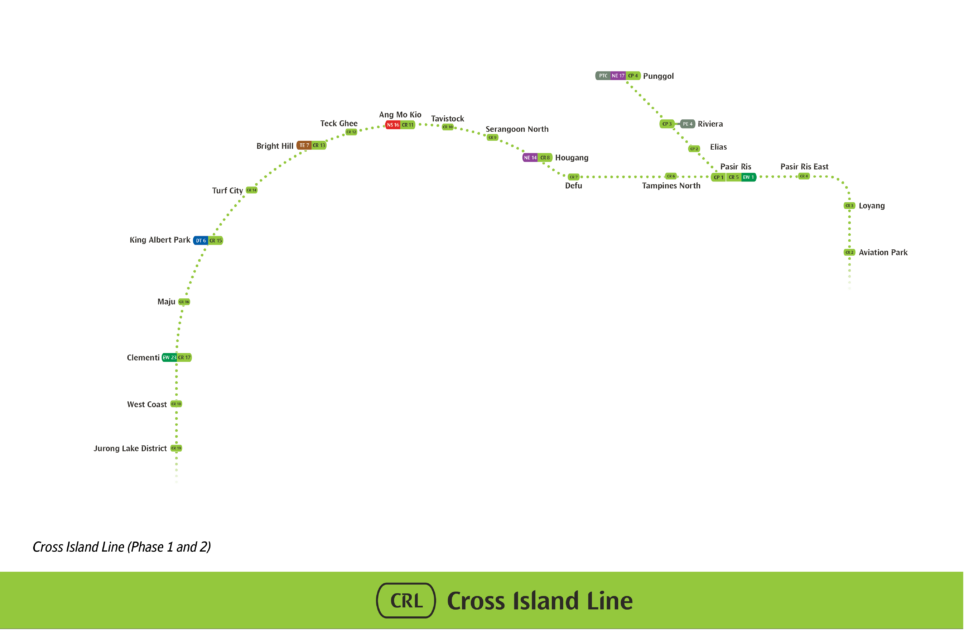

Six new MRT stations, set to be completed by 2032, have been announced as part of Phase 2 of the Cross Island Line (CRL). They are Turf City, King Albert Park, Maju, Clementi, West Coast and Jurong Lake District.

You can see their exact station locations here.

