Views and opinions expressed in this article are those of the author.

Previously, mainstream media repeatedly pointed to low-interest rates as a key factor for the bullish property market.

Now with the US Fed’s focus on combating record-high inflation taking centre stage for all market watchers, local media has shifted to blaring high alert on rising interest rates and the strain they will purportedly cause to our housing market.

But is there really such cause for alarm?

There’s no denying that interest rates influence the real estate market, and indeed you can see several global real estate markets now beginning to falter in the face of rising rates.

However, my personal opinion is that its role in the case of Singapore’s market has been far overestimated – failing to consider the many measures in place here and Singapore’s natural market landscape that helps ensure financial prudence, make overleverage impossible and also provide safeguards in case of economic turbulence.

Many of these measures and conditions have been part of Singapore’s market for so long that we take them for granted, but collectively they ensure a property market that is more resilient than most.

I will start by running through our home loan interest situation, and then go on to explain how Singapore’s world-renowned mandatory social security savings scheme, alongside our multiple tiers of cooling measures calibrated over the past couple of decades, have helped establish a more robust real estate market.

This might seem too obvious to state, but somehow it seems to be overlooked in recent news on rising interest rates – there is almost always a premium for fixed rates over floating rates, and it’s usually widest when the market is expecting rates to rise, ie right about now.

Banks

Banks are profit-seeking entities, not charitable organisations – they grant loans to generate income, and also need to manage their risk exposure.

Whilst news headlines seek to capture eyeballs with the shock value of say, UOB’s 3.08% per annum 3-year fixed rate package, think about what this really means. When a bank is willing to offer 3.08% pa fixed for 3 years today, it’s unlikely that they’re expecting floating rates to hit much higher than 3.08% (if at all) for a protracted period of time during those 3 years.

In the meantime, their corresponding floating rate package is currently still around 1.8% pa, being 3M Sora plus 0.8% pa – and this is after the Feds have already imposed three rounds of hikes totalling 1.5 percentage points.

The other thing is this – these fixed rates are offered to new borrowers and those seeking re-financing. How do you think these new packages affect current homeowners and would-be sellers? It really makes me laugh when some hopefuls postulate that property prices will drop with “interest rates so high now!”

I’ll give you my personal situation as an example: I refinanced my home loan on a 2-year fixed rate of 1.1% pa around the end of 2021. If I were to sell now, I’d naturally need a replacement home – a choice between paying current high rental or getting a pricier home at a higher interest rate.

If I wish to opt for a fixed-rate loan again, it will be at almost 2% pa more than what I will otherwise continue to enjoy till late 2023. If anything, we’re more likely to see a further reduction in resale supplies than a rush of desperate sellers in this scenario.

But how about homeowners who are on floating packages, when variable interest rates start hitting around 3% pa rates, won’t these owners feel the heat?

Our Annual Personal Savings

Coupled with the economic turmoil, when employees start getting retrenched, how will they keep up on home loan repayments? These figures from Singapore Statistics may surprise you:

The corollary of this is, of course, that Singapore has higher personal savings rates than most notable developed nations, except China.

The corollary of this is, of course, that Singapore has higher personal savings rates than most notable developed nations, except China.

In nominal terms, Singapore’s annual personal savings hit S$106 billion in 2020, with S$261 billion in personal disposable income for the same time period.

Singapore’s impressive savings rate is further bolstered by our national social security savings scheme, otherwise known as CPF (Central Provident Board).

For the benefit of overseas readers, let me briefly explain.

All Singaporean and PR employees below the age of 55 contribute 20% of their wage whilst their employers contribute an additional 17% towards this mandatory enhanced-interest savings scheme; the contribution rate is reduced at various statutorily determined ages after 55.

Contributing members may use their CPF funds for certain permitted uses, such as property purchases, approved investment schemes and certain medical fees, but are otherwise not allowed to cash out these funds until after they clear the requisite retirement age.

According to CPF’s website, S$1.6B of CPF monies was withdrawn for property ownership in Q1 of 2022. Comparatively, S$2B was withdrawn for retirement and S$1B for healthcare purposes.

