Calculating leasehold property values has always been a headache, anywhere in the world. How exactly do you work out the value between a property with 60 years lease remaining, versus one with 50 years left?

To make life a bit easier (and fairer) in Singapore, organisations like the Singapore Land Authority (SLA) use a leasehold value table, based on an tried-but-true guideline called Bala’s Curve.

Who is Bala? What is his curve/table?

Waaaay back when Singapore was still a British colony, the Land Office needed a way to work out the fees for alienation of the land (by alienation, I mean “renting” out state land to private entities for long periods.

At around that time, it’s widely believed that a Land Office employee named Bala came up with a table (also called Bala’s Curve in graph form), which acted as a sort of guideline for the price of renting out state land. Over time, Bala’s Table/Curve made its way to the real estate market. It also became a bit tangential to its original intent, and became a guide point on valuations for leasehold land against leasehold value.

This adaptation of Bala’s Curve to work out leasehold land values is believed to have come about sometime in 1947, when the colonial administration decided they would start handing out 99-year leases instead of further freehold titles.

The SLA’s leasehold value table follows Bala’s Curve. This fact was made public in July 2000, so we know for a fact that the government uses this method to assess land values. It directly impacts what developers pay in terms of Development Charges (DCs), differential premiums, and the cost of topping up the lease in an en bloc transaction.

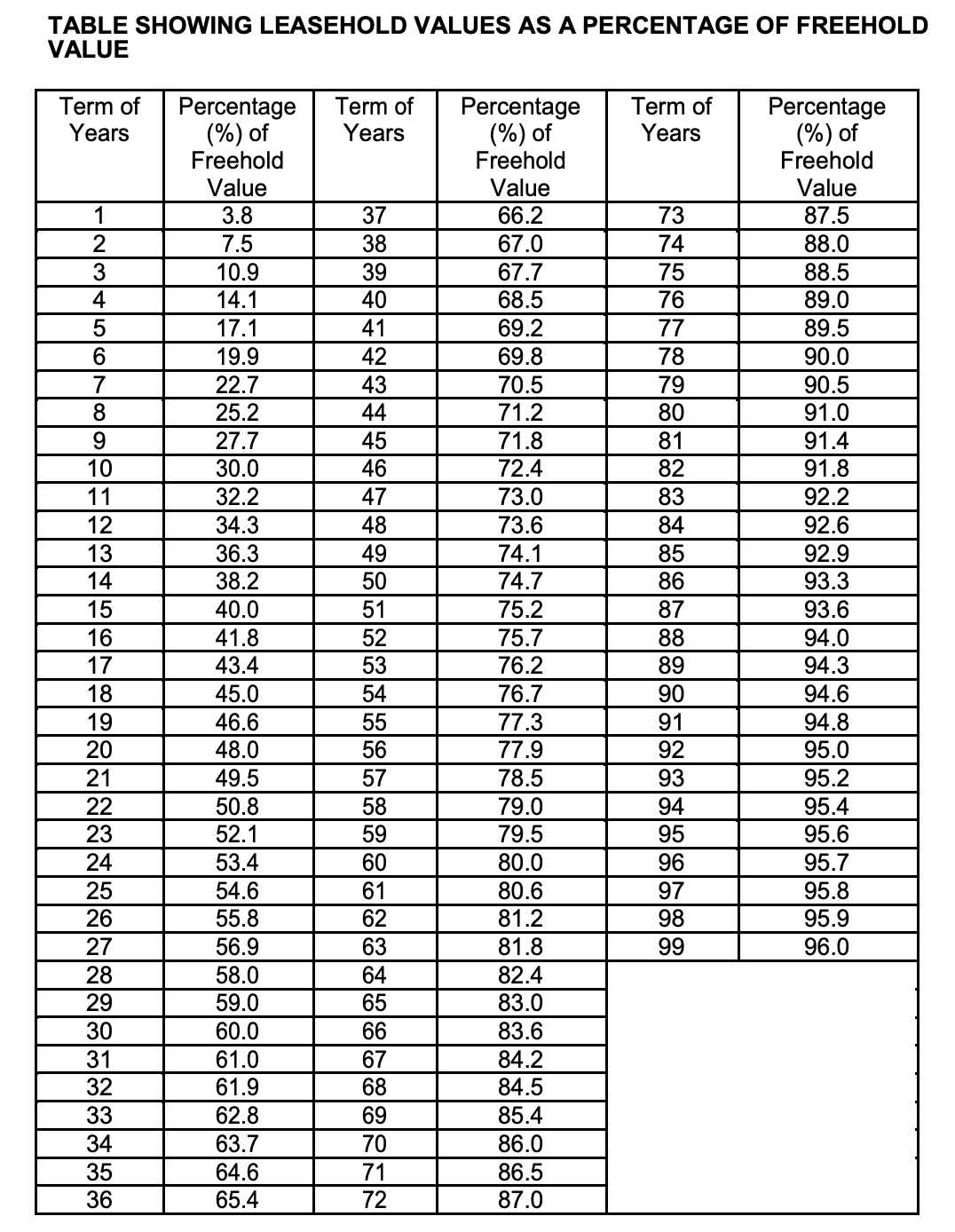

Let’s say a developer has set eyes on a 39-year-old leasehold development for en bloc sale. The land would be valued at S$50 million if it were freehold. Its leasehold value (80% of freehold value) is thus S$40 million, using Bala’s Curve. To top it back up to 99 years (96% of freehold value), the developer would have to pay an additional S$8 million (S$48 million – S$40 million).

