It’s been slightly over a month since the 27 April 2023’s cooling measures came into effect.

Since then, foreigners buying any property in Singapore are subject to a 60% Additional Buyer’s Stamp Duty (ABSD) rate. This is a hefty increase of 30% from the previous rate. For Singapore Permanent Residents (SPRs), there is a 5% increase if they’re buying their 2nd or subsequent property.

For Singapore citizens buying their first property, there is no ABSD. But if they’re buying their 2nd or subsequent property, they will need to fork out 3-5% more in ABSD compared to the previous rate. There is also the possibility that mixed-nationality couples are buying some of these properties, so the higher ABSD rate would apply.

Still, this isn’t the first time the government has implemented higher ABSD rates targeted at non-Singaporean residents.

So while it’s only a month in, it would be interesting to study how recent and past cooling measures have impacted private condo purchases among foreigners and SPRs.

Based on URA Realis data, we’ve compiled several snapshots of caveats lodged for the purchase of new, sub-sale and resale condos and apartments. These are non-landed private residential properties (excluding Executive Condominiums) across all tenures (99-year, 999-year and freehold) from January 2021 to May 2023.

Condo buyers by Region and Residential Status

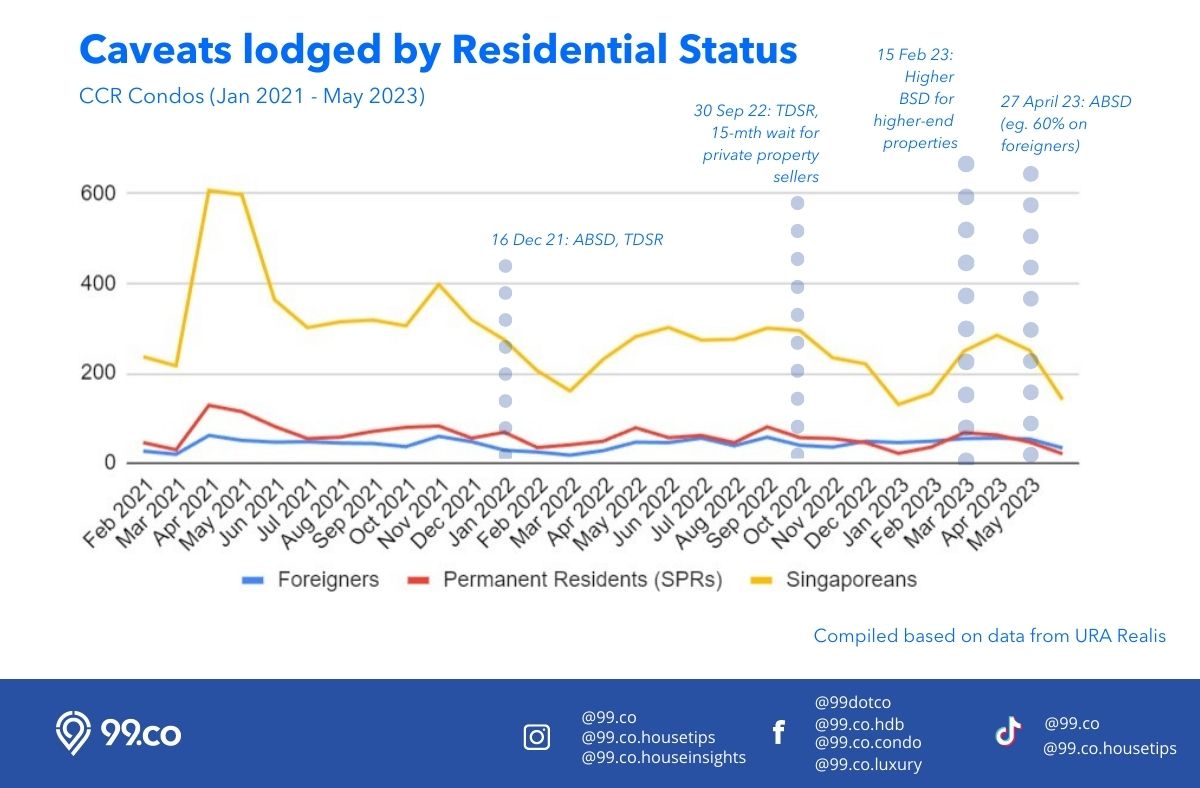

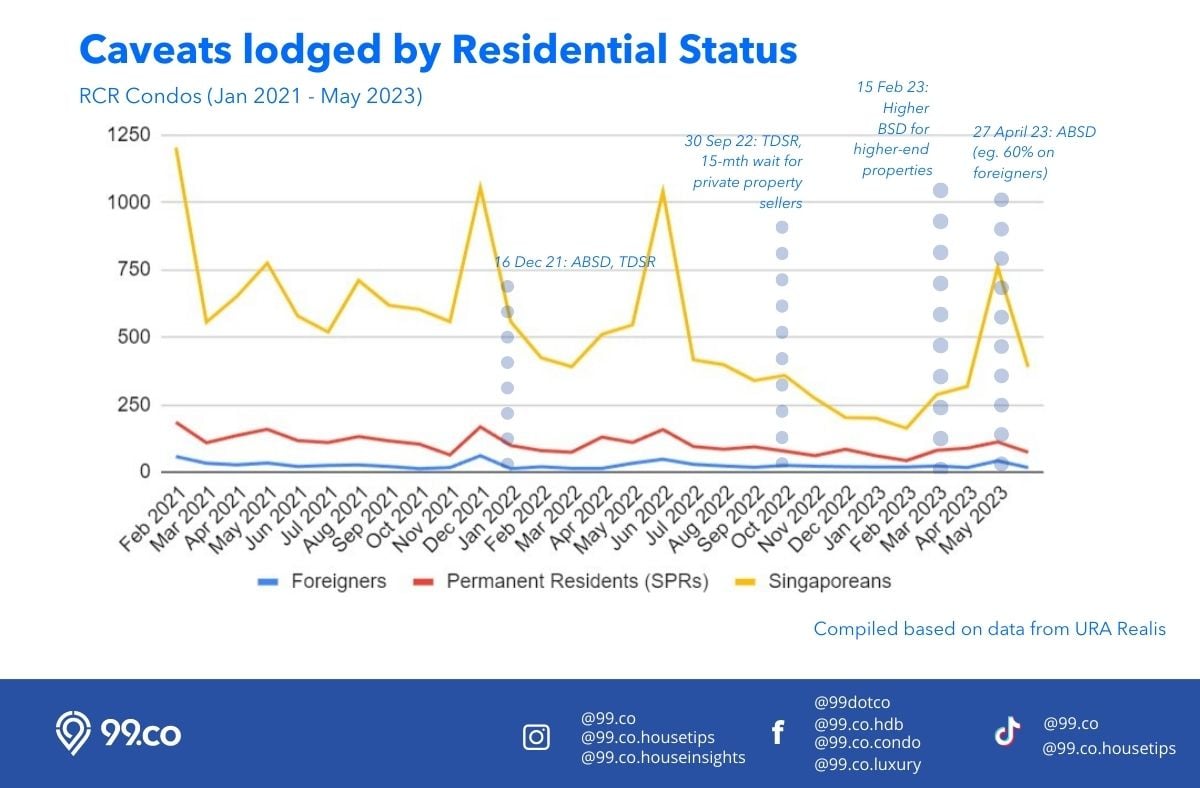

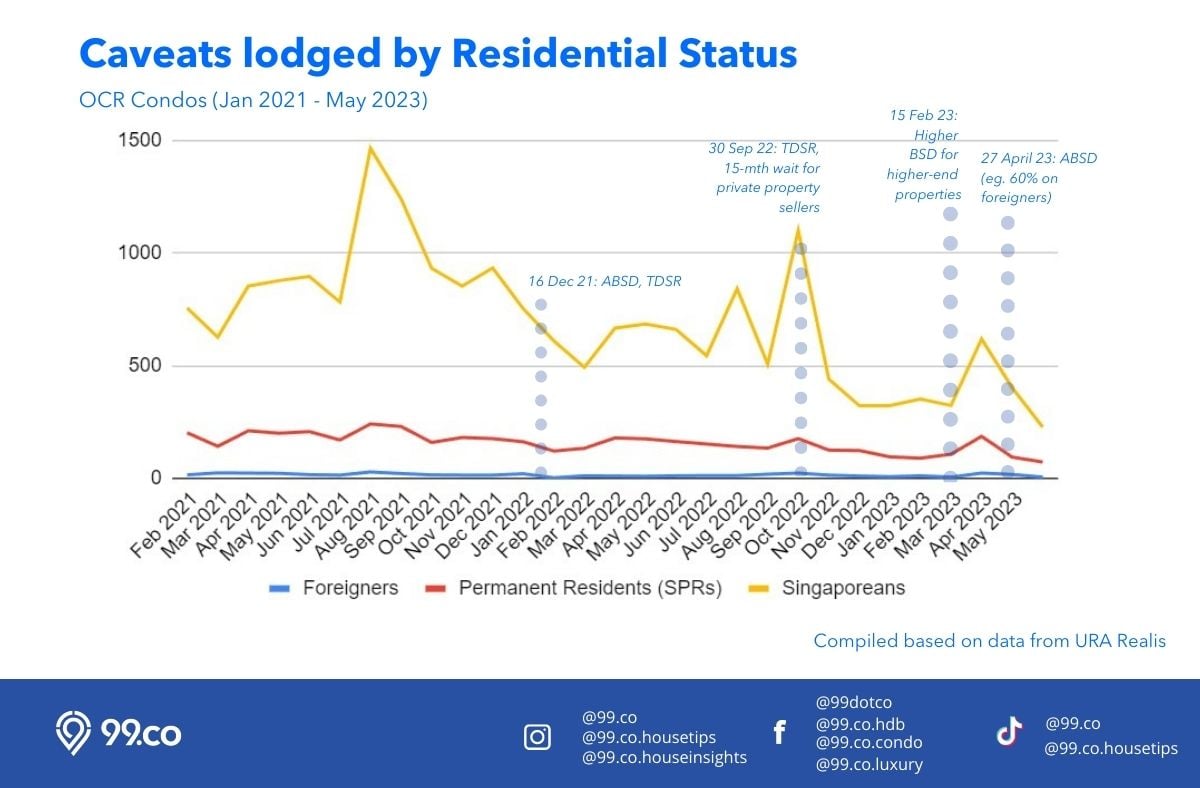

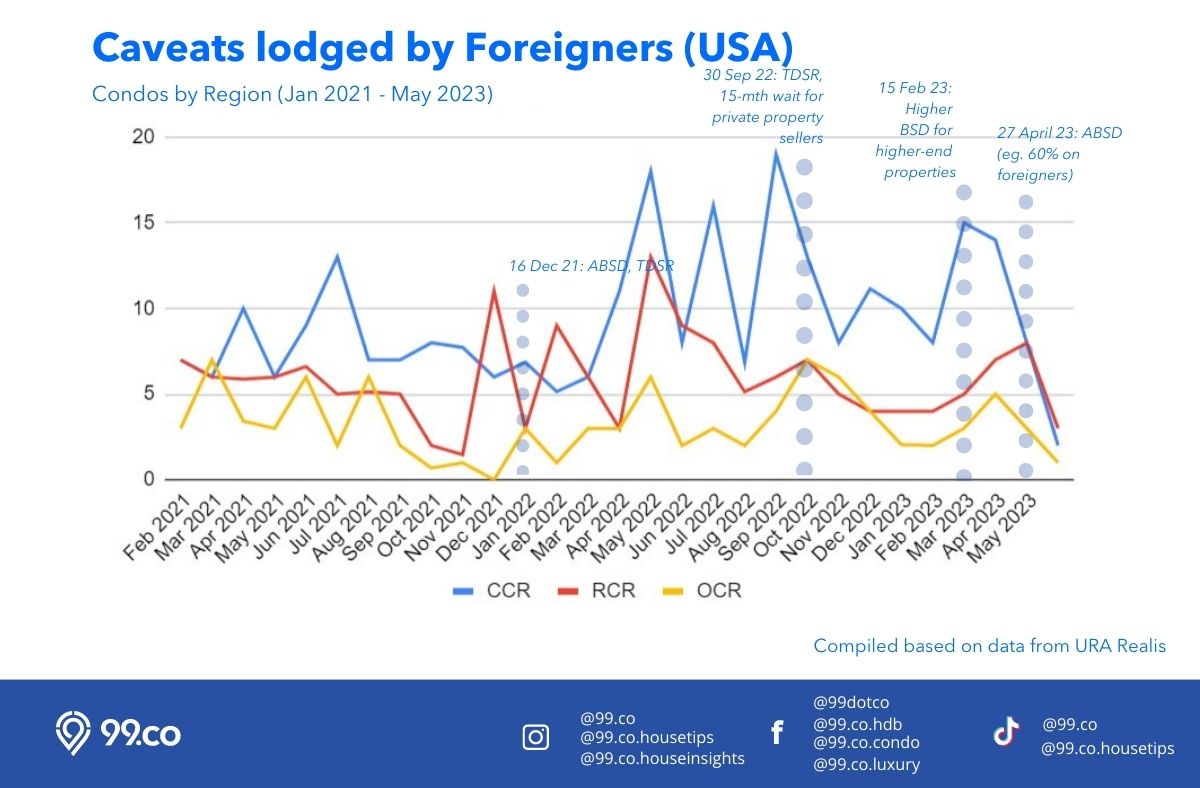

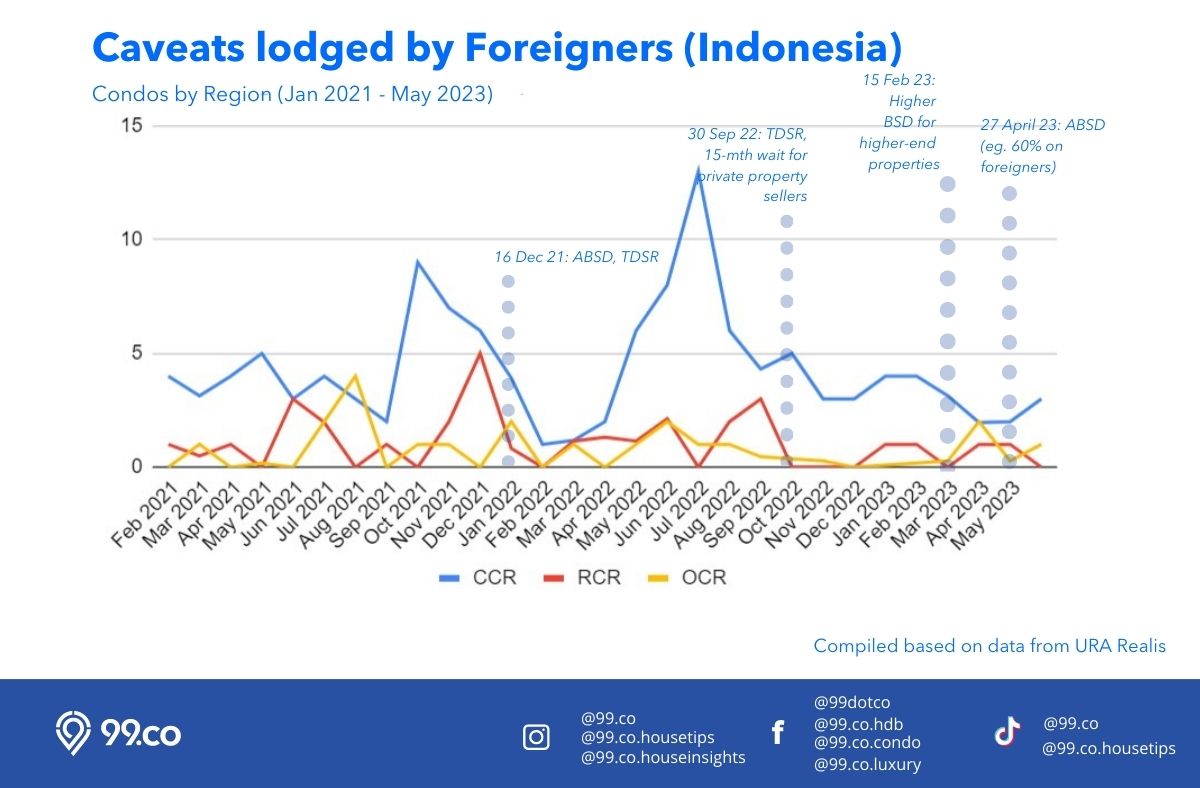

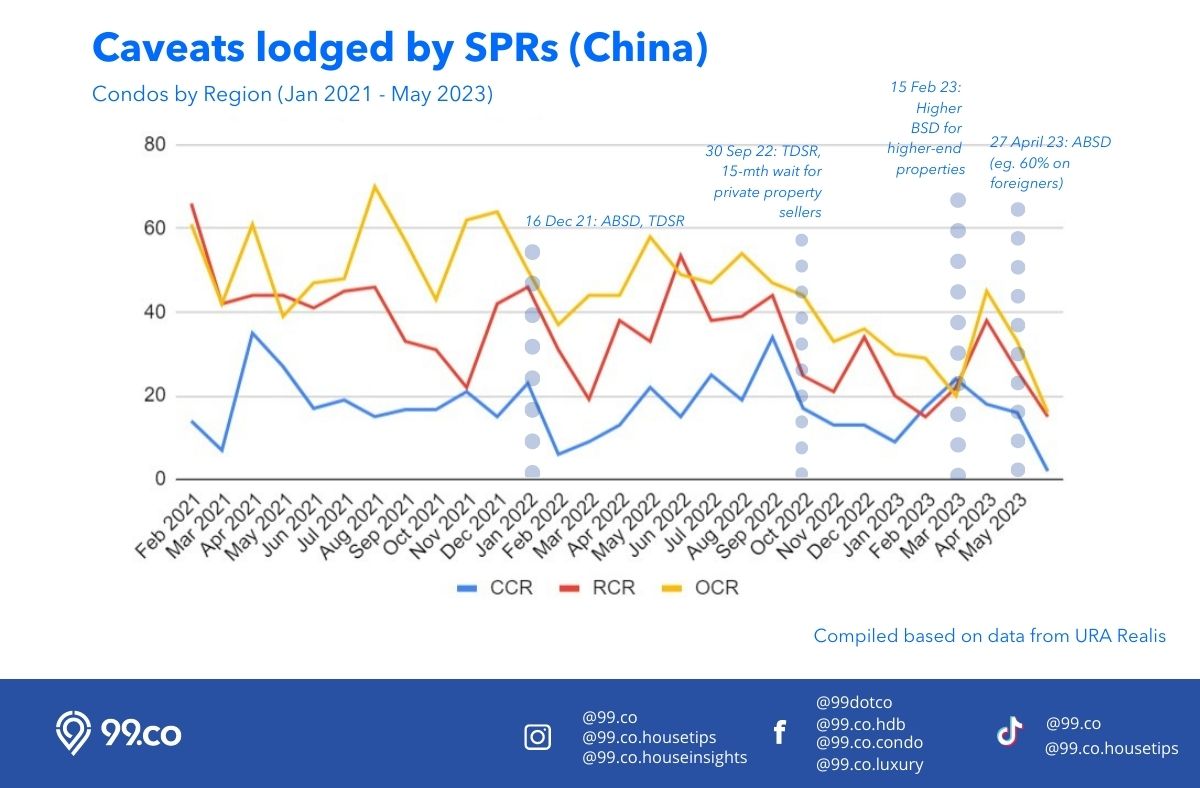

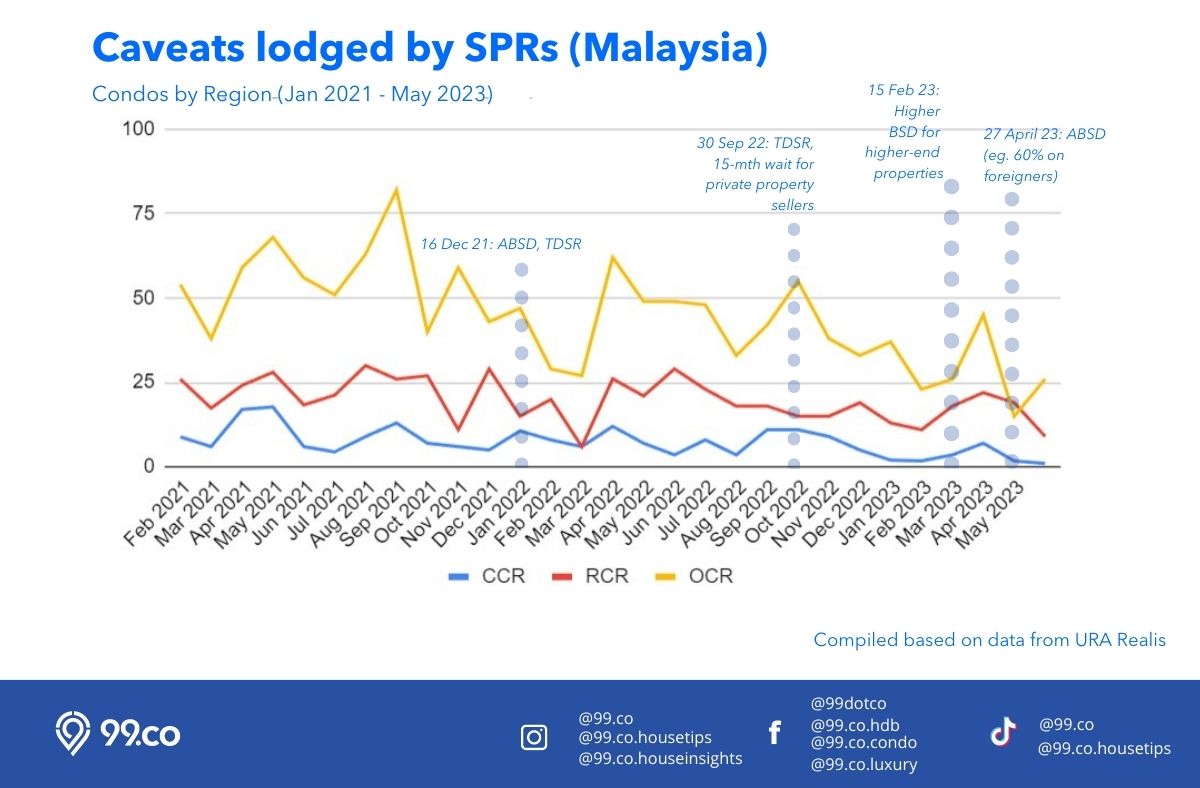

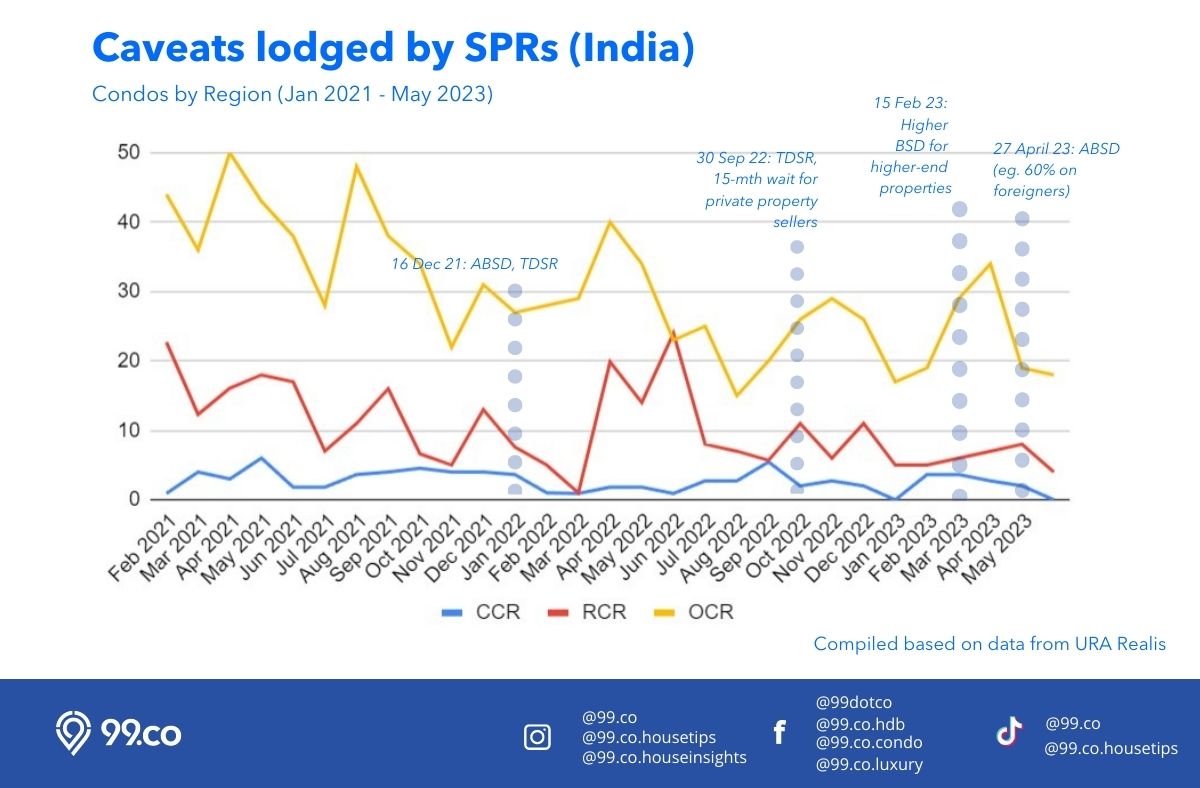

