Chances are, you already know a fair bit about HDB’s Build-To-Order (BTO) and resale flats. But there’s a third option available in the public housing market: Sale of Balance Flats (SBFs). You might also be wondering when the HDB Sale of Balance Flats exercise will be in 2023. In this article, we explain what these flats are and what to take note of.

What is a Sale of Balance Flat (SBF)?

Sale of Balance Flats (SBF) are leftover flats from previous BTO launches, surplus Selective En Bloc Redevelopment Scheme (SERS) replacement flats and repurchased flats. These include flats that previous owners chose to give up. Possible reasons for this include couples splitting up or inability to finance their flats.

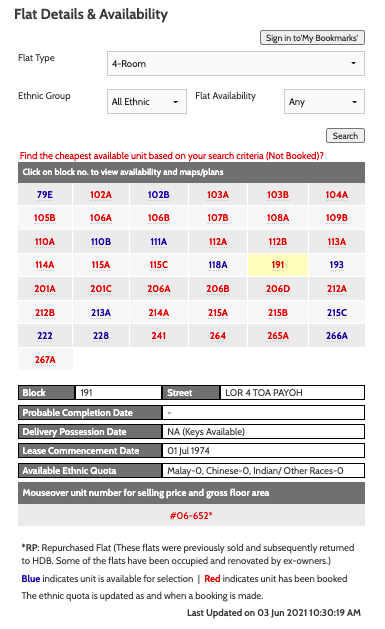

This means that for the flats that have been built, they may even be as old as 40 years old. In fact, we found a Toa Payoh flat to be nearly 47 years old when it was put up for SBF in November 2020.

You can read more about old Sale of Balance Flats in this article.

What this also means is that not all flats under SBF come with a fresh lease of 99 years. So just like buying a resale flat, you’ll need to take note of the lease decay if you purchase an SBF built several years ago.

But here’s the good news if you’re keen on buying an old flat for its larger size. You’ll be able to buy it through SBF at a cheaper price than through the resale market. And similar to getting a BTO, you may be eligible for the Enhanced CPF Housing Grant (EHG) of up to S$80,000.

What’s the eligibility criteria to buy a Sale of Balance flat?

The eligibility criteria is similar to getting a BTO flat. If you are buying a flat with your fiancé/fiancee or spouse, you’ll need to be at least 21 years of age. Alternatively, if you’re buying a flat as a single, you’ll need to be at least 35 years and above.

(You can find out more about HDB’s eligibility criteria on HDB’s website).

Read this: Quick guide to BTO, SBF and resale HDB grants for singles

How long do you need to wait if you purchase a Sale of Balance flat?

It depends! If you’re purchasing a unit that has already been built, you’ll be able to collect your keys six months after booking the flat from HDB. If not, you’ll need to wait for the flat to be completed. This can take anywhere from a few months to three or four years.

But the main advantage SBFs have over BTOs is that they have a much shorter waiting time.

When is the next Sale of Balance flat launch?

SBF launches are held twice a year, coinciding with HDB BTO sales launches in May and November.

When is information about Sale of Balance flats released?

HDB only releases information about SBF during the launch itself. This is unlike BTO flats, in which we usually have the info on the exact locations, estimated number of units and flat types three months in advance.

This leaves you with only one week to look through the flats available through SBF and submit the application.

But the plus side is that you get more information about the flats available, right down to the block number and unit number. So you’ll be able to know which flats to avoid (such as those west-facing flats).

