Earlier this year, Cape Royale, a Sentosa Cove condominium, made headlines for launching for sale nine years after it was completed.

When the 302-unit luxury condo launched on 6 July, developers Ho Bee Land and IOI Properties sold about half of the 50 units they put up for sale (according to reports by Forbes and The Business Times).

3-bedroom units had a median price of S$4 million, while 4-bedroom units had a median price of S$5.5 million. The psf price started at S$2,103.

Interestingly, this comes months after a spike in sale transactions of properties in Sentosa was reported in 2021. That’s after years of declining prices and sales.

With Cape Royale’s latest launch, could it be that the property market in Sentosa is making a comeback? We look at Sentosa’s property landscape over the years and how it’s faring today.

Impact of 2013 cooling measures

Cape Royale TOP-ed in 2013 but its developers didn’t put it up for sale due to several cooling measures that year. Instead, the property was rented out.

The cooling measures included an increase in Additional Buyer’s Stamp Duty (ABSD) for Singaporeans, PRs and foreigners. The Total Debt Servicing Ratio was also introduced and this capped monthly loan repayments for buyers at 60% of their monthly income.

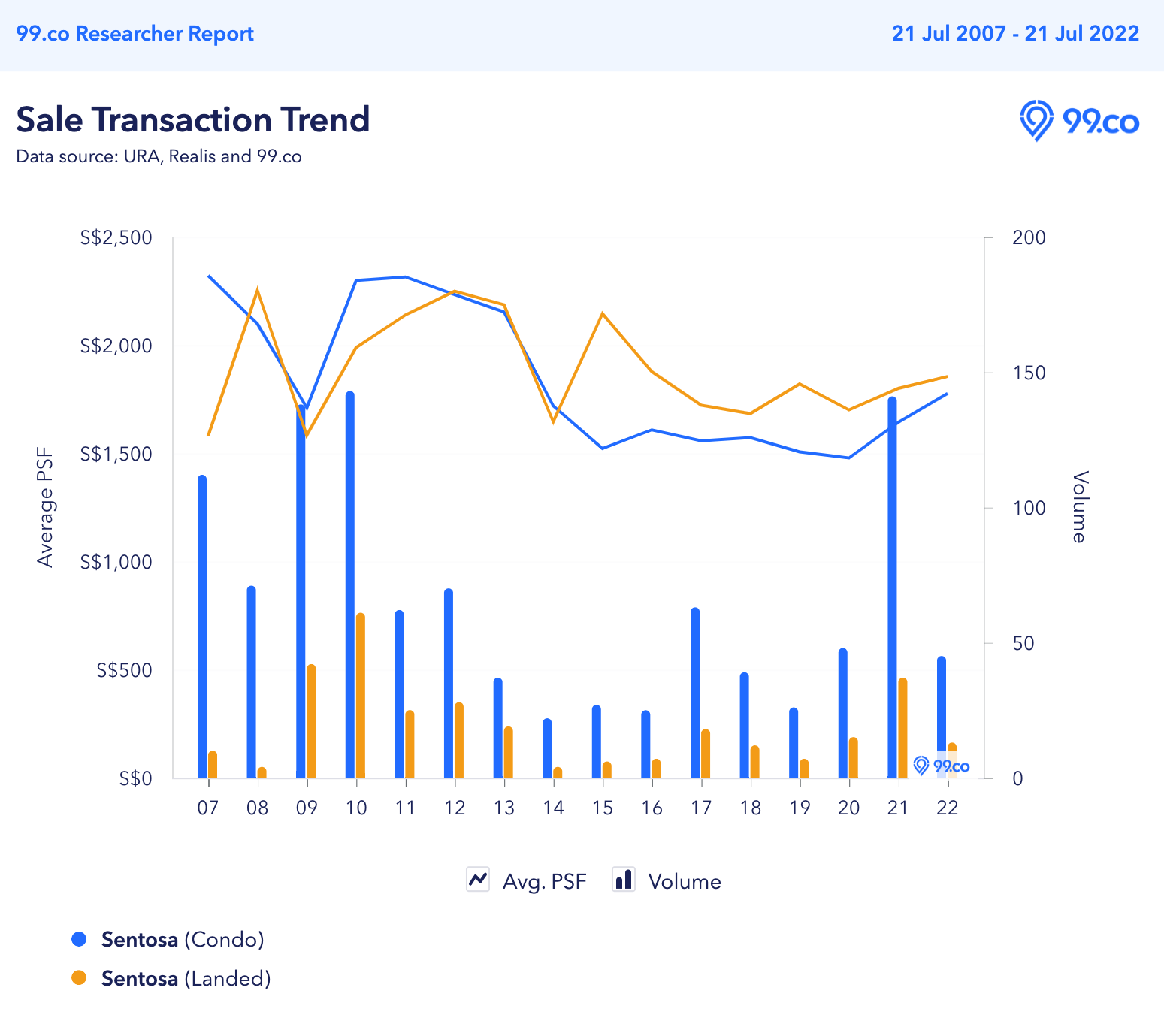

At that time, the average price psf for condos in Sentosa was S$2,153, down from S$2,233 in 2012. The number of sales also dropped from 70 to 37 in the same period. Prices went down even more in 2014 to S$1,718 psf with only 22 transactions.

Subsequently, the number of transactions dwindled, and prices came to an all-time low in 2020 at S$1,418 psf.