The three main charts below reflect the number of caveats lodged across our timeline separated by residential status and region: CCR, RCR and OCR. We’ve also added markers of cooling measures or rate hikes introduced over the past year or more.

Core Central Region(CCR)

First up, we should point out that roughly 79% of condo buyers (based on the duration we’re studying) are Singaporeans, 17% are SPRs and almost 4% consist of foreigners. A small percentage are bought by companies.

Even among Singaporean buyers, the impact of these cooling measures will be felt the most if they’re buying their 2nd or subsequent properties for investment purposes.

For example, when the September 2022 cooling measures were introduced, the month-on-month declines in CCR condos purchased by Singaporeans were -20% (Oct), -6% (Nov) and -41% (Dec).

More recently, between April and May 2023, there was a 43% decrease in caveats lodged among Singaporeans for CCR condos, -55% for SPRs and -37% for foreigners.

Rest of Central Region (RCR)

For RCR condos, the fall between April and May 2023 was even more dramatic – a near-49% drop among Singaporean buyers, -34% among SPRs and a steep -60% among foreigners.

Outside of Central Region (OCR)

For OCR condos, the fall between April and May 2023 is -43% for Singaporeans, -23% for SPRs and -67% for foreigners.

With the exception of the BSD rate hike in February 2023, there seems to be an obvious impact between the time a cooling measure is introduced and the subsequent condo purchases 1-3 months after.

While a bulk of these charts are centred around Singaporean buyers, let’s zoom in a little to see how they affect SPRs and foreigners.

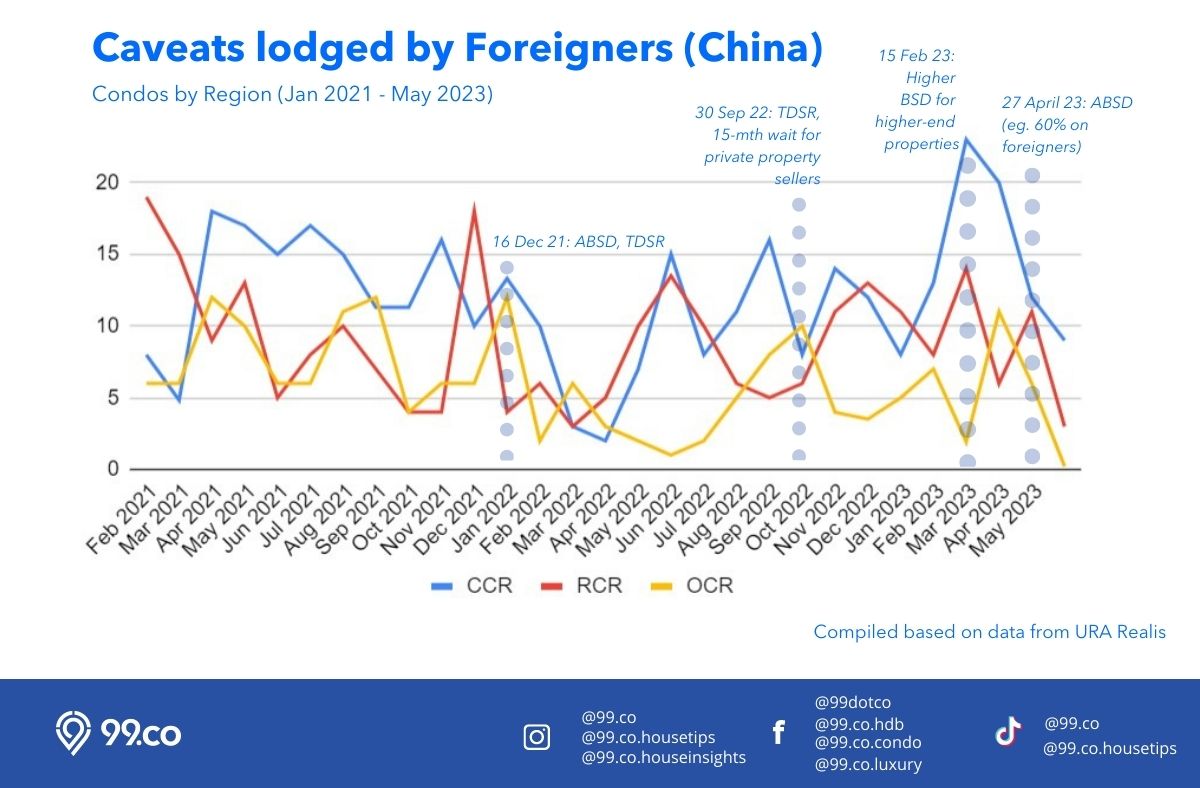

Condo buyers by Region and Nationality (Foreigners)

Based on data compiled, the top three foreign nationalities across the time period we looked at are from China, the USA and Indonesia.

