Whether you are a first-time homeowner or looking to sell your property in Singapore, you should know to set aside extra cash to pay for stamp duty.

If you are unfamiliar with what stamp duty is and how you can make payment via the online e-stamping IRAS portal, here’s a guide we created to simplify the process for you.

What Is Stamp Duty

For the uninitiated, stamp duty is the tax on documents relating to the purchase or lease of a property, payable to the Inland Revenue Authority of Singapore (IRAS). You are required to e-stamp a document before you sign it or within 14 days after signing the document (if it is signed in Singapore).

Most, but not all, residential property transactions in Singapore require you to pay stamp duty. The responsibility of who should pay the stamp duty varies. Some common instances of when stamp duty fees are incurred include buying, selling, renting (as a landlord or tenant), or inheriting property.

Related articles:

- Buyer’s Stamp Duty Guide for Property Buyers: What It Is and How Much to Pay (Up to 4%)

- Additional Buyer’s Stamp Duty (ABSD) in Singapore (2022): A Guide for Property Buyers

- Seller’s Stamp Duty of Up to 12%: What Property Sellers Need to Know

While you can head down to Service Bureaus at designated SingPost offices or use the e-kiosks at IRAS Taxpayer and Business Service Centre to settle your e-stamp transactions, the most convenient mode of payment is via the online IRAS e-stamping portal.

What Is the IRAS e-Stamping Portal?

The e-Stamping IRAS portal is an all-in-one secured website you can use to view and manage your stamp duty transactions. Aside from obtaining and paying for the required document e-stamps, you can request refunds, amend submitted stamp certificates and seek adjudication or appeal.

The main benefit of using the e-stamping IRAS portal is that you can take care of your financial matters anywhere, anytime. For those unable to physically head down to an AXS kiosk or Service Bureau during designated hours, the convenience of the e-stamping IRAS portal will help you avoid late penalty fees.

IRAS e-Stamping Portal: How to Pay Stamp Duties Online

Step 1: Signing In

To log in to the site, you would need your SingPass details. Either manually type in your username and password, or use the QR code function on your SingPass mobile app.

If you are a first-time user on the e-stamping IRAS portal, you will be prompted to key in your details (i.e. e-stamping portal username, address, phone number, email).

Step 2: Click ‘Stamping’ on the Main Banner to Choose Your Stamp Duty Option

Once you have logged in, you should be directed to the main e-Stamping IRAS Portal page. Select the ‘Stamping’ option in the main menu and choose the type of stamp duty you have to pay.

For example, if you have recently purchased an HDB flat, you will want to click on the ‘Stamp Sale & Purchase of Property’ option under ‘Sale & Purchase’. Depending on whether you own another property or if you are not a Singapore Citizen, you will also be subject to paying the Additional Buyer’s Stamp Duty (ABSD) too.

Before you perform transactions, ensure you have installed Adobe Acrobat Reader and disabled your pop-up blockers. This is so you can view or download your stamp certificate once you have made payment.

Moving forward, we will use the ‘Stamp Sale & Purchase of Property’ application form as an example of how you should fill in a form. Most of the e-stamp payment forms follow mostly the same format so do not worry about encountering too much difficulty.

Step 3: Fill In Your Details

Fill in your personal particulars, document details, and property information for the required boxes.

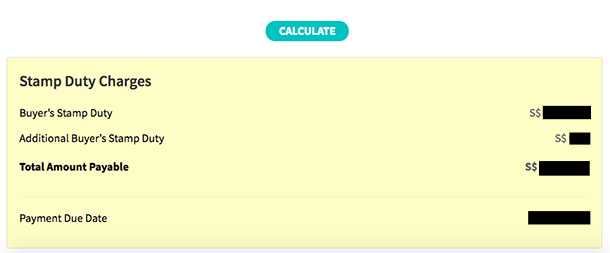

Once you have completed your form, scroll down and click ‘CALCULATE’ to generate your stamp duty charges. A yellow box should pop up and show the payable amount. You may also use PropertyGuru’s Stamp Duty Calculator Tool For Property.

