There are various reasons why homeowners want to downgrade and right-size from private property (executive condominium, condo or landed) to an HDB flat. It can be because they are empty nesters and no longer need a big space or no longer use the condo facilities. After all, there’s no point in paying S$300 per month for condo maintenance fee if you haven’t been using the facilities all these years.

On top of that, there are benefits of downgrading. For instance, Singaporeans living in a house with an annual value of S$21,000 and below will be eligible for GST vouchers. (In general, the median annual values of private properties are above S$21,000).

Aside from the reasons and perks of downgrading private property to an HDB flat, moving houses can be stressful. For a smoother process, here are some mistakes to avoid.

1. Not arranging for a temporary accommodation

Before the September 2022 cooling measures, this was more applicable if you were aiming to buy directly from HDB.

This is because you’ll need to dispose of your local private property and overseas property (if you have any) before you can qualify for these:

- Buy a flat directly from HDB through BTO, Sale of Balance Flats (SBF) or open booking

- CPF housing grants and HDB housing loan (more on these later)

This also means that if you’re planning to get a BTO flat, you must sell your house 30 months before you can ballot for it. After that, you must wait for another four to five years before you can finally move into your new flat. And that is if you manage to secure a queue number to select a flat on your first try. Otherwise, the wait will be even longer.

The wait is shorter if you go for SBF or open booking, which may also offer completed flats.

(The 30-month wait isn’t applicable if you’re planning to buy a short-lease 2-room Flexi flat or Community Care Apartment from HDB. Instead, you can sell your private property within six months of getting the keys to your new flat.)

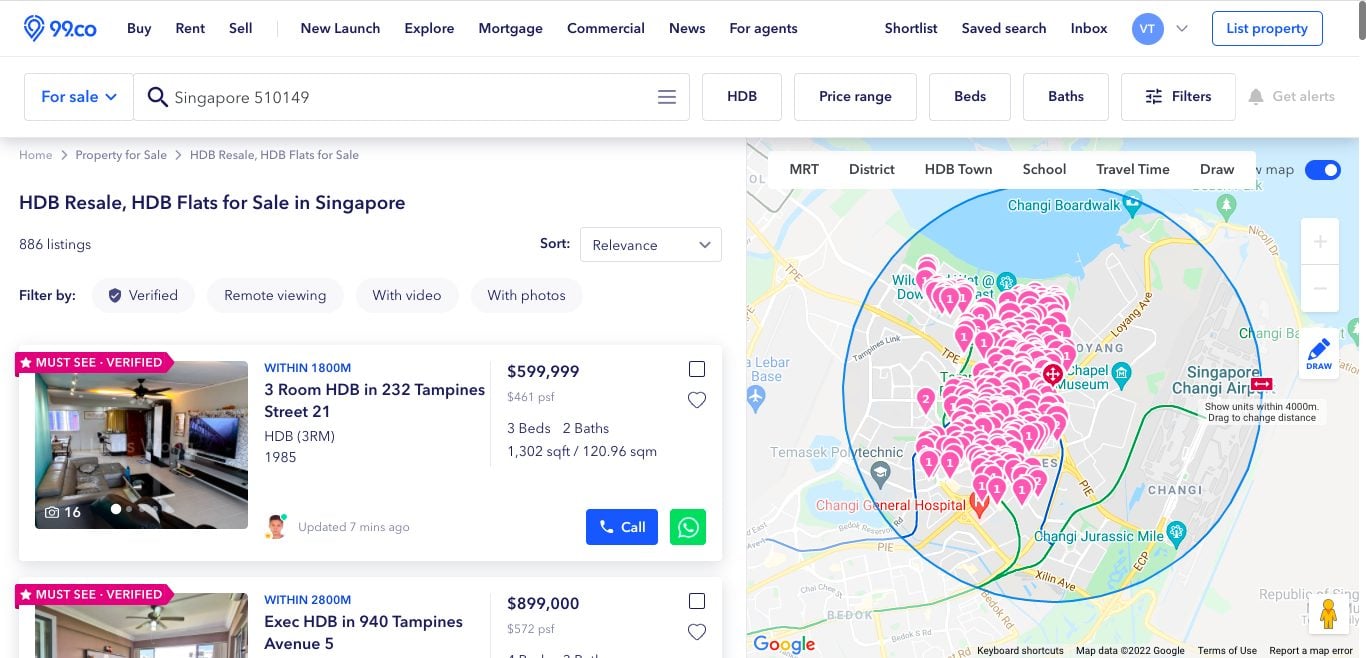

Nevertheless, the time bar means you’ll need to stay at temporary accommodation in the meantime (whether it’s renting or staying with your family). That’s why when people downgrade from private property, they will go for HDB resale flats. They could buy the resale flat and then sell the private property within six months.