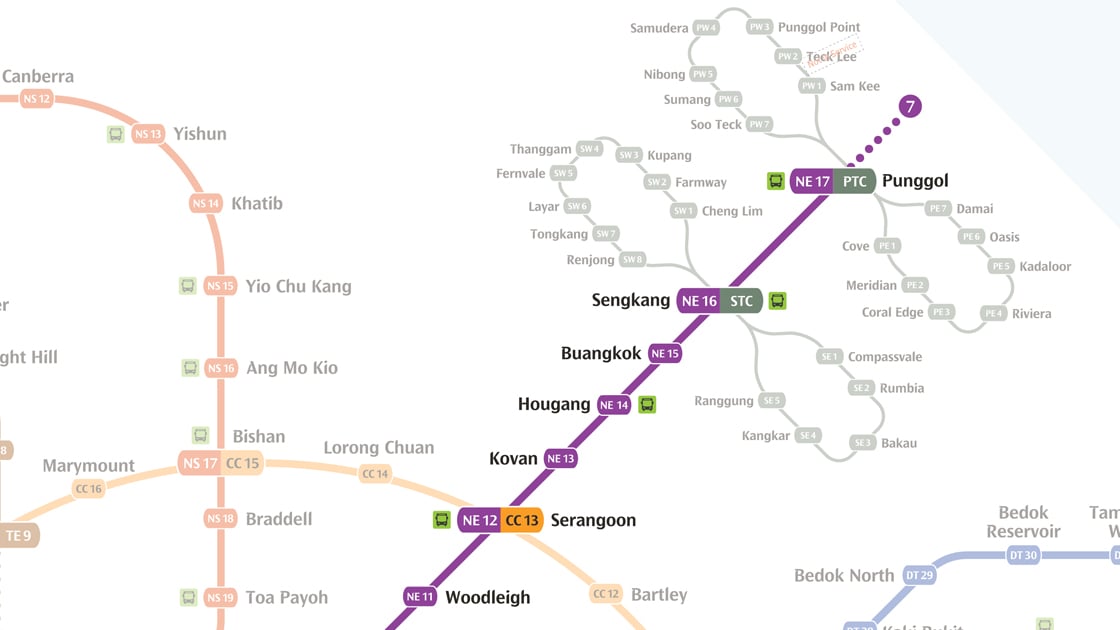

Additionally, King Albert Park and Clementi CRL stations will become interchanges, forming links with their existing stations on the Downtown Line and East-West Line respectively. As interchanges, they join four other interchange stations from Phase 1, namely Pasir Ris, Hougang, Ang Mo Kio and Bright Hill stations. Phase 1, which has 12 stations, is slated to complete by 2030.

Combined, the 18 stations from Phases 1 and 2 will form a 44-kilometre Cross Island Line network. Phase 3, which continues from Jurong Lake District to Tuas, has yet to be officially announced.

When Phases 1 and 2 are completed, North-Eastern residents from Loyang, Pasir Ris East and Tampines North will be able to enjoy a single-ride journey to Clementi and Jurong. This means a Pasir Ris Central resident can get to Jurong Lake District in 55 minutes instead of the current 1 hour 15 minute travel time.

Interchange predictions

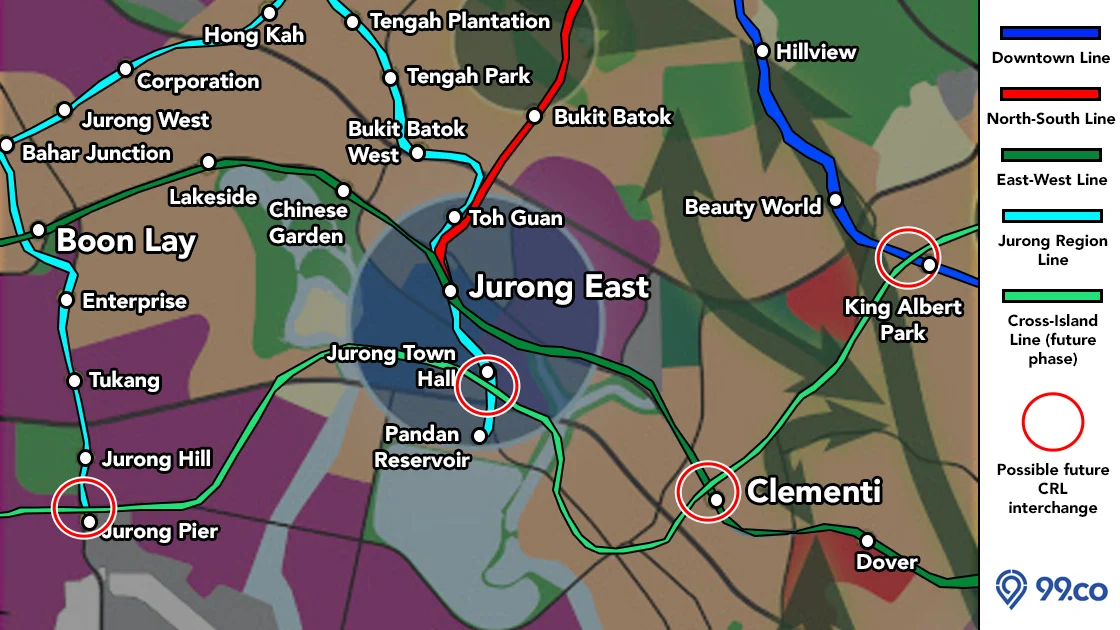

In a previous June 2022 story, we made predictions about which stations along the Cross Island Line near the Jurong Lake District would be an interchange.

Looks like we got two (Clementi and King Albert Park) out of four correct (so far). We also hazarded a guess that there might be stations for well-developed but underserved neighbourhoods (like West Coast), which came true.

