Besides million-dollar HDB flats, there are now multi-million-dollar kopitiams, or coffee shops, in our HDB heartlands.

You may be sitting on those flimsy plastic chairs, sanguinely sipping your kopi siu dai and eating your kaya toast and half-boiled eggs, not realising that potentially, you could be doing so at an 8-figure joint.

Notably, these are your HDB neighbourhood coffee shops, usually surrounded by HDB flats and near a wet market.

While not air-conditioned as food courts or iconic as hawker centres, there are over 770 of them across the country. Some are privately owned, and others are rented out by HDB.

It should be noted that HDB no longer sells coffee shops since 1998.

Yishun kopitiam holds current record in psf terms

Recently in June 2022, two kopitiams – one at 201 Tampines Street 21 and another at 848 Yishun Street 81 – were reportedly being sold for S$41.68m and S$40m, respectively.

In per-square-foot terms, the Yishun coffee shop’s price of S$9,361 is even higher than psfs of ground-level retail units in Orchard Road’s Far East Plaza and Lucky Plaza.

We probably should also mention a wild boar ran into a woman at Block 844 Yishun Street 81 four months ago.

In July 2022, a kopitiam at 496 Jurong West Street 41 was reportedly sold for an undisclosed “8-figure sum”.

Apparently, the new owner is the same company which bought the Bukit Batok coffee shop for a record-breaking S$31m back in 2015.

A few reasons we came up with behind these sky-high valuations (between buyer and seller):

a. They are conveniently located and popular among residents and visitors

b. The selection of food and beverage options is top-notched (near Michelin-level maybe?)

c. They are usually corner units or standalone island structures, attracting greater footfalls.

d. Despite 2 to 4 other kopitiams in the immediate vicinity, they somehow have that 1 or 2 stalls selling the same thing but always seem to attract long, ungodly queues.

e. There’s unfettered demand (eg. reopening after a pandemic lockdown)

f. There’s a “lucky” 4D/TOTO outlet nearby

g. The beer ladies are… (never mind)

Anyway, here’s a quick look at some figures behind the record-breaking transactions of some kopitiams so far:

| Date of sale and media coverage | Name of Kopitiam | Location | No. of stalls (at time of sale) | Estimated amount (S$) | Size (sqft) | PSF (S$) |

| July 2022 | Coffee United / FoodHub | 496 Jurong West Street 41 | Stalls include Chef Kin HK Wanton Noodle and Tiong Bahru Hainanese Boneless Chicken Rice | Reported 8-figure sum | N/A | N/A |

| June 2022 | 24-hour KPT Kopitiam | 848 Yishun Street 81 | 14 | 40m | 4273 | 9361 |

| June 2022 | 21 Street Eating House | 201 Tampines Street 21 | 18 | 41.68m | 6501 | 6411 |

| June 2015 | Yong Xing Coffee Shop | 155 Bukit Batok Street 11 | 19 | 31m | 4521 | 6856 |

| Jul 2013 | Coffee Express 2000 | 682 Hougang Avenue 4 | 17 | 23.8m | 4025 | 5935 |

Concern over increased rental costs, and food and beverage prices

The general concern among residents is whether these heady transactions would trickle down and translate into higher rental costs for stall owners and F&B prices for end-consumers like you and me.

In Parliament, in light of the >S$40m sale of the two kopitiams at Tampines and Yishun, PAP’s Carrie Tan asks the Ministry of National Development (MND) if there are plans for rent control measures on coffee shop stalls in HDB estates. This is to prevent the transfer of cost increases to consumers.

While MND explained that it is mindful of the need to ensure residents have access to affordable cooked food options and the potential impact of the resale transactions, it also shared the need to guard against unintended impacts (if rent control measures are implemented).

“For example, by controlling rent, we could end up reducing the incentive for coffee shop owners to invest in improving their coffeeshops to provide better services and facilities to customers.”

Do these multi-million-dollar coffee shops “trickle up” and affect the demand and prices of HDB flats around them?

An interesting trail of thought is whether these 8-figure transactions among these few “outlier” kopitiams would “trickle up” and affect demand and psf prices of HDB flats around them.

We decided to take a look at HDB blocks around two previous multi-million-dollar kopitiams sold – the S$23.8m Coffee Express in Hougang Avenue 4 (2013) and the S$31m Yong Xing Coffee Shop in Bukit Batok Street 11 (2015).

