Once in a while, 99.co picks a piece of property jargon to demystify. Today we look at the term “fire sale”.

What is a fire sale?

The term “fire sale” used to refer to the sale of goods damaged by fire. After someone’s house burned down, for example, they’d usually sell off any partially surviving furniture at steep discounts.

But today, fire sale is a common term used in many industries including property. A fire sale refers to an urgent sale, often at a steep discount, by a distressed seller.

Common situations that cause fire sales are:

- A property owner is unable to service the mortgage beyond the next month (or even shorter)

- Someone is about to be declared bankrupt, and urgently needs to sell the property to prevent this

- The seller is facing some kind of litigation or divorce proceedings, and need to liquidate fast

- The property owner foresees the unit is going to be a major liability (e.g. an expensive luxury unit that can’t be rented out for some reason) and wants to minimise losses by getting rid of it quickly, rather than waiting for a better price

One example of a fire sale was in 2020, when Actress Hong Ling snagged a freehold Balestier condo in a fire sale.

Where to find fire sales?

Auctions

The most common source of fire sales is mortgagee sales. This is when a bank forecloses on a property, and auctions it off.

But there are also auctions that are initiated by the property owners. One common reason for an owner-auction is due to divorce, when the law may compel someone to sell their property.

Several real estate agencies, such as Knight Frank, JLL, Edmund Tie @ Co and Colliers, conduct these auctions. But note that not all properties at auctions are mortgagee sales, nor are they necessarily fire sales.

Unlike many other countries, Singapore doesn’t require any pre-registration to attend these auctions and scout for fire sales. You can just walk in to attend them.

Auction times will usually be announced on the various real estate agencies’ websites, so check regularly if you’re seeking a fire sale. In most cases, you will have one to two weeks to view the properties before they go under the hammer.

Note that, at these auctions, a successful bid can require you to put down up to 10% of the purchase price on the spot. Make sure you have cash prepared before you go.

Also, make sure that you meet all the requirements to own the property. For instance, if you’re a foreigner, you can’t buy an HDB flat or a landed home (except those in Sentosa Cove).

Read more: 6-step guide to buying a property on mortgagee sale.