Still, based on our map below, Jurong Pier and Jurong Town Hall stations (for Jurong Region Line) aren’t completed yet, so let’s see what happens when subsequent phase announcements for either network are made.

With the announcement, we would like to offer 3 insights related to property developments around these six new stations which you might have missed.

Here they are:

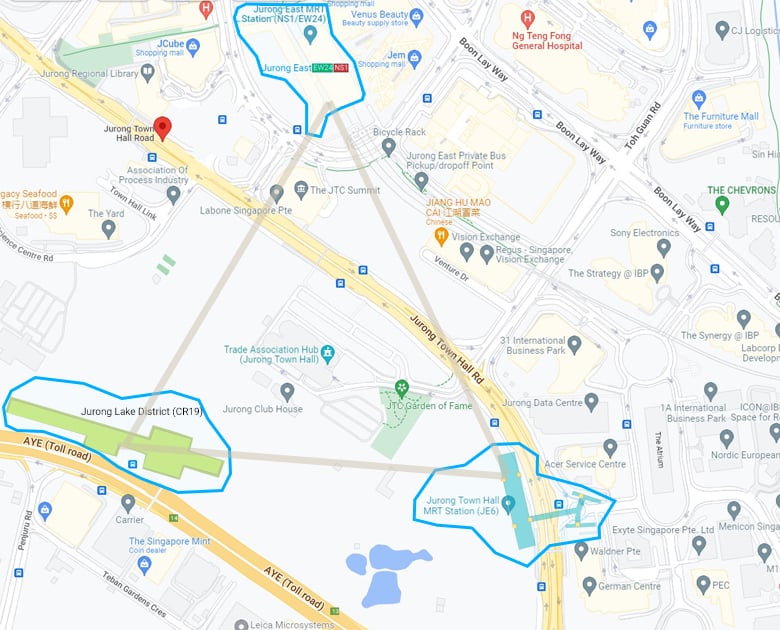

1. Jurong Lake District (JLD) CRL station forms a triangle with Jurong East interchange and Jurong Town Hall JRL station

Based on the published CRL station location of Jurong Lake District, a triangle is formed between the JLD CRL station (CR19) with Jurong East MRT interchange (NS1/EW24/JE5) and Jurong Town Hall JRL station (JE6).

The estimated distance between each station is around 800 metres, give or take. This would give us a rough “triangulated zone” of about 320k sqm or 32 hectares.

One thing to note is that there’s a significant landmark here: the Jurong Town Hall (previously iHub), which has been gazetted as a Singapore national monument. It sits on a hill, and, believe it or not, is surrounded by quite a few open-air carparks and gardens.

From a site area perspective, this area is collectively part of a larger site comprising the former 67-hectare Jurong Country Club and the soon-to-relocate Science Centre. Part of this URA White Site is originally meant to be redeveloped to make way for the shelved (or is it?) Malaysia-Singapore High-Speed Rail Terminus.

As a White Site, the entire area can be redeveloped into any of these: Residential, Office, Shop, Hotel, Serviced Apartments, Recreation Club, Association, Convention/Exhibition Centre, or Entertainment.

With the Town Hall serving as a national monument, we reckon the surrounding area could be redeveloped into a mixture of residences, offices, and a major exhibition centre (rivalling Marina Bay Sands or Singapore EXPO, perhaps?). Some analysts predict short-term leased homes so that the land can be redeveloped after, say, 35 years. Others say landed home estates and private condominiums, especially within the former golf course overlooking Jurong Lake.

We think if URA launches any residential sites within this zone (or adjacent to it), demand and prices will set new records, particularly for the OCR. Considering there are only a few private and public housing around the immediate area (J Gateway, Ivory Heights, Jurong East Ville, Teban Gardens), it’s anybody’s guess, really.

Since Jurong Lake District is envisioned as Singapore’s 2nd CBD, it’s potentially possible to build a mega-development within the triangulated zone and around it – comprising of underground concourses and surface structures, landmarked by the national monument, gardens and open spaces, and bounded on three corners by the three MRT stations.