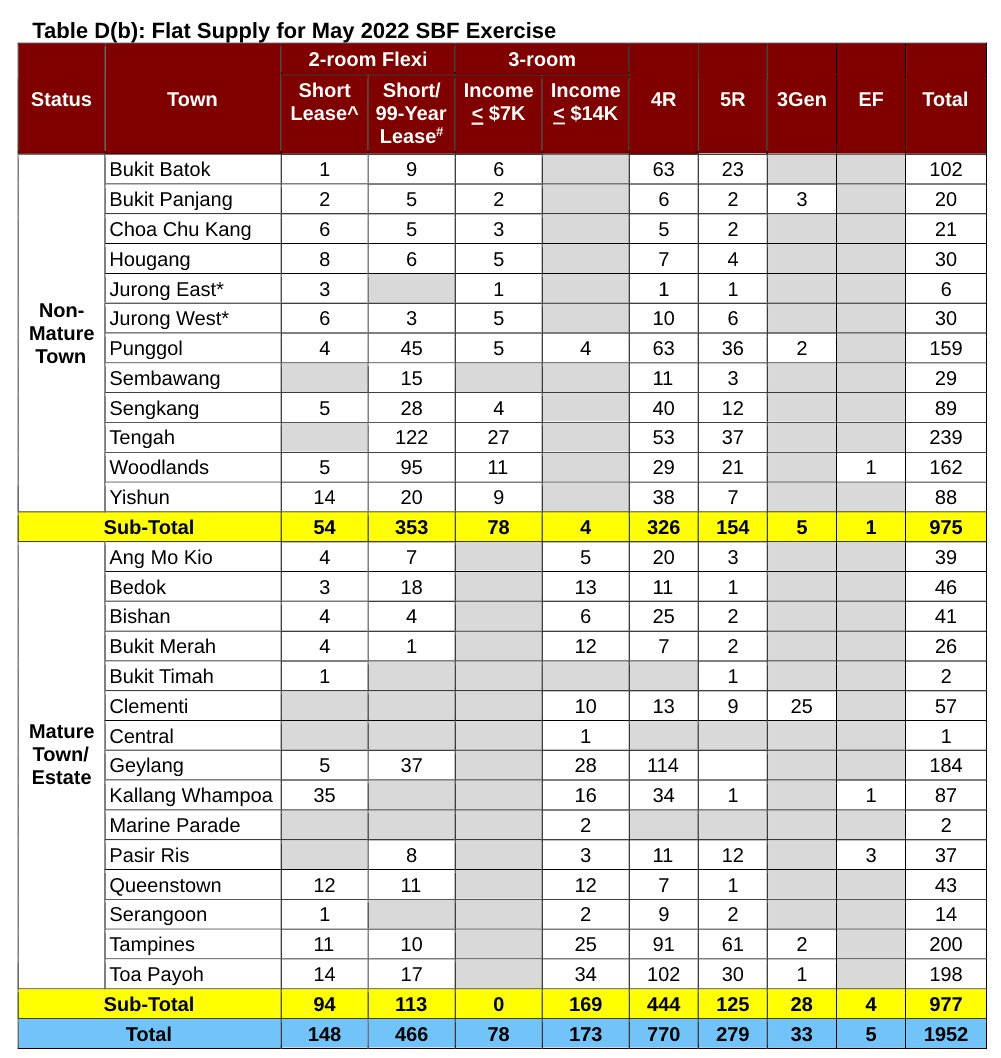

Another good thing about the Sale of Balance Flats scheme is that it doesn’t just comprise four to five locations like in a typical BTO launch. You can find flats of various types spread across the different estates in Singapore, as well as the race quota, put up for SBF.

In the SBF exercise in May 2022, popular estates like Bishan and Bukit Merah were included as well.

How many available flats are there in each Sale of Balance flat launch?

It depends. For instance, in the sales launch in May 2022, HDB launched 1,952 flats for sale via SBF. More recently in November 2022, 1,071 SBF units were launched for sale.

Do take note that availability of a unit also depends on the ethnic quota. Depending on the existing racial profile of resident households in the block, a listed unit may only be made available to applicants of a certain race.

Can you apply for both a Sale of Balance flat (SBF) and a Build-To-Order (BTO) at the same time?

No, you can’t. In the same exercise, you can either apply for a Sale of Balance flat OR a BTO flat, not both.

How much does a Sale of Balance flat cost? Is it more expensive than a BTO?

It depends on factors such as the location of the flat and other attributes such as floor level and remaining lease.

So some SBF flats may actually be cheaper than BTO flats.

For instance, during the May 2022 BTO and SBF launch, 2-room Flexi SBF flats at Yishun were priced from S$102,000 onwards, which was cheaper than those launched through BTO (priced from S$123,000).

But if you’re getting a unit that is currently being constructed, expect to pay slightly more than what you would have paid if you’re getting the exact same unit via BTO. And it may be more expensive if you’re getting a completed unit. This is because prices for SBF have been adjusted to market conditions.

During the same launch, 2-room Flexi SBF flats at Toa Payoh had a starting price of S$210,000, which was higher than the starting price of 2-room Flexi BTO flats in the same estate at S$162,000.

Nevertheless, SBF are subsidised flats. So they’re still cheaper than the ones available on the resale market.

How does HDB allocate BTO and SBF flat supply?