Property portals

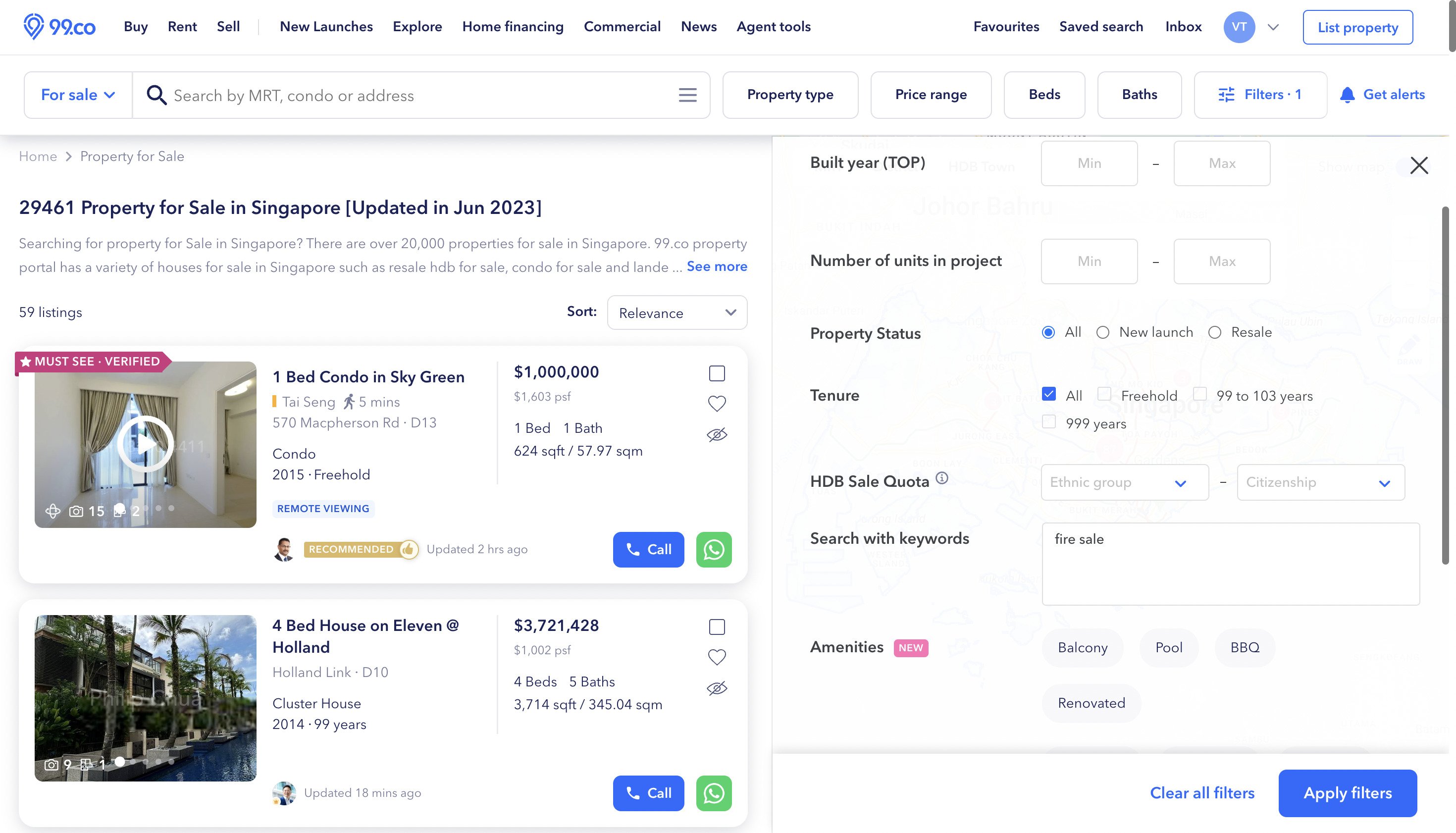

Another way of finding fire sales is to go on a property portal such as 99.co.

Click the Filters button and enter keywords such as “fire sale”, “mortgagee sale” and “bank sale”, and you’ll get listings of urgent sales with discounts.

You can then contact the agent through the listing to arrange a viewing.

Private contracts and fire sales

A fair number of fire sales end up being bought through private contracts. This is when a buyer and seller agree on their own terms, and a law firm is hired to be the third party.

For example, rather than use a bank, the buyer could sign a contract promising to pay the seller a certain amount per month. In return, the seller agrees to transfer ownership to the buyer, with all the usual costs and paperwork it may entail.

A buyer may resort to this kind of contract if they are very interested, but cannot secure financing as quickly as the seller wants (e.g. when the seller urgently needs the cash in a month, and the buyer cannot secure a bank loan in time).

These sort of deals are unfavourable to the seller, due to the added risk (if the buyer decides to break the contract, the seller is in serious trouble). However, some sellers go through with it anyway, if the buyer’s offer is the best they can get.

Is a fire sale always a good deal?

No. Just because the seller is desperate and selling a property for cheap, that doesn’t automatically mean you’re getting a value buy.

The fundamental issues remain the same: consider the location, the future developments (check the URA Master Plan for the area), and the amenities.

It is quite possible to buy a property at a cheap price, but later find that it’s hard to rent it out because the MRT station is 20 minutes away. Or that it’s so poorly maintained, the repair costs exceed any initial savings.

You also need to pay attention to the reasons for a fire sale. Some investors will point out that, if a property is good, it won’t have to be so heavily discounted to attract a fast buy.

