If you’re in the market for an executive condominium, but unable to apply for one at launch, it could be due to several reasons. Usually, it’s tied to your citizenship status, age or household income, but there are a few more reasons that may restrict you from buying directly from a developer at launch.

Reasons why you may not be able to apply for an EC at launch

- Neither you nor your spouse/significant other/sibling is Singaporean. This applies to singles too (who are applying under the Joint Singles Scheme).

- Neither of you is 21 years old and above. If you’re applying as a single, you’re not at least 35 years old yet.

- Your monthly household income exceeds S$16,000.

- Either one of you owns private residential property (local or overseas) or has disposed of private property in the last 30 months.

- You have bought 2 subsidised housing in Singapore before.

- You have an interest in an HDB flat and are unable to dispose of this interest within 6 months of completing the EC purchase (a possible reason is that the HDB flat is co-owned with your parent)

- You are an undischarged bankrupt who is unable to obtain prior consent from the Official Assignee (OA) or private trustee

- You have previously booked a flat and cancelled your booking, so you’re now in a 1-year waiting period before you can apply

- You have previously bought an EC but subsequently terminated the Sale and Purchase Agreement, so you’re now in a 5-year waiting period

More often than not, couples and singles would then consider a private condo if new launch EC eligibility is unattainable. Alternatively, they can consider a resale EC after its 5-year Minimum Occupation Period (MOP). If you’re a foreigner, then that option opens up after the EC passes its 10th year (which is when it becomes private).

Eligibility conditions to buy a resale EC (after its 5-year MOP)

- You and your spouse/significant other are either Singaporean or a Singapore Permanent Resident. Both of you must be at least 21 years old and above.

- If you’re buying as a single, you need to be either Singaporean or PR and be at least 21 years old.

- There is no monthly household income ceiling, but there is the Total Debt Servicing Ratio (TDSR), which is 55% of your monthly income.

- You can own other private residential property if you’re buying a resale EC.

- If you’re a Singaporean and you already own an HDB flat that has completed its MOP, you can buy a resale EC without needing to dispose of your HDB flat. If you’re PR, then you must dispose of the HDB flat within 6 months of buying the resale EC.

Note that with resale EC, you will not be eligible for CPF housing grants. If you intend to get a housing loan, you can only apply via a bank, subject to approval and regulations. If you own more than one property in Singapore, Additional Buyer’s Stamp Duty (ABSD) will apply. There is also no MOP applicable after the initial 5-year MOP for ECs.

Here are some Executive Condominiums which are nearing or have recently completed their 5-year MOPs:

| EC Name | District | Location | Project Size | Bedrooms | TOP |

| The Terrace | 19 | 92 Edgedale Plains | 747 | 3, 4 and 5 | 2017 |

| Bellewoods | 25 | 116 Woodlands Avenue 5 | 561 | 2, 3, 4 and 5 | 2017 |

| Signature At Yishun | 27 | 37 Yishun Street 51 | 525 | 2, 3 and 4 | 2017 |

| The Vales | 19 | 75 Anchorvale Crescent | 517 | 2, 3, 4 and 5 | 2017 |

| Bellewaters | 19 | 11 Anchorvale Crescent | 651 | 3, 4 and 5 | 2017 |

| Westwood Residences | 22 | 180 Westwood Avenue | 480 | 2, 3, 4 and 5 | 2017 |

| The Brownstone | 27 | 158 Canberra Drive | 638 | 2, 3, 4 and 5 | 2017 |

| The Criterion | 27 | 17 Yishun Street 51 | 505 | 2, 3, 4 and 5 | 2018 |

| Wandervale | 23 | 349 Choa Chu Kang Avenue 3 | 534 | 3 and 4 | 2018 |

| Parc Life | 27 | 39 Sembawang Crescent | 628 | 2, 3, 4 and 5 | 2018 |

| Sol Acres | 23 | 16 Choa Chu Kang Grove | 1,327 | 1, 2, 3, 4 and 5 | 2018 |

| The Visionaire | 27 | 196 Canberra Drive | 632 | 2, 3 and 4 | 2018 |

| Treasure Crest | 19 | 66 Anchorvale Crescent | 504 | 3 and 4 | 2018 |

PSF Price Performance of ECs after hitting their 5-year MOP

What’s interesting is how the per-square-foot prices of ECs surge in the years following their 5-year MOP.

