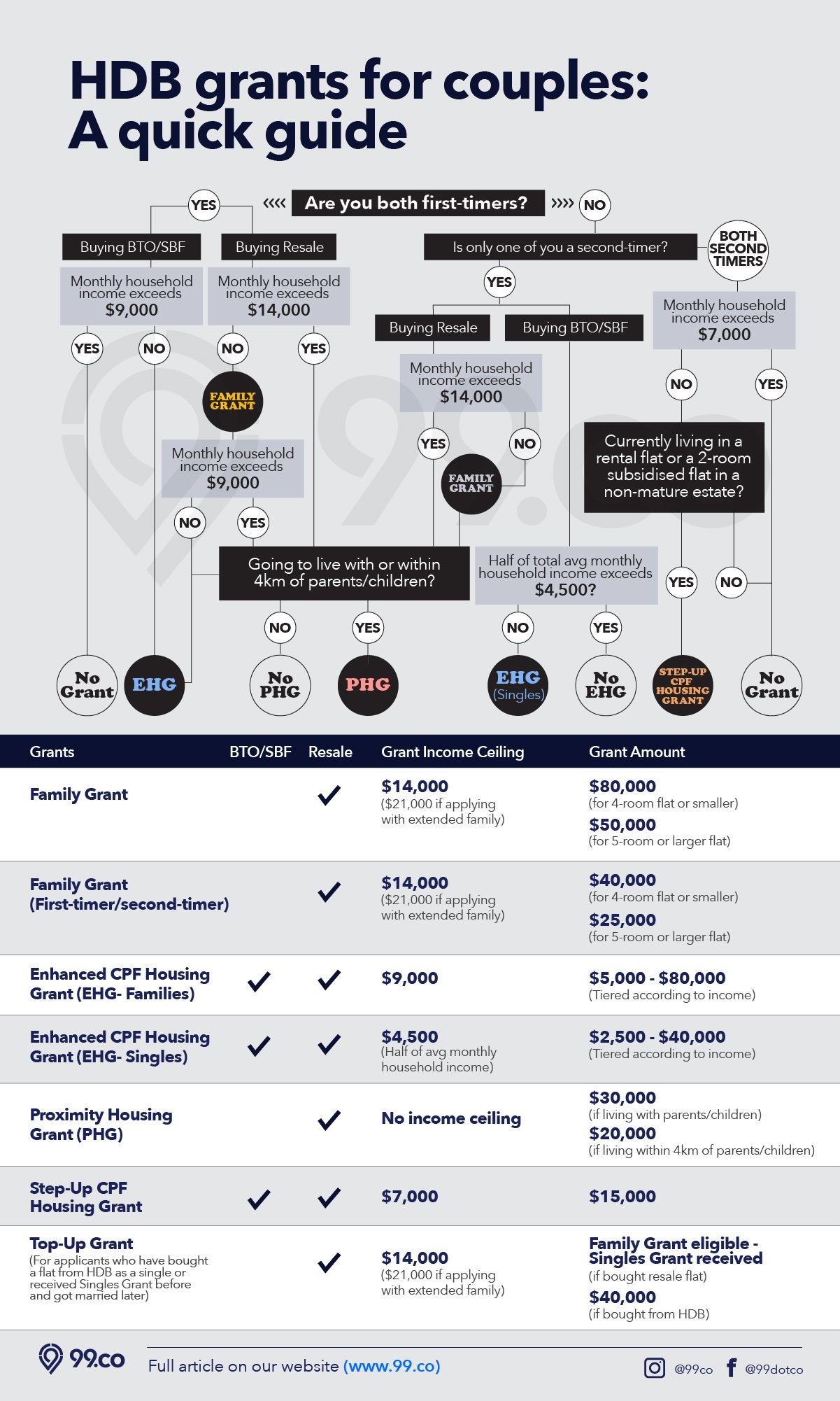

You might already know that there are various housing grants for couples to offset the cost of buying a new flat, be it an HDB BTO flat or HDB resale flat. But it can be confusing trying to figure out which grant you’re eligible for, with different eligibility criteria for various situations.

So here’s 99.co‘s quick-and-easy guide and updated infographic to help you make sense of grants and budget for your HDB flat.