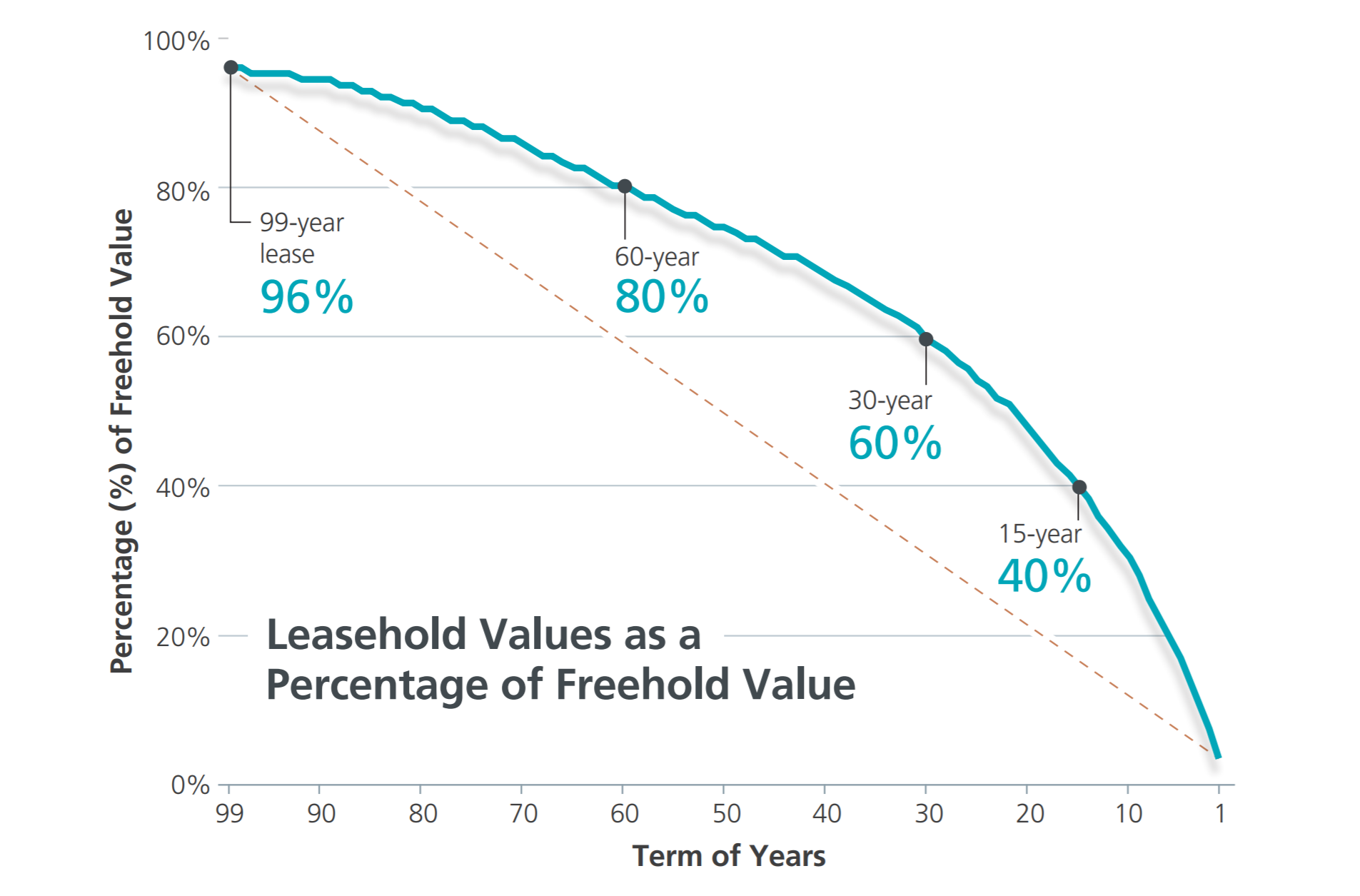

A simplified look at how Bala’s Curve works:

On the curve, the value of leasehold land is expressed as a percentage of the land value were it freehold. For example, consider a property that would be worth S$1 million as freehold:

- At the start of a fresh 99-year lease, the value of a property is 96% of its freehold value. So if it would hypothetically be worth S$1 million as a freehold property, the actual value of the leasehold property in reality is S$960,000.

