When selling your property, the location of your next home is an important consideration. You might be looking at finding a home in an area that’s great for property investment.

We’ve compiled a list of up-and-coming areas in Singapore that will have exciting developments in the next 5-10 years. These areas have also enjoyed great price appreciation in recent years and are expected to do even better because of new developments.

If you want a better guarantee of appreciation and yield from your next home but are still trying to figure out where to look, this is the list for you.

Woodlands

Gone are the days when Woodlands was seen as “ulu” (remote/deserted in Malay). With the Thomson-East Coast Phase 3 Line opening in November this year, residents can conveniently get to Orchard in around 30 minutes and the CBD in less than 40 minutes.

On top of that, the North-South Corridor (NSC) will also cut the travelling time to the city centre for cars and buses. Set to be completed in 2026/27, the NSC is an integrated transport corridor with an expressway, bus lanes, and cycling and pedestrian paths.

In 2026, Woodlands North station will also be connected to the Johor Bahru-Singapore Rapid Transit System (RTS) link. This will significantly boost the appreciation value of properties in the area as it will attract those who travel to JB frequently.

Aside from transport developments, the Woodlands Regional Centre (comprising Woodlands Central and North Coast) will be a business, commercial and industrial hub.

There will also be a mix of private and public housing around Woodlands North MRT. Coupled with the Woodlands Waterfront Park, the area is set to be a vibrant waterfront precinct with scenic trails and abundant nature.

Price appreciation of properties in Woodlands

HDB

This year, Woodlands had its first million-dollar HDB transaction; to date, there have been 9 such transactions. All of them are executive apartments (EA) with sizes of around 2,000 sq ft.

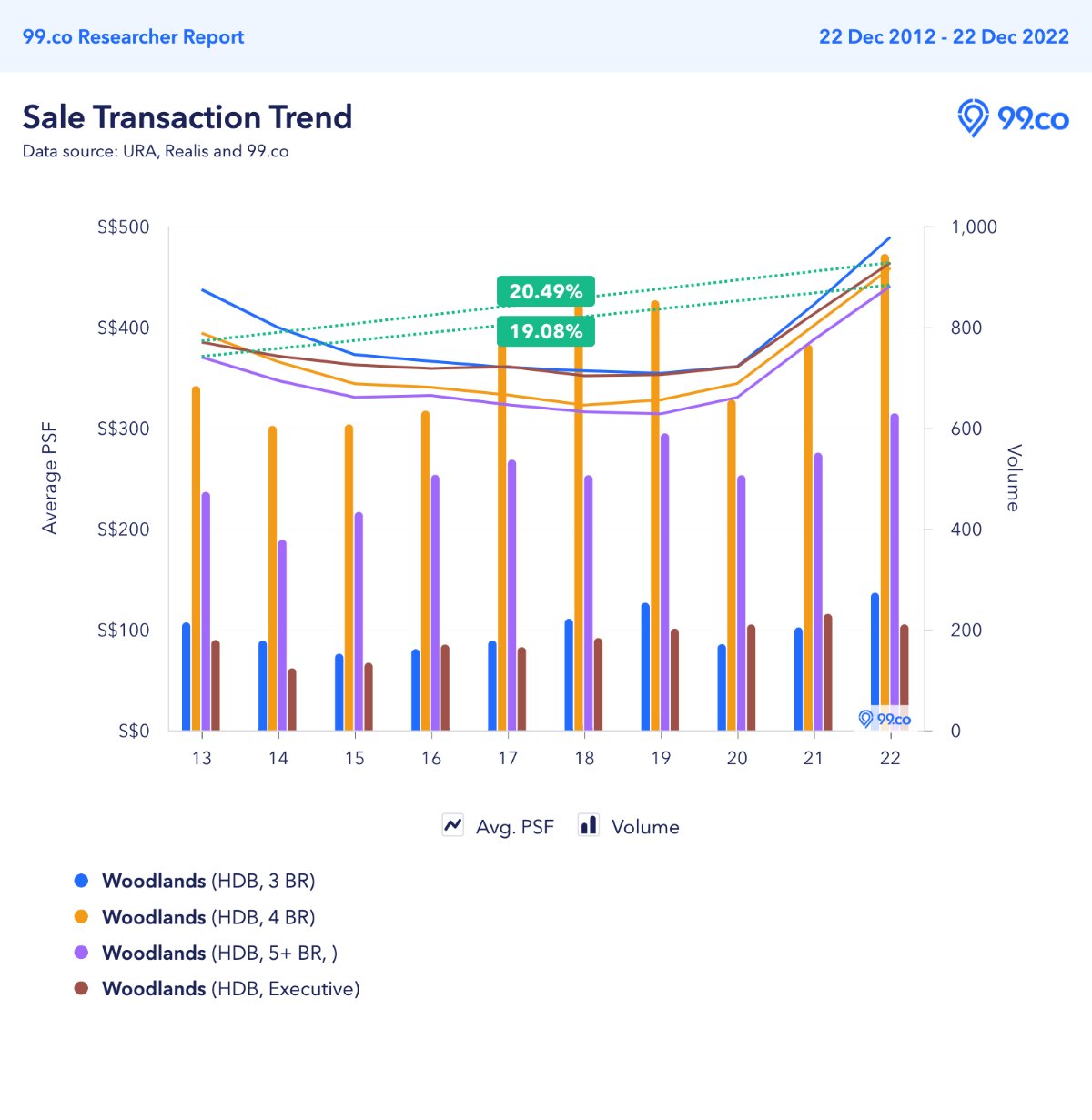

Based on transaction data from URA, Realis, and 99.co, HDBs in Woodlands have had a healthy appreciation over the last 10 years. While there was a downward trend from 2013 to 2019, the average psf prices have appreciated. We foresee that the rate of appreciation will continue to increase.

