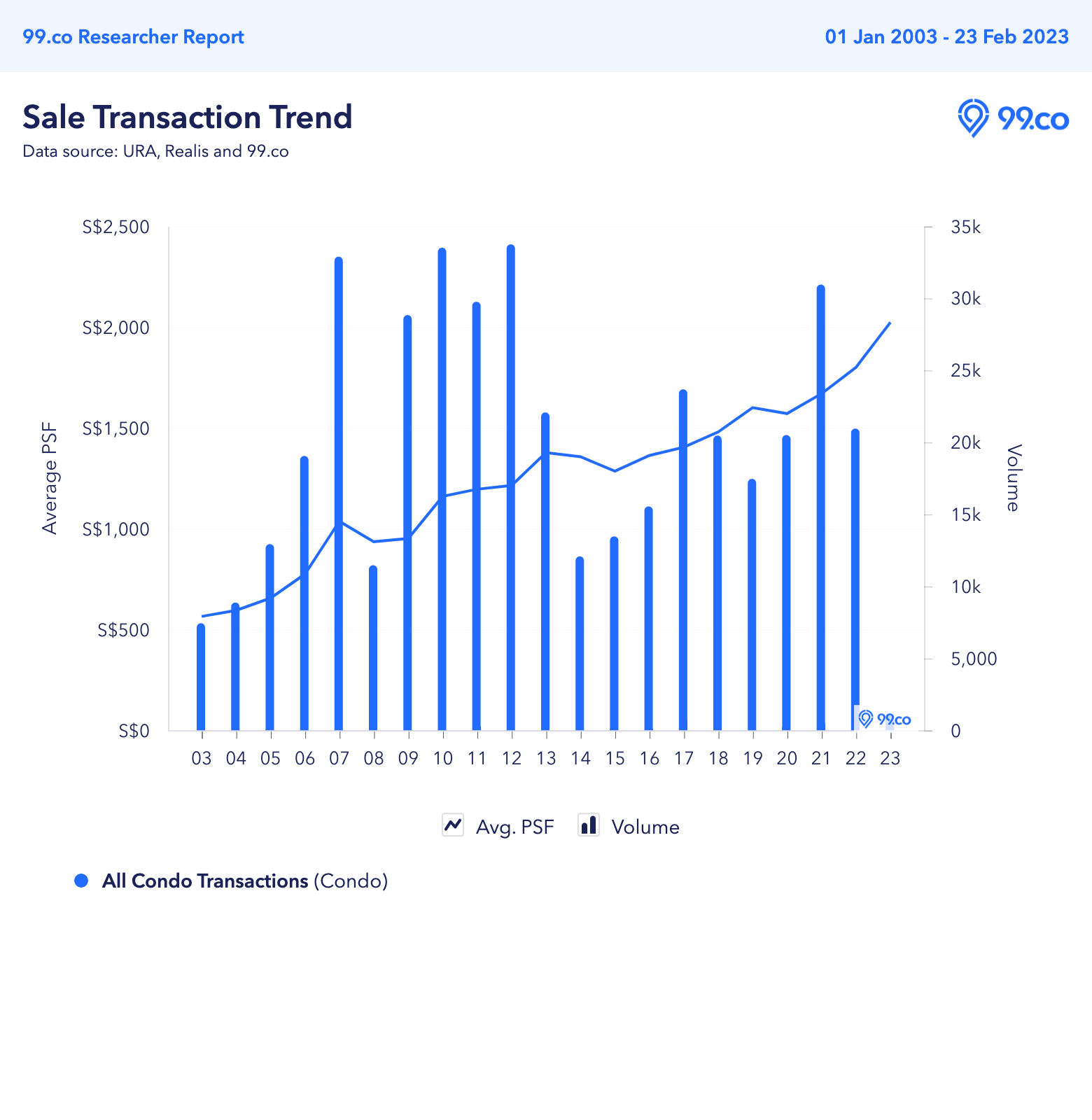

With housing prices increasing for almost three years now, it’s not surprising to see homeowners making gains by selling their properties.

At the same time, amidst increasing prices, there’s a handful who made a loss selling their properties.