Contributions and total interest earned for 2021 amounted to S$13.7B and $18.3B, respectively. Total CPF balances as of March 2022 stood at S$519B.

CPF Trends Report for November 2021 stated that about 800,000 members actively use CPF to pay their housing instalments, with 80% of those below the age of 50 having at least 6 months or more home loan instalments set aside in their CPF accounts.

Given those actively using CPF for home repayments form just under 20% of all 4.2M CPF members, I believe we can safely presume that many homeowners in Singapore would have sufficient CPF funds to fall back on in the event that they find themselves unable to repay their home loans with full cash.

That’s a formidable safety net against escalating mortgage interest right there – if bank loan interest exceeds the 2.5% pa their monies would earn sitting in their CPF account, then it becomes more favourable to use CPF to either partially repay their mortgage loan to reduce their debt obligations, or simply meet their usual monthly instalments without the need for cash output.

Property Investors and Mortgages

Now let’s consider investor owners – wouldn’t they be considered more interest-rate sensitive and moved to sell in the face of rising interest rates?

Thanks to Singapore’s multiple rounds of cooling measures, any speculator participation and risky market leverage have been reduced tremendously.

One regularly invoked form of cooling measure has been the tightening of loan-to-value (LTV) – a total of six times since the first phase in February 2010 reduced maximum LTV from 90% down to 80%.

In our most recent LTV tightening in July 2018 (for bank loans), the maximum LTV has been further reduced to 75% (or 55% if the loan tenure is more than 30 years or extends past age 65) for the first home loan, 45% (or 25%) for a second home loan, and 35% (or 15%) for third housing loan; loans for institutional borrowers was reduced to a mere 15% LTV.

With LTVs of 45% or less for investment borrowers, rising interest rates do not have the same level of sting as in markets with looser credit.

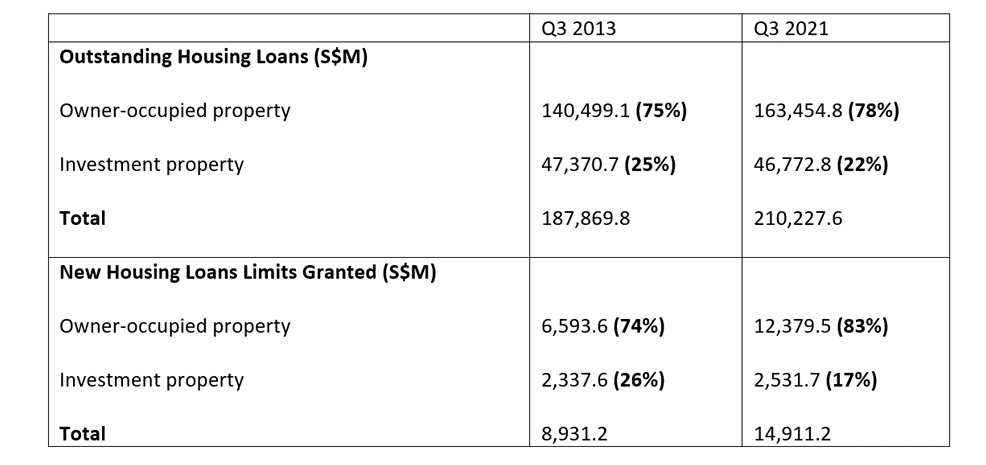

If you look at MAS’ Housing Loan Data, you can see from the previous market peak of Q3 2013, that outstanding home loan growth has come primarily from owner-occupied properties, with outstanding loans for investment properties actually lower in Q3 2021 than 8 years prior.

For new home loans granted, the shift is naturally more dramatic, with own-stay properties going from 74% to 83% of all new home loans.

With investment units being a lot less leveraged, investment property loans forming a smaller proportion of total home loans, and bolstered by a rental market strongly favouring landlords over tenants for short to midterm, it’s hard to presume that rising interest rates will hurt investment sellers in a way that would cause a dramatic price fall as what we’ve seen on other international markets.