Out of all HDB types, executive HDBs have the highest appreciation rate of 20.49%, followed by 5-room flats at 19.08%, 16.36% for 4-room and 11.88% for 3-room flats. All of the HDB types in Woodlands, except 5-room, have a higher appreciation rate than Singapore’s overall rate over the past 10 years (shown in the graph below).

Condo

In terms of resale condos in Woodlands, they haven’t appreciated as fast as HDBs.

4-bedroom condos in Woodlands saw the most constant price appreciation at a rate of 17.09% but do note that there are very few yearly transactions for it. Although average psf prices have fluctuated from 2012 to 2019, they have been increasing since 2020.

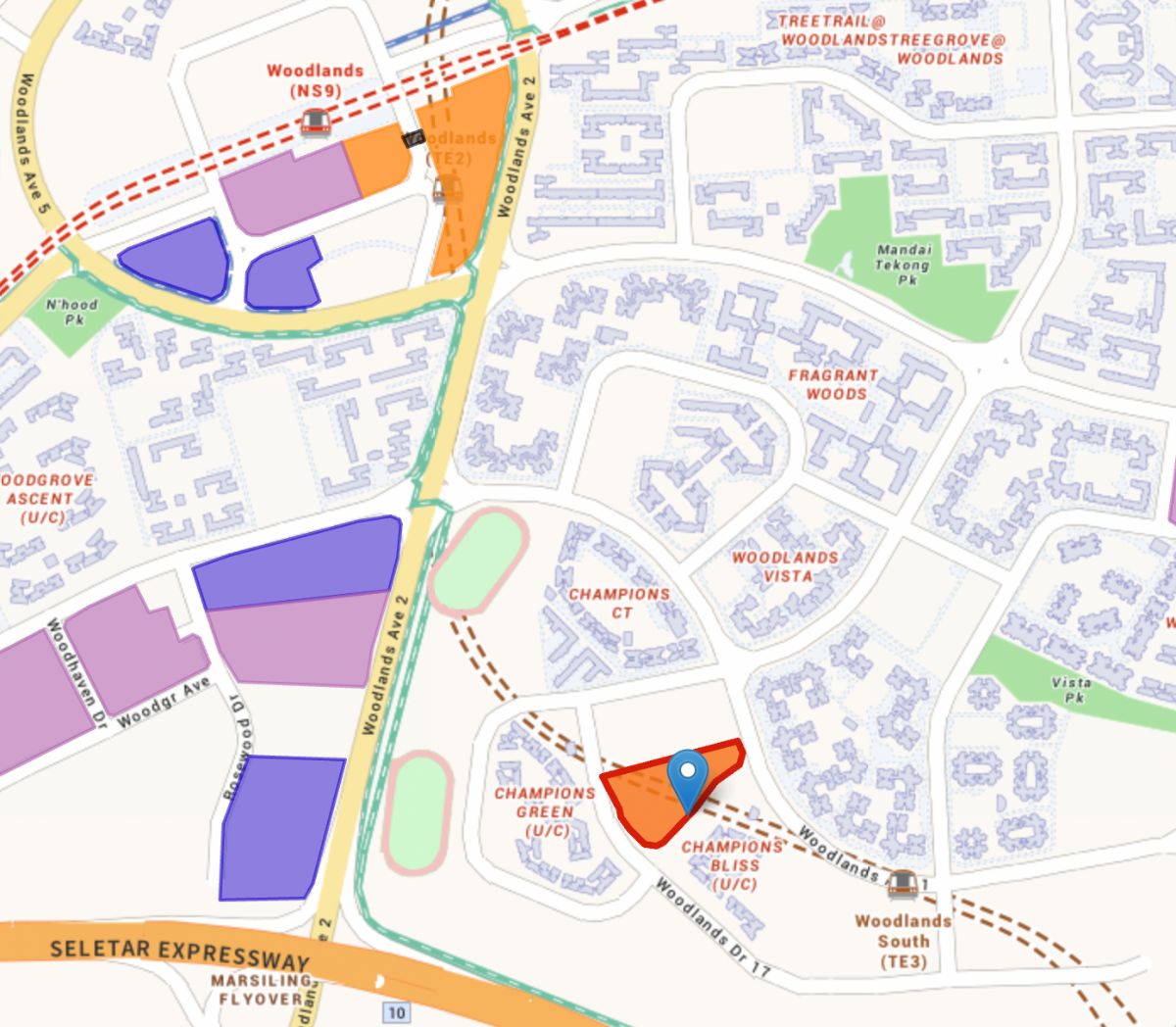

In the coming years, there will also be more private residential sites in Woodlands. A residential site at Champions Way (near Woodlands South MRT) is on the confirmed list of government land sales (GLS) for H1 2023, and more private residential sites will be launched near Woodlands North MRT.

There will also be mixed-use developments planned in Woodlands Central. Hence, there’s more investment and price appreciation potential as these future sites are near an MRT station. Mixed-use developments are also attractive for investments.

Jurong Lake District

Dubbed Singapore’s second CBD, Jurong Lake District (JLD) will be the largest mixed-use business district outside the city centre. There will be offices, housing, amenities, green spaces, and leisure and recreational facilities around Jurong Lake. Plus, a new tourism development and science centre will be built too.

