantum)

| Condo name | Region | District | Size (sqft) | Purchase price and date | Sale price and date | Capital gain | Years held | Annualised gain |

| Ardmore Park | CCR | 10 | 2,885 | S$5.85m

Jul 1996 |

S$12.9m

May 2023 |

S$7.05m

120% |

27 | 2.97% |

| Grange Residences | CCR | 10 | 2,669 | S$3.3m

Apr 2004 |

S$8.88m

May 2023 |

S$5.58m

169% |

19 | 5.35% |

| Yong An Park | CCR | 9 | 7,719 | S$9.58m

Feb 2008 |

S$14.1m

May 2023 |

S$4.5m

47.0% |

15 | 2.60% |

| Scotts Highpark | CCR | 9 | 4,112 | S$8.69m

Jan 2007 |

S$12.7m

May 2023 |

S$3.99m

45.9% |

16 | 2.39% |

| New Futura | CCR | 9 | 2,691 | S$9.13m

Jan 2018 |

$12.5m

May 2023 |

S$3.37m

36.8% |

5 | 6.47% |

| Casa Esperanza | RCR | 21 | 2,109 | S$1.2m

Aug 2006 |

S$3.7m

May 2023 |

S$2.5m

208% |

17 | 6.85% |

| Pandan Valley | RCR | 21 | 2,325 | S$1.05m

Sep 2002 |

S$3.35m

May 2023 |

S$2.3m

219% |

21 | 5.68% |

| Clementi Park | OCR | 21 | 1,959 | S$1.05m

Mar 2000 |

S$3.18m

May 2023 |

S$2.13m

203% |

23 | 4.94% |

| Aspen Heights | CCR | 9 | 1,335 | S$895k

Nov 1998 |

S$2.96m

May 2023 |

S$2.07m

231% |

25 | 4.90% |

| The Blossomvale | RCR | 21 | 1,367 | S$898k

Jan 2007 |

S$2.95m

May 2023 |

S$2.05m

229% |

16 | 7.72% |

Figures (except floor area) in the table are rounded off to 3 significant figures.

Resale condos for sale

4

4

2

2

3

4

1

1

3

2

4

4

2

3

3

2

2

2

1

1

3

2

4

5

3

3

1

1

3

3

2

2

3

2

4

4

4

3

4

3

4

3

2

2

3

2

3

4

2

2

1

1

2

2

4

4

3

3

2

1

4

4

2

2

3

4

4

4

1

1

See all District 9 >

4

5

4

4

1

1

3

3

3

2

2

2

4

4

4

4

4

4

1

1

3

3

1

1

1

1

2

2

2

2

2

2

3

3

2

2

5

5

4

4

3

4

2

2

7

7

4

3

4

5

3

4

2

1

2

2

5

5

4

4

3

2

4

6

4

4

4

5

2

2

See all District 10 >

2

2

1

1

3

2

3

3

2

2

2

2

3

3

4

3

2

2

2

2

3

2

3

2

1

1

3

3

3

3

0

0

2

1

3

3

0

1

3

2

3

3

2

2

2

2

2

2

3

3

2

2

3

3

3

3

3

3

2

1

2

2

2

1

1

1

2

3

2

See all District 21 >

40% of the top 10 condo gainers came from District 21

60% of the top 10 condo gainers came from the Core Central Region (CCR). In fact, when we look closer at the data, the top five condo gainers were all from the CCR.

Specifically, these CCR units are located in District 9 and District 10, which are traditionally the prime areas in Singapore. Factors such as proximity to the city centre help support the price growth in these districts.

Nevertheless, there’s still some opportunity for homeowners to earn a high capital gain outside the CCR.

Among the top 10 condo gainers last month, three units are located in the Rest of Central Region (RCR), while one is in the Outside Central Region (OCR).

But we should note that these four units are all located in District 21, which is at the north-west of Bukit Timah.

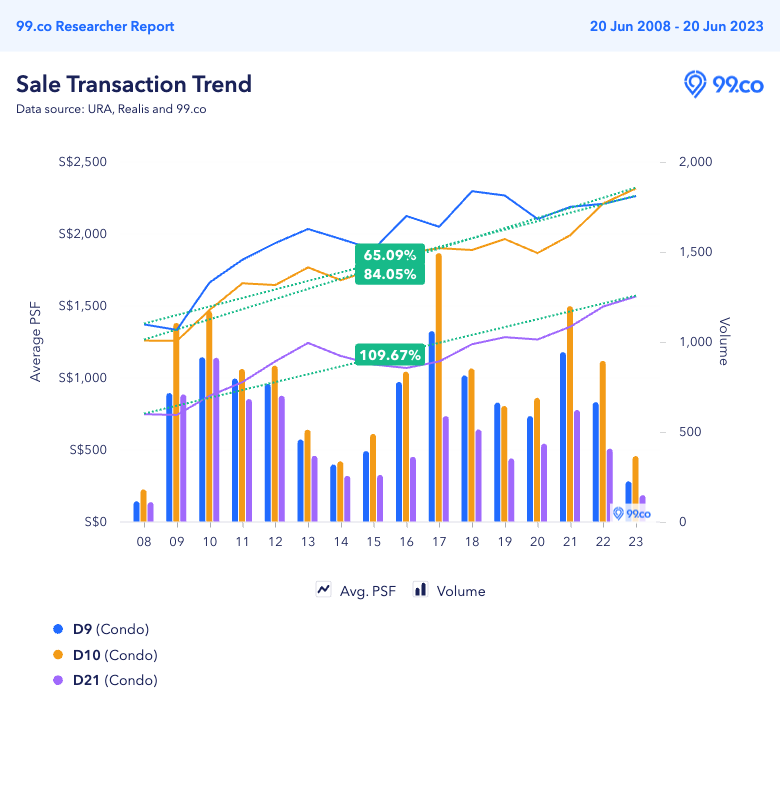

When we compare the price trends of resale condos in these three districts, we find that District 21 has seen the highest appreciation in the last 15 years at 109.67%. This is followed by District 10 at 84.05% and District 9 at 65.09%.

90% of the top 10 condo gainers were held for at least 15 years

Given the long holding period of most of these units, they were most probably bought for owner-occupation instead of property investment. The huge size of the units (at least 1,300 sqft) signals this as well.

The only exception is the New Futura unit, which was sold after five years and made a capital gain of S$3,365,200.

With its District 9 location (to be more specific, it’s in River Valley), the unit was likely bought with property investment in mind.

For starters, it’s within walking distance of two MRT stations: Somerset MRT and Great World MRT. In particular, the latter was only opened in late 2022 as part of Stage 3 of the Thomson-East Coast Line. The increased connectivity in the area has made nearby condos such as New Futura more attractive to potential home buyers.

Planning to sell your condo soon? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends List of properties within 1km of Nanyang Primary School and Resale condos with dual-key units that are 3-bedroom and bigger.

The post Ardmore Park unit made S$7.05m profit; highest capital gain for resale condos in May 2023 appeared first on .