When an application for a Build-to-Order (BTO) or a Sale of Balance Flat (SBF) is submitted, it goes to a ballot to determine a queue number. But, depending on whether you’re a first-timer or a second-timer, it might be more difficult for you to get a flat because of HDB’s predefined allocation percentages.

Other factors and criteria, such as whether the flat is located in a non-mature estate, also come into play. Here’s the rundown on the allocation of BTO and SBF flats in every sales exercise to help you understand your chances of getting a flat and plan ahead.

(HDB has increased the allocation for first-timer buyers looking to buy in a non-mature estate, starting with the August 2022 BTO.)

BTO: For 2-room Flexi flats

Non-mature estates:

- At least 40% of the flat supply or 100 units in a project for senior applicants aged 55 and above

• 20% of the remaining non-senior flat supply for first-timer family applicants

• 15% of the remaining non-senior flat supply for second-timer family applicants (down from 30%)

• 65% of the remaining non-senior flat supply for first-timer singles (up from 50%)

Mature estates:

- At least 40% of the flat supply or 100 units in a project for senior applicants aged 55 and above

• 95% of the remaining non-senior flat supply for first-timer applicants

• 5% of the remaining non-senior flat supply for second-timer family applicants

(Singles are only eligible to apply for a 2-room flat in a non-mature estate through BTO and SBF. On the other hand, there’s no restriction on the flat type if they’re buying via the resale market.)

Read this: HDB’s new community care apartments vs 2-room Flexi flats: Which is better?

BTO: For 3-room flats:

Non-mature estates:

- 85% of the flat supply for first-timer applicants (up from 70%)

• 15% of the flat supply for second-timer applicants (down from 30%)

Mature estates:

- 95% of the flat supply for first-timer applicants

• 5% of the flat supply for second-timer applicants

BTO: For 4-room or larger flats:

Non-mature estates:

- 95% of the flat supply for first-timer applicants (up from 85%)

- 5% of the flat supply for second-timer applicants (down from 15%)

Mature estates:

- 95% of the flat supply for first-timer applicants

- 5% of the flat supply for second-timer applicants

For BTO projects with shorter waiting time:

- 95% of the flat supply for first-timer applicants

- 5% of the flat supply for second-timer applicants

The flat supply location differs slightly for Sale of Balance Flats (SBF):

SBF: For 2-room Flexi flats:

Non-mature estates:

- At least 40% of the flat supply for senior applicants aged 55 and above

- 90% of the remaining non-senior flat supply for first-timer family applicants (100% of flat supply if fewer than 20 units)

- 5% of the remaining non-senior flat supply for second-timer applicants (deprioritised* if flat supply fewer than 20 units)

- 5% of the remaining non-senior flat supply for first-timer singles

*Meaning that seniors and first-timer families will be shortlisted within 100% of the flat supply and thereafter, depending on the supply, there may be second-timer families invited to book a flat.

Mature estates:

- At least 40% of the flat supply for senior applicants aged 55 and above

- 95% of the remaining non-senior flat supply for first-timer family applicants

- 5% of the remaining non-senior flat supply for second-timer applicants

SBF: For 3-room and larger flats:

Both non-mature and mature estates:

- 95% of the remaining non-senior flat supply for first-timer applicants (100% of flat supply if fewer than 20 units)

- 5% of the remaining non-senior flat supply for second-timer applicants (deprioritised if flat supply fewer than 20 units)

According to HDB, the above allocation percentages for BTO and SBF flats are indicative and some flats may additionally be set aside for quota-based priority schemes. All said and done, it’s generally more difficult for second-timer applicants to secure a flat through BTO or SBF in a mature estate than in a non-mature estate.

More priority for some first-timers

MND and HDB has also introduced a new priority category called First-Timer (Parents & Married Couples) for upcoming BTO and SBF sales exercises, starting with the August 2023 BTO.

New category: First-Timer (Parents & Married Couples), or FT (PMC)

Here’s the eligibility criteria:

- Families with at least one SC child aged 18 and below, or married couples aged 40 and below

- Never owned or sold a residential property before

- Did not get to book a BTO/SBF flat in the last five years before flat application

If you’re eligible to apply under this category, you get to enjoy an additional ballot chance (meaning you get a total of three ballot chances).

Expanded category: Family and Parenthood Priority Scheme (FPPS)

The Parenthood Priority Scheme (PPS) will be expanded and renamed to Family and Parenthood Priority Scheme (FPPS) as it will include those under the FT (PMC).

Up to 60% of the SBF supply will be set aside for those applying under this new priority scheme.