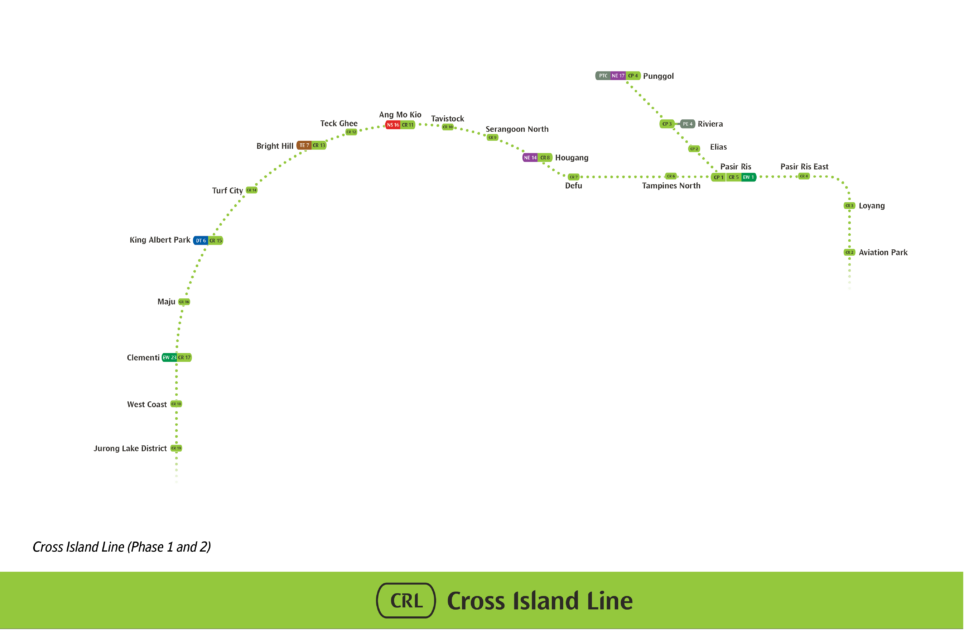

By 2035, JLD will also be served by 4 MRT lines – Jurong Region Line (JRL), Cross-Island line (CRL) and the existing East-West and North-South lines. The CRL will connect JLD conveniently to the CBD, Changi Airport and Jurong Innovation District.