This is because we’ve seen examples of it before.

If we look at the Marina One site in the CBD, it occupies an approximately 3.67m sqft (341k sqm) area – near-similar, in fact, to the area size bounded by the three Jurong East stations. The Marina One site comprises mixed-use developments of residential towers, prime grade A offices, retail and greenery.

Similarly, the site is bounded by three MRT stations – Shenton Way (TEL), Downtown (DTL) and Marina Bay (NS/CCL) stations – and connects to four different MRT networks. The three Jurong East stations, when operational, also connect to four different networks – East-West, North-South, Jurong Region Line and Cross Island Line.

Another example we can reference is the 3.2-hectare mixed-use development of Guoco Midtown in the Bugis area.

There, GuocoLand is developing two condominiums (Midtown Modern and Midtown Bay), three retail clusters, a 30-storey office tower and a network hub – all accessible via Bugis MRT interchange station. Besides links to Downtown Line and East-West Line, the underground station also serves residents from Duo Residences, various hotels and serviced apartments.

In fact, if you’ve been to Japan, the underground and above-ground main Nagoya train station (Meieki) occupies 440k sqm (44 hectares) in area size and links to seven different train networks (together with its smaller Meitetsu and Kintetsu stations). With the station grounds forming a central meeting point, commuters can traverse and access any of the four department stores (including Takashimaya), food and beverage outlets, hotels and even an open-air fish market called Yanagibashi.

So imagine the potential for a mega-underground and above-ground development, linking commuters, residents and visitors to the three Jurong East stations, complete with a mixture of residences, offices, exhibition centres, retail and parks. It’s not entirely improbable, at least if we’re putting a wishlist together.

In terms of what’s really coming, do keep an eye on CapitaLand’s JCube shopping mall (the one with Singapore’s first and only Olympic-size ice skating rink and, uh, Shaw IMAX Theatre).

Currently a 7771.2-sqm commercial site with a gross plot ratio of 3.0, JCube may be redeveloped into a mixed-use residential site with a GPR of 4.2.

If approved, it could potentially yield a maximum gross floor area of 351k sqft. This, however, is inclusive of the first-level retail area, which will need to be excluded if we want to calculate the potential number of residential units.

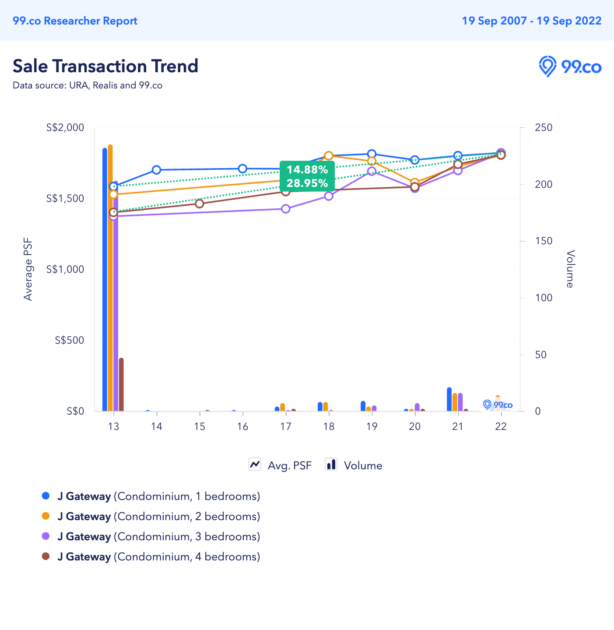

For reference, the 738-unit J Gateway, a residential-only condominium, also has a GPR of 4.2. It has a site area of 11,590 sqm, giving us a maximum permissible GFA of 48678 sqm (524k sqft), or about 570 residential units.

During its land sale tender in 2012, MCL Land won the bid at S$369 million or S$705.10 psf per plot ratio.

When it launched in July 2013, J Gateway almost sold out at 99.7% on its launch day. At the time, its one-bedders were selling at S$1,573 psf while four-bedders went for S$1,400 psf.