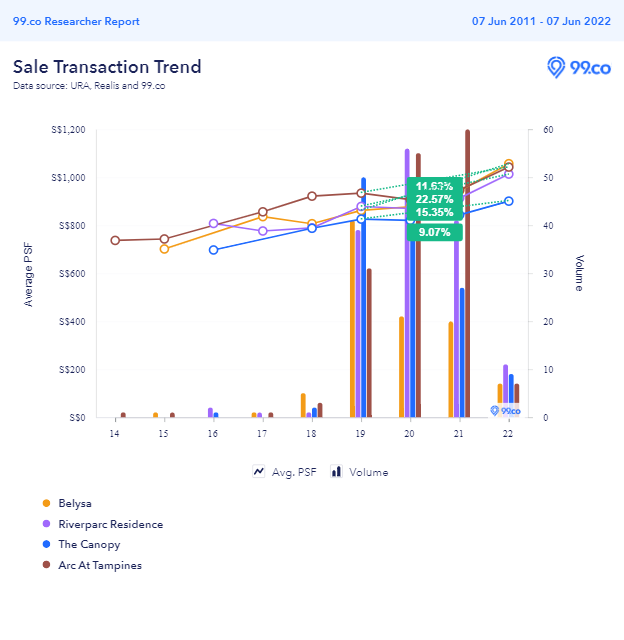

Taking a leaf from ECs which TOPed in 2014 and MOPed in 2019, it’s clear that besides greater volume transactions, there would be higher psf price appreciation as well.

The apartments for four ECs below – Belysa, Riverparc Residence, The Canopy and Arc At Tampines – all TOPed in 2014 and mostly MOPed in 2019. Their trend chart shows average psf price increased between 9.07% and 22.57% within the past three to four years of fulfilling their MOPs.

So don’t be surprised when newly MOPed ECs follow the same trend as well.

So don’t be surprised when newly MOPed ECs follow the same trend as well.

Privatised ECs

If you’re a foreigner (non-Singaporean/PR), then you can consider buying a resale EC when it gets privatised after its 10th year. While there isn’t any development we know of which will be privatised this year, there are a few planned in 2024 and 2025.

If you’re a Singaporean or PR thinking of buying a resale EC, some of these might appeal to you. Furthermore, when the development becomes privatised in 2-3 years’ time, you will then be able to resell these units to a broader market as there may be potential demand from foreign buyers as well.

Here is the list:

| EC Name | District | Location | Project Size | Bedrooms | TOP |

| Privé | 19 | 35 Punggol Field | 680 | 2, 3 and 4 | 2013 |

| Esparina Residences | 19 | 121 Compassvale Bow | 573 | 2, 3 and 4 | 2013 |

| The Canopy | 27 | 83 Yishun Avenue 11 | 406 | 2, 3 and 4 | 2014 |

| Austville Residences | 19 | 15 Sengkang East Avenue | 540 | 2, 3 and 4 | 2014 |

| Belysa | 18 | 59 Pasir Ris Drive 1 | 315 | 3 and 4 | 2014 |

| RiverParc Residence | 19 | 104 Punggol Drive | 504 | 2, 3 and 4 | 2014 |

| Blossom Residences | 23 | 30 Segar Road | 602 | 2, 3 and 4 | 2014 |

| Arc at Tampines | 18 | 21 Tampines Avenue 8 | 574 | 2, 3 and 4 | 2014 |

| WaterColours | 18 | 21 Pasir Ris Link | 416 | 2, 3 and 4 | 2014 |

Similarly, for ECs which were privatised, most showed significant psf price appreciation (and volume) after 10 years. The three ECs below – The Esparis (TOP in 2005, privatised 2016), The Quintet (TOP in 2006, privatised 2017) and La Casa (TOP 2008, privatised 2019) – show double-digit appreciation in average psf prices since being privatised.

The Esparis, a small development of 274 units in Pasir Ris, showed a 16.94% appreciation over the last six years of privatisation. The Quintet, a mid-sized condo of 459 units at Choa Chu Kang, has a 16.19% average psf price appreciation over the past five years of privatisation. Finally, La Casa, a medium-sized condo of 444 units at Woodlands, saw a 14.52% appreciation since going private in 2019.

While it is common for us to often compare psf prices and volume transactions between ECs and private condos, we should note that ECs have three distinct life-cycle events in their first decade:

- When they first launch

- After their 5-year MOP and

- When they go private after 10 years

Whether you’re a new launch EC homeowner or investor, or someone buying a resale EC, knowing these life-cycle events can be insightful, especially when deciding when to buy and when to sell – subject to your eligibility of course.

–

–

Have any other tips we missed out on? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Has the price gap between private and executive condominiums changed? and Buying resale EC vs new launch: The key differences you need to know.

The post ECs nearing 5-year MOP or 10-year privatisation: eligibility, price and should you buy? appeared first on 99.co.