Price appreciation of properties in Jurong

HDB

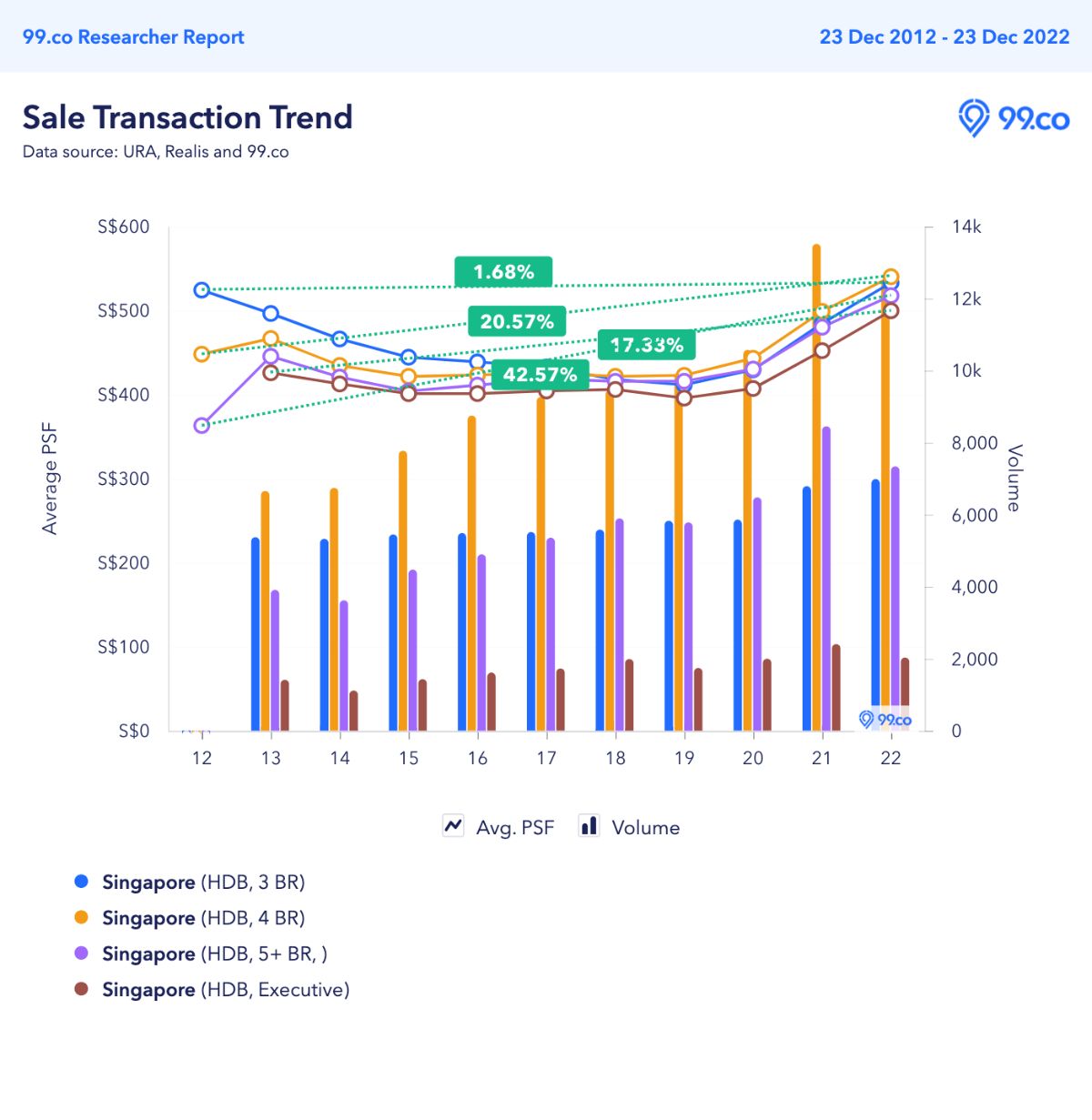

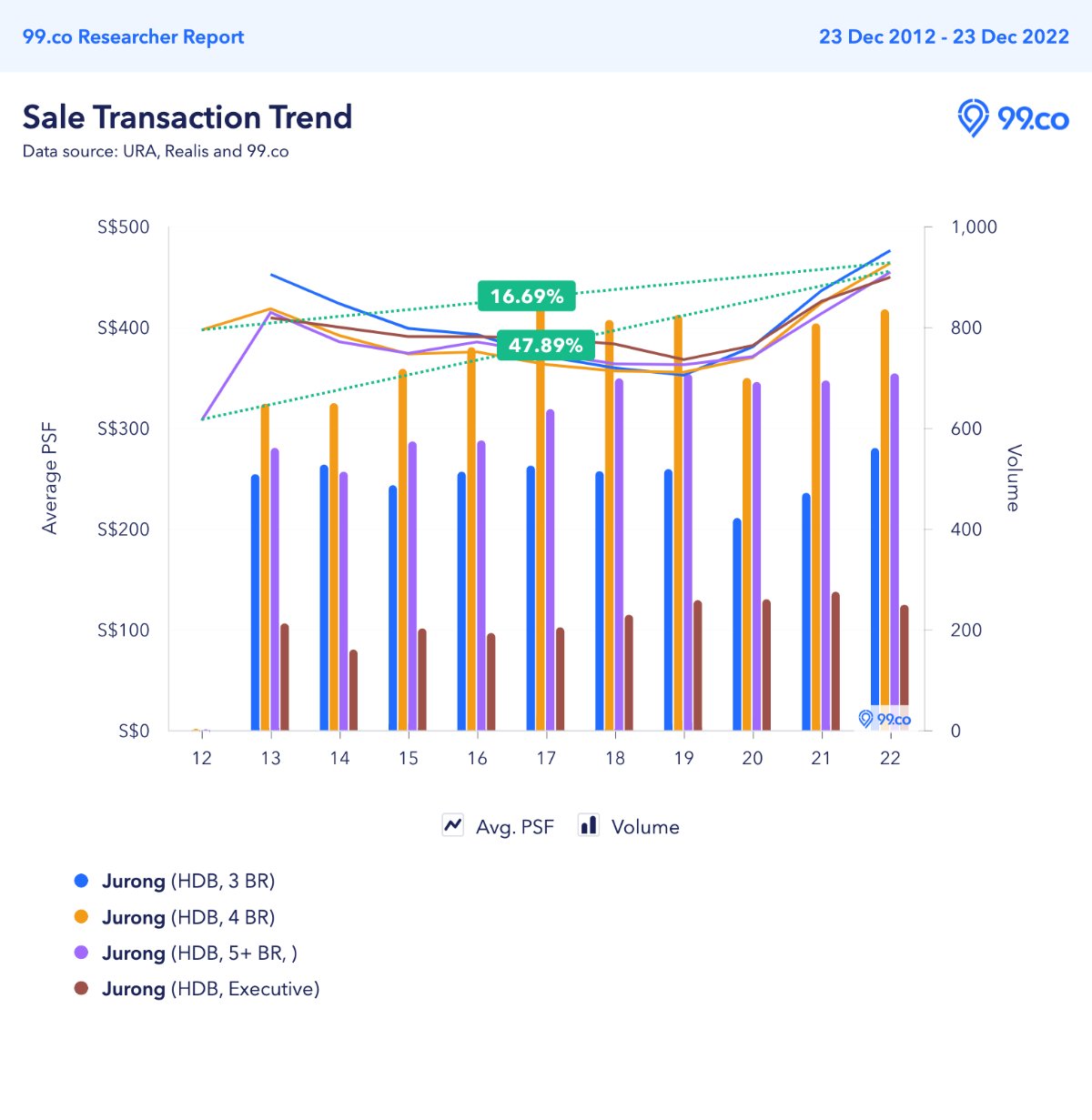

The average psf price of HDB flats in Jurong has generally increased over the last 10 years and has increased much faster since 2019. This could be due to several announcements of JLD’s developments announced that year.

5-room flats had the highest appreciation rate at 47.89%, followed by 4-room flats at 16.69%. The appreciation rate of 5-room flats is higher than that of Singapore, which is 42.54%.

SELLING YOUR PROPERTY? Would you like to know how much your property is worth? Or maybe you’re considering listing your property for sale? Let us know, and we’ll have a consultant reach out to you!