Is it easy to get a Sale of Balance flat?

The Sale of Balance Flats scheme isn’t as widely known as the BTO. After all, the typical Singaporean proposal is along the lines of “BTO ai mai?” and not “SBF ai mai?“

However, despite the “leftover” connotation SBFs have, application rates for flats under the scheme have been very high over the years.

For instance, in the SBF exercise in November 2022, 188 applicants had balloted for 4-room flats in Choa Chu Kang. With only four units available, this translated to an application rate of 33 for first-timers! Given that the available supply has exceeded demand from the first-timers, the second-timers didn’t even get shortlisted.

On top of that, there’s the priority scheme to deal with. Even if you’re applying under the Married Child Priority Scheme (MCPS), your chances are slimmer if you’re a second-timer applicant.Regardless of the location of the flat you’re balloting (mature or non-mature estate), only 3% of the flats will be set aside for second-timers applying through SBF.

What’s more, there’s the race quota due to the EIP. Some estates may have more flats set aside for your race. Depending on your race and the estate chosen, you may have a higher chance of securing a flat.

The good news about the SBF is that the race quota info is available during the launch (unlike BTO). So you can better strategise on where to ballot for to increase your chances of securing a queue number.

It’s also best not to rush the application submission since you have one week to do so. Once the application starts, look out for the application rate online, which HDB updates at different times of the day.

How do you know if a Sale of Balance flat is suitable for you?

The good thing about Sale of Balance Flats launches is that you get more information about the actual locations of the units available. This includes the block number and unit number, which are not available during a BTO launch.

On the other hand, from our observation, Sale of Balance Flats tend to be those situated on the lower floors. If you’re not really selective over the specifics of your flat (orientation of the unit, the level the flat is on, etc), then by all means, go ahead!

However, if you’re particular about choosing a unit by yourself, you might be better off taking the usual route of applying for one via regular BTO balloting, or buying a resale flat.

The shorter waiting time also translates to a reduced time period to save up for the downpayment and other costs. On the other hand, with BTO flats, you’ll have a buffer of three to five years to save up before your flat is ready.

Plus, if you apply for a Sale of Balance flat and manage to get a unit which is already built, you’ll need to register your marriage within just three months of key collection. Talk about a quick turnaround!

If BTO and SBF don’t suit your needs, there’s always resale. Although priced higher than BTO and SBF flats, HDB resale flats offer home-seekers maximum choice and flexibility.

So, should you go for BTO, SBF or resale?

Actually, we have a simple thought process for this.

If you can wait, apply for BTO while checking out resale flats in the area you’re applying for (on a property portal such as 99.co). You can gain insights by doing so, for example how much your flat could be worth when it’s built, and also if your area is a high buyer demand or high seller supply area.

If you have a specific area you want to live in that’s not in the BTO sales exercise, apply for SBF. SBF sales launches offer a wider range of mature and non-mature estate options as compared to the four to five estates in a typical BTO launch. Before submitting your application, you may want to compare resale flat options and prices in the area you want to live. This comparison is very important so that you don’t lose out.

If you need a flat ASAP, apply for SBF or Open Booking while actively seeking resale flats through a property portal such as 99.co. If you’re particular about location and other attributes, drop SBF altogether and just focus all your energy into looking for a resale flat.

Happy house-hunting!

[Additional reporting by Virginia Tanggono and Faruq Senin]

Do you prefer to apply for a BTO or SBF? Let us know in the comments section below.

If you found this article helpful, 99.co recommends An in-depth guide to HDB’s priority schemes to increase your BTO or SBF ballot chances and 5 scenarios that can disqualify you from getting HDB BTO first-timer applicant benefits.

Frequently Asked Questions

What are Sale of Balance Flats (SBF)?

Sale of Balance Flats (SBF) are leftover flats from previous BTO launches, surplus Selective En Bloc Redevelopment Scheme (SERS) replacement flats and repurchased flats.

How can I be eligible to buy a Sale of Balance flat?

The eligibility criteria is similar to getting a BTO flat. If you are buying a flat with your fiancé/fiancee or spouse, you’ll need to be at least 21 years of age.

What is the waiting time to purchase a Sale of Balance flat?

It depends! If you’re purchasing a unit that has already been built, you’ll be able to collect your keys six months after booking the flat.

The post Sale of Balance Flats 2023, What you need to know about HDB’s Sale of Balance Flats (SBF) in 2023 appeared first on .