Today, the condo’s one-bedders are selling at an average psf of S$1,820 while its four-bedders are going at an average psf of S$1,806.

2. CRL-Punggol Extension has been pushed back by a year to 2032

Another development is the Punggol Extension link to the Cross Island Line network. Previously, the original completion timeline was 2031, but the latest announcement seems to have pushed this to a year later.

While this isn’t a major delay, it might be worth noting if you’re someone with plans to buy, sell or lease an apartment along the extension during this transitional period. It would not, however, interfere with commuters travelling from the Punggol Digital District to the west, as they can take the upcoming Punggol Coast MRT (ready by 2024) on the North-East Line and transfer to the CRL via Hougang.

So we think this one-year delay will mainly affect commuters in Punggol, Riviera and Elias who are looking forward to quicker travel times to, say, Changi Airport via Pasir Ris interchange.

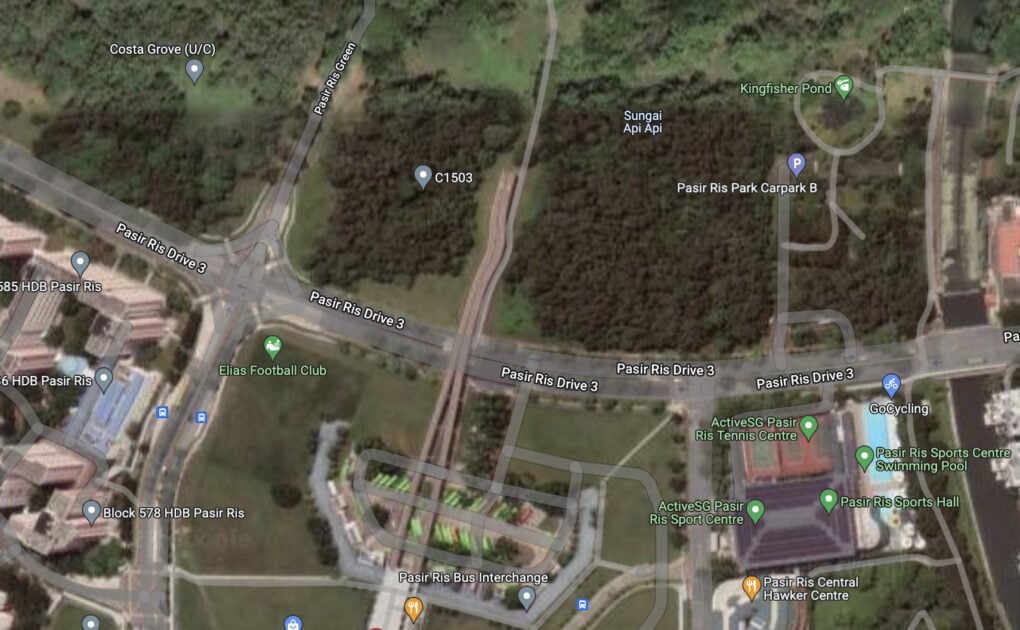

We should also highlight that two land parcels totalling 4.6 hectares along Pasir Ris Drive 3 (opposite Pasir Ris 8 mixed-use condo and Pasir Ris MRT station) have been earmarked for public housing. These include an open-air carpark (Carpark B), which is often used to access Pasir Ris Park and its mangrove boardwalks.

While no timeframe has been given for these potential BTO housing, it makes sense that we’ll be seeing more housing (read: higher foot traffic) being developed around interchanges such as Pasir Ris Central.

Expect to see more housing plans (or further infrastructural developments in the neighbourhood), especially around the 18 stations along the Cross Island Line in due time.

3. Property demand and/or prices near these stations are expected to increase, the ones near interchanges even more so

Speaking of interchanges, home prices around the six Phase 2 stations, especially Clementi and King Albert Park, are expected to increase.

Analysts are already forecasting property price increases of up to 3% for some of these areas with the announcement. By the time the stations are completed in 2032, they estimate a 5-15% increase.