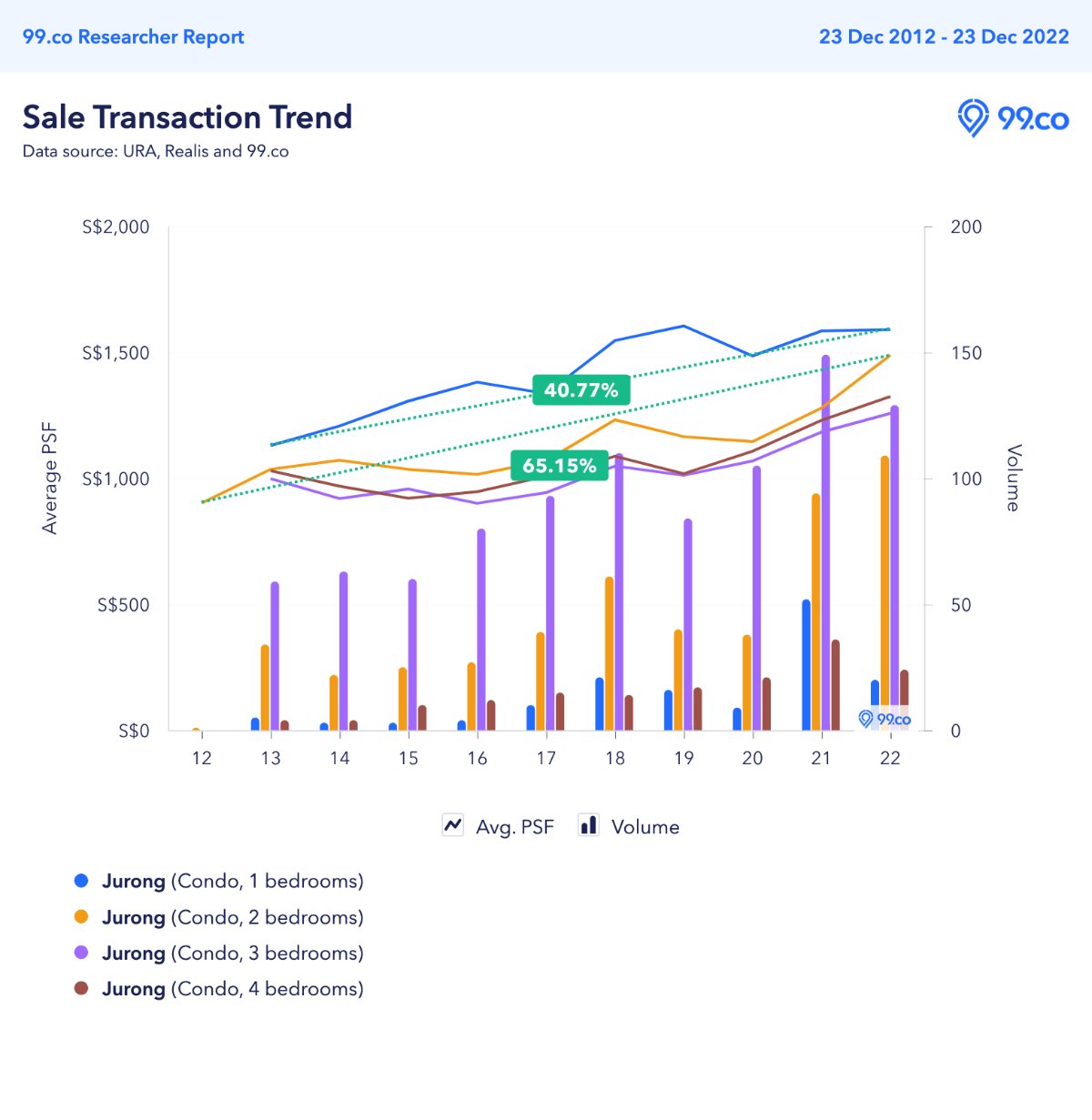

Condos

The average price psf of resale condos in Jurong has also appreciated well in the last 10 years.

The average psf price of 2-bedroom condos appreciated the most at 65.15% (vs 14.66% in Singapore), followed by 40.77% (vs -10.39% in Singapore) for 1-bedroom condos. Generally, all condo unit types have appreciated faster than those in Singapore.

There’s also more room for potential investment in Jurong. A white site near the current Science Centre is on URA’s confirmed list for H1 2023 and is estimated to launch in June. Located near Jurong East station and the upcoming Jurong Lake District station, the site is also expected to yield about 600 residential units.

The other areas around the site have also been reserved as white sites, which means there will potentially be more residential buildings and mixed-use developments.

Furthermore, Jurong has seen several enbloc projects in 2022 like The LakeGarden Residences (former Lakeside Apartments) and Park View Mansions. Lakeside Apartments was sold at 14% above its reserve price, which is a testament to its strong investment potential. Lakepoint Condo nearby is also currently undergoing private treaty discussions for an enbloc sale.

Adding to the list of enbloc projects in Jurong is JCube, which will make way for a mixed-use development.

Greater Southern Waterfront

An area you might have kept hearing about in the news is the Greater Southern Waterfront (GSW). Stretching from Pasir Panjang to Marina East, the GSW will be 6 times the size of Marina Bay and have residential, commercial and recreational areas.

An interesting development will be a continuous waterfront promenade along Singapore’s southern coast. This promenade will connect West Coast Park, Labrador Nature Reserve and Kent Ridge Park.

The development will be in phases over the next 5-10 years, starting from a redevelopment of the former Pasir Panjang Power District, Keppel Club and Mount Faber.

There are also plans for 9,000 public and private homes to be built at the Keppel Club site. These homes will enjoy the greenery and, possibly, waterfront living. Hence, they might potentially be great for investment or rental opportunities.

However, new BTO flats in this area are highly likely to be under the Prime Location Public Housing model (PLH) as they are near the city. This means the MOP will be 10 years.