For US citizens, as there is a Free Trade Agreement with Singapore, they are accorded the same Stamp Duty treatment as Singapore citizens (hence they pay 0% ABSD for their first property in Singapore).

Anyway, from January 2021 to May 2023, non-PR Chinese buyers bought 783 condos across all regions, followed by 537 for non-PR US citizens and 178 for non-PR Indonesians.

Among foreign Chinese nationals, one significant cooling measure impact seems to be the BSD rate hike in February 2023. Then, the Buyer’s Stamp Duty rates for properties valued in excess of S$1.5m to S$3m, and above S$3m, saw tax increases of 1-2% more from the previous 4%.

CCR properties saw the sharpest month-on-month declines in March and April 2023, at -13% and -40% respectively.

The reverse happened with OCR properties however, with a month-on-month increase of 470% between February and March 2023. This could mean a small group of Chinese foreign nationals were switching purchase intent from CCR to OCR during that period.

As for the impact from April’s cooling measure, month-on-month condo purchases from Chinese foreign nationals in the CCR, RCR and OCR have fallen by -25%, -73% and -96% respectively.

We should point out that while the percentages are high, the quantum is small (less than 20 buyers) in a month.

The narrative’s slightly different for non-PR US citizens buying condos in Singapore. Since they enjoy the same ABSD rate as Singapore citizens, we’d assume the cooling measures would have a lesser impact on their purchase decisions.

When the December 2021 cooling measures were implemented, month-on-month condo purchases in the CCR and OCR by foreign US citizens fell by -25% and -67% respectively.

However, RCR condo purchases rose by 200% over the same period. Then in February 2022, OCR condo purchases by US citizens rose another 200%. Later on in March 2022, US citizens resumed buying CCR condos in greater numbers (83% more than the previous month).

In terms of April’s cooling measure, the month-on-month decline in CCR, RCR and OCR condo purchases among non-PR US citizens are -75%, -63% and -67% respectively.

Once again, similar to foreign Chinese nationals, the quantum of buyers among foreign US citizens is low (below 20 a month).

As for the Indonesians, the third largest foreign nationality who bought condos during the period, we saw some of the steepest declines immediately after cooling measures were announced.

For example, the December 2021 measures saw month-on-month declines for CCR, RCR and OCR condo purchases among Indonesians at -74%, -100% and -100% respectively.

However, as you can see from the chart, between March 2022 and June 2022, condo purchases by Indonesian citizens resurged, some as high as 63% between May and June 2022.

In contrast to the other foreign nationalities, post-April 2023, Indonesians are buying condos in the CCR and OCR sectors (despite needing to fork out 60% in ABSD).

Still, relative to SPRs and Singaporeans, the quantum of foreign Indonesian buyers is small, at less than 15 a month.

Condo buyers by Region and Nationality (SPRs)

The three largest SPR groups purchasing condos in Singapore (at least over the period we’re studying) are from China, Malaysia and India.

From January 2021 to May 2023, 2,822 Chinese SPRs purchased condos across all regions, followed by 2,083 Malaysians and 1,244 Indians.

Over the period of study, 46% of Chinese SPRs bought their condos in the OCR, followed by 36% in the RCR and 18% in the CCR.

Relative to what we saw with purchases by foreign Chinese nationals, the declines as a result of cooling measures on Chinese SPRs seem to be steeper but over a shorter duration.

For instance, there was a 74% month-on-month decline in CCR condos bought by Chinese SPRs after the December 2021 measures, but that bounced back by 50% in February 2022. Similarly, OCR condos saw a -26% decline in January 2022, but rebounded by 19% the next month.

Similarly, after the BSD rate hike in February 2023, the number of caveats lodged by Chinese SPRs for CCR condos fell by 25% in March 2023. However, purchases of RCR and OCR condos surged by 73% and 125% respectively.

Following April’s cooling measures, CCR, RCR and OCR condo purchases by Chinese SPRs have fallen by -88%, -42% and -52% respectively in May.

Notably, the percentage decline isn’t as pronounced as compared to foreign Chinese nationals, since the ABSD rate hikes for SPRs are relatively lower.

Across the same period, 62% of Malaysian SPRs bought condos in the OCR, compared to 28% for RCR and 10% for CCR.

When the Dec 2021 cooling measures were announced, the month-on-month declines of CCR and OCR condos bought by Malaysian SPRs were -25% and -38% respectively. There was however a 33% uptick in sales for RCR condos.

Furthermore, in March 2022, Malaysian SPRs bought more than double the condo units in the RCR and OCR than the previous month (a 335% and 130% increase respectively)!

The trend repeated itself in the subsequent Sept 2022 cooling measures. Monthly declines were at -18% and -31% in October 2022 for CCR and OCR condos. Then in November 2022, Malaysian SPRs bought 27% more RCR condos than a month before. Interesting!

There’s also a significant bounceback between February and March this year, especially as new OCR condos were launched.

With April’s cooling measures affecting foreigners mostly, there is a positive 73% uptick in OCR condo purchases among Malaysian SPRs in May 2023. This is as opposed to a respective -44% and -53% monthly decline in CCR and RCR condo purchases in the same month.

Last but not least, across the period of study, 70% of Indian SPRs purchased their condos in the OCR, followed by 24% in the RCR and 6% in the CCR.

The cooling measure-purchase impact trendline for this group is significantly different compared to the other groups we’ve seen.

For instance, after the Dec 21 cooling measure, Indian SPRs continued buying OCR condos at a steady near 4% rate, before a resurging 38% monthly increase in March 2022. There was also a notable 1888% monthly increase in RCR condo purchases that month as there was only 1 buyer the month before.

The same trend followed September 2022’s measures – the month after its implementation, 12% more Indian SPRs bought OCR condos.

For April’s cooling measures, the May declines in CCR, RCR and OCR condo purchases among Indian SPRs are -100%, -50% and -5% respectively.

Condo buyers by Nationality and Price Range

While what we’ve shared were the number of buyers by Nationality, Residential Status and Region, it is also critical to see if recent cooling measures have affected their affordability.