A common mistake is reading the headlines on mortgage interest potentially doubling, and then imagining monthly instalments doubling too – your monthly instalments are part interest payment, part principal repayment, so it’s not a direct multiplier.

A 30-year mortgage of S$1M will be S$3,451/mth at 1.5% pa, but S$4,216/ mth if interest doubles to 3% pa, and since a homeowner aged 35 or younger would have needed supporting income of at minimally $8500/mth and a downpayment of at least $333K, a hike of $765/mth shouldn’t be too onerous.

As mentioned previously, if cash happens to be tight, it’s still likely that his or her CPF balances should be sufficient to lessen the cash burden.

Furthermore, rentals have increased over the past couple of years and show little signs of abating in the near to mid-term.

Tenancies here are typically signed for 2-year contracts, so the leases signed today should provide a good cushion for landlords to stomach the higher interest rates.

As you can see from the charts below, rentals have generally come up about 20% over the past 3 years.

Coincidentally, if you look at the figures used to illustrate the case for a S$1M, 30-year mortgage, the doubling of mortgage interest would result in a monthly instalment that rises by approximately 22% (from S$3,451/mth to S$4,216/mth.)

So indeed, investor owners shouldn’t be getting overly anxious about a rise in interest.

How we’re different from the US

You would think that after the subprime crisis of June 2007, the US would be a lot stricter with home financing, but I was shocked to learn that it is widely possible to obtain mortgage loans of up to 95% LTV, although loans within 80% LTV generally enjoy better terms.

Online research into the US loan approval process also turned up a disturbing number of ads promising to “improve your credit score with these simple steps!” or similar.

There’s an article entitled “How to Get a Mortgage with Bad Credit” on Forbes.com that details how you can get an FHA loan with a credit score of at least 580 and put down as little as 3.5%! (Credit scores go up to 850, it seems that scores below 600 would put borrowers in the bottom 5% of homebuyers.)

FHA loans are still not the loosest home loan available in the US, there are also the very forgiving VA home loans which allow service personnel, veterans and surviving spouses access to financing with little to no down payment.

According to military.com, the Department of Veteran Affairs backed a record 1.44M VA home loans in 2021, so it’s by no means a negligible player in the US property market.

With this in view, it’s understandable that those in the US would equate low-interest rates with fast, easy cash – and rising interest rates would pose a serious threat to how well their market will hold out.

Contrast this with Singapore, where you must put down a minimum of 5% cash (not CPF) on your first home loan, regardless of how pristine your credit history is, and maximum LTV dictates down payments of 25% or more.

Debt Servicing Ratios

It has never been a case of people buying homes here because of cheap financing – throughout these years of low sub-2% pa interest rates, loan approvals here have been approved based on monthly instalments calculated using 3.5% pa interest, alongside strict TDSR requirements.

Supporting income is trimmed by CPF contributions, whilst those earning variable income like myself actually go through a 30% “haircut” on supporting income for our loan approvals, so what we can borrow is considerably less than what we can actually afford.

Our approved home loans are, of course, also affected by our other debt servicing commitments like car loans – and with cars as expensive as they are in Singapore, the monthly instalments for a 5-year car loan can have a dramatic effect on the loan quantum a homeowner can borrow.

Let’s illustrate with an example for a 40-year-old homeowner earning $10,000/mth income: without a car loan, he can borrow up to $1.1M, thus budgeting for a home up to $1.46M (presuming he has the $365K down payment.)

If he owns a car, his monthly instalments for a 5-year $55K car loan would be about $1K/mth, bringing his home loan eligibility down an outsized $200K, to just $890K.

In the event of financial difficulties, the more natural thing to go first would be the car, not his property.

I think our ABSD and SSD controls would go a big way in explaining why Singapore’s property investors are generally not of the ilk that jumped in simply because of low rates, nor the sort to jump ship in a hurry when rates rise.

ABSD

Since the first round of Additional Buyers Stamp Duties was introduced in December 2011, we have seen a total of four rounds of ABSD hikes that have local investors and foreign/non-individual buyers paying anywhere between 17-35% in additional taxes after the latest adjustment in December 2021.