Various factors — such as household income — determine the HDB grant amount a couple can get. The key thing is that buyers of HDB resale flats are offered more grants than BTO (Build To Order) and SBF (Sale of Balance Flats) applicants.

This is because BTO and SBF flats are sold directly by HDB at a subsidised rate. (Open booking flats also fall under the same category as BTO and SBF flats.)

Now, let’s find out which HDB grants you may be eligible for. (From 9 May 2023 onwards, you can find out how much grant you’re eligible for by applying for the HDB Flat Eligibility (HFE) letter.)

If you’re on a mobile device, use two fingers to zoom in or out.

If you’re on a desktop browser, simply click on the image to magnify.

If you’re single, we at 99.co have another article for you here: Quick guide to BTO and resale HDB grants for singles.

HDB grants for couples applying for BTO/SBF/Open Booking flats

Technically, only two grants are available for BTO/SBF/Open Booking flats: the Enhanced CPF Housing Grant (EHG) and the Step-Up CPF Housing Grant. (The EHG replaced the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG) in September 2019.)

The EHG is for first-timers, while the other grant is for second-timers. Specifically, the Step-Up CPF Housing Grant is reserved for those upgrading from a subsidised 2-room flat or public rental flat.

So most BTO/SBF/Open Booking flat applicants would be looking at only the EHG, which is tiered according to household income. This means that lower-income households will receive a higher EHG grant.

If both applicants are first-timers

- Enhanced CPF Housing Grant (EHG): up to S$80,000. To qualify, the average gross monthly household income for the 12 months prior to the flat application date must be within S$9,000.

If one applicant is a first-timer, and the other a second-timer

- Enhanced CPF Housing Grant for Singles, EHG (Singles): up to S$40,000. To qualify, half of the average monthly household income for the 12 months prior to the flat application date must be within S$4,500. For example, a couple who earned S$56,000 in the past calendar year will be eligible for the EHG (Singles), as half of the average monthly income is S$2,333.

Here’s the table showing how the EHG is tiered for couples and singles:

| Enhanced CPF Housing Grant for Couples | Enhanced CPF Housing Grant for Singles | ||

| Average monthly household income | Grant amount | Half of the average monthly household income | Grant amount |

| Not more than S$1,500 | S$80,000 | Not more than S$750 | S$40,000 |

| S$1,501 – S$2,000 | S$75,000 | S$751 – S$1,000 | S$37,500 |

| S$2,001 – S$2,500 | S$70,000 | S$1,001 – S$1,250 | S$35,000 |

| S$2,501 – S$3,000 | S$65,000 | S$1,251 – S$1,500 | S$32,500 |

| S$3,001 – S$3,500 | S$60,000 | S$1,501 – S$1,750 | S$30,000 |

| S$3,501 – S$4,000 | S$55,000 | S$1,751 – S$2,000 | S$27,500 |

| S$4,001 – S$4,500 | S$50,000 | S$2,001 – S$2,250 | S$25,000 |

| S$4,501 – S$5,000 | S$45,000 | S$2,251 – S$2,500 | S$22,500 |

| S$5,001 – S$5,500 | S$40,000 | S$2,501 – S$2,750 | S$20,000 |

| S$5,501 – S$6,000 | S$35,000 | S$2,751 – S$3,000 | S$17,500 |

| S$6,001 – S$6,500 | S$30,000 | S$3,001 – S$3,250 | S$15,000 |

| S$6,501 – S$7,000 | S$25,000 | S$3,251 – S$3,500 | S$12,500 |

| S$7,001 – S$7,500 | S$20,000 | S$3,501 – S$3,750 | S$10,000 |

| S$7,501 – S$8,000 | S$15,000 | S$3,751 – S$4,000 | S$7,500 |

| S$8,001 – S$8,500 | S$10,000 | S$4,001 – S$4,250 | S$5,000 |

| S$8,501 – S$9,000 | S$5,000 | S$4,251 – S$4,500 | S$2,500 |

| More than S$9,000 | NA | More than S$4,500 | NA |

Source: HDB

Income criteria for EHG:

To qualify for the EHG, at least one of the applicants must have worked continuously for 12 months prior to the flat application, and must be working at the time of the flat application.