Although there’s a rush to sell the property, at least they won’t have to move to another place while the sale is processed and the new house is being renovated.

But then came the September 2022 cooling measure announcement, which stipulated that private property owners looking to buy an HDB resale flat would have to wait for 15 months. This means they must sell their house first and stay at temporary accommodation.

(This isn’t applicable if you’re above 54 and downgrading to a 4-room flat or smaller. Also, note that this is a temporary measure to rein the demand for HDB resale flats.)

If you’re subject to the 15-month wait and don’t want to wait till the government lifts this measure, here are a few temporary accommodation options to consider.

Temporary accommodation options to consider

Rent

The first option that most people consider is renting. It’s a good option if you’re planning to move to another area, allowing you to familiarise yourself with the surroundings in the meantime.

At the same time, rents are currently at an all-time high. So before deciding to sell your house, find out the market rate of the rent in your preferred area and property type first. Figure out how much you’re prepared to pay for the rental.

Co-living

An alternative is co-living. The main benefit is that the leases offered are more flexible, with a minimum lease of three months. In comparison, traditional rentals typically have a lease of one or two years.

Co-living is also a hassle-free option as the units are all fully-furnished, and utilities are included in the rental.

Move in with your parents/ child

Of course, the cheapest alternative is to move in with your family.

But this also depends on your relationship with them, and if there’s enough space in their house.

2. Assuming that you only have to meet the TDSR

This is more for those planning to take a housing loan for the new house. There are stricter loan requirements when buying an HDB flat.

When taking a housing loan for private property, you’ll need to meet the 55% total debt servicing ratio (TDSR), which means your total monthly debt obligations shouldn’t exceed 55% of your household income. On top of the housing loan, this includes your car loan, personal loan and credit card. If you don’t have any other loans besides the home loan, you can essentially set aside 55% of your monthly household income for your housing loan. This means you may be eligible for a higher loan amount as well.

But when taking a housing loan for an HDB flat, you’ll have to meet the 30% mortgage servicing ratio (MSR). This restricts your monthly instalment to 30% of your monthly household income, so the loan amount you can get will be lower.

SELLING YOUR PROPERTY? Would you like to know how much your property is worth? Or maybe you’re considering listing your property for sale? Let us know, and we’ll have a consultant reach out to you!

3. Buying the HDB resale flat right after the 15-month period

Hear me out first. This is more of a mistake only if you’re looking to qualify for CPF housing grants and HDB loans.

To be eligible for these, you’ll have to wait another 15 months before you can buy a resale HDB flat with these grants and HDB loan.

Cannot get CPF housing grants (apart from PHG)

The good thing about HDB resale flats is that if it’s your first time getting subsidised housing, you can get up to S$160k in grants. These are Family Grant, Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG).

But if you’re downgrading from private property to an HDB resale flat, you’ll have to wait 30 months before you can enjoy the Family Grant and EHG.

There’s no time bar for the Proximity Housing Grant. So if you haven’t received it before and your new house will be within 4km of your child or parents, you get to enjoy S$20,000 from this grant.

Cannot apply for the HDB housing loan

Singaporeans are eligible for up to two housing loans from HDB.

And right now, the HDB concessionary loan is more attractive than bank loans. For instance, its interest rate is pegged to 0.1% above the prevailing CPF OA rate (currently at 2.5%). In the current high interest rate environment, a 2.6% interest rate is considered low, especially when banks these days have raised their interest rates for fixed home loans to 4.5%.

On the other hand, just like the CPF housing grants, private property owners are only eligible for HDB loans if they buy the HDB flat 30 months after selling off their private property.

Of course, at this point, it’s hard to say if interest rates will go down in a couple of years (which will make bank loans more attractive). Nevertheless, it’s always good to have one more option besides bank loans, especially if you prefer paying for fixed monthly instalments.

Planning to downgrade and right-size from a private property to an HDB flat? Let us connect you with a property consultant.

If you found this article helpful, 99.co recommends With December 2021 and September 2022 cooling measures, what can you upgrade to if you were to sell your existing property today? and 6 signs and steps to find out if your house has unrealised gains.

The post 3 mistakes to avoid when downgrading from private property to HDB flat appeared first on .