Looking to buy private property but not sure how much you can afford? Never fear, for 99.co is here — to help you make informed property decisions and beyond!

When it comes to buying property, it pays to be mindful when working out how much you can borrow, so you don’t end up with a very expensive mistake.

Eligibility versus affordability

Eligibility is not to be confused with affordability. In the property-buying context, it is important to note that one’s eligibility to take up a home loan is not the same as one’s ability to afford a property.

How do you afford a condo in Singapore? Some financial experts say that your monthly mortgage repayment, including principal and interest, should not exceed 30% of your gross monthly income.

This is the same as the Mortgage Servicing Ratio (MSR) for HDB flats and new ECs. Others say that such requirements are too stringent.

While opinions on what constitutes a golden mortgage-to-income ratio may differ, what’s important to note is that financial sustainability should always be a key focus when making big-ticket purchases like property. This is so you don’t end up starved of cash for your other goals (or having to eat instant noodle and bread every day).

How much do you need to earn to buy a condo?

To make life easier for property seekers in Singapore, we’ve crunched the numbers to provide the approximate income that you need to be earning to afford a condo. This will depend on the type of condo you’re buying (new condos are generally more expensive) and its location (homes in the Core Central Region (CCR) are more costly).

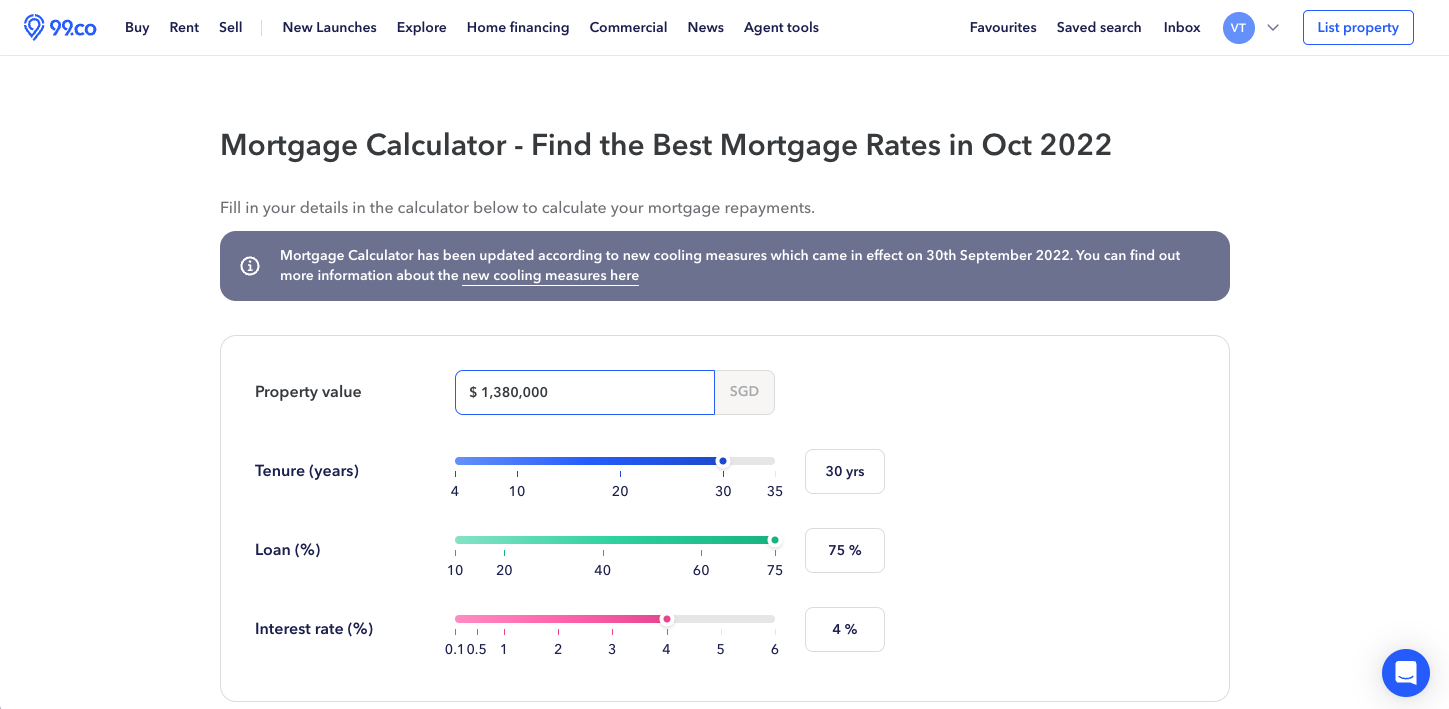

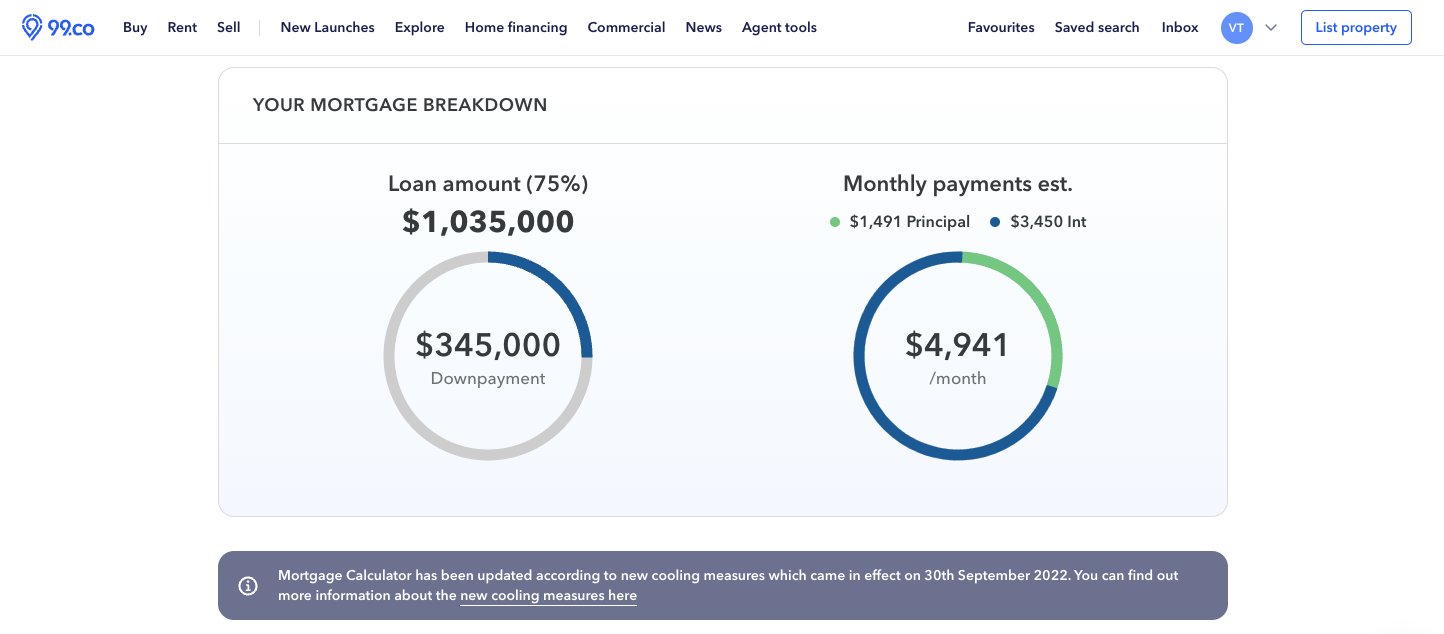

These estimates are made based on the ability to service mortgage repayments with the following assumptions in mind:

- You’re a Singapore Citizen without any other residential properties here, and hence don’t have to pay 17% Additional Buyer’s Stamp Duty (ABSD)

- You’re paying a 25% down payment, maximising the 75% loan-to-value (LTV) limit and taking up a 30-year loan tenure

- A medium-term interest rate of 4% is applied, as advised by the Monetary Authority of Singapore

- You don’t have any other loans to service, including property, car loans, personal loans and student loans

- Total Debt Servicing Ratio (TDSR) framework, which dictates that the total loans you need to service in a month should not exceed 55% of your gross monthly income

For this article, we’re looking at 2-bedroom condo units. Average prices are derived from 99.co’s Researcher, based on sales transactions that occurred in Q4 of 2022. We also used 99.co’s mortgage calculator to calculate estimated monthly mortgage repayments

The estimated monthly income you need to buy a new condo

*Do note that these estimates are based on the average price, which may be higher or lower than the actual price. We recommend you to calculate with 99.co’s mortgage calculator based on the actual price to determine if it’s within your means.