Price appreciation of properties near the Greater Southern Waterfront (Queenstown, Bukit Merah)

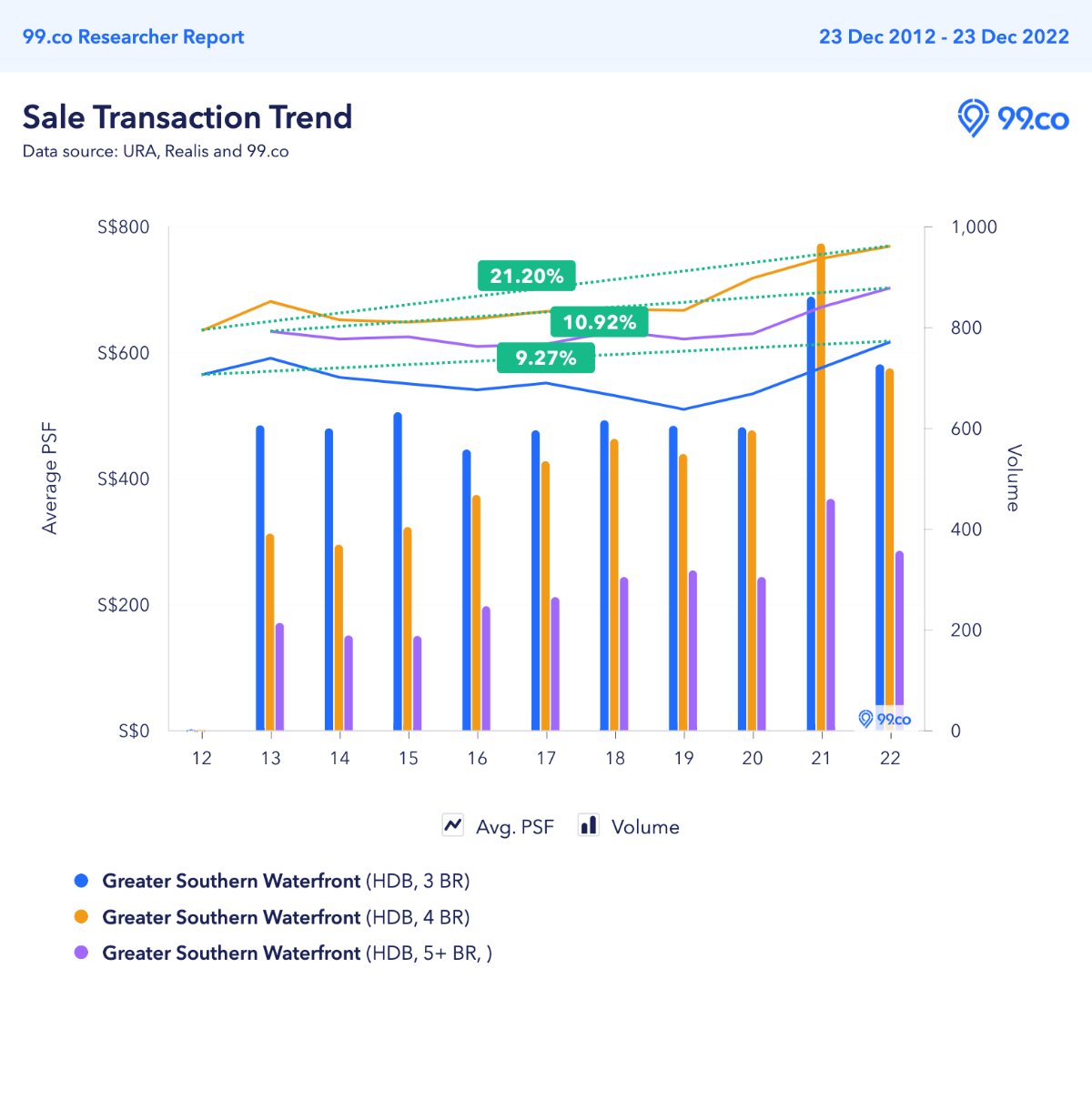

HDB

As the GSW is still undergoing development, we’ll look at the average psf prices of properties in neighbouring Queenstown and Bukit Merah.

The average psf price of 4-room flats in Bukit Merah and Queenstown has increased by 21.2%. Five-room flats follow this at 10.92% and 3-room flats at 9.27%. Average psf prices of 3 and 4-room flats have appreciated at a better rate against Singapore’s 1.68% and 20.57%, respectively. However, the appreciation rate of 5-room flats is lower than that of Singapore’s 42.54%.

The Bukit Merah and Queenstown area also saw dozens of million-dollar resale HDBs in 2022. This includes some record-breaking transactions – a 5-room flat at SkyTerrace @ Dawson (sold for S$1.418m) and a 5-room flat at City Vue @ Henderson (sold for S$1.4m).