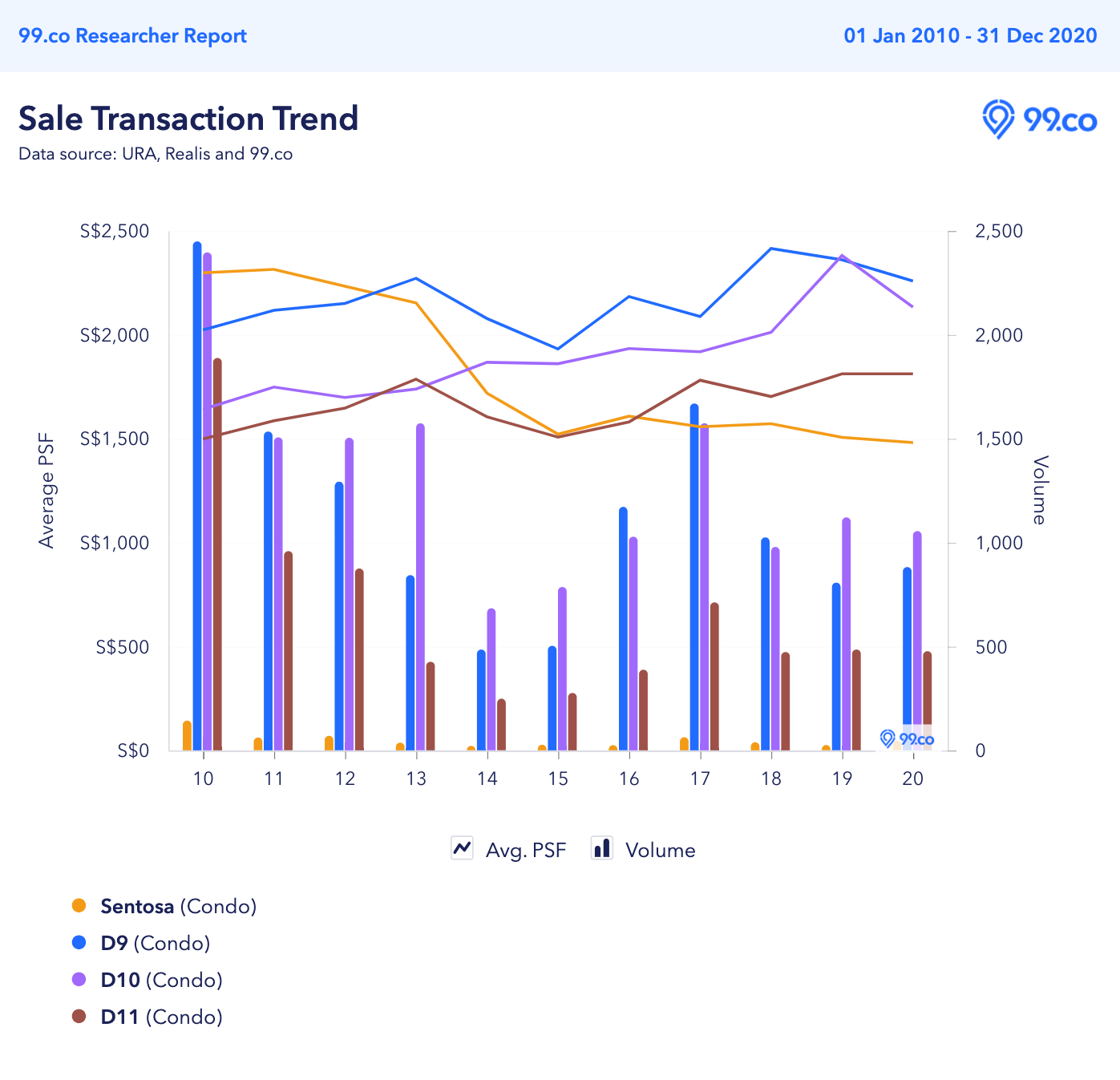

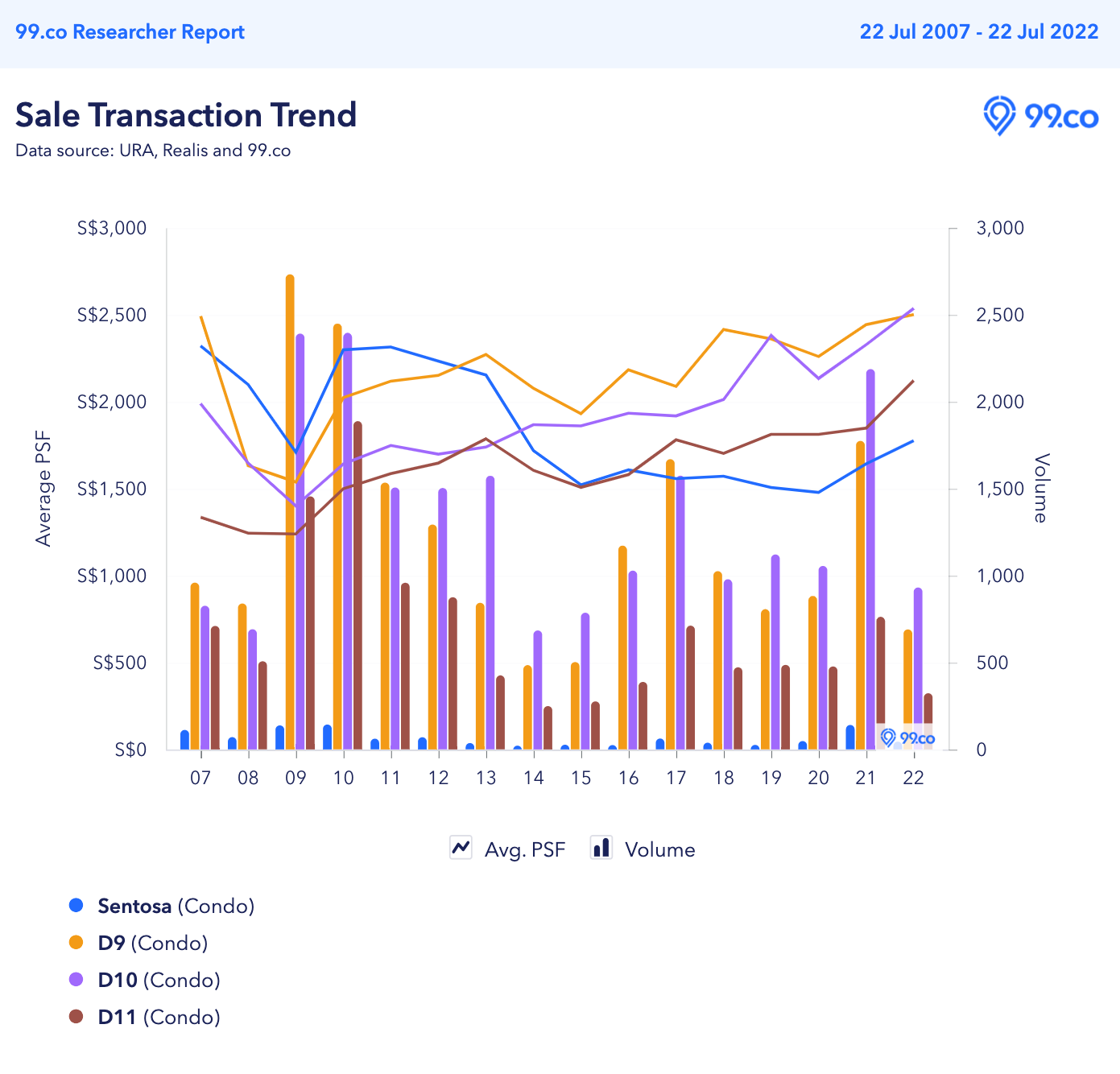

If you compare this to sale transactions in similar wealthy districts like 9, 10 and 11, properties in Sentosa were way more affected. Based on the chart above, the other districts saw some recovery after 2015 (even with cooling measures in 2017 and 2018) but Sentosa went on a downward trend.

Spike in sale transactions in Sentosa in 2021

However, things started to change in 2021, a year into the Covid-19 pandemic. There was a surge in sale transactions in Sentosa.

