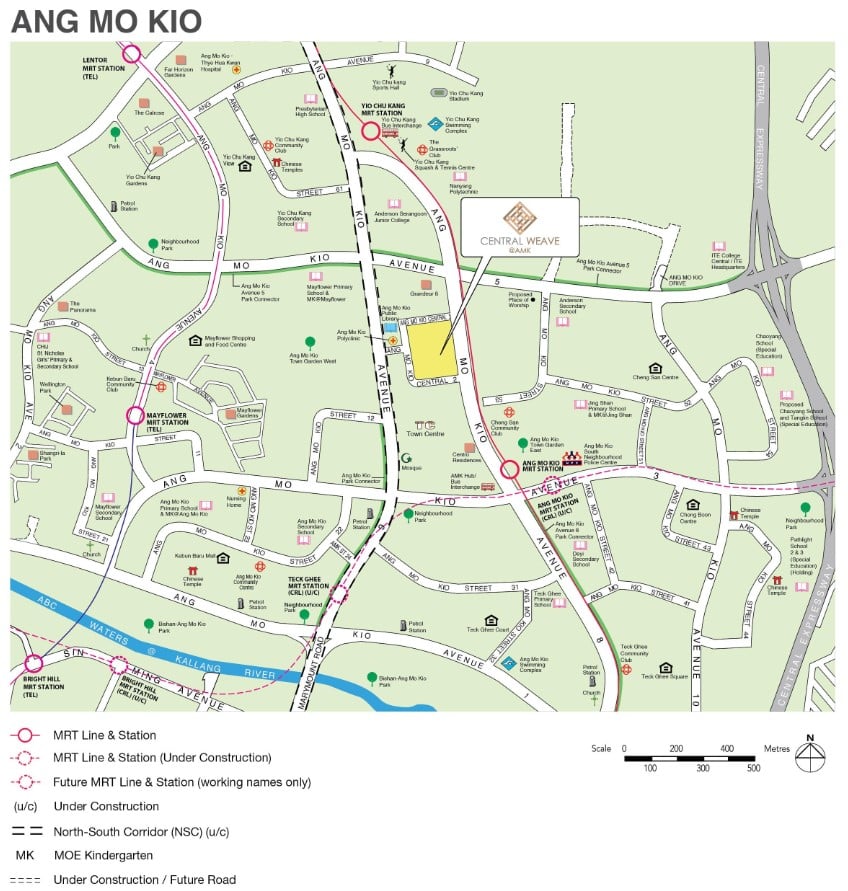

Minister for National Development Desmond Lee said in Parliament on Tuesday (4 October) that HDB will incur an estimated development loss of S$270 million from the Central Weave @ Ang Mo Kio BTO.

The project was launched in the last HDB BTO exercise in late August. In particular, it drew significant attention during its launch, as 5-room flats were priced ranging from S$720,000 to S$877,000.

What followed was a post by The Alternative View suggesting HDB would profit from the sale of flats at the project. The page was later POFMA-ed for the post.

Around a month later, in response to NCMP Leong Mun Wai’s question on HDB’s net loss, cost of land, and the net profit and loss position for the project, Minister Lee said that HDB will incur a development loss of around S$250 million.

This loss would increase by an estimated S$20 million to around S$270 million after factoring in the CPF grants for eligible buyers.

He also said that the estimated land cost for the project was S$500 million, which was determined independently by the chief valuer using market valuation principles.

Following these comments, we can’t help but wonder a few things.

1. What’s the breakdown of the land and construction costs?

This was something that some online users have asked:

A Parliamentary reply in 2021 states that HDB buys land from SLA for public housing developments.

A Parliamentary reply in 2021 states that HDB buys land from SLA for public housing developments.

Currently, we know that the S$500 million was determined independently by the chief valuer based on market valuation principles. (We should note that land can also be used for private development, or any other residential-based development under the URA Masterplan.)

At the same time, this got us wondering about the breakdown of the costs as well, not just the land cost, but also the building costs of the project.

2. How much would the flats be priced if HDB were to break even?

Understandably, HDB does not make a profit from selling new flats. After all, as public housing, they are heavily subsidised and are still cheaper than private properties. It makes sense that HDB records a deficit.

But since Minister Lee said that HDB will incur a loss of around S$250 million, excluding the grants for the Ang Mo Kio BTO, and that HDB does not price new flats based on costs, we can’t help but wonder, how much would new flats be priced at if HDB were to breakeven?

How much more would buyers have to pay when buying a flat directly from HDB, if there were no subsidies given?

We don’t know the exact breakdown of the costs. But based on what we know so far, that

- the estimated land cost is S$500 million, and

- the estimated development loss is around S$250 million,

let’s hypothesise that the S$250 million loss represents the subsidies covered by HDB.

We also don’t know what’s the breakdown for the subsidies given. But for hypothetical purposes, let’s assume that it’s equal for all flat types. With this S$250 million shared among 896 households (the total number of units in the Ang Mo Kio BTO), each household gets an average subsidy of S$279,000.

Here’s the price range if, hypothetically, HDB were to breakeven as no subsidies were given out:

| Flat type | Number of flats | Actual price range | Price range if HDB were to break even |

| 2-room Flexi (Type 1) | 40 | S$198k – S$232k | S$477k – S$511k |

| 2-room Flexi (Type 2) | 86 | S$250k – S$292k | S$529k – S$571k |

| 4-room | 398 | S$535k – S$676k | S$814k – S$955k |

| 5-room | 333 | S$720k – S$877k | S$999k – S$1.156m |

| 3Gen | 39 | S$713k – S$842k | S$992k – S$1.121m |

Based on this hypothesis, some 5-room and 3Gen flats would actually breach the million-dollar mark!

3. What about the costs of the other BTO projects?

Now that we know a few details about the cost (and loss) incurred by HDB for the Ang Mo Kio BTO, we’re curious about the costs of the other BTO projects.

Being a property portal, we can’t help but wonder, how much less some people would profit from selling their BTO flats after the MOP, if they were to buy them from HDB without subsidies.

Something to think about for sure!

What do you think about Minister Desmond Lee’s comments? Let us know in the comments section below.

If you found this article helpful, 99.co recommends Selling Your Flat Soon After MOP: Smart Move or Dumb Move? and Property Cooling Measures 2022 : Higher Interest Rate Floors, HDB LTV Lowered to 80% and Other Updates.

The post 3 questions we have arising from Minister Desmond Lee’s comment on the S$270 million loss incurred for Central Weave (August 2022 Ang Mo Kio BTO) appeared first on .