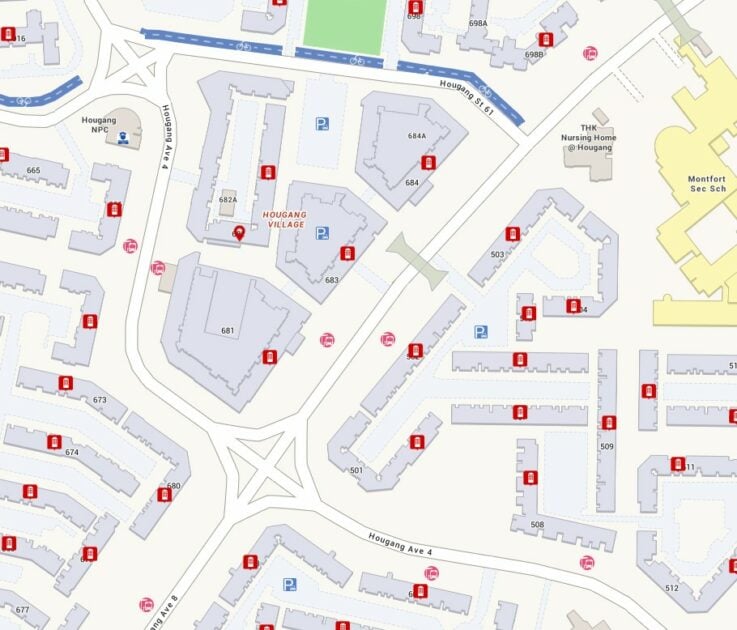

2013: Coffee Express in 682 Hougang Avenue 4

With the sale of Hougang Avenue 4’s Coffee Express in 2013, we decided to look at average psf prices and demand for surrounding flats (and apartments above the coffee shop itself).

The area, known among heartlanders as Hougang Village, sees the coffee shop being directly accessible to residents of four low-rise 4-storey blocks, namely 681, 682, 683 and 684 Hougang Avenue 4 and 8.

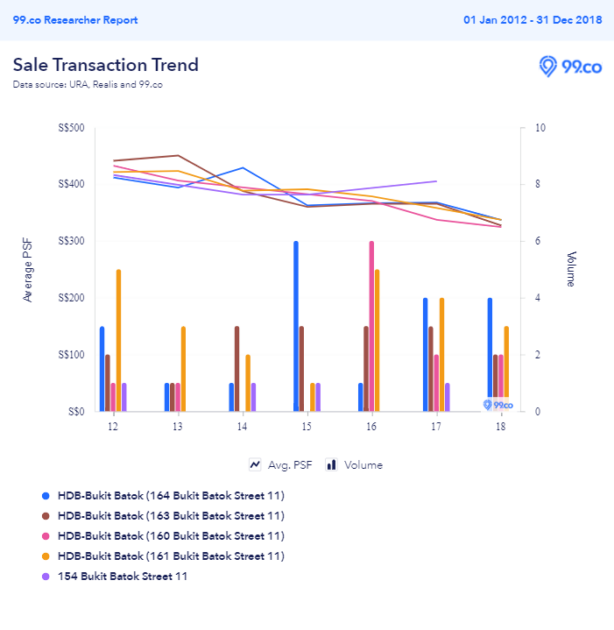

Looking at the average psf prices of the four low-rise blocks 3 years before and after the sale, we can see a general ascending trendline peaking in 2013 at S$400-S$500 psf. After 2013, the trendline descends to below S$400.

What’s noticeable is the spike in volume (7 units) from block 682 itself in 2014. It’s possible that after the sale, some landlords or residents above the kopitiam moved out.

A review of adjacent blocks across the roads from Hougang Village, such as blocks 502-698 along Hougang Avenue 4 and 8 and Street 61, show a similar trendline.