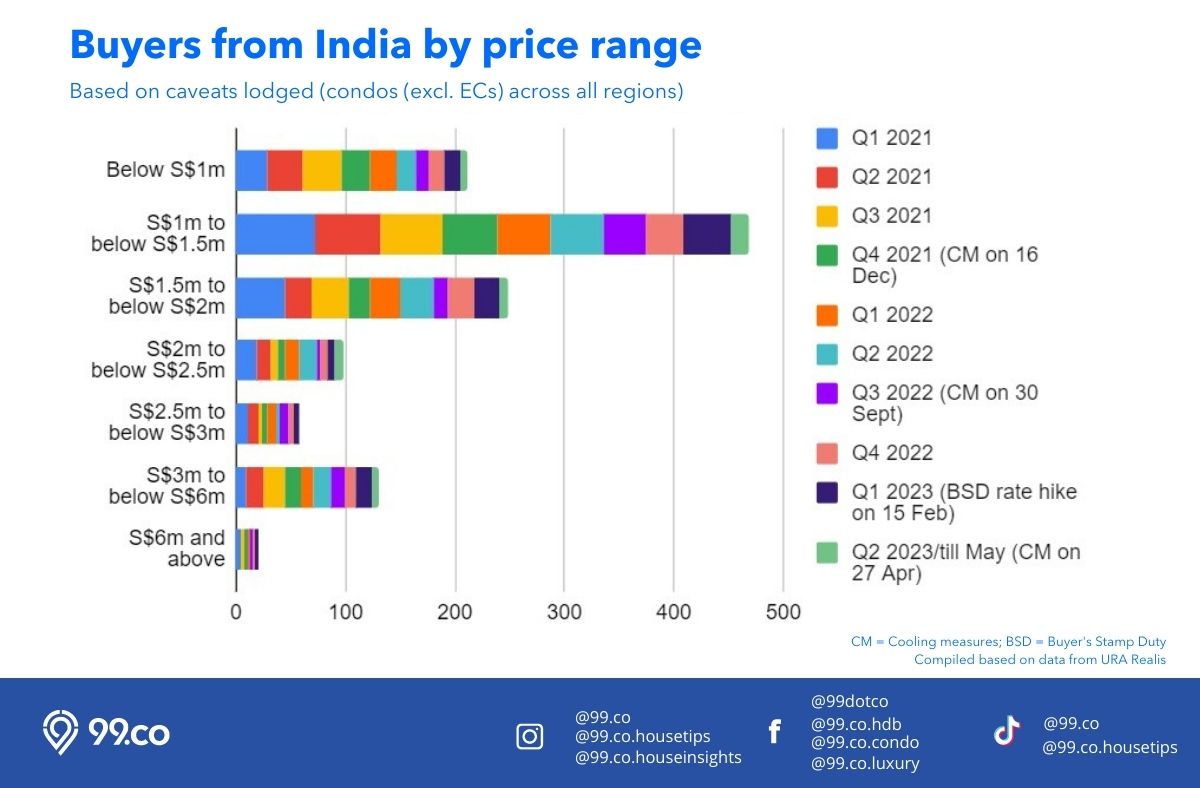

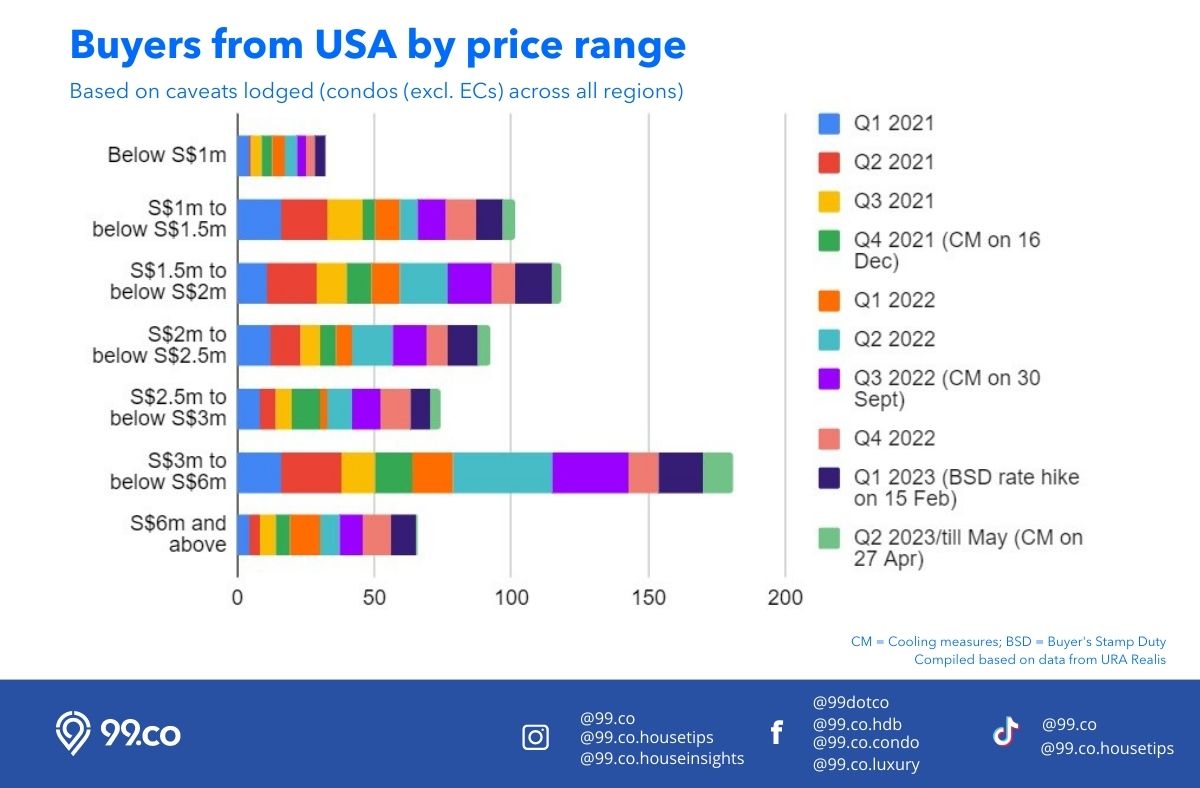

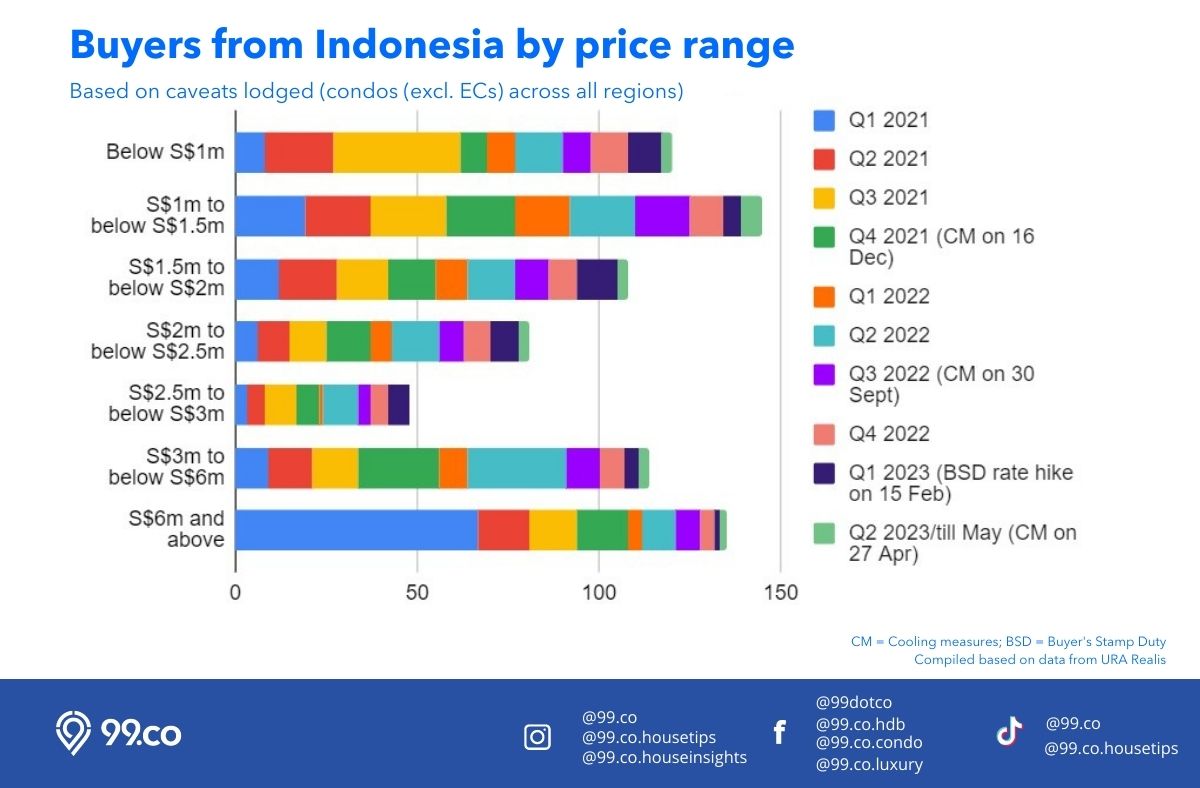

The charts below reflect the buying appetite of different nationalities based on different condo price ranges or bands.

