A slower buying sentiment may be setting in among HDB resale flat buyers.

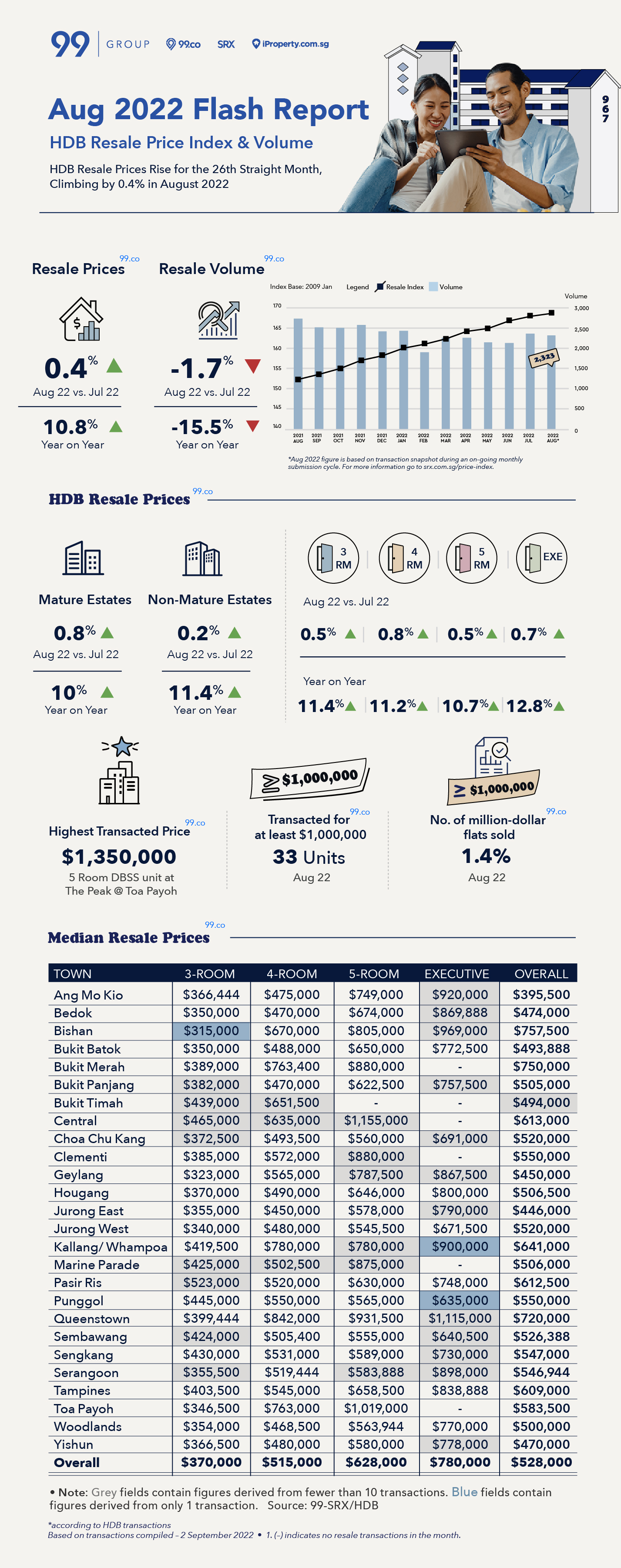

According to 99.co and SRX flash report on the HDB resale market in August 2022, 2,323 transactions were recorded last month, representing a 1.7% drop from July.

While this could be due to the Hungry Ghost Festival (during which people tend to avoid making big decisions, including purchasing a home), resale volume has dropped by 15.5% from the previous year.

Christine Sun, Senior Vice President of Research & Analytics at OrangeTee & Tie, noted that last month’s resale volume was below the past 12-month average of 2,361 units.

A possible reason is that people are turning to the BTO sales exercise. For instance, almost 5,000 units were launched in last month’s BTO exercise. Another approximately 9,500 units will be available during the November 2022 BTO launch.

People may also be delaying their home purchases due to the rising home loan interest rates and HDB resale prices.

HDB resale prices have increased for the 26th straight month, by 0.4%.

At the same time, there has been a slower price growth in the past couple of months. June saw an increase of 1.2%, followed by a slower price growth in July (0.7%) and in August (0.4%).

This could signal price resistance in the HDB resale market, as fewer people are willing to pay a higher price and COV for resale flats.

Mark Yip, CEO of Huttons Asia, added that higher interest rates have shifted some buyers to non-mature estates, where prices are more affordable.

“These buyers are less willing to pay higher prices which may have translated into a 0.2% price gain in non-mature estates in August. This is the smallest price gain since June 2020, where prices in non-mature estates contracted by 1%.”

Nevertheless, Sun expects prices to hold firm, given that demand for completed homes still outweighs supply.

“With a strong employment rate and income growth, there is little impetus for sellers to drop prices now. We may expect more sellers, especially new flats in mature estates to test the million-dollar mark. Hence, we may see more million-dollar transactions in the coming months,” said Sun.

Likewise, Yip expects to see as many as 350 million-dollar HDB flat transactions this year, as cash-rich buyers seek larger homes.

33 HDB resale flats breached the million-dollar mark in August, constituting 1.4% of the total resale volume.

“Price gains in the HDB resale market are likely to stabilise for the last four months of 2022. Transaction volume should be around 27,000 flats and prices may increase up to 10% in 2022.”

Looking to buy an HDB resale flat soon? Let us know in the comments section below.

If you found this article helpful, 99.co recommends 5-room HDB resale flat at Jurong West Street 61 made record S$618k sale for the neighbourhood and Singapore Consumer Sentiments Study Q2 2022.

The post Lower demand, some price resistance in HDB resale market in August appeared first on .