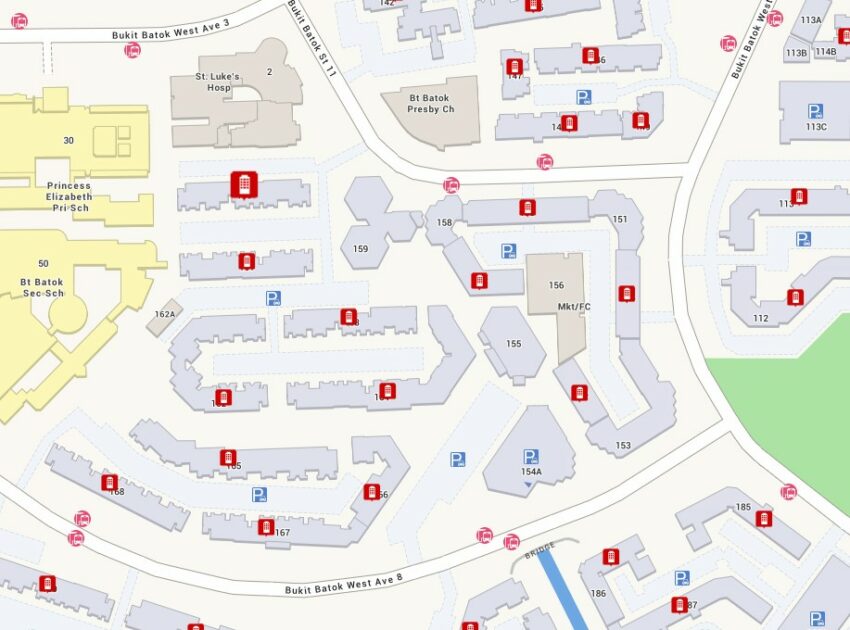

2015: Yong Xing Coffee Shop at 155 Bukit Batok Street 11

The S$31m sale of Yong Xing Coffee Shop at Bukit Batok Street 11 in June 2015 generated significant buzz at the time.

It prompted Minister for National Development at the time, Khaw Boon Wan, to emphasise that these transactions were outliers.

“The two transactions at Hougang (in 2013) and Bukit Batok were outliers, but these were market transactions between private entities. If they overpay and need to charge above market price, they risk losing their customers and becoming insolvent.”

An analysis of adjacent blocks (154, 160-164 Bukit Batok Street 11) shows a declining average psf trendline three years before and after the sale. Across the period, the average psf of these blocks has fallen from S$400-S$450 to about S$330-350 (except block 154, which is a low-rise 4-storey block).

It should be noted, that, unlike the Hougang neighbourhood, these blocks are also near St. Luke’s Hospital and two schools.

An analysis of nearby blocks around the immediate vicinity (blocks 112, 148, 185 Bukit Batok West Avenue 6 and 178 and 183 Bukit Batok West Avenue 8), show a similar downtrend but tapering at around the S$350-S$390 mark.

Blocks 178 and 183, which have a direct line of sight of the multi-million-dollar coffee shop (across Bukit Batok West Avenue 8), saw marginally higher volume transactions a year after the sale.

While it is hard to place if these HDB resale transactions are related in any form to the coffee shop, there have been reports of stall owners leaving their premises due to higher rental costs – like this one on popular Indian-Muslim family restaurant Saffrons at Tampines Street 21.

It is also not entirely illogical to consider that HDB residents living on lower floors near these coffee shops may move out after a year or two due to noise and crowd.

For others, being within walking distance of a coffee shop may actually be a boon, especially for elderly folks, since they can just take the lift down from their apartment and chat with other seniors over their favourite drinks.

–

In summary, it is still too early to tell if these multi-million dollar kopitiams have any impact on the psf prices or transaction volumes of HDB flats near or around them.

Naturally, an HDB flat near any kopitiam that serves decent food and drinks is already a good amenity, so we think it doesn’t really matter to landlords or residents if it costs less than a million or S$41.68m.

These multi-million-dollar coffee shops will probably only make a difference to HDB residences if landlords and residents associate them with a specific distinction separate from other coffee shops – like better-quality food, drinks, unique customer experience or identity.

Other than that, to most residents, they will just be another coffee shop to order their kopi siu dai and half-boiled eggs from – they just have to be prepared if these come at extra cost.

–

–

What are your thoughts on these multi-million-dollar coffee shops? Let us know in the comments section below.

If you found this article helpful, check out 5 commercial properties Singaporeans secretly wish they own and 5 Top Properties Below $1.3 Million To Jump Start Your Cafe.

The post Do sales of multi-million-dollar kopitiams affect price and demand of surrounding HDB flats? appeared first on .