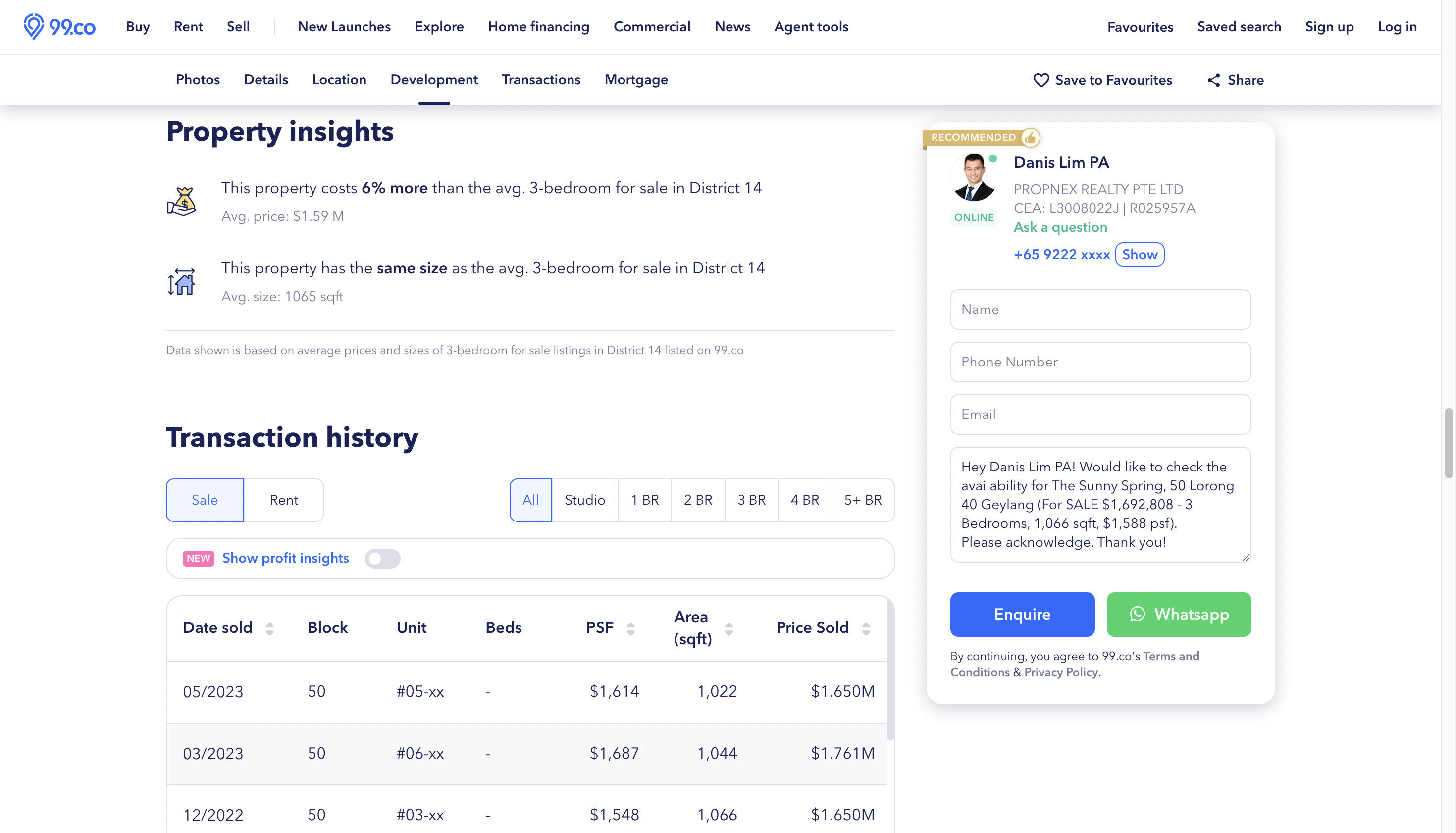

Whether the fire sale is conducted through an auction or not, be sure to check the transaction history of the project and the area before you go for the auction or viewing.

Here’s a tip: Scroll down the listing page on 99.co to get price insights and the transaction history of the project.

