Flat owners look forward to their MOP like NS men look forward to their ORD. Once it happens, you’re free to…carry on with 20 more years of debt? Obsess over the impact of a nearby columbarium on property price? Eh, here are some better ideas.

But first, what is the MOP?

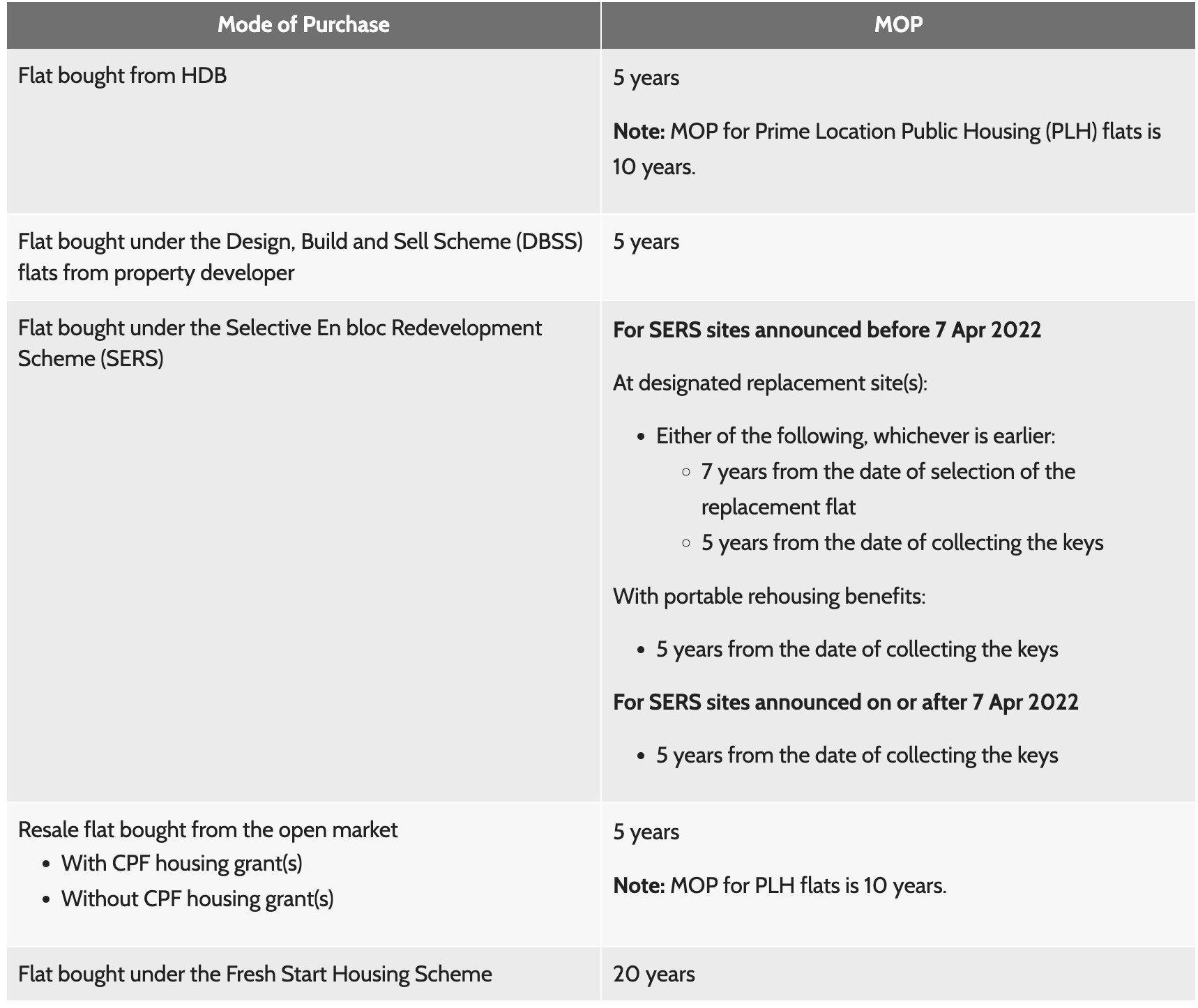

The Minimum Occupation Period (MOP) is a five-year stretch that applies to most HDB properties (yes, including Executive Condominiums that have not yet been privatised).

*The MOP is extended to 10 years for Prime Location Public Housing (PLH) flats.

During the MOP, you cannot sell your flat on the open market, and you cannot rent out the entire flat (although you can still rent out individual rooms, provided you still live there). In addition, you cannot buy a private property during the MOP.

One exception to the rule is if you own a one-room resale HDB flat, which you purchased without any HDB grants. There’s no MOP on these units. (Although this exception doesn’t seem to apply anymore; as of this update, HDB’s website states that resale flats bought without any grants are subject to the five-year MOP).