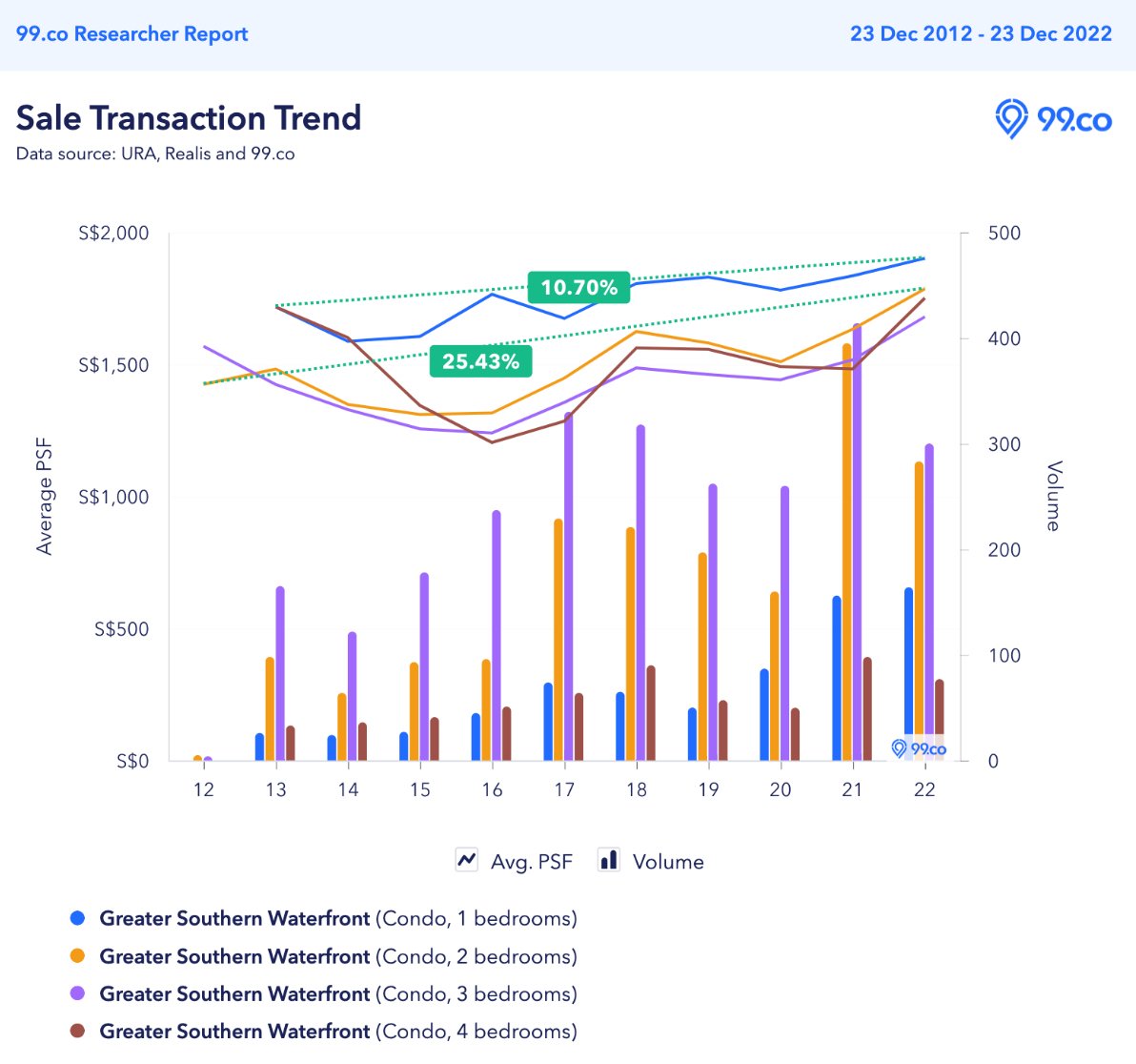

Condos

As for condos, 2-bedroom units have the highest appreciation rate of 25.43%, followed by 10.7% for 1-bedroom units. These are higher than the appreciation rate in Singapore, which is 14.66% and -10.39%, respectively.

1 and 2-bedroom units are doing better than 3 and 4-bedroom units as there might be demand for smaller units for condos in a city-fringe location. Buyers might be working professionals, singles and couples who want to live near the city centre.

Pasir Ris

Known for its laidback vibes and popular spots like Pasir Ris Park and Downtown East, Pasir Ris could be an underrated choice for investment potential.

In a recent article on the top district with the most profitable sales in the last 5 years, Pasir Ris was the third most profitable estate for HDB flats. The median capital gain was S$89,694 based on 886 transactions. The top 2 were Bukit Timah and Bishan, both in more central locations.

There will be exciting developments in Pasir Ris, such as the CRL, reducing travelling time from the estate to other parts of Singapore, including Jurong Lake District. Pasir Ris station will be an interchange station connecting the main CRL and the Punggol extension. There will also be 2 other CRL stations in Pasir Ris – Elias and Pasir Ris East.

Another development that’ll boost the value of properties in Pasir Ris is Pasir Ris 8, an upcoming mixed-use development. There will be retail shops, a bus interchange, a polyclinic, and childcare facilities linked to Pasir Ris MRT.

Price appreciation of properties in Pasir Ris

HDB

Overall, the average psf prices of 4-room, 5-room and executive flats in Pasir Ris have appreciated in the last 10 years. (We didn’t include 3-room transactions as there were no transactions in some years)

Executive apartments had the highest appreciation rate at 18.17% followed by 4-room at 16.6% and 5-room at 16.12%. While the rate is slower than the whole of Singapore in 10 years, the rate of appreciation over the past 5 years is faster than Singapore.

With the new CRL stations coming up in Pasir Ris, we’d expect the HDB projects around these stations to grow in appreciation.

Condo

Resale condos also had a steady appreciation rate over the last 10 years. All unit types had an appreciation rate of over 20%.

3 and 4-bedroom units had the highest appreciation rate of 27.43% and 28.98%, respectively. Both unit types have appreciated faster than the overall appreciation rate in Singapore, which is 22.09% for 3-bedders and -9.34% for 4-bedders.

Unsurprisingly, 3 and 4-bedroom units are faring well in Pasir Ris as its average psf prices are lower than in more centrally located areas. Hence, families who want bigger houses but don’t wish to pay such a high quantum might choose Pasir Ris as their home.

Tampines

Tampines is already established as an estate with many amenities and malls like Tampines Mall, Century Square and Our Tampines Hub.

The estate also has three MRT stations – Tampines, Tampines East and Tampines West.

Even though it’s a mature estate, there will be more developments in the coming years, increasing its investment potential. For instance, the Tampines North and Tampines South areas are currently being built with new homes, community facilities and green spaces.

Tampines North will have an MRT station on the CRL, making it convenient for residents to travel to central and western parts of Singapore.

Furthermore, the Tampines Ave 11 mixed-use development will be linked to the MRT, a shopping mall, and a bus interchange. It is expected to have 1,190 residential units. These developments will help boost the appreciation value of the properties in the area.

Lee Sze Teck, Senior Director (Research) at Huttons Asia, says the mixed-use site “will inject much-needed amenities to the area,” adding that there are at least 7 uncompleted BTO projects and 1 EC project (Tenet) in Tampines North.