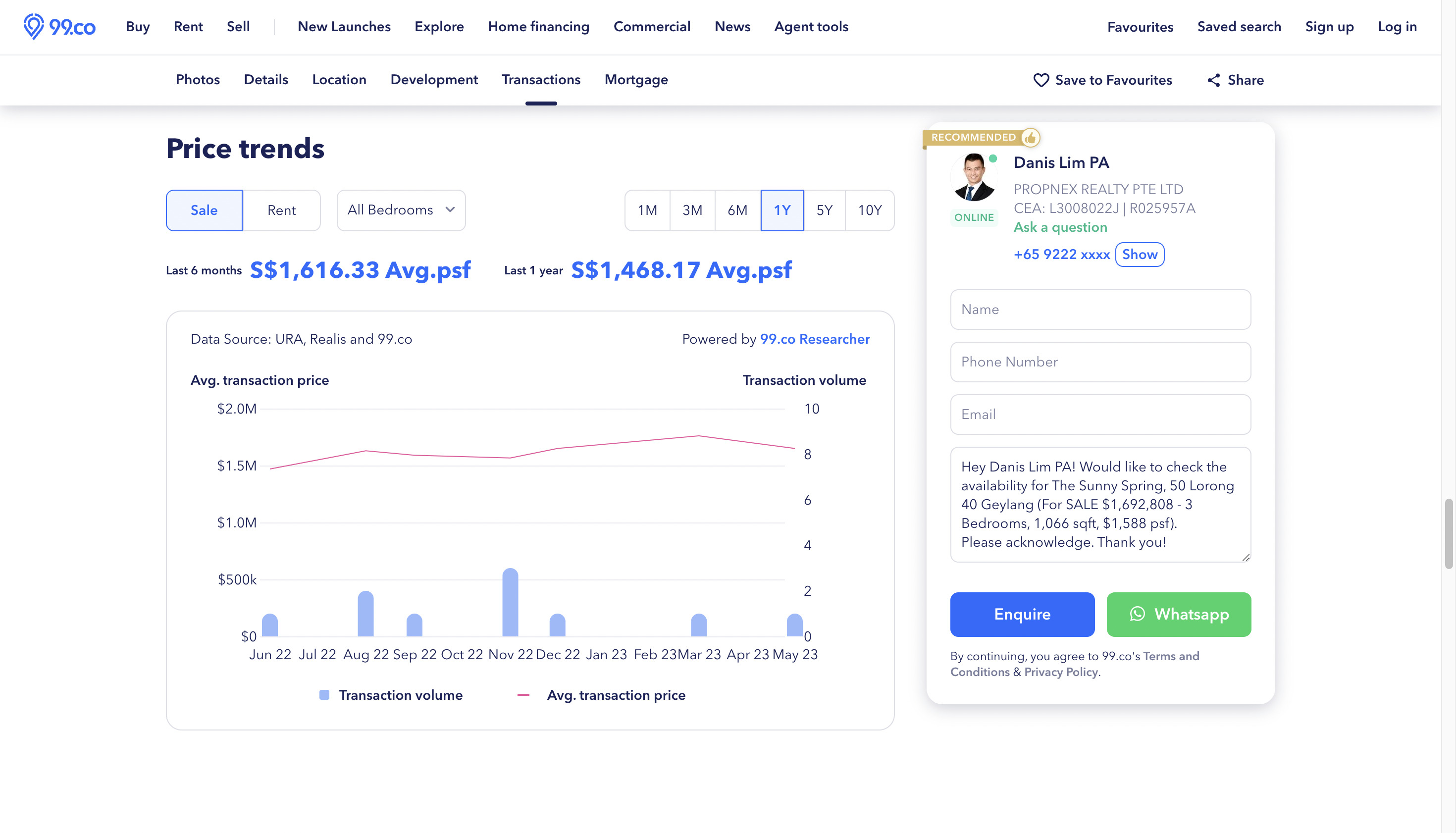

You can also see the price trend of the development, along with the average price psf.

Doing so allows you to get a sense of the market price of the property, which is especially crucial if you’re going to an auction. This is because biddings at auctions can get aggressive, negating any potential savings.

There have been mortgagee sales where the competition for a property is so fierce, it’s as good as buying at a non-discounted price — or even higher.

[Additional reporting by Virginia Tanggono]

Any bits of property jargon you would like to learn more about? Let us know in the comments section below.

The post What is a fire sale and where to find them? appeared first on .