The MOP begins from the day you complete the sale transaction (aka when you collect the keys to your new home). If there’s a gap in which you’re not living in the flat (e.g. you fly overseas to work for two years), those years do not count toward your MOP.

So, that being said, what can you do after your MOP? Well, you can…

- Buy a private property in addition to your flat (if you’re a Singapore Citizen)

- Upgrade to a private property

- Move in elsewhere and rent out your whole flat (if you’re a Singapore Citizen)

- Sell and move to a different flat

1. Buy a private property in addition to your flat (if you’re a Singapore Citizen)

If you’re a Singapore Permanent Resident (PR), skip to point 2, or keep reading to rage at the unfairness.

A Singapore Citizen can buy a private property in addition to their HDB flat, once the five-year MOP is up. Also, do you have a lot of money? Because you’ll need a ton of it. Like, enough-to-take-a-year-off-work levels of money.

First, you need to pay all the usual taxes, such as the Additional Buyer’s Stamp Duty (ABSD) of 17% on the second property. Then, you need to be ready for either a huge down payment or to pay off the outstanding home loan of your current HDB flat.

That’s because, if you still have an outstanding home loan when you buy the second property, the maximum you can borrow is 45% of the property’s price or value (whichever is lower).

Assuming you settle all that in cash without triggering a Central Narcotics Bureau investigation, congratulations! You’re a proud owner of a flat and a condo. You can generate rental income by living in one and renting out the other.

As an important aside, note that you can’t do this the other way around. If you own a private property and then buy an HDB resale flat, you’ll need to sell the private property within six months.

(Although the current temporary regulation is that, following the September 2022 cooling measures, you’ll have to sell the private property 15 months before you can buy a resale flat. That is, unless you’re 55 years old and above and buying a 4-room flat or smaller.)

The only way to have both an HDB flat and a private property is to be a citizen, buy a flat, wait for the MOP to be over, and then buy a private property.

2. Upgrade to a private property

After the MOP is up, you can sell your flat and upgrade. There are two ways to do this:

First, you can buy a private property first, and then sell your flat. This is usually more convenient, as it can eliminate the need for temporary accommodations. But it’s also a much bigger hassle.

If you choose to buy a second property before selling your flat, you need to pay the ABSD as usual. Then, if you’re a married couple and at least one of you is a Singapore Citizen, you can get ABSD remission if you sell the flat within six months of buying a second property. If you can’t sell the flat within six months, then thank you for your contribution to nation building.

Also, you’ll probably want a mortgage broker to sort out the paperwork with the bank. Unless your existing flat loan has been paid off, you may get a lower financing for your private property due to the Total Debt Servicing Ratio (TDSR), which limits your monthly debt obligations.

You’ll need documentation to prove to the bank that you’re in the process of selling your flat, and will do so in six months. These include:

- A copy of a signed undertaking to the HDB committing to complete the sale of your current property within the period stipulated in the undertaking

- A written declaration that you will take steps, in accordance with the signed undertaking, to sell your current property.

The bank will then consider excluding the monthly instalments of your current flat in the TDSR calculation, so that you can get a higher financing.

The alternative to all this hassle is just to sell your flat first, collect the proceeds and pay off the flat loan, and then buy a private property. The downside is that there may be a delay, during which you have neither an HDB flat nor private property to stay in. You may have to find temporary accommodations for a while.

Properties for rent that are available now

3

2

3

3

3

2

3

2

2

2

1

2

2

2

3

2

3

2

2

2

3

2

3

2

3

2

3

2

3

2

3

2

2

2

1

1

3

1

2

1

2

1

3

2

3

2

2

2

3

2

3

2

1

2

2

2

2

2

2

2

2

2

3

2

3

2

3

2

4

2

See all HDB flats >

2

2

0

1

1

1

4

3

4

3

3

2

1

1

0

1

3

2

0

1

0

1

3

2

4

2

1

1

3

2

1

1

0

1

4

3

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

0

1

3

2

4

2

3

2

4

2

0

1

3

2

0

1

0

1

See all Executive Condos (ECs) >

4

4

1

1

4

4

2

3

1

1

3

5

2

2

2

2

2

2

3

2

2

1

3

2

1

1

1

1

2

1

1

1

1

1

3

2

4

2

1

1

1

1

1

1

2

1

1

1

3

2

1

1

4

3

3

2

2

2

1

1

4

3

4

5

3

3

3

3

4

4

See all Condos >

3. Move in elsewhere and rent out your whole flat (if you’re a Singapore Citizen)

Again, skip this if you’re a PR. Sorry, but only citizens get to rent out their entire HDB flat. PRs can only ever rent out rooms, but not the whole unit.

For you lucky citizens, this can turn your flat into a cash-generating asset. For example, if your parents have a huge flat or condo already, you can move in with them and rent out your whole flat. It’s common for some couples to do this for a few years after their MOP has finished, as they can save up the rental income as down payment on a condo.