With help from our data team, we’ve compiled a list of condo units that were sold at a loss in January 2023.

| Condo name | Size (sq ft) | Bought for/ Date bought | Sold for/ Date sold | Capital loss | Years held | Annualised loss |

| Reflections At Keppel Bay | 2,464 | S$5.5m

18 Apr 2012 |

S$4.5m

9 Jan 2023 |

-S$1m (-18.2%) | 11 | -1.81% |

| Reflections At Keppel Bay | 1,723 | S$3.98m

16 May 2013 |

S$3.07m

17 Jan 2023 |

-S$916k

(-23%) |

10 | -2.58% |

| Scotts Square | 947 | S$3.51m

30 Aug 2007 |

S$2.76m

6 Jan 2023 |

-S$749k

(-21.3%) |

16 | -1.49% |

| Reflections At Keppel Bay | 1,798 | S$3.65m

8 May 2007 |

S$2.95m

16 Jan 2023 |

-S$700k

(-19.2%) |

16 | -1.32% |

| Martin No 38 | 3,660 | S$8.05m

11 Nov 2016 |

S$7.5m

19 Jan 2023 |

-S$552k

(-6.9%) |

7 | -1.01% |

| Marina Bay Suites | 1,625 | S$3.79m

31 Oct 2011 |

S$3.28m

27 Jan 2023 |

-S$506k

(-13.4%) |

12 | -1.19% |

| Vida | 527 | S$1.37m

12 Jul 2007 |

S$1.07m

11 Jan 2023 |

-S$298k

(-21.8%) |

16 | -1.52% |

| Three Balmoral | 614 | S$1.6m

19 Apr 2013 |

S$1.31m

27 Jan 2023 |

-S$290k

(-18.1%) |

10 | -1.98% |

| Reflections At Keppel Bay | 1,421 | S$3.2m

15 Sep 2011 |

S$2.93m

3 Jan 2023 |

-S$270k

(-8.4%) |

12 | -0.73% |

| V On Shenton | 484 | S$1.29m

15 Nov 2012 |

S$1.04m

16 Jan 2023 |

-S$250k

(-19.4%) |

11 | -1.94% |

| Duchess Residences | 2,756 | S$5.20m

1 Aug 2007 |

S$5m

18 Jan 2023 |

-S$201k

(-3.9%) |

16 | -0.25% |

| The Foresta @ Mount Faber | 538 | S$1.16m

2 Dec 2021 |

S$990k

16 Jan 2023 |

-S$170k

(-14.7%) |

2 | -7.62% |

| The Greenwich | 603 | S$852k

27 Apr 2012 |

S$720k

11 Jan 2023 |

-S$132k

(-15.5%) |

11 | -1.52% |

| Marina Bay Residences | 743 | S$1.62m

9 Apr 2019 |

S$1.5m

3 Jan 2023 |

-S$120k

(-7.4%) |

4 | -1.91% |

| Marina Bay Residences | 1,980 | S$5.35m

20 Nov 2017 |

S$5.23m

16 Jan 2023 |

-S$119k

(-2.2%) |

6 | -0.37% |

| L’Viv | 657 | S$1.59m

21 Jan 2013 |

S$1.48m

5 Jan 2023 |

-S$113k

(-7.10%) |

10 | -0.73% |

| Paterson Linc | 818 | S$2.03m

20 May 2010 |

S$1.93m

17 Jan 2023 |

-S$102k

(-5%) |

13 | -0.40% |

| Stellar RV | 894 | S$1.6m

5 Sep 2012 |

S$1.52m

18 Jan 2023 |

-S$80k

(-5%) |

11 | -0.47% |

| The Sail @ Marina Bay | 883 | S$1.67m

9 Dec 2009 |

S$1.59m

3 Jan 2023 |

-S$78.2k

(-4.7%) |

14 | -0.34% |

| Kingsford . Hillview Peak | 560 | S$766k

22 Apr 2013 |

S$740k

9 Jan 2023 |

-S$26k

(-3.4%) |

10 | -0.34% |

| The Tennery | 613 | S$800k

14 Dec 2017 |

S$779k

30 Jan 2023 |

-S$21k

(-2.6%) |

6 | -0.44% |

| Kingsford Waterbay | 850 | S$1.06m

25 Sep 2017 |

S$1.04m

3 Jan 2023 |

-S$19.3k

(-1.8%) |

6 | -0.31% |

| EiS Residences | 915 | S$909k

28 Jan 2013 |

S$900k

9 Jan 2023 |

-S$9k

(-1%) |

10 | -0.10% |

Biggest capital loss unit was from Reflections at Keppel Bay

The biggest capital loss last month was S$1 million by the sale of a 2,464 sq ft unit at Reflections at Keppel Bay. Bought for S$5.5 million in 2012, the unit was sold at S$4.5 million in January.

Interestingly, the unit with the second-biggest capital loss at S$916,000 also came from the same development. The 1,723 sq ft unit, bought in 2013 for S$3.98 million, was sold for S$3.07 million last month. With a holding period of around 10 years, it has the second-highest annualised loss at 2.58%.

But these are not the only units in the condo that made a loss last month.

Reflections at Keppel Bay had the highest number of loss-making units in the month

One of the first things that caught our eye is that Reflections at Keppel Bay had not one, not two, but four condo units that were sold at a loss in January.