Not only that, underserved but well-developed (gentrified) neighbourhoods with established F&B outlets and attractions like Sunset Way, West Coast and Turf City will see significant price gains.

With the planned Turf City station, some commercial tenants at Turf City, including the Grandstand, will need to vacate the premises no later than the end of 2023. This is to make way for private, and public housing there, which some analysts predict can happen as early as 2026 or 2027.

Besides Turf City tenants needing to vacate, Phase 2 construction would also inconvenience residents of freehold condominium Casa Esperanza at Bukit Timah.

This is because 18 carpark spaces at the freehold condo will need to be relocated to accommodate the underground construction of the King Albert Park CRL station.

Estimated to take six years to complete, LTA will compensate the condo’s land owners and lessees for the space, before returning the surface land and reinstating the affected structure to the condo’s MCST.

Right now, to get to King Albert Park Downtown Line station, residents of the 90-unit condo have to cross Blackmore Drive and access the Bukit Timah Road station entrance/exit.

With the completion of the Cross Island Line interchange in 2032, they may no longer need to, as one of the exits seems to be on their side of the road, below where their carpark used to be.

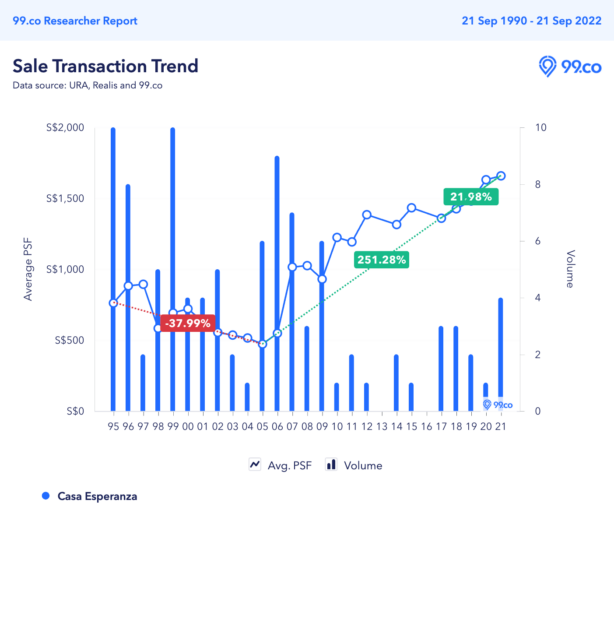

Expect property prices for Casa Esperanza to increase even more by then. You might be thinking – what do we mean by even more?

When Casa Esperanza was completed in 1992, and its earliest resale transactions were recorded in 1995, its average psf price was on a downtrend up till 2005 (see chart above). This changed when the King Albert Park Downtown Line was announced in 2005.

After the announcement, average psf prices have increased by 251.28% so far. When the station was completed in end-2015, no units were sold in all of 2016. Since 2017, average psf prices have increased by 21.98%.

If we look at just the 3-bedroom apartments at the property, average prices were trending downwards from S$1.5m in 1995 to about S$1m in 2005. After the announcement, prices of the 3-bedders surged. Today, each 3-bedroom apartment is worth S$3.3m on average (an astounding 243.23% increase from the time of the announcement and 17.50% from the time the station was completed and operational).

This analysis of Casa Esperanza is a good indicator of how the announcement and completion of an MRT station can impact the demand and property prices of homes near it.

We’re sure property prices at Casa Esperanza will continue to be covered extensively in the coming years with the development of the CRL station at King Albert Park.

September’s Cross Island Line Phase 2 announcement and the lead-up to their completion over the next decade will provide us with more case studies for sure – particularly new launches, en bloc potentials (we’re looking at you again, Ivory Heights… <wink>) and resale properties within the vicinity of these six stations.

–

–

Are you planning on finding properties around these six new CRL stations? Let us know in the comments section below.

If you found this article helpful, check out On the Right Track with the Cross Island Line and Singapore suburban neighbourhoods with major, public infrastructural upgrades by 2030 and beyond.

The post 3 insights from the recently announced Phase 2 Cross Island Line MRT stations you might have missed appeared first on .