For example, say you want a S$1.5 million condo. The minimum cash component is 5%, or S$75,000 (the rest of the down payment can normally come from your CPF). If you move in with mum and dad, and rent out your entire flat for S$2,800 a month, you can more than cover this cost after two and a half years.

Condos for sale at S$1.5m and below

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

See all 1-bedders >

2

2

2

1

2

2

2

1

2

2

2

2

2

1

2

1

2

2

2

1

2

2

2

2

2

2

2

1

2

3

2

2

2

2

2

1

2

1

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

1

2

2

2

2

2

2

2

2

2

1

2

3

2

2

2

2

See all 2-bedders >

3

3

3

2

3

2

3

2

3

3

3

2

3

2

3

3

3

2

3

2

3

2

3

2

3

3

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

3

3

3

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

3

3

2

3

3

3

2

3

2

See all 3-bedders >

4

3

4

3

4

2

4

3

4

3

4

3

4

3

4

3

4

3

4

3

4

4

4

3

4

5

4

4

4

4

4

3

4

3

4

6

4

5

4

4

4

4

4

5

4

5

4

5

4

4

4

3

4

4

4

4

4

3

4

4

4

3

4

4

4

3

4

6

4

3

See all 4-bedders >

5

3

5

2

5

4

5

4

5

4

5

4

5

7

5

7

5

4

6

5

5

4

5

4

5

7

5

6

5

5

5

5

5

4

5

5

5

7

5

7

5

4

6

7

5

7

5

4

5

5

5

4

5

5

5

3

5

3

5

4

5

7

5

4

5

5

6

7

See all 5-bedders and larger >

4. Sell and move to a different flat

The end of the MOP is an opportunity to move somewhere more appropriate. Either to be closer to your workplace, to right-size for financial benefits, or to minimise the chances of appearing on Crime Watch, because you’re one argument away from throwing that annoying neighbour down the stairs.

There’s three things to note, if you want to do this.

First, if you’re going to buy a second subsidised flat, you need to be prepared to pay the resale levy.

This is the amount you need to pay back to the government, because they subsidised your first flat, remember? The amount is currently as follows:

- 2-room flats – S$15,000

- 3-room flats – S$30,000

- 4-room flats – S$40,000

- 5-room flats – S$45,000

- Executive flats – S$50,000

For Singles Grant recipients, the amount will be halved. For example, the resale levy for 2-room flat, for a Singles Grant recipient, is S$7,500 instead of S$15,000.

If you’re going to buy the second flat before selling your current flat, the levy can be deducted from the sales proceeds — any shortfall will have to be paid in cash. Note that you must sell your previous flat within six months of buying a new one.

If you’re going to sell your existing flat first, you’ll have to pay the resale levy upon buying your second flat (this has to be in cash).

Second, you need to refund any CPF monies you used back to your CPF account.

This includes any CPF grants used, as well as the 2.5% annual interest that you would have earned if you hadn’t used your CPF monies for the house. You can log in to your CPF account to verify the amount. The good news is that you can still use your CPF monies to pay for your next flat.

(If you managed to pay for your flat without using CPF savings at all, then congratulations, you can keep the cash.)

Third, if you’re buying a resale flat, there are some differences to the loan.

You can take a second HDB loan and buy another flat immediately, instead of waiting for the sales proceeds from your previous flat.

But if you do this, the interest rate is not the usual concessionary rate of 2.6%. Instead, it’s pegged to the interest rates offered by the three local banks (DBS, OCBC and UOB).

After you’ve sold your previous flat and gotten the sales proceeds, you must pay back up to 50% of the cash proceeds into this loan. On top of that, you’ll have to use the CPF monies refunded to pay for the next house. After that, the loan is converted to the usual HDB loan at the concessionary 2.6% per annum.

If you want to sell your existing flat and buy a second one at the same time, you can use the Enhanced Contra Facility (ECF).

Simply put, ECF lets you tap on the sale proceeds and returned CPF monies to directly pay for your second flat. But note that stamp duties and legal fees have to be paid in cash, instead of with CPF, if you use this method.

For more information, check out 99.co’s guide on what you should know before buying your second HDB flat.

And those are your options! Before you pick any of them, just remember…

- Make arrangements for bulky furniture, especially if you’ll use temporary accommodations

- Check on 99.co to make sure you’re getting the best prices for your next home (psst, we have listings that are exclusively on 99.co)

- Start the sale process early, especially if you’ll need to sell your flat within six months. Don’t end up paying ABSD when you’re not really buying a second house; that’s just ridiculous. Work with your real estate agent on a marketing strategy, well before the six month timer starts.

[Additional reporting by Virginia Tanggono]

Need to sell your flat within six months? Consider engaging a property agent if you haven’t done so.

If you found this article helpful, 99.co recommends Selling your flat soon after MOP: Smart move or dumb move? and Full list of HDB BTO projects hitting MOP in 2023 (and should you sell right after MOP?).

The post So you’ve met your MOP. Now what can you do with your flat? appeared first on .