All four units have desirable attributes, such as being on a high floor (from 18th to 28th floor) and having a large floor area (ranging from 1,421 sq ft to 2,464 sq ft).

At the same time, we notice that all the units were bought during the property booms in 2007 and 2011 to 2013.

But Reflections at Keppel Bay isn’t the only project with more than one loss-making transaction last month.

Marina Bay Residences had two units sold at a loss last month. While the losses for both units were around S$120,000, the smaller unit (743 sq ft) made a higher annualised loss of 1.91% after a holding period of around four years.

74% of the loss-making units were held for at least 10 years

Another notable observation is that among the 23 units that made a loss last month, 17 of them were held for 10 years and longer.

Four units had the longest holding period of 16 years, which means that they were all bought during the 2007 property boom. This includes a unit from (yes, you guessed it right) Reflections at Keppel Bay. It made a loss of around S$700,000, or an annualised loss of 1.32%.

But among these four units, there’s a wide difference between their capital losses. Both units from Scotts Square and Reflections at Keppel Bay made losses from S$700,000 to S$749,000. These units are also located on a higher floor, with one on the 15th floor and the other on the 18th floor.

| Condo name | Size (sq ft) | Floor level | Bought for/ Date bought | Sold for/ Date sold | Capital loss | Years held | Annualised loss |

| Scotts Square | 947 | 15th | S$3.51m

30 Aug 2007 |

S$2.76m

6 Jan 2023 |

-S$749k

(-21.3%) |

16 | -1.49% |

| Reflections At Keppel Bay | 1,798 | 18th | S$3.65m

8 May 2007 |

S$2.95m

16 Jan 2023 |

-S$700k

(-19.2%) |

16 | -1.32% |

| Vida | 527 | 11th | S$1.37m

12 Jul 2007 |

S$1.07m

11 Jan 2023 |

-S$298k

(-21.8%) |

16 | -1.52% |

| Duchess Residences | 2,756 | 5th | S$5.20m

1 Aug 2007 |

S$5m

18 Jan 2023 |

-S$201k

(-3.9%) |

16 | -0.25% |

In comparison, two units from Vida and Duchess Residences made a lower loss of S$200,000 to S$298,000. And they’re located on a lower floor, at 5th floor and 11th floor.

Condos for sale

2

2

1

1

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

2

2

1

1

2

2

2

2

3

2

3

3

3

3

2

2

2

2

2

2

1

3

3

2

2

2

2

3

2

2

2

3

2

2

2

3

3

1

1

3

3

1

1

1

1

3

3

3

3

See all Scotts Square >

3

4

3

3

3

3

3

3

3

4

3

2

3

4

2

2

4

5

3

4

2

2

2

2

4

0

4

3

2

3

3

3

2

3

3

2

2

5

7

4

4

4

4

3

2

4

4

5

6

3

2

3

2

5

6

4

4

5

4

4

3

2

2

2

2

3

3

See all Reflections at Keppel Bay >

1

1

2

2

2

2

1

1

1

1

1

1

1

1

See all Vida >

4

4

4

4

4

4

4

5

3

3

See all Duchess Residences >

2

2

2

2

4

4

4

5

3

3

4

4

4

4

2

2

3

3

2

2

1

1

3

3

4

4

4

4

2

2

1

1

6

6

3

3

3

3

2

2

2

2

1

1

5

5

3

3

2

2

0

4

2

2

3

4

4

6

2

2

2

2

1

1

4

4

3

3

2

2

See all Marina Bay Residences >

56.5% of the loss-making condos were from the CCR

Among the 23 condo units that made a loss in January 2023, 13 of them came from the Core Central Region (CCR). Six were from the Rest of Central Region (RCR), while the remaining four were from Outside Central Region (OCR).

Capital losses among the CCR units ranged from as low as around S$78,000 (The Sail @ Marina Bay) to as high as S$749,000 (Scotts Square), with the majority ranging between S$100,000 and S$300,000.

Meanwhile, the RCR had the biggest and lowest capital losers. The biggest capital loss was S$1 million from the sale of a Reflections at Keppel Bay unit, while the lowest capital loss was S$9,000 from a sale at EiS Residences.

Over in the OCR, the highest capital loss was S$132,000 from the sale of a unit at The Greenwich, while the lowest loss was S$19,300 for a unit at Kingsford Waterbay.

Planning to cut your losses and sell your property? Let us help you ease the process by connecting you with a property agent.

If you found this article helpful, 99.co recommends Reflections At Keppel Bay unit sold S$6.6m higher in just over a year and A review of the 28 condo units that sold at a loss in November 2022.

The post 4 units at Reflections at Keppel Bay made a loss in January 2023, the biggest at S$1m appeared first on .