Cutting across the past 10 quarters (including Q2 2023 till May), we can measure if different cooling measures in Q4 2021, Q3 2022, Q1 2023 and Q2 2023 have changed or reduced the number of buying activities in subsequent quarters.

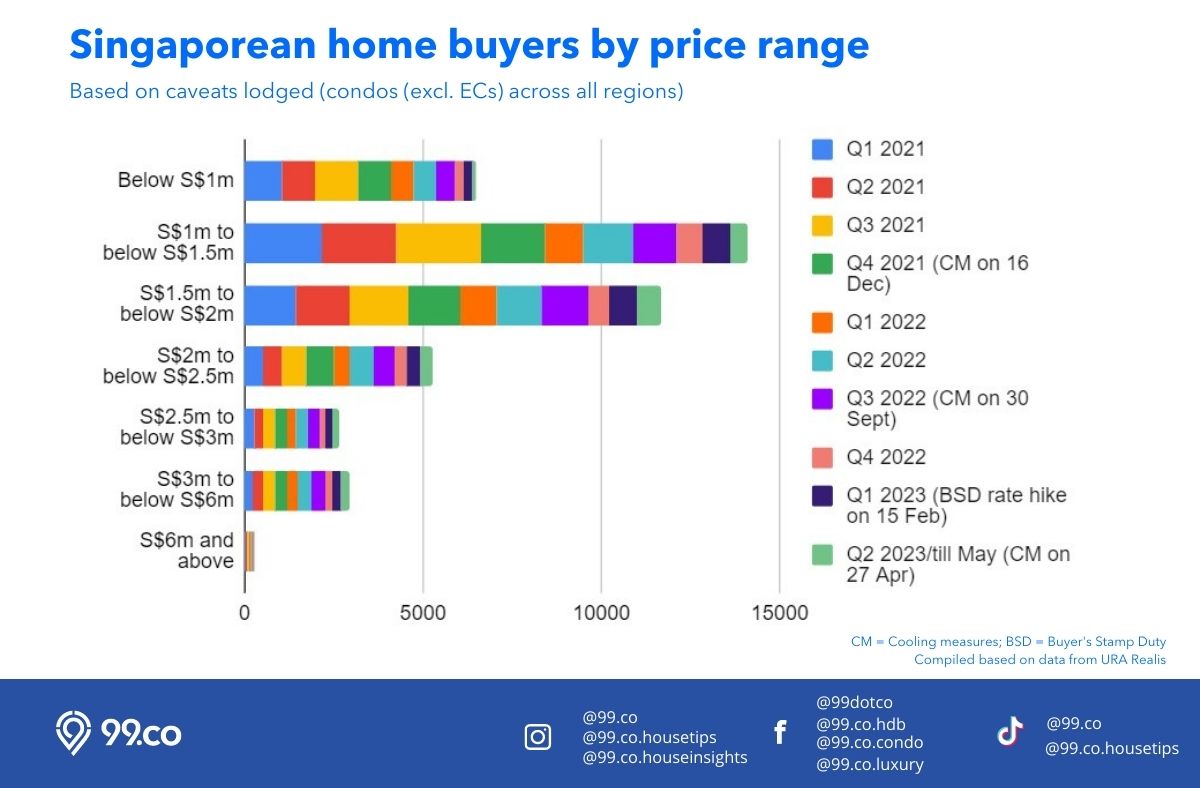

The chart above shows the number of caveats lodged by Singaporean buyers for condos of different price ranges.

The first thing that we noticed is that after a quarter where a cooling measure is introduced (dark green and purple), the number of buying activities for condos in that price range is reduced in the subsequent quarter.

The second thing we observed is that there’s been a gradual reduction in buyers over time, especially for properties below the S$2m price ranges (eg. longer blue bars in Q1 2021, shorter orange ones in Q1 2022). This is also reflective of the impact the Dec 2021 cooling measures had on buyers of properties within these price ranges since then.

Third, when comparing the properties valued in the S$1m-<S$1.5m and S$1.5m-<S$2m price ranges, there were more Singaporean buyers for the lower range initially.

However, there was a near-similar number of buyers in Q3 2022 across both ranges – 1,258 vs 1,297. Alas, when the September 30 cooling measures were announced, the parity changed, with more buyers in the lower range thereafter.

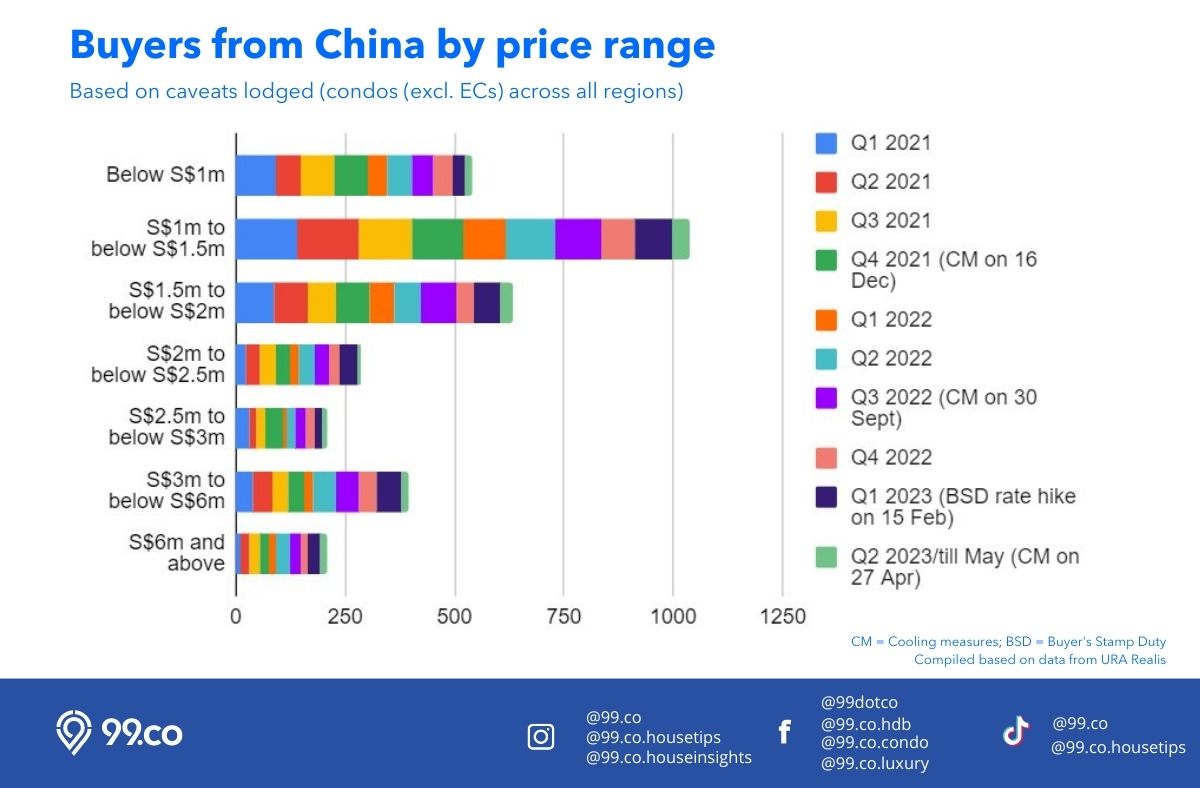

If we look at buyers from China, the impact of cooling measures on price range affordability seems to be less direct compared to the previous chart.