There were 141 condo sale transactions in 2021, which was the highest number since its peak in 2010 (143). Average prices also seemed to be on the road to recovery, at S$1,643 psf. Although this was still far off from the highest average price psf in 2011, S$2,314, it seems like an upward trend as compared to the previous years. This trend is also continuing in 2022 when average prices have increased to S$1,776 psf. There have been 45 transactions so far.

The allure of Sentosa properties now

1. Average prices in Sentosa are lower than in prime districts in mainland Singapore

Gone are the days when living in Sentosa are only reserved for the ultra-high-net-worth individuals. We’re not saying that you won’t need to have deep pockets (you still do) to own a home in Sentosa but the prices seem more accessible now as compared to a decade ago.

Over the past 10 years, the average prices in Districts 9, 10 and 11 have overtaken the average prices in Sentosa. Here’s how they compare now:

- Sentosa – S$1,776 psf

- District 9 – S$2,500 psf (40.8% price gap with Sentosa)

- District 10 – S$2,536 psf (42.8% price gap with Sentosa)

- District 11 – S$2,121 psf (19.4% price gap with Sentosa)

According to Dominic Lee, Head of Luxury Team at PropNex Realty, new launches in the CCR have been selling at unit prices above S$2,600 psf while some projects in the RCR are already selling at unit prices over S$2,100 psf. Hence, it makes the properties at Sentosa more appealing.

Living in Sentosa is also a more viable option for some buyers as it’s an opportunity for them to own bigger homes. Many also come with seafront views and are located in an exclusive enclave, which makes it more attractive for those who prefer such a lifestyle.

One thing to note is that the average quantum in Sentosa is still higher due to the larger proportion of bigger homes.

2. Interest in bigger homes due to Covid-19?

It is understood that 90% of Cape Royale’s buyers are Singaporeans/PRs.

Cape Royale’s 3-bedroom sizes range from 1,679 to 2,077 sq ft, while 4-bedroom sizes range from 2,508 to 2,713 sq ft. Penthouse sizes range from 2,939 to 4,671 sq ft.

Hence, this might reflect the changing habits of Singaporean buyers after Covid-19. With people staying at home more and hybrid working arrangements, there’s been an interest in larger homes.

There have also been changing patterns when it comes to living near the office. Thus, some buyers might take the opportunity to snag a home in Sentosa as it’s perceived to be more exclusive and is a low-density neighbourhood. And they’ll be paying a lower average price psf.

However, foreign interest in Sentosa properties have also been growing this year, thanks to the reopening of international borders and relaxing of travel rules. Propnex’s Lee says, “In 2022 YTD, foreigners accounted for 19% of private home purchases in Sentosa, comparatively higher than in 2021, where foreigners accounted for nearly 13% of home sales in Sentosa.”

Will interest in Sentosa Cove’s condominiums keep up?

Besides Cape Royale, neighbouring condos have also had substantial transactions in the past year. Seascape saw 17 transactions at average prices of S$2,129 psf, The Oceanfront @ Sentosa Cove saw 26 transactions at average prices of S$1,657 psf and Turquoise saw 21 transactions at an average of S$ 1,514 psf.

While average resale prices generally don’t go over the S$2,000 psf mark, there have been a number of transactions over S$2,000 psf. According to Propnex’s Lee, a unit in The Oceanfront @ Sentosa Cove was sold for a unit price of S$2,225 psf in April this year.

Read this: From city-living to Sentosa Cove condo: How a family’s love for golf made them uproot for a “resort” lifestyles

However, it’s only been a short period of time since there’s renewed interest in Sentosa Cove’s condos. Hence, we feel it’s still too early to tell if the upward trend will continue.

After all, living in Sentosa might not be for everyone. For one, all properties (both landed and condos) only have a 99-year lease. For buyers who prefer freehold properties for their future generations, Districts 9, 10 and 11 will still seem more attractive.

There’s also a lack of new launches in Sentosa. Although Cape Royale TOPed in 2013, it’s still considered the newest condo in Sentosa. Even then, the 99-year lease started from 2010, which means there are 87 years left for buyers. For buyers who prefer a fresh lease or want to live in a new condo, they might also look for other options.

Otherwise, for those who like the Sentosa lifestyle and can afford it, it’s probably a good time to ride on this current wave before prices skyrocket.

–

–

Are you looking to buy property on Sentosa Island? Ask us in the comments below!

If you found this article helpful, 99.co recommends From city-living to Sentosa Cove condo: How a family’s love for golf made them uproot for a “resort” lifestyle and How much do you need to buy a Sentosa Cove property?

The post Cape Royale’s launch after 9 years: Is Sentosa’s property market making a comeback? appeared first on .