Steven Tan, CEO of OrangeTee & Tie, adds that the site will attract developers. “Integrated developments remain attractive to buyers, given the convenience of having a transport node and shopping amenities at one’s doorstep. There are many BTO sites located close by; hence, there will likely be heavy footfall to the retail and commercial hub.”

Tampines is also located adjacent to the future Paya Lebar Airbase redevelopment, which will be completed in the 2030s. This area is 5 times the size of Toa Payoh and will have commercial and industrial hubs and housing.

Price appreciation of properties in Tampines

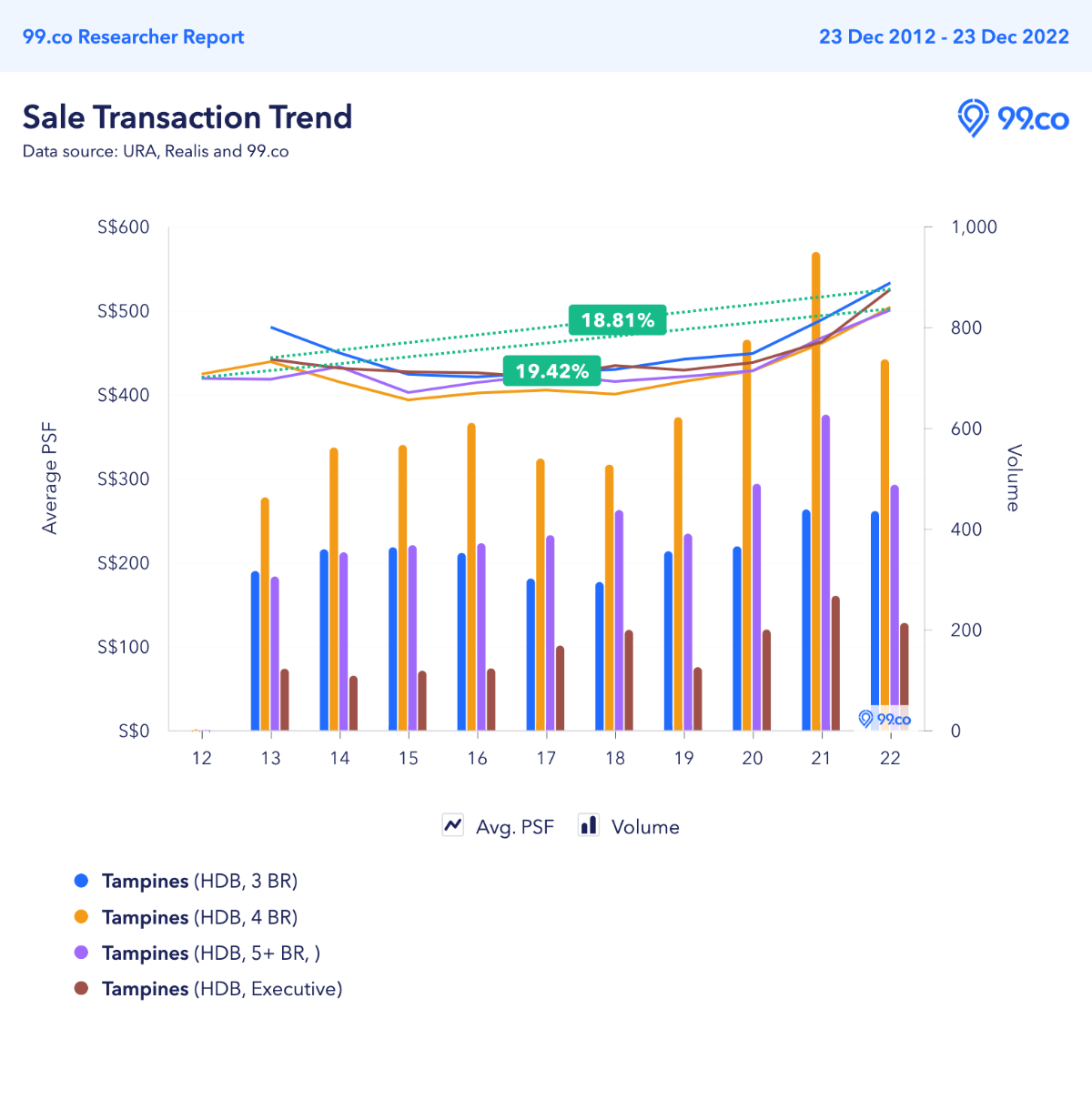

HDB

Overall, the average psf prices of HDB flats in Tampines have had a healthy appreciation, especially since 2020.

5-room flats had the highest appreciation rate of 19.42%, followed by executive apartments at 18.81%. The appreciation rate of executive apartments is slightly higher than in Singapore, which is 17.33%, while the appreciation rate of 5-room flats is lower.

We foresee that the HDB flats in Tampines North will have a high appreciation rate once the MRT station and mixed-use development are completed.

Condos

As for condos in Tampines, all unit types have appreciated well over the last 10 years and at a better rate than the whole of Singapore.

1-bedroom condos had the highest appreciation rate of 54.17% compared to Singapore’s -10.39%. 2-bedroom condos also appreciated well, at 34.71% compared to Singapore’s 14.66%.

With all the upcoming developments that we mentioned above, average prices will continue to appreciate at healthy levels.

Are you planning to sell your home but not sure if your next property can make you a high profit?

99.co recommends Top districts with the most profitable sales in the last 5 years and November’s top 10 condo sales in CCR, RCR and OCR with highest capital gains split by holding periods.

The post Up-and-coming estates in Singapore for future property investments appeared first on .