Continue scrolling to the bottom of the page. Select ‘Preview & Declare’ to proceed to the next step.

At any time of the application process, you can opt to save your draft and exit the page. You can retrieve any completed or partially-filled form by selecting the ‘Records’ tab in the main menu and accessing the ‘Search Stamping Records’ link.

Related article: 2022 Property Tax Singapore Guide: How to Calculate Property Tax for HDB and Condo

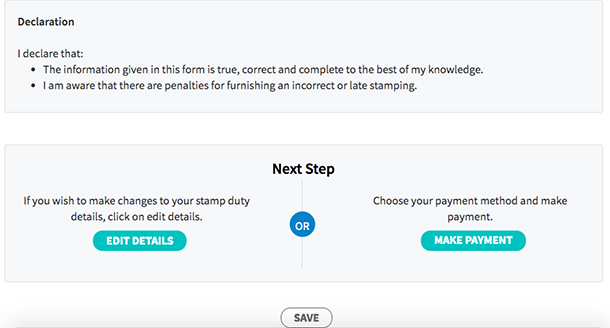

Step 4: Review Your Document

Double-check the information you have keyed in. Once you have confirmed it is correct, hit the ‘MAKE PAYMENT’ button at the end of the page.

Subsequently, a pop up will appear and prompt you to click ‘YES’ to make payment. Select ‘YES’.

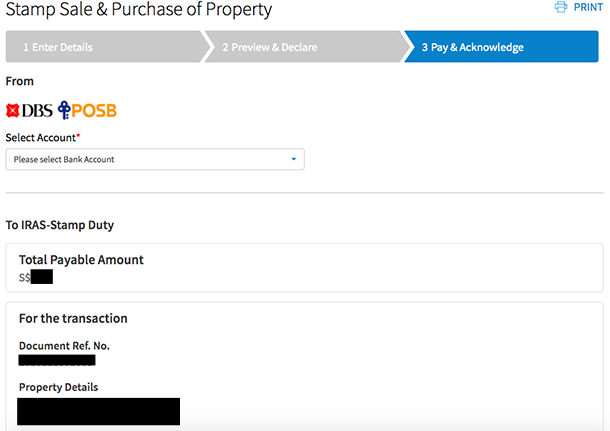

Step 5: Select Your Payment Mode

At this step, if you have not disabled your pop-up blockers or installed Adobe Acrobat Reader yet, please do so. You will be directed to choose your payment option.

Digital payment can be made via the following options:

- eNETS

- FAST via DBS/POSB (for conveyancing documents only)

If you choose the eNETS option, make sure you have an existing internet banking account with DBS/POSB, UOB, OCBC, Citibank or Standard Chartered Bank. Check that your internet banking daily payment limit for the account is high enough to allow for the stamp duty payment to go through. For the FAST via DBS/POSB option, there is a payment limit of $200,000.

Otherwise, select the ‘Other Modes with Payment Slip’ option to generate a payment slip so you can pay by alternative means. See full stamp duty payment options here.

Step 6: Finalise Payment

After selecting how you would like to pay for your stamp duty, you will be prompted to key in the necessary bank details. Once that is completed, you will be directed to a page that includes your document reference number and property details.

Verify that the information is in order before consenting to the payment disclaimer. Press ‘PAY’ to finish making payment.

Once the payment has successfully gone through, print or save an electronic copy of your transaction. Your document reference number can be used to retrieve your completed form later.

IRAS e-Stamping Guide

And you’re done! Congratulations, you have paid your stamp duty via the IRAS e-stamping portal. Hopefully, this step-by-step guide has helped you understand how to use the IRAS e-stamping portal a little better.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

Are you looking to buy a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Already found a new home? Let PropertyGuru Finance’s home finance advisors help you with financing it.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of the information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained on this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, and its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.