Here are some observations: For properties in the S$1m to below S$1.5m range, despite restrictions in Q4 2021 (dark green) and Q3 2022 (purple), the number of buyers after (ie. length of coloured bars), remains fairly consistent.

There’s also greater appetite for luxury properties valued above S$6m, relative to the total number of buyers.

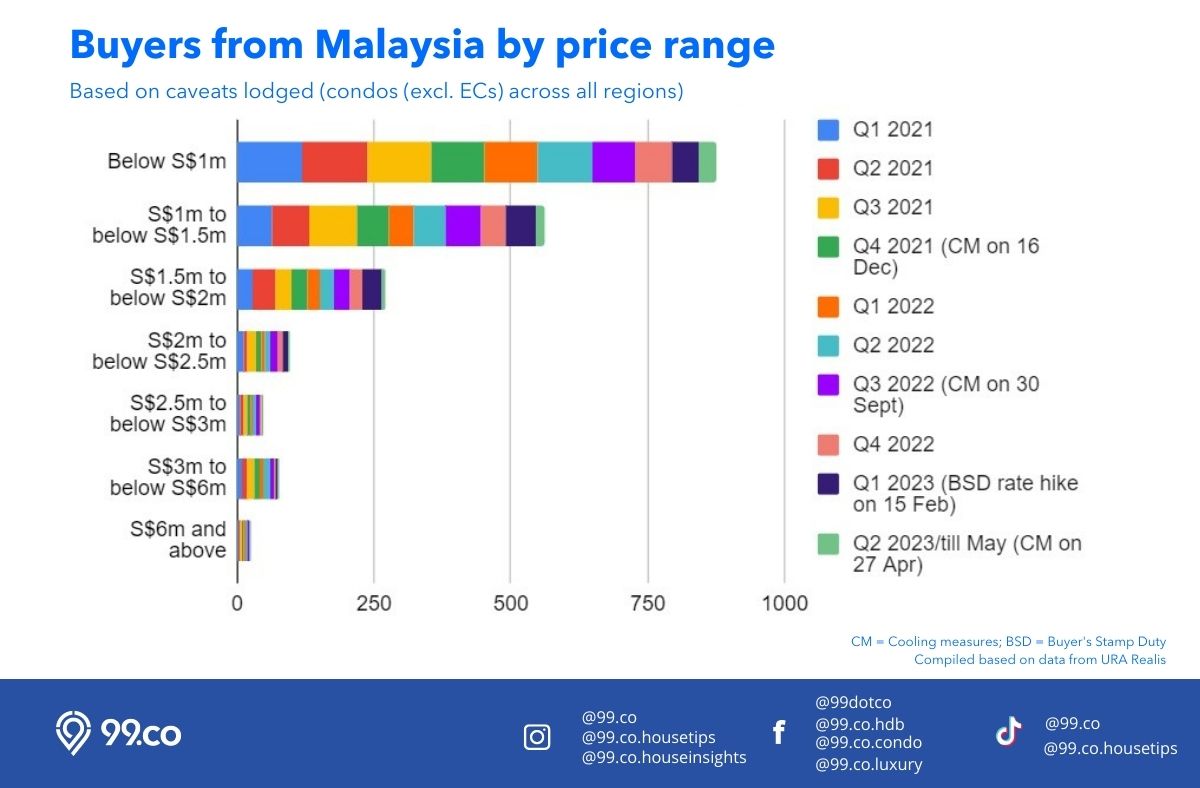

For the Malaysians, what’s obvious is that there’s higher purchasing intent for properties below S$1m and in the S$1m-<S$1.5m price ranges.

The cooling measures in Q4 2021 and Q3 2022 seem to have little impact on the subsequent number of buyers within the respective ranges. It is however notable that despite its smaller quantum, the number of condo buyers from Malaysia within the S$1m-<S$1.5m and S$1.5m-<S$2m price ranges have shrunk between 2021 and 2022.

There is however a small spike in buyers in Q1 2023 for properties in the S$1m-<S$1.5m and S$1.5m-<S$2m price ranges.

Relative to the other nationalities, condo buyers from India, showed greater purchasing intent for properties valued in the S$1m-<S$1.5m price band.

There’s also a higher percentage of buyers interested in properties valued in the S$3m-<S$6m range. Notably, cooling measures in Q4 2021 and Q3 2022 had little impact on subsequent quarterly purchases within the same price ranges.

In fact, we saw higher purchases in Q1 2023, when the BSD rate hike was introduced, particularly for the lower three ranges (and properties valued at S$3m and below S$6m).

For the Americans, the first thing we picked up is that there’s an immense interest in properties priced within the S$3m-<S$6m range.

In fact, after the cooling measures in Q4 2021, there was one quarter of fairly subdued buying (the wait-and-see quarter?), before a spike in Q2 2022 in that price range.

One noticeable impact of a cooling measure affecting buyers here is the one in Q3 2022. That was when the government introduced stress-test interest rate checks for property loans. In the subsequent quarter – Q4 2022 – buying intent shrunk by more than half across most price ranges (except some of the lower bands and the noticeable S$6m-and-above band).

The BSD hike in Q1 2023 also did little to dampen buying sentiment, with fairly high buying intent across all price ranges (except the S$2.5m-<S$3m range).

Last but not least, Indonesian buyers seem to have a fairly even spread when it comes to the type of properties they want.

For instance, while a sizeable number of buyers are buying properties valued at below S$2m, there’s also a significant proportion of buyers (more so, than other nationalities) who are buying properties valued at S$3m and above.

Noticeably, the number of buyers within their respective ranges has shrunk between 2021 and 2022, especially the last band (S$6m and above), when there were close to 70 buyers in Q1 2021.

In terms of cooling measures, we can see some impact from the Dec 21 measures in some of the price bands, such as properties valued between S$1.5m and above. After that period, there was a surge of buyers in the S$3m-<S$6m band, especially in Q2 2022.

–

Conclusion

It is clear from these studies that cooling measures have an immediate and direct impact on the purchase intentions for condos, particularly in the CCR and RCR.

Even for Singaporeans and US citizens, who pay 0% ABSD for their first property, some of these measures can impact them immensely, such as the stress-test interest rate.

However, if we look at past measures, the declines, usually a wait-and-see or knee-jerk reaction, can last anywhere between 1-3 months before buyers return. For some nationalities, their purchasing intent post-measures may be even higher than before.

What’s significant is that with as many as three major cooling measures over the past one-and-half years, there is still a noticeable resilience and consistency among buyers of different nationalities.

Undoubtedly, the spikes after a period of uncertainty help, thanks in part to new condo launches and sales. There’s still a month left in Q2 2023, so it’s anybody’s guess how the rest of the quarter will play out.

If we use May’s monthly indications as a gauge, at best, the monthly declines are a short-term reaction to April’s cooling measures.

As we’ve seen in the past, buyers seem more than willing to wait it out, at least over the next 2-3 months. At worst, they could choose to sit it out longer and hope for an industry-wide catalyst – such as a pause or reduction in US interest rate hikes.

Some may even review their buying profiles (nationality, residential status) and if need be, recalibrate their appetites to hunt for condos within more affordable price ranges.

Do let us know your thoughts in the comments, or if you have a different perspective, do share them with us.

–

–

Planning to sell off your property fast? Let us help you get the right price by connecting you with a premier property agent.

The post One month after April’s cooling measures: A study on its impact to foreigners and Singapore PRs appeared first on .