If you meet the minimum income requirements, here are some new launch condos with 2-bedder units that hover quite comfortably within the average price ranges in the respective market segments:

Core Central Region (CCR):

- Pullman Residences Newton

- Leedon Green

Rest of Central Region (RCR):

- The Landmark

- Myra

Outside Central Region (OCR):

- Urban Treasures

- Bartley Vue

The estimated monthly income you need to buy a resale condo

Despite two rounds of cooling measures in December 2021 and September 2022, prices of condos have increased by 8.1% in 2022. When broken down by market segments, RCR condos saw the highest price increase at 9.7%, followed by OCR condos at 9.3% and CCR condos at 4.8%

If you’re looking for affordable condos, you may want to consider resale condos.

*Do note that these estimates are based on the average price, which may be higher or lower than the actual price. We recommend you to calculate with 99.co’s mortgage calculator based on the actual price to determine if it’s within your means.

If you’re looking to buy resale private property, here are some projects with 2-bedder units that nestle comfortable within the average price ranges in the respective market segments:

CCR:

- D’leedon

- 26 Newton

RCR:

- Queen’s Peak

- Sky Green

OCR:

- The Estuary

- Skies Miltonia

Median salary in Singapore: Can I afford a condo?

Now that you’re caught up with how much both new and resale condos cost in Singapore, you might be asking the million-dollar question (literally): Can I really afford to buy a condo?

We’ll look at the income numbers published by the Ministry of Manpower’s Research and Statistics Department.

According to them, the median gross monthly income from work (this includes employer CPF contributions) of full-time employed residents in 2022 is S$5,070 an 8.33% increase from the previous year.

For the uninitiated, the median takes the income in the middle, so half of the workers earn less than the numbers below, and half earn more.

If you’re a dual-income couple looking at buying a condo, you’ll have twice the earning power to finance it. With your combined income, condos in the OCR and RCR will fall within your monthly affordability range.

After being in the workforce and saving up for a few years, you and your partner will probably be able to afford the hefty downpayment and sign that cheque to buy your dream condo.

Read this: 8 steps to buying a new launch condo in Singapore

Find out more about your affordability range with 99.co’s affordability calculator!

[Additional reporting by Virginia Tanggono and Jamie Wong]

Planning to sell your property to buy a new or resale condo? Let us help you get started.

If you found this article helpful, 99.co recommends New launch condos launching in Q1 of 2023 to upgrade or rightsize to and A quick review of condo sales with at least 100% gain in December 2022.

The post Here’s how much you need to earn to afford a condo (2023) appeared first on .