Earlier this month, DBS Bank made the decision to raise the interest rates for its Multiplier deposit account holders by up to 0.8 percentage points.

It was a bold move by a local bank to attract customers as it was promising higher returns on regular savings amid rising inflation (and the rise in mortgage interest rates).

Reading the fine print

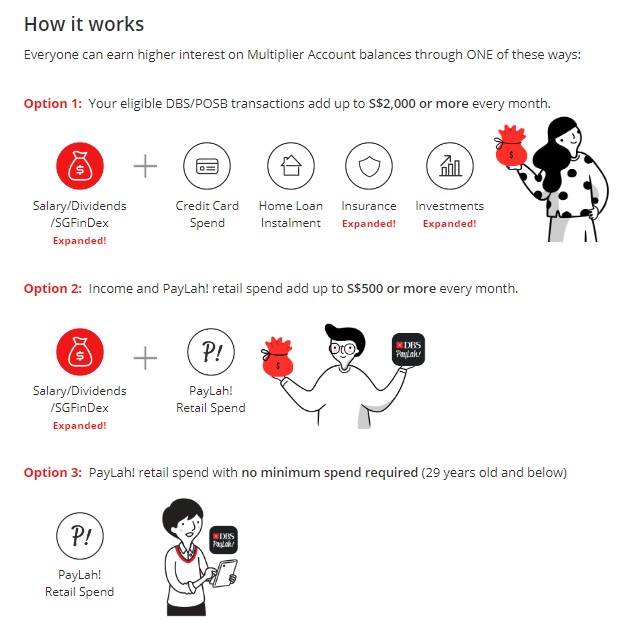

DBS Multiplier accounts customers with cash balances of over S$50,000 and up to S$100,000, stand to earn up to 3.5% in interest per annum if they transacted in eligible categories, such as using DBS/POSB credit cards, PayLah! retail, insurance, home loan payments and investments.

For example, a customer can earn up to 1.1% a year on his first S$25,000 if he transacted in one category, 2.5% a year on his first S$50,000 if he transacted in two categories and a maximum of 3.5% a year for balances between S$50k-S$100k if he has made transactions in three or more categories.

Similar to other local and global banks, DBS has previously cut its Multiplier interest rates three times during the Covid-19 pandemic.

UOB has also increased its interest rates for depositors for its One Account, where balances between S$75,000 and S$100,000 earn 3% with an additional S$500 spent on an eligible UOB credit card.

Similar to DBS, to be eligible, customers would also need to credit their salaries via General Interbank Recurring Order (GIRO) into their One Accounts.

OCBC 360 account customers are also now eligible to earn up to 2.38% effective interest rate per annum on their first S$75,000 account balance. This includes crediting their salaries of at least S$1,800 via GIRO, increasing average daily balance savings by at least S$500 monthly, and purchasing insurance and an eligible investment product from OCBC.

According to the banks, these increases help customers with the financial strain on their savings as goods and services become pricier.

However, it should be noted, that in order to enjoy the higher interest rates (such as 3.5%), bank customers need to fulfil certain criteria, including having the mentioned minimum account balances.

What about our CPF accounts?

Around the same time that the banks introduced tiered interest rate increases, questions were raised on whether the CPF interest rate would rise in tandem to compensate for inflation.

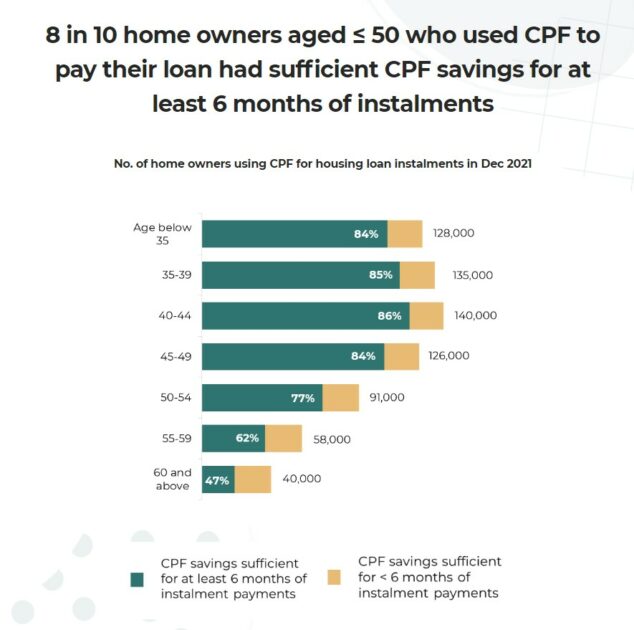

Considering that in a Dec 2021 CPF survey, 2 in 10 homeowners under 50 years old were not able to pay for their home loans for at least six months, it’s definitely worth a study.

While there are 800k homeowners using CPF to service their home loans, there isn’t a breakdown between HDB and executive condo/private property loans. Those taking up the latter and paying in CPF+Cash are in for a rough ride ahead.