If both applicants are second-timers

- Step-Up CPF Housing Grant: S$15,000. This is for couples living in a 2-room subsidised flat in a non-mature estate or public rental flat, and wish to buy a new 3-room flat in a non-mature estate. Those living in a public rental flat buying a 2-room flat in a non-mature estate may also be eligible for the grant.

If one applicant is not a Singapore Citizen (Non-Citizen Spouse Scheme)

- Enhanced CPF Housing Grant for Singles, EHG (Singles): up to S$40,000. To qualify, half of the average monthly household income for the 12 months prior to the flat application date must be within S$4,500. For example, a couple who earned S$56,000 in the past calendar year will be eligible for the EHG (Singles), as half of the average monthly income is S$2,333.

Resale levy

Couples who buy a new HDB flat or receive a CPF Housing Grant will be required to pay resale levy (based on the size of the first HDB flat) if they plan to buy another new HDB flat or a new EC unit.

This is how the government ensures a level playing field, making sure people won’t take advantage of the property subsidies and game the housing system.

Those buying a resale flat won’t have to pay resale levy.

HDB grants for couples applying for resale flats

If both applicants are first-timers

- Family Grant:

4-room flat or smaller

5-room flat or larger

S$80,000* (up from S$50,000)

S$50,000* (up from S$40,000)

To qualify, your monthly household income must not be more than S$14,000 (or S$21,000 for extended family applicants).

- Enhanced CPF Housing Grant (EHG): up to S$80,000. To qualify, the average gross monthly household income for the 12 months prior to the resale flat application date must be within S$9,000.

- Proximity Housing Grant (PHG):

Live with your parents/ children

Live within 4km of your parents/ children

S$30,000

S$20,000

As for the proximity condition, your parents or children can either be living in public housing or private property. There’s no income ceiling for the PHG.

This means you can get a maximum of S$190,000 HDB housing grants if you’re buying a resale flat as a first-timer.

HDB flats for sale

2

2

2

2

2

1

2

2

1

1

2

1

2

2

1

1

2

1

1

1

2

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

1

1

1

2

1

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

See all 2-room >

3

2

2

2

2

2

3

2

2

2

2

2

3

2

2

2

2

2

3

2

2

2

3

2

3

2

2

2

2

2

2

2

3

2

2

2

2

2

2

1

3

2

1

1

3

2

3

2

3

2

2

2

3

2

3

2

2

1

2

2

2

2

2

1

3

1

2

2

2

2

See all 3-room >

3

2

3

2

3

2

3

2

3

3

3

2

3

2

2

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

1

3

2

3

2

3

2

3

2

3

2

See all 4-room >

4

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

4

2

4

2

3

2

3

3

3

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

3

2

See all 5-room >

4

4

4

2

4

3

4

3

4

3

4

2

4

2

4

3

4

3

6

2

4

3

5

3

3

2

8

4

3

3

4

2

4

2

6

2

4

3

3

2

4

2

4

2

3

3

4

2

4

2

4

2

4

4

4

2

3

2

4

3

4

2

3

3

4

2

3

2

3

2

See all Executive >

One applicant is a first-timer, and the other is a second-timer

- Family Grant:

4-room flat or smaller

5-room flat or larger

S$40,000* (up from S$25,000)

S$25,000* (up from S$20,000)

- The monthly household income is capped at S$14,000 (or S$21,000 for extended family applicants).

- Previously, this grant was called the Half-Housing Grant, in which the amount is half of what you would get from the Family Grant. Now this grant falls under the Family Grant.

- Enhanced CPF Housing Grant (EHG) for Singles: Up to S$40,000. The grant amount is based on the income, with the maximum grant amount being S$40,000. Likewise, half of the average gross monthly household income must be within S$4,500.

- Proximity Housing Grant (PHG):

Live with your parents/ children

Live within 4km of your parents/ children

S$30,000

S$20,000

You and your partner must not have taken the PHG before to be eligible for this. To meet the proximity condition, your parents or children can either be living in public housing or private property. There’s no income ceiling for the PHG.

For applicants who have previously received a Singles Grant

- Top-Up Grant: This is for those who have previously bought an HDB flat

- as a single and later got married with an SC or PR, or

- with a non-resident spouse, who later received SC or PR status (or the child gets an SC or PR status)

The amount depends on whether the house you bought is from the resale market or HDB. The monthly income is capped at S$14,000.

|

Resale flat |

2-room or 2-room Flexi flat from HDB (eg. BTO, SBF or open booking) |

|

The amount of the Family Grant amount you are eligible for currently, minus the Singles Grant amount you had previously received* |

S$40,000 |

If both applicants are second-timers

- Step-Up CPF Housing Grant: S$15,000. This is for couples living in a 2-room subsidised flat in a non-mature estate or public rental flat, and wish to buy a resale 3-room flat in a non-mature estate. Those living in a public rental flat buying a 2-room resale flat in a non-mature estate may also be eligible for the grant.

HDB flats for sale in non-mature estates

2

2

2

2

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

2

1

1

1

1

1

1

1

2

1

1

1

1

See all 2-room >

2

2

3

2

2

2

3

2

2

2

2

2

3

2

3

2

2

2

3

2

2

2

3

2

2

2

3

2

3

2

3

2

3

2

2

2

3

2

2

2

3

2

3

1

2

2

2

2

3

2

2

2

3

2

2

2

2

2

2

2

2

2

2

2

3

2

2

2

2

2

See all 3-room >

Citizen Top-Up Grant

For Singapore Citizen/Singapore Permanent Resident (SC/SPR) households with a household member obtaining Singapore Citizenship status, they are also eligible for a Citizen Top-Up Grant of S$10,000. This household member can either be:

- The SPR spouse originally listed in the flat application gets Singapore Citizenship

- An SC child who is born to the SC applicant/owner and spouse listed in the flat application

- The SPR parent/child/sibling listed in the flat application gets Singapore Citizenship

This Citizen Top-Up Grant is akin to a reimbursement for the household. This is because SC/SPR households have to pay an extra S$10,000 when they buy a BTO flat, or get S$10,000 lower in grant amount when they buy a resale flat.

For more information about HDB resale grants, check out our detailed article: HDB Resale Grants: How much can you get?

What if one of the applicants has yet to graduate/ORD from National Service?

HDB announced that for BTO applications from May 2018 onwards, the income assessment can be deferred until key collection for full-time National Servicemen (NSFs) and student applicants. One of the applications must also be aged 30 years old and below at the point of application. The deferment of income assessment for these couple applicants still qualifies them to apply for the Enhanced CPF Housing Grant (EHG).

You can head over to HDB’s website for more information about the Deferred Income Assessment.

How will the HDB grants for couples be disbursed?

All grants will be credited into the CPF Ordinary Accounts (CPF OA) of eligible Singapore Citizen applicants before the resale completion. For couples, the grant amounts are split equally into the two CPF OA accounts. No cash will be disbursed.

*Given the increase in Family Grant amount announced during Budget 2023, if you submit your resale flat application from 14 February 2023 3.30 pm to 31 March 2023, you’ll receive the additional grant from HDB within three months from the date of the resale completion.

Do take note that when you sell your house, you’ll need to refund the grant amount plus accrued interest (of 2.5% per year) back to your own CPF account. This is on top of any CPF savings used to pay for your house.

The first S$60,000 of the housing grants will be credited back to your CPF OA account, while the remaining grant amount will be put into your CPF Special Account / Retirement Account and Medisave Account.

(Single and aged 35 and above? Find out what grants you may be eligible for when buying a BTO or resale HDB flat.)

What do you think about the BTO and resale HDB grants? Let us know in the comments below.

If you found this article helpful, 99.co recommends How to get enough money to buy a property in Singapore and Deciding between HDB loan vs bank loan? Here’s a quick reference.

[Additional reporting by Virginia Tanggono]

Frequently asked questions

The EHG is a housing grant that you can apply if you’re a first-timer applicant buying a BTO flat or resale flat, with a gross monthly household income of not more than S$9,000.

If you’re a first-timer getting a BTO flat, you can get up to S$80,000 HDB grant. The maximum grant amount is more than double (up to S$190,000) if you apply for a resale flat.

No, you don’t have to return it to HDB or CPF. What you need to do, though, is to refund it back to your own CPF account, plus any other CPF monies used to pay for the house and accrued interest, when you sell your house.

The post HDB grants for couples – Quick guide (with updated infographic) to resale HDB and BTO grants for couples appeared first on .