- When there are 60 years left on the lease, it is worth 80% of its freehold value—so S$800,000 as a leasehold

- When there are 30 years left on the lease, it’s valued at 60% of its freehold value, or S$600,000

Here’s Bala’s Curve:

Here it is in table form, from SLA:

Note that Bala’s Curve doesn’t follow a precise pattern and the fall in value over time is NOT linear (i.e. it falls faster as the property becomes older). That’s because the drop in leasehold value isn’t linear in reality anyway. Property values tend to depreciate faster as the lease nears its end (e.g. the value of the last 30 years is lower than the value of the first 30 years).

The simplest explanation for the non-linear nature of Bala’s Curve is to treat the leasehold property is a future rental income source, while also taking into account inflation by introducing a discount rate to the formula.

In the rather complicated formula for Bala’s Curve, which we won’t touch on here, rental income is assumed to rise at a constant rate, but still at about 3.5% below the discount rate (according to this report), which erodes the value of rental income over time.

With the formula, the value of the leasehold value decreases gently at first. But just after the 30-year mark, the discount rate really makes its effect known (it’s like the reverse of compound interest on your bank savings). As a result, your rental income in the later years of a lease (i.e. the value of that property) worth less and less at an ever faster rate until it hits zero at the end of the lease.

In reality, however, a leasehold property’s value won’t start falling from day one. Real-world property prices, especially for newer homes, tend to keep pace with inflation pretty well, hence avoiding the devaluing effects of the discount rate.

But eventually, at around the 40-year mark, mathematics catches up with the property no matter how many new amenities gets built around it. You can see the effect on the older flats in Toa Payoh and Clementi.

As we can see from the curve above, after the price peak in 2013, the value of the older Toa Payoh flats have slid at a faster rate than the value of the Clementi flats, which are 10 years younger.

From 2013 to 2019, prices of these flats were on a downtrend consistent with Bala’s Curve. This is precisely why banks and the HDB are reluctant to approve the full loan amount to buyers of properties with a shorter remaining lease, eg. less than 60 years of remaining lease for bank loans.

For HDB loans, HDB won’t approve the full loan amount if the remaining lease of the property doesn’t cover up till age 95 of the buyer.

Additionally, the use of CPF funds are also regulated for these older properties.

(While we note that prices of these older flats have since increased over the last couple of years, this is due to the robust resale flat market, driven by pandemic factors such as construction delays and demand for bigger space.)

Properties over 40 years old for sale

Bala’s Curve used by HDB in its Lease Buyback Scheme?

Bala’s Curve probably also plays a role in HDB’s Lease Buyback Scheme (LBS). The LBS allows eligible older public flat owners to sell part of their lease (depending on your age, it will be a minimum of 15 years to a maximum of 35 years of the tail-end lease) to the HDB in exchange for cash/CPF proceeds. It’s likely that HDB’s professional valuers use the SLA leasehold table to determine the value of the tail-end lease based on current market value.

(Note that, however, HDB may be more generous towards flat owners who participate in the LBS, giving them higher proceeds than what mathematics would prescribe. This is done partly to compensate for the fact that flat owners can no longer rent out the whole flat, or choose to sell it on the open market, once they take up the LBS.)

Another consideration is the Voluntary Early Redevelopment Scheme (VERS), which we have yet to see in action. We know that during the VERS exercise, the government will compensate the flat owners based on the market value of their homes, which by then would have less than 30 years of remaining lease.

It seems probable that Bala’s Curve may be used as the guideline here, in working out the value based on the remaining lease—but this remains to be seen.

There are some limitations to Bala’s Curve

The key thing to remember is that Bala’s Curve is not an absolute rule. Don’t expect any entity—be it a government body or private developer—to steadfastly adhere to it.

One of the key factors here is the prospect of en-bloc sales and the developer’s qualitative judgement. Bala’s Curve doesn’t take into account a developer swooping in with an especially generous en-bloc offer, such as we often saw in 2017 and 2018. In the end, if a developer believes a location is under-valued, they may pay far more than Bala’s Curve implies they should.

On an individual level, we have seen things like a million-dollar sale for a 43-year-old flat in Tiong Bahru, which seems to have gained the sellers so much profit that it seems like its leasehold status is not even in question. Well, that’s because if there’s an overwhelmingly positive attribute about the home, or if a certain type of property is scarce, old-fashioned demand-and-supply economics take over and Bala steps aside.

[Additional reporting by Virginia Tanggono]

Planning to sell your leasehold property soon? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends Freehold vs 999/99-year leasehold condos — Which is the better choice? and What’s the appeal of 99-year leasehold landed properties?

The post What does Bala’s Curve tell us about leasehold property value? appeared first on .