This is because, between May and August 2022, the three-month compounded SORA, used as a benchmark to price floating home loans, quadrupled from 0.32% to 1.27%, while the three-month SIBOR, another benchmark, more than doubled from 1.11% to 2.48% over the same period.

This has led some banks to raise interest rates for their two- and three-year fixed-rate loans from the previous 2.45% to 2.75-3.08% per annum. DBS even scrapped its five-year, fixed-rate plan for HDB flat buyers, which was going at 2.05%.

So having additional interest earned through CPF may provide some added relief, since there are withdrawal limits, and you will need to pay cash once you’ve hit your limit (you’re also meant to set aside a Basic Retirement Sum once you hit 55 years old).

Will CPF interest rates rise in tandem?

In Parliament, Sengkang GRC MP Louis Chua did talk about the banks’ increased interest rates, including DBS Multiplier rates. He asked if CPF interest rates should increase considering GIC’s nominal return of 7% for the past 20 years.

Minister for Manpower Tan See Leng responded by saying that banks’ interest rate increases are more short-term, volatile instruments, while the Central Provident Fund (CPF) system is aimed at giving members over the longer horizon better security in retirement and old age.

“Being custodians of members’ monies, we take a very long-term view in providing members with a fair rate of return,” Tan said. “The CPF interest rates continue to be attractive.”

Tan shared that the government pays 1% of extra interest on the first S$60k of members’ combined CPF balances and an additional 1% on the first S$30k for members aged 55 years old and above.

In other words, current CPF members below 55 years old are already earning up to 5% in interest, while those 55 years old and above are earning up to 6%.

Tan emphasised that when members transfer their OA monies to their Special or Retirement account, they earn a higher “risk-free” rate.

“That really tells you how secure your savings are.”

However, to understand whether CPF interest rates should even be increased, Tan shared how they are derived and the levers that would justify an increase in the first place.

How CPF interest rates are derived

According to the Minister, Ordinary Account (OA) savings are in a liquid account, which can be withdrawn anytime for home purchases, servicing of mortgage loans or other specified purposes, such as investments.

Tan shared that the OA interest rate is pegged to the three-month average fixed deposit and savings rates of Singapore’s three major local banks (DBS, UOB and OCBC).

He explained that the ratio formula for this peg used to be 50:50, where 50% was for fixed deposits, and the other 50% was for savings. That was changed to 80:20 in July 1999, which switched to 80% of fixed deposits and 20% savings.

“This was done to reflect the longer duration that CPF OA monies remain with CPF Board,” he said.

He cited CPF Board’s effective interest rate from July-September 2022 has remained at 0.09%, which followed the local banks’ three-month average interest rate of 0.09%.

On the other hand, the Special Medisave and Retirement Account (SMRA) interest rates are pegged to the 12-month average yield of 10-year Singapore Government Securities +1%. This peg was 2.72% based on the latest CPF press release – so around 3% based on the latest estimates.

Tan informed Parliament that this pegged rate for the SMRA has been below 4% since the Global Financial Crisis in 2008.

This means that for the past 14 years, the average delta (above the pegged rate) that CPF has paid (for SMRA) is 0.9%.

For OA, Tan shared that since 1 July 1999, the average delta that CPF has paid out (above the pegged rate) is double that of SMRA, which was 1.8%.

Tan did mention “risk-free” several times in his address and response in Parliament.

No immediate change in CPF interest rate

As CPF Board will soon announce effective interest rates from Oct-Dec 2022 in September, Tan shared that current rates are still below the effective legislative minimum or floor rates for these accounts.

In other words, the interest rates for OA and SMRA will be maintained at 2.5% and 4%, respectively.

While interest rates for the Ordinary, Special and Medisave accounts are reviewed quarterly, the SMRA rate is reviewed annually.

“Despite the low interest-rate environment since the Global Financial Crisis, the government has continued to pay generous interest rates due to the floor rates. Now, if the peg rates exceed the floor rates, members will correspondingly earn the higher interest rates on their CPF Savings.”

Based on Tan’s explanation, there do not seem to be any immediate plans to increase interest rates for CPF accounts. This is because they are still below the effective floor rates, and the Government has been paying generous “deltas” above the base rates to CPF members.

What’s more, since 80% of the OA interest rate peg is dependent on the three banks’ three-month average fixed deposit rates, the recent tiered interest rate increases in the banks’ saving rates wouldn’t affect the pegged rate all that much, let alone the legislative floor rate.

–

Do you think there will be adjustments in the upcoming CPF interest rate announcement? Let us know in the comments section below.

If you found this article helpful, check out 9 things about SORA for home loan interest rates and MAS begins transition from SOR to SORA.

The post Should CPF savings interest rate be raised as banks’ savings and mortgage rates rise? appeared first on .