Before that, since July 2018, citizens buying a second residential property have had to pay 12% ABSD, PRs paid 15%, foreigners 20%, and entities paid 25%.

It’s clear to me that anyone serious enough to pay double-digit entry fees into the Singapore property market isn’t buying because financing is cheap, but because they believe there is value.

As if the sunk costs aren’t enough, there are also sellers’ stamp duties of between 4-12% payable if properties are sold within the first 3 years of purchase, so this is really not for fast money.

These multiple measures that have prevented overheating and kept our gains fairly modest in the past decade or so are also what has helped build a property market that now has a rock-solid foundation and is well-equipped to bear out a storm.

What is a 1.5-2.5% pa jump in interest rates (buffering by strengthened rental yield) compared to 17-35% upfront fees?

Even investor owners who didn’t pay such rates to enter the market previously will think twice about selling unless prices are attractive enough because their cost of re-investment will be high.

Let’s consider some fascinating data shared in a 14 Feb 2022 Parliamentary Reply to a question posed by Sengkang MP Mr Louis Chua.

Since 2017 was a full year of ABSD holding constant at 7% and 10% for citizens purchasing their second and third residential properties, we can deduce $5B of transactions in second properties and $1.39B in the third or subsequent properties were transacted that year.

There was a hike to 12% and 15% in July 2018, making it difficult to determine the breakdown for 2018, but the figures do suggest that a not insignificant number of locals have been paying their dues.

That can be confirmed by the next table I’ll share, also share in the same Parliamentary Reply previously mentioned.

From the basic stamp duties data, you can see that foreign purchases now form a modest share of property acquisitions here, whilst the ABSD tab is fairly evenly borne by citizens, PRs and foreigners despite the heftier rates paid by non-citizens.

This suggests that buying activity comes from those with a stronger sense of stake holding in Singapore, rather than passing speculators.

With our property prices and stamp duties both amongst the highest of our neighbouring ASEAN countries, it naturally filters out buyers with weaker holding power.

Segments most affected by rising interest rates

After sharing all the reasons why the bulk of our sellers will not be too adversely motivated by rising rates, I’ll wrap up by sharing which market segment I feel will be the most affected by rising interest rates – the home seekers who are currently finding limited suitable options within their budget.

As rates march towards 3% pa, the bank’s credit approval process will most likely need to shift their stress test calculations upwards to 4 or 4.5% pa instead of the long-standing 3.5% pa.

This means those who require the maximum 75% LTV to support their purchases will find their budgets further reduced – a S$1M 30-year loan that could previously gain approval with just above S$8K/mth nett income, would need over S$9K/mth to support the loan if credit approval were based off 4.5% pa instead.

For the borrower earning S$8K/mth, his loan would go from around S$1M to just under S$900K. With demand from home seekers already outstripping tight supply, buyers in the lower price tiers will find competition heating up if buyers who could previously afford larger loans, decide to step down a notch or two and join their fray.

As it is, we are already seeing this happening in the HDB market, with home seekers finding themselves competing with buyers who can afford private homes but opt for flats instead- as evidenced by June HDB transactions comfortably crossing the 2000-mark, and consistently over 20 flats hitting past the S$1M mark each month since August 2021.

And what do you know, HDB being another uniquely Singaporean product – HDB homeowners have always had the option of taking a concessionary loan from HDB to finance their flat purchases – with interest rates pegged at 0.1% pa above the prevailing CPF ordinary account rate (currently 2.5%pa).

I’m hard-pressed to think of another country where 80% of the resident population live in public housing, with 90% of these residents owning their flats – as HDB proudly proclaims, that’s one of the highest rates of ownership in the world.

So right there, we have our broad base of the country’s most affordable homes, coupled with concessionary loans as a safeguard against runaway interest rates. For all the reasons stated and more, we should be able to navigate the storms ahead relatively unscathed.

–

The post What do rising interest rates really mean